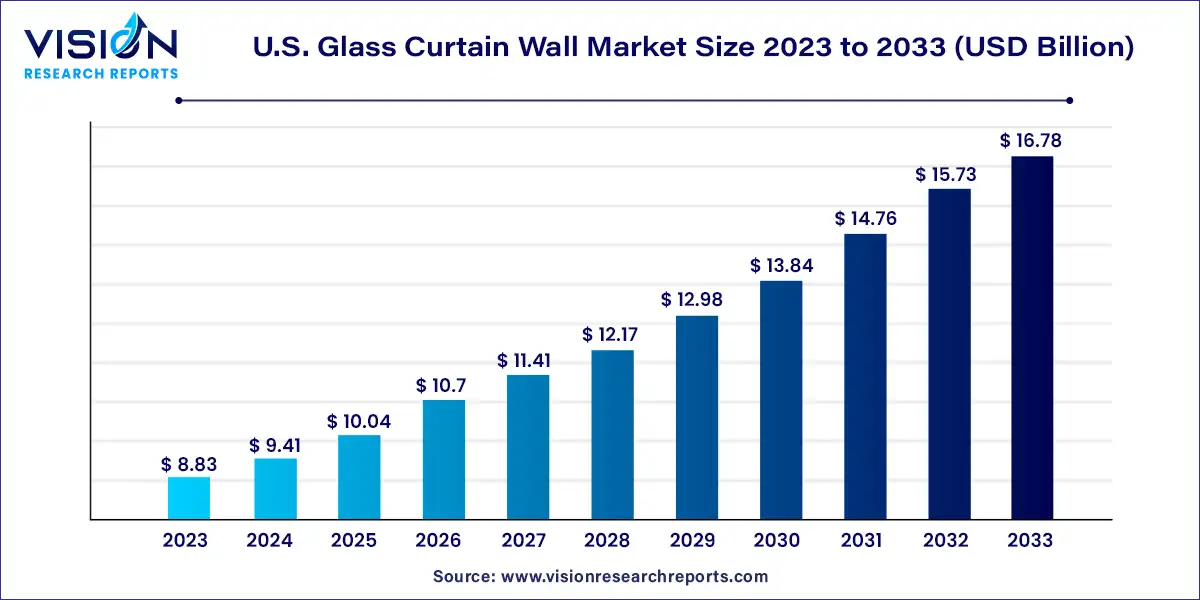

The U.S. glass curtain wall market was valued at USD 8.83 billion in 2023 and it is predicted to surpass around USD 16.78 billion by 2033 with a CAGR of 6.63% from 2024 to 2033.

In the architectural design and construction, the utilization of glass curtain walls has become a defining feature in modern buildings across the United States. These sleek, transparent facades not only enhance the aesthetic appeal of structures but also offer numerous functional benefits. This overview delves into the dynamics of the U.S. glass curtain wall market, shedding light on its growth drivers, key players, and emerging trends.

The growth of the U.S. glass curtain wall market can be attributed to several key factors. Firstly, increasing construction activities in both commercial and residential sectors are driving the demand for modern and aesthetically pleasing building facades. Glass curtain walls offer architects and developers flexibility in design while providing energy efficiency and natural light, thus enhancing the overall appeal of the structures. Additionally, advancements in glass technology, such as the development of energy-efficient and high-performance glass materials, have further fueled market growth. Moreover, rising awareness about environmental sustainability and stringent building regulations promoting energy-efficient construction solutions have propelled the adoption of glass curtain walls. Furthermore, the growing trend of smart buildings integrating technologies like sensors and automation into curtain wall systems is expected to drive market expansion in the coming years. These combined factors indicate a promising trajectory for the U.S. glass curtain wall market, with sustained growth anticipated in the foreseeable future.

| Report Coverage | Details |

| Market Size in 2023 | USD 8.83 billion |

| Revenue Forecast by 2033 | USD 16.78 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The unitized system type dominated the U.S. glass curtain wall market and accounted for a revenue of USD 5.80 billion in 2023. The increasing demand for modern and aesthetically appealing building designs in the U.S. is expected to increase the utilization of glass curtain walls. Unitized systems offer flexibility in design options, allowing architects to create visually striking facades.

The increasing investment in the construction of high-rise buildings in the U.S., such as 98 Red River Street by KPF, Austin, Texas, U.S.; Waldorf Astoria Miami by SSA/Carlos Ott, Miami, Florida, U.S.; Seattle Tower by ODA, Seattle; and Washington, U.S. is also expected to drive the segment growth over the forecast period. Some major upcoming construction projects in the U.S., including MSG (Madison Square Garden) Sphere, Fontainebleau, Amazon HQ2, and others, are expected to present opportunities to manufacturers of glass curtain walls.

The market for stick glass curtain walls in the U.S. is expected to grow at a CAGR of 5.04% over the forecast period. Stick glass curtain wall systems are commonly used in commercial buildings such as office complexes, shopping malls, hotels, and retail outlets. Their aesthetic appeal and customization options make them a popular choice for modern architectural designs. The launch of various construction projects in the U.S. related to commercial and residential buildings to offer leisure facilities is projected to favor the growth of the segment.

The commercial end-use segment of the U.S. glass curtain wall market is expected to expand at the highest CAGR of 6.18% over the forecast period. Glass curtain walls have been a popular architectural choice for commercial buildings in recent years due to their aesthetic appeal and energy efficiency. The demand for glass curtain walls in the U.S. has been influenced by various factors, including economic conditions, construction activities, and sustainability trends. Strong economic conditions and increasing construction spending on commercial buildings are likely to drive the glass curtain wall market in the U.S.

The demand for glass curtain walls in public end-use is expected to grow at a significant rate over the forecast period. Increasing construction activities and a rise in spending on public infrastructure, including healthcare facilities, airports, and hotels, are some factors driving the growth of the segment. Recent modifications to federal funding programs in the U.S. have significantly expanded the scope of airport development plans throughout the country. Moreover, a growing emphasis on environmental responsibility and sustainable building practices is expected to boost the market over the coming years.

Increasing residential development in the U.S. continues to raise the demand for supplies such as walls, windows, and doors, and it also generates the demand for clean, sophisticated, and unique appearances in residential buildings. Glass curtain walls offer a modern and elegant aesthetic that appeals to homeowners seeking contemporary architectural designs. The sleek and transparent nature of glass curtain walls can create a visually striking appearance, enhancing the overall appeal and value of residential properties. Such factors lead to drive the demand for glass curtain walls in the segment.

By System Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Glass Curtain Wall Market

5.1. COVID-19 Landscape: U.S. Glass Curtain Wall Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Glass Curtain Wall Market, By System Type

8.1. U.S. Glass Curtain Wall Market, by System Type, 2024-2033

8.1.1. Unitized

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Stick

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Glass Curtain Wall Market, By End-use

9.1. U.S. Glass Curtain Wall Market, by End-use, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Public

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Glass Curtain Wall Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by System Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Viracon

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Apogee Enterprises Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Guardian Industries

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Trulite

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kawneer (U.S.)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. YKK AP America Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Accura Systems, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Technical Glass Products

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Kalwall

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Lockheed Architectural Solutions, Inc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others