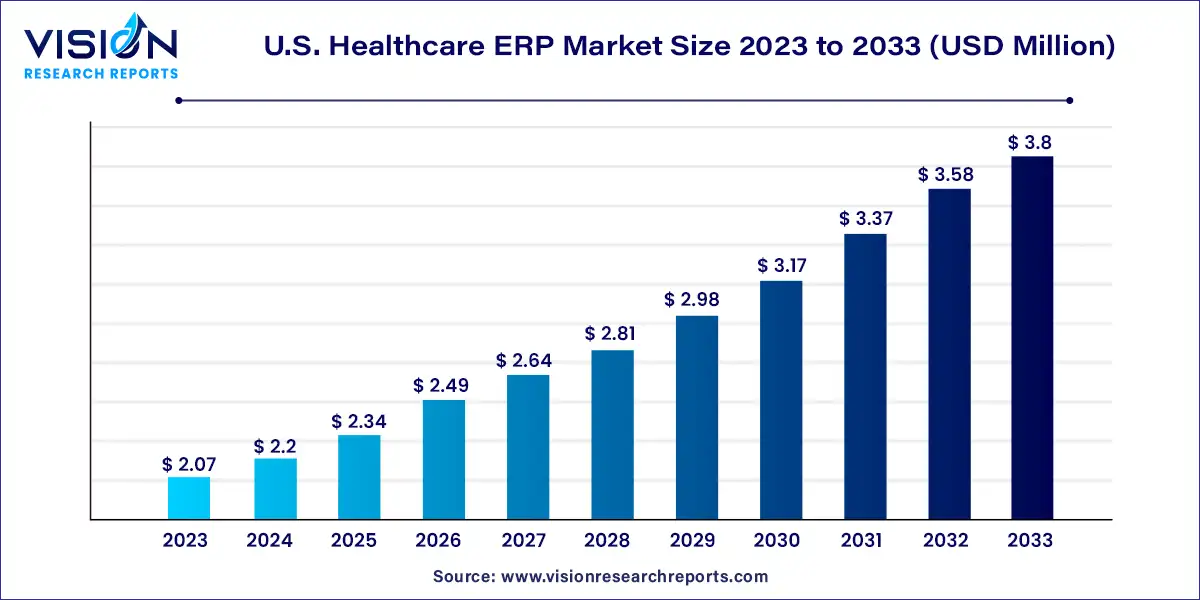

The U.S. healthcare ERP market size was surpassed at USD 2.07 billion in 2023 and is expected to hit around USD 3.8 billion by 2033, growing at a CAGR of 6.25% from 2024 to 2033.

"The growth of the U.S. Healthcare ERP market is underpinned by various factors contributing to its expansion. One significant driver is the stringent regulatory landscape, including compliance standards such as HIPAA and HITECH, compelling healthcare organizations to invest in ERP solutions for ensuring data security and regulatory adherence. Moreover, the pressing need for operational efficiency in healthcare delivery fosters the adoption of ERP systems to streamline workflows, optimize resource allocation, and reduce costs. Additionally, the integration of ERP with advanced analytics capabilities enables healthcare providers to derive actionable insights from data, driving informed decision-making and improving patient outcomes. The market is further propelled by the rising demand for patient-centric care, prompting healthcare entities to leverage ERP technologies for personalized treatment plans and enhanced communication channels.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.07 billion |

| Revenue Forecast by 2033 | USD 3.8 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.25% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on function, the U.S. healthcare ERP market has been further segmented into inventory and material management, supply chain and logistics management, patient relationship management, finance and billing, and others. The finance and billing segment accounted for the largest market share of 34% in 2023. ERP systems offer robust reporting and analytics capabilities in the finance and billing segment. These features enable healthcare organizations to generate comprehensive financial reports, monitor key performance indicators, and gain actionable insights. The availability of accurate and timely financial data empowers healthcare providers to make informed decisions, identify revenue trends, and optimize financial performance.

The inventory and material management segment is expected to grow at the fastest CAGR of 7.55% during the forecast period. This is owing to the timely need for medical devices to ensure effective therapy and diagnosis of the patients, storing the inventory, assuring on-time ordering of material, and minimizing wastage and storage expenses by maintaining an adequate inventory level. ERP enables automated inventory management, ensuring its accuracy, tracking supply, and refining the overall operation, which has a favorable impact on the U.S. healthcare company's overall development and efficiency.

The on-premises segment accounted for the largest revenue share of around 75% in 2023. This segment offers benefits such as centralized inventory control, optimization, and the integration of financial and human resource systems, as well as the capacity to adapt and customize the software for different needs and requirements and data security. It enhances patient care, and improves supply chain, inventory management, and financial analysis.

The cloud segment is expected to register the fastest CAGR of 9.26% over the forecast period. Cloud computing is allowing enterprises to store their data on a remote server and access it using the internet. Technological advancement in cloud computing is facilitating agility, scalability, reliability, and flexibility, thereby encouraging the adoption of cloud computing in the healthcare industry. ERP solutions enable operational improvements in the overall business process and benefit in terms of profitability, productivity, and growth.

The dynamics of the healthcare system in the U.S. are changing rapidly as automation continues to proliferate in the healthcare sector. At this juncture, cloud computing is allowing vendors to cater to the needs of their clients through various delivery models, including software as a service (SaaS), infrastructure as a service (IaaS), and platform as a service (PaaS). These models allow customers to pay according to usage and reduce their IT infrastructure costs. Cloud-based ERP systems can provide healthcare organizations with universal access to data at any given time and from any location, thereby enhancing the efficiency of critical business functions.

By Function

By Deployment

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Healthcare ERP Market

5.1. COVID-19 Landscape: U.S. Healthcare ERP Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Healthcare ERP Market, By Function

8.1. U.S. Healthcare ERP Market, by Function, 2024-2033

8.1.1. Inventory and material management

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Supply chain and logistics management

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Patient relationship management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Finance and billing

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Healthcare ERP Market, By Deployment

9.1. U.S. Healthcare ERP Market, by Deployment, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Healthcare ERP Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Function (2021-2033)

10.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.3. U.S.

Chapter 11. Company Profiles

11.1. Epic Systems Corporation.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cerner Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. McKesson Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Oracle Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Microsoft Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Sage Software Solution

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Pvt. Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. QAD Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Medical Information Technology, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. SAP SE

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others