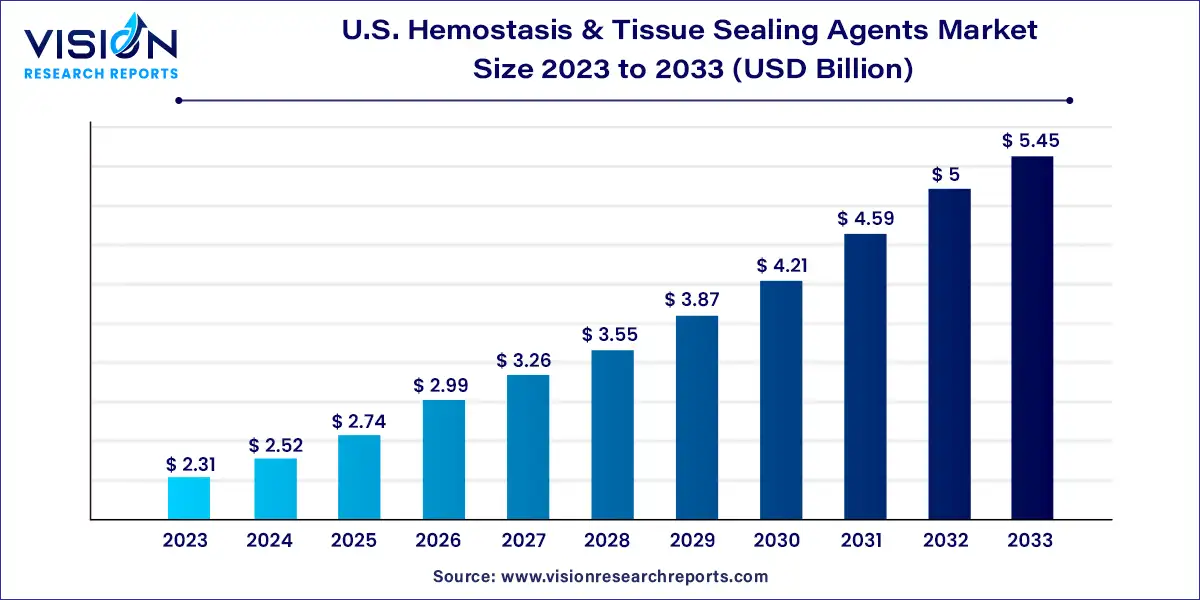

The U.S. hemostasis & tissue sealing agents market size was estimated at around USD 2.31 billion in 2023 and it is projected to hit around USD 5.45 billion by 2033, growing at a CAGR of 8.97% from 2024 to 2033.

The U.S. hemostasis and tissue sealing agents market is witnessing significant growth driven by advancements in medical technology, rising surgical procedures, and increasing awareness about the benefits of these products. Hemostasis and tissue sealing agents play a crucial role in controlling bleeding and promoting wound healing, thereby improving patient outcomes and reducing healthcare costs.

The growth of the U.S. hemostasis and tissue sealing agents market is driven by the technological advancements in the development of innovative hemostatic agents and tissue sealants with improved efficacy and safety profiles are driving market expansion. Furthermore, the escalating number of surgical procedures, fueled by the rising prevalence of chronic diseases and the aging population, has significantly increased the demand for these products across various medical specialties. Moreover, heightened awareness among healthcare professionals and patients regarding the benefits of hemostasis and tissue sealing agents in minimizing bleeding and enhancing surgical outcomes has contributed to their widespread adoption. Additionally, the expanding applications of these agents in minimally invasive procedures, trauma management, and wound care are further propelling market growth. Despite challenges such as stringent regulatory requirements and high costs, manufacturers are actively focusing on research and development endeavors to introduce safer and more cost-effective solutions to meet the growing demand in the market.

In 2023, the topical hemostat segment dominated the market with a significant share of 66%. Typically used in conjunction with conventional treatment methods, these hemostats offer minimal tissue reactivity, quick absorption, non-antigenicity, and cost-effectiveness. They are categorized into mechanical, active, and flowable types, comprising materials such as polyethylene glycols, porcine gelatin, cellulose, and collagen.

The adhesive and tissue sealant segment is projected to witness substantial growth during the forecast period, given its crucial role in managing blood loss during surgeries. This segment is further divided into synthetic, natural, and adhesion barrier subcategories. Factors driving their demand over sutures include faster procedural rates, minimal invasiveness, reduced post-surgical infections, and prevention of fluid exudation from the body.

By Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Hemostasis & Tissue Sealing Agents Market

5.1. COVID-19 Landscape: U.S. Hemostasis & Tissue Sealing Agents Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Hemostasis & Tissue Sealing Agents Market, By Product

8.1.U.S. Hemostasis & Tissue Sealing Agents Market, by Product Type, 2024-2033

8.1.1. Topical Hemostat

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Adhesive & Tissue Sealant

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Hemostasis & Tissue Sealing Agents Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Johnson & Johnson

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. CryoLife Inc

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Advance Medical Solution (AMS) Group Plc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Cohera Medical Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Integra Life Sciences Corporation

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Pfizer Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. BD

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Baxter

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. HyperBranch Medical Technology

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Biomet Inc

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others