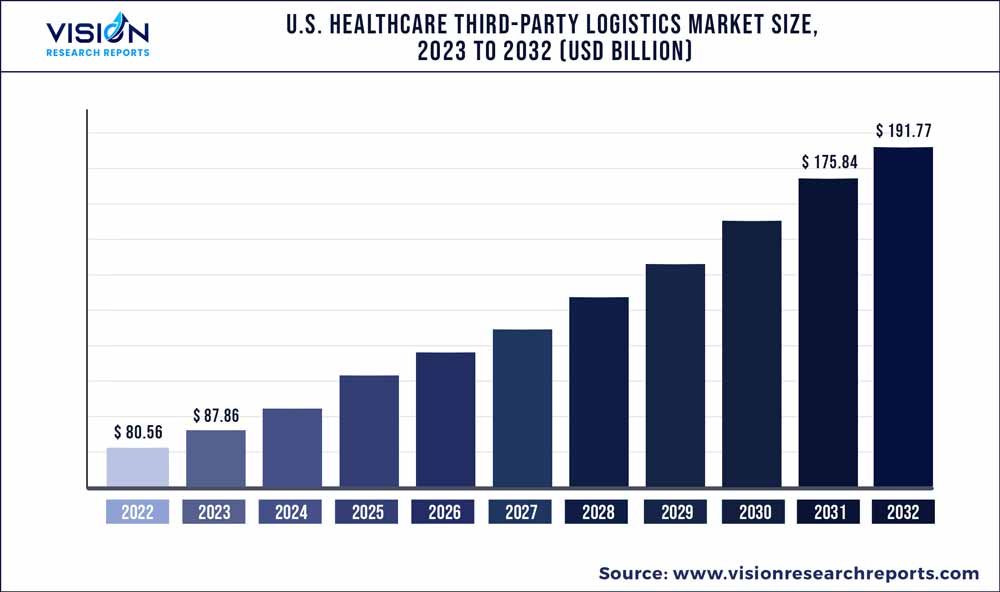

The U.S. healthcare third-party logistics market was valued at USD 80.56 billion in 2022 and it is predicted to surpass around USD 191.77 billion by 2032 with a CAGR of 9.06% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Healthcare Third-party Logistics Market

| Report Coverage | Details |

| Market Size in 2022 | USD 80.56 billion |

| Revenue Forecast by 2032 | USD 191.77 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.06% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ShipMonk; DHL International; Cardinal Health; MCKESSON CORPORATION; Kuehne+Nagel; AmerisourceBergen Corporation; C.H. Robinson; CEVA Logistics; Promptus, LLC; FedEx |

The market has been growing significantly due to the expanding e-commerce sector. Healthcare companies are using online platforms to sell their products because they lack the resources to provide their own logistics services, which has increased the demand for third-party logistics. Increasing technological advancements in the domain is expected to create growth opportunity for the market. The adoption of advanced technologies such as real-time tracking systems, the Internet of Things (IoT), and blockchain is becoming more accepted in healthcare logistics. These technologies support shipment tracking, visibility enhancement, and product integrity, which improve supply chain management and increase customer experience. A complex regulatory environment related to pharmaceutical and medical devices is further expected to provide this market with growth opportunities. Storage, handling, and transportation of drugs and medical devices are all subject to stringent regulations and compliance standards in the healthcare industry. The third-party logistics entities offer expertise in navigating regulatory frameworks that can aid healthcare companies ensure compliance and avoid penalties. Safety measures and quality control requirements are often part of regulatory compliance. Third-party logistic entities help their clients maintain and implement these standards throughout the supply chain.

The COVID-19 pandemic significantly impacted the market. The COVID-19 pandemic resulted in increased demand for medical supplies such as ventilators, personal protective equipment, and other crucial products. As a result, several companies in the market adopted the changing needs of the healthcare business to meet the demand. Moreover, the COVID-19 pandemic contributed to increased partnerships between healthcare entities with third-party logistics companies to operate in a growing and changing demand.

Industry Insights

The biopharmaceutical segment dominated the overall market with a revenue share of over 61% in 2022. This dominance is attributed to an increase in the number of biosimilar introductions and pharmaceutical companies' focus on their distribution network. Technological advances have increased the use of temperature management logistic services. Furthermore, the growing trend of medical companies outsourcing logistics to strengthen their distribution system is also expected to boost the segment’s growth.

The medical device segment is expected to witness the fastest growth over the forecast period. Supply chains in the medical device sector are complex and involve the sourcing of raw materials, manufacturing procedures, quality control, and distribution. 3PL providers offer expertise in enhancing productivity, cutting costs, and streamlining supply chains. They can help with order fulfillment, inventory management, shipping, and warehousing, guaranteeing a smooth supply chain from the point of production to the end-user.

Supply Chain Insights

The non-cold chain logistics segment generated the largest revenue share of over 61% in 2022.This is due to the rising sales of pharmaceuticals through distributors. Scalability, reduced operational costs, higher profits, and fewer risks are all features of logistic services. Due to all these advantages, third-party logistic providers have become an essential component of the pharmaceutical business.

Cold chain logistics is expected to showcase a significant market share in the coming years. There is increasing demand for temperature-sensitive biologics, pharmaceuticals, vaccines, and other healthcare products in the U.S. This demand is driven by factors such as the introduction of advanced therapies, an aging population, and the need for effective disease control. These pharmaceutical products need strict temperature control throughout the supply chain, resulting in raised dependence on cold chain logistics.

Service Type Insights

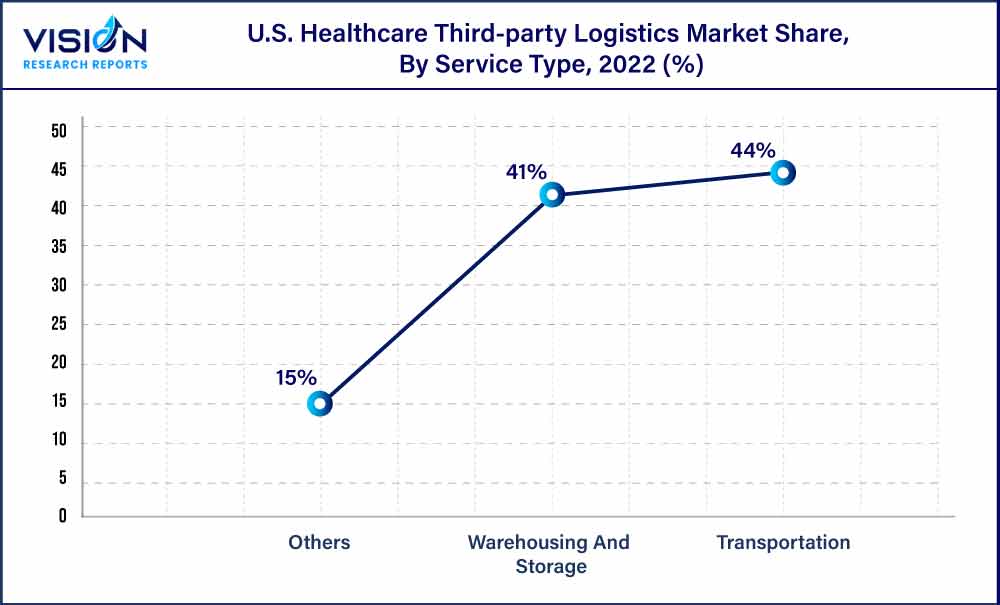

The warehousing and storage segment dominated with the largest revenue share of over 41% in 2022.In the healthcare industry, efficient inventory management is essential to ensuring the availability and prompt delivery of drugs and medical supplies. Warehousing and storage entities offer services such as stock rotation, and inventory tracking to simplify the supply chain processes. These services assist healthcare facilities in minimizing stockouts, increasing operational effectiveness, and optimizing inventory levels. Such advantages are expected to boost the segment growth.

The other services segment is expected to register the fastest CAGR during the forecast period. This segment includes custom & duty management, packaging, procurement services, and a few other value-added services. Procurement services are one of the crucial services of healthcare logistics. To ensure that production costs do not exceed a company's budget objectives, procurement and logistics management must coexist and function together efficiently.

U.S. Healthcare Third-party Logistics Market Segmentations:

By Industry

By Supply Chain

By Service Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Industry Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Healthcare Third-party Logistics Market

5.1. COVID-19 Landscape: U.S. Healthcare Third-party Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Healthcare Third-party Logistics Market, By Industry

8.1. U.S. Healthcare Third-party Logistics Market, by Industry, 2023-2032

8.1.1 Biopharmaceutical

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pharmaceutical

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Medical Device

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Healthcare Third-party Logistics Market, By Supply Chain

9.1. U.S. Healthcare Third-party Logistics Market, by Supply Chain, 2023-2032

9.1.1. Cold Chain

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-cold Chain

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Healthcare Third-party Logistics Market, By Service Type

10.1. U.S. Healthcare Third-party Logistics Market, by Service Type, 2023-2032

10.1.1. Transportation

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Warehousing And Storage

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Healthcare Third-party Logistics Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Industry (2020-2032)

11.1.2. Market Revenue and Forecast, by Supply Chain (2020-2032)

11.1.3. Market Revenue and Forecast, by Service Type (2020-2032)

Chapter 12. Company Profiles

12.1. ShipMonk

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DHL International.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cardinal Health.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. MCKESSON CORPORATION

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kuehne+Nagel

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AmerisourceBergen Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. C.H. Robinson.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CEVA Logistics

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Promptus, LLC.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. FedEx

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others