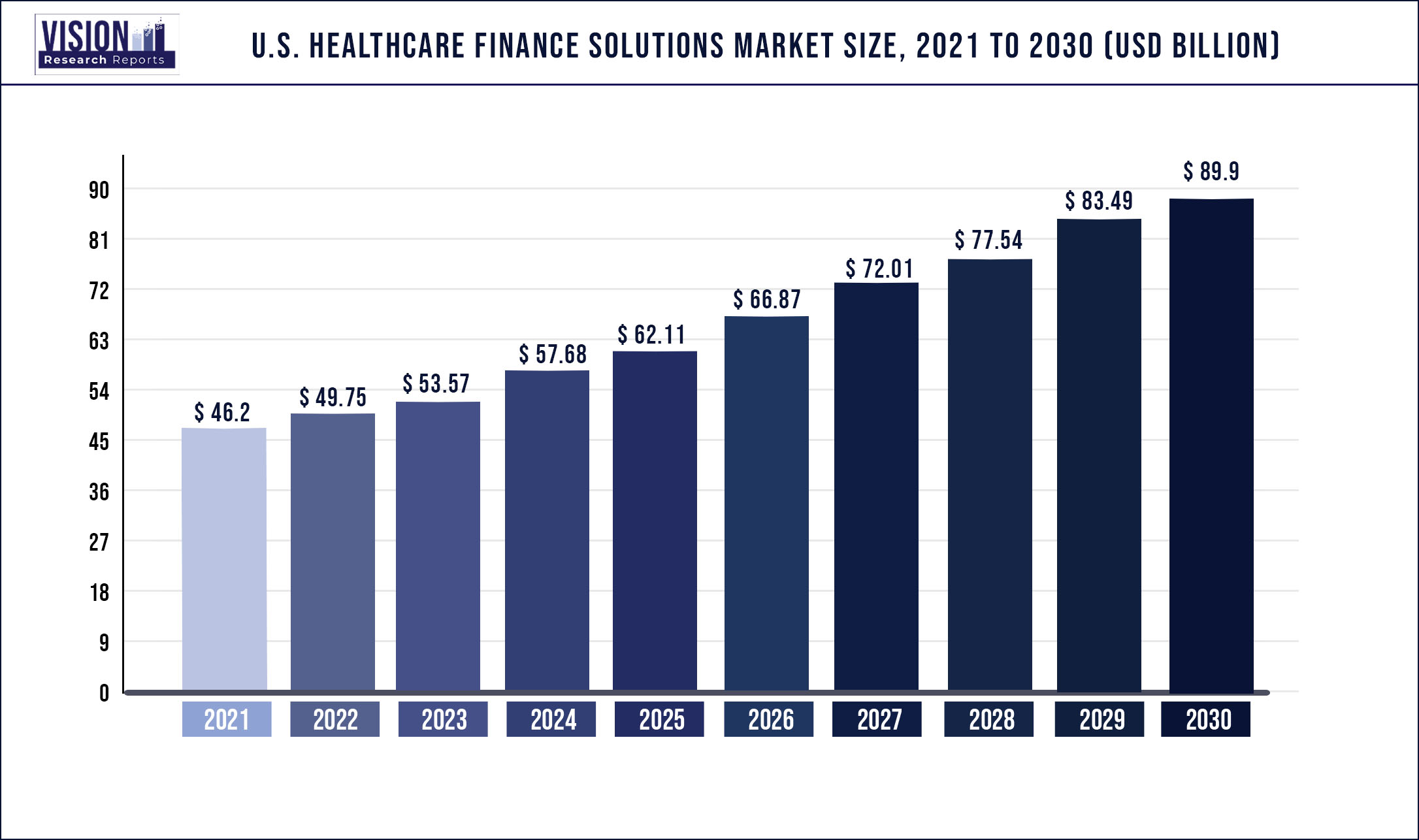

The U.S. healthcare finance solutions market size was estimated at around USD 46.2 billion in 2021 and it is projected to hit around USD 89.9 billion by 2030, growing at a CAGR of 7.68% from 2022 to 2030.

The need for capital investment and the development of healthcare infrastructure are some of the key factors boosting the growth of the market. The COVID-19 pandemic has positively changed the growth projections of the market.

Healthcare is an evolving and expanding industry. The increasing prevalence of diseases, advances in digital technology, and the introduction of novel drugs and medicines have led to a rise in healthcare demand and expenditure. In today’s world, the healthcare system is shifting from volume to value-based care to improve patient care and engagement. Competitive pricing & improved quality of healthcare services and changes in reimbursement plans in the U.S. are expected to drive the healthcare finance solutions market over the forecast period.

The COVID-19 pandemic has increased the adoption of digitalization in healthcare. It has increased the requirement for funding in the healthcare sector to maintain the cash flow of day-to-day activities. With increased costs related to COVID-19 and the lost revenue from the cancellation of outpatient office visits, elective surgeries, and elective procedures, hospitals throughout the country became financially stressed.

The increasing consumer demand and frequently changing laws are also contributing to the growth. For instance, in 2016, the mission of The Department of Health and Human Services has entailed improving patient outcomes and reducing medical costs. These changes are driving the need for financial services in the healthcare sector. Also, the requirement for investment in advanced and innovative technology and services to reduce the overall healthcare expenditure is expected to propel the market growth during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 46.2 billion |

| Revenue Forecast by 2030 | USD 89.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.68% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Equipment type, healthcare facility type, services, lenders |

| Companies Covered |

Siemens Financial Services, Inc.; General Electric Company; Commerce Bankshares, Inc.; Thermo Fisher Scientific, Inc.; Siena Healthcare Finance; CIT Group, Inc.; Stryker; Gemino Healthcare Finance; Oxford Finance LLC; TCF Capital Solutions |

Equipment Type Insights

The decontamination equipment segment dominated the U.S. healthcare finance solutions market with a 36.0% revenue share in 2021 as there is a high requirement for the equipment and they are costly and need huge capital investment. The COVID-19 pandemic has boosted the diagnostic area for the detection and testing of the virus which increased the demand for diagnostic kits and other diagnostic equipment.

Based on equipment, the market is segmented into diagnostic/imaging equipment, specialty beds, surgical instruments, decontamination equipment, and IT equipment. The specialty beds segment is anticipated to grow at the fastest CAGR of 9.2% over the forecast period. This is due to the increase in demand for advanced beds in the healthcare facilities and the development of healthcare infrastructure is expected to fuel this industry’s growth over the forecast period.

Healthcare Facility Type Insights

The hospital & health systems were the largest segment in 2021 accounting for 25.0% of the market share owing to the increasing number of hospitals & health systems along with their increasing demand for medical care. Among frequently changing laws, expansion of healthcare access, and increasing patient admission, hospitals need financial support. Simultaneously, healthcare facilities are expected to offer the most appropriate care and the most desired outcomes to the patients. Hence, the segment is anticipated to witness significant growth over the forecast period.

The outpatient surgery center is another highly driven healthcare facility. Outpatient imaging centers are medical facilities providing imaging services. These imaging centers use advanced techniques and high-tech equipment to generate accurate images of organs, soft tissues, and blood vessels, among others. Outpatient imaging centers are expected to grow at the fastest rate of 9.1% over the forecast period due to increasing investments in R&D for developing innovative technology and the growing incidence of chronic diseases in the country.

Lenders Insights

The private player's segment contributed to the largest market share accounting for 51.1% of the share in 2021 This can be attributed to the fast approval and cash disbursement process by the private players. Based on lenders, the U.S. market is segmented into government and other federal agencies, private players, and others (such as patients).

The traditional methods of financing solutions involve endless paperwork and manual document collection are time-consuming processes that caused delays in the loan disbursement. In today’s world, with the help of AI-based platforms, the process is fast, paperless, and provides flexibility to design financial solutions and orchestration of responsibilities and communications.

Services Insights

Based on services, the equipment and technology finance segment accounted for the largest market share of 45.0% in 2021. This is due to the huge capital required for the setup along with the costly healthcare equipment which requires financial support. Financial solutions companies work closely with the business sector to fulfill the long-term financial requirements of the sector. Finance companies provide various benefits to their clients such as tax benefits, flexible payment terms, and no depreciation.

The finance companies provide various benefits to their clients such as tax benefits, flexible payment terms, no deprecation, etc. These companies use financial expertise and digitalization to provide financial solutions to serve the equipment & technology need of the healthcare sector which is likely to result in smooth functioning of the business operations.

The report also provides a crisscross analysis of lenders and service side segments for analyzing the share of lenders in each service type. In equipment and technology finance, the private players segment dominated the market with a share of 50.0% in 2021 and is likely to grow at a CAGR of 7.4% during the forecast period. The majority of the private finance companies offer equipment and technology finance to healthcare providers, which is a major factor driving the market growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Healthcare Finance Solutions Market

5.1. COVID-19 Landscape: U.S. Healthcare Finance Solutions Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Healthcare Finance Solutions Market, By Equipment Type

8.1. U.S. Healthcare Finance Solutions Market, by Equipment Type, 2022-2030

8.1.1. Diagnostic/Imaging Equipment

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Specialist Beds

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Surgical Instruments

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Decontamination Equipment

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. IT Equipment

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Healthcare Finance Solutions Market, By Healthcare Facility Type

9.1. U.S. Healthcare Finance Solutions Market, by Healthcare Facility Type e, 2022-2030

9.1.1. Hospitals & Health Systems

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Outpatient Imaging Centers

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Outpatient Surgery Centers

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Physician Practices & Outpatient Clinics

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Diagnostic Laboratories

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Urgent Care Clinics

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Skilled Nursing Facilities

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Pharmacies

9.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Healthcare Finance Solutions Market, By Services

10.1. U.S. Healthcare Finance Solutions Market, by Services, 2022-2030

10.1.1. Equipment & Technology Finance

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Working Capital Finance

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Project Finance Solutions

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Corporate Lending

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Healthcare Finance Solutions Market, By Lenders

11.1. U.S. Healthcare Finance Solutions Market, by April, 2022-2030

11.1.1. Government & Other Federal Agencies

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Private Players

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global U.S. Healthcare Finance Solutions Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Equipment Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Healthcare Facility Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Services (2017-2030)

12.1.4. Market Revenue and Forecast, by Lenders(2017-2030)

Chapter 13. Company Profiles

13.1. Siemens Financial Services, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. General Electric Company

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Commerce Bankshares, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Thermo Fisher Scientific, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Siena Healthcare Finance

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. CIT Group, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Stryker

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Gemino Healthcare Finance

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Oxford Finance LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. TCF Capital Solutions

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others