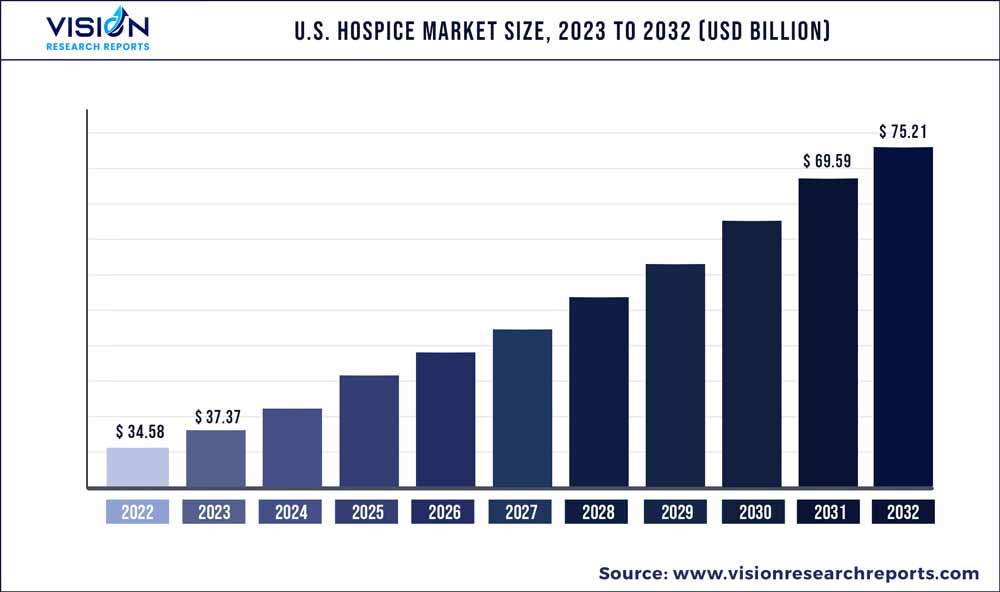

The U.S. hospice market was valued at USD 34.58 billion in 2022 and it is predicted to surpass around USD 75.21 billion by 2032 with a CAGR of 8.08% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Hospice Market

| Report Coverage | Details |

| Market Size in 2022 | USD 34.58 billion |

| Revenue Forecast by 2032 | USD 75.21 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.08% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Chemed Corporation; Amedisys; Kindred Healthcare Inc.; Inc.; Brookdale Senior Living, Inc.; LHC Group, Crossroads Hospice; Accentcare, Inc.;Seasons Hospice & Palliative Care; Heart to Heart Hospice; Oklahoma Palliative & Hospice Care |

The growth of the market can be attributed to the rising prevalence of chronic diseases among the rapidly growing geriatric population. According to CDC data from November 2022, around 6 in 10 adults in the U.S. are suffering from chronic diseases, and around 4 in 10 have two or more chronic diseases. The hospice provides end-of-life services to such individuals and focuses on improving the quality of life through palliative care.

Hospice and palliative services benefit the elderly by decreasing hospitalizations, focusing on the body, mind, & spirit, managing pain & symptoms, and supporting patients & families in comprehending treatment regimens, resulting in increased demand for these services. Both state and federal governments regulate organized home care and hospice programs.

The U.S. Code of Federal Regulations (CFR) includes more specific Medicare regulations, such as standards for quality reporting and appeals process for Medicare Part D prescription coverage. Parts of the Social Security Act (42 U.S.C., Section 1395d, et seq.) deal with hospice care standards for federal entitlement programs, particularly Medicare.

Moreover, increasing Medicare reimbursement for hospice and growing demand for end-of-life services in the U.S. is expected to boost the demand for the market during the forecast period. For instance, in July 2022, CMS issued FY 2023 hospice payment update and increased payment by 3.8% (USD 825 million) compared to 2022. However, apart from Medicare, Medicaid, other private insurance, and charity or uncompensated care providers covers the cost of hospice in the U.S.

Furthermore, the number of hospice centers in the U.S. is constantly growing in the U.S. owing to growing demand as the U.S. population ages and the number of patients with end-of-life conditions rises. This is expected to contribute to the growth of the market in the coming years. According to the CMS's 2022 Hospice Information Gathering Report, in 2019, around 1.6 million Medicare beneficiaries in the U.S. received hospice, and Medicare spent around USD 20.9 billion on these services.

The COVID-19 pandemic slightly impacted the market in the U.S. owing to a reduction in patient visits to the centers due to lower referrals from hospitals. Moreover, these centers were utilized to treat COVID-19 patients, adversely affecting the operations of the centers. According to a NAHC survey in 2020, nearly two-thirds (61%) of hospices admitted COVID-19-positive patients in their care.

At the same time, more than half of those polled said admissions were down in March 2020 compared to March 2019. More than a quarter of respondents experienced a 15% or greater decline in admissions. In the current scenario, hospices have substantially adopted the technology. In NAHC's survey, more than 84% of respondents reported using telecommunications technology to deliver services to Medicare patients, with 82% saying they use two-way audiovisual communications, which positively impacts the overall market.

Type Insights

Based on type, the market is segmented into continuous home care, routine home care, inpatient respite care, and general inpatient care. The Routine Home Care (RHC) segment held the largest market share of 91% in 2022 due to high comfort, favorable reimbursement policies, and routine visits by licensed nurses, physicians, and aides. It has the advantage of receiving constant attention, companionship, and family involvement. In 2022, VITAS Healthcare generated the maximum of its revenue from RHC. According to NHPCO, in 2018, 89.81% of the total Medicare spending was for RHC, an increase of 17.8% from 2014.

Other settings, such as inpatient respite care, continuous home care, and general inpatient home care, are anticipated to grow at a steady pace over the forecast period. Continuous home care (CHC) services are short-term services provided at home where symptoms cannot be managed. Furthermore, as the main aim of CHC is to manage acute symptom crises at home, it significantly reduces hospital admissions. A study published in NCBI found that hospice CHC decreases the likelihood of hospitalization and non-enrollment. Thus, it provides comprehensive end-of-life care. These factors are expected to drive segment growth.

However, inpatient home care and inpatient respite care services are provided in healthcare facilities as the symptoms cannot be managed at home. The inpatient respite care segment is expected to grow owing to supportive reimbursement policies for respite care and increasing focus on the mental health of primary care providers.

Location Insights

Based on location, the market is segmented into hospice centers, hospitals, home hospice care, and skilled nursing facility. The hospice center segment held the maximum share of 59% in the market in 2022, owing to the benefits offered by these facilities. These centers prevent the need for hospitalization and offer more balanced and controlled care settings.

Hospice centers can be helpful to patients who need round-the-clock care or do not have a caregiver. Hence, many organizations are launching hospice centers at different locations, which is expected to contribute to the market's growth over the forecast period. For instance, in February 2022, Chemed Corporation, a subsidiary of VITAS Healthcare, opened two new hospice in-patient centers in Florida. This initiative by VITAS Healthcare is expected to increase services to 900 patients annually with the opening of new centers.

The home hospice care segment is expected to witness significant growth over the forecast period. This can be attributed to the growing preference of patients and family members. It offers a more comfortable environment to the patient along with freedom for visitors. In addition, it saves family members the traveling costs required to reach the patient. It is a more cost-effective option compared to long-term hospital stays.

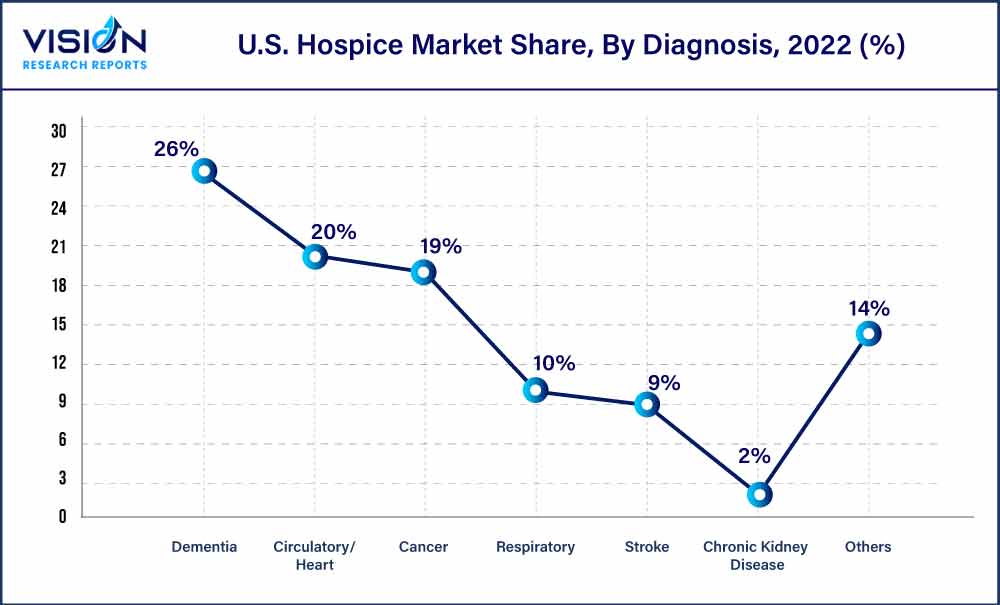

Diagnosis Insights

Based on diagnosis, the dementia segment held the largest market share of 26% in 2022 and is expected to maintain its dominance over the forecast period. Dementia is one of the leading causes of mental impairment among older adults in the U.S., contributing to the growth of the segment. The population suffering from end-stage dementia is more vulnerable to loss of awareness and infections and faces increased difficulty in communicating, which increases the need for effective treatment.

Effective end-of-life care prevents and relieves suffering and supports patients in the best possible way. It also reduces the caregivers’ burden and ensures optimal treatment decisions. The mortality rate due to Alzheimer’s disease is on the rise in the U.S., which ultimately increases the demand for palliative care. According to Alzheimer's Association, in 2023, an estimated 6.7 million Americans aged 65 and above are estimated to be suffering from Alzheimer's dementia. Around 73% of those people are over the age of 75 years.

The cancer segment is expected to hold a considerable share of the market in the near future owing to the growing prevalence of cancer among the geriatric population. The rising preference for palliative care among the families of these elderly patients is anticipated to fuel the growth of the segment. According to NHPCO, in 2022, cancer was the third largest category for diagnoses, accounting for around 7.5% of Medicare decedents. Patients with a principal diagnosis of cancer had 55 days of care on average in 2022.

U.S. Hospice Market Segmentations:

By Type

By Location

By Diagnosis

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Hospice Market

5.1. COVID-19 Landscape: U.S. Hospice Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Hospice Market, By Type

8.1. U.S. Hospice Market, by Type, 2023-2032

8.1.1 Routine Home Care

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Continuous Home Care

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Continuous Home Care

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. General Inpatient Care

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Hospice Market, By Location

9.1. U.S. Hospice Market, by Location, 2023-2032

9.1.1. Hospice Center

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Hospital

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Home Hospice Care

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Skilled Nursing Facility

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Hospice Market, By Diagnosis

10.1. U.S. Hospice Market, by Diagnosis, 2023-2032

10.1.1. Dementia

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Circulatory/Heart

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Cancer

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Respiratory

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Stroke

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Chronic Kidney Disease

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Hospice Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Location (2020-2032)

11.1.3. Market Revenue and Forecast, by Diagnosis (2020-2032)

Chapter 12. Company Profiles

12.1. Chemed Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amedisys.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kindred Healthcare Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Brookdale Senior Living, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. LHC Group, Crossroads Hospice

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Accentcare, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Seasons Hospice & Palliative Care.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Openpay

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Oklahoma Palliative & Hospice Care

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others