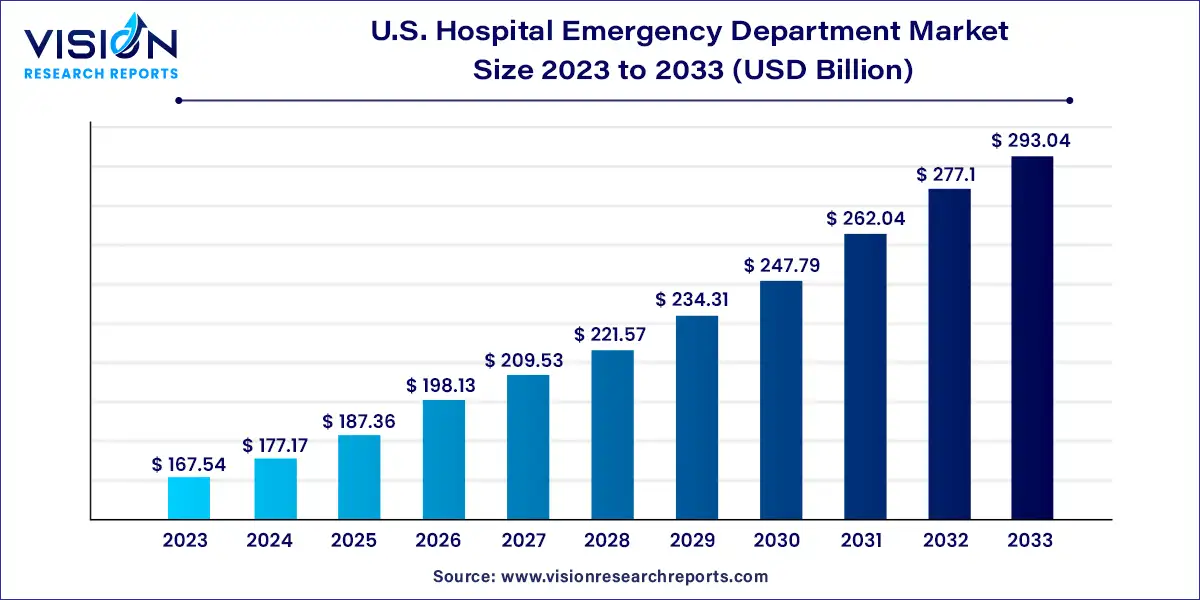

The U.S. hospital emergency department market was surpassed at USD 167.54 billion in 2023 and is expected to hit around USD 293.04 billion by 2033, growing at a CAGR of 5.75% from 2024 to 2033.

The U.S. hospital emergency department (ED) market plays a pivotal role in the nation's healthcare landscape, serving as the frontline for urgent medical care. With a growing emphasis on healthcare accessibility, quality, and efficiency, understanding the dynamics of this market is crucial for stakeholders ranging from healthcare providers to policymakers and investors.

The growth of the U.S. hospital emergency department (ED) market is driven by several key factors. Firstly, population growth and an aging demographic contribute to increased demand for emergency medical services, as older adults often require urgent care for chronic conditions and age-related emergencies. Additionally, limited access to primary care services, particularly in rural and underserved areas, prompts individuals to seek care in EDs for non-emergency conditions, further boosting utilization rates. Furthermore, public health emergencies, such as natural disasters and infectious disease outbreaks, highlight the critical role of EDs in disaster preparedness and response efforts. These factors collectively contribute to the sustained growth and importance of the U.S. Hospital Emergency Department market, underscoring its significance in the nation's healthcare landscape.

| Report Coverage | Details |

| Market Size in 2023 | USD 167.54 billion |

| Revenue Forecast by 2033 | USD 293.04 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.75% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on the insurance type, the market is further bifurcated into Medicare & Medicaid and private & others. The private & others segment dominated the market with a revenue share of 48% in 2023 and is expected to witness the fastest growth rate over the forecast period. This is owing to the increasing number of commercial insurance providers and rising disposable income levels. For instance, a study conducted by a researcher at the University of North Carolina found that from 1996 to 2015, private insurance providers paid more for ED visits than Medicare or Medicaid. Some private payers use value-based care strategies to reduce ED visits and hospitalizations rather than cutting coverage. Humana, for example, used value-based care models in Medicare Advantage plans, which resulted in fewer ED visits.

Preventive screenings, collaboration with care teams, and effective management of chronic illnesses are all components of a value-based care model that can help reduce the number of emergency room visits. This is expected to boost the growth of the private player’s segment. The Medicare and Medicaid segment held a significant share of the market for U.S. hospital emergency departments. This can be attributed to the high number of beneficiaries covered under Medicare. According to CMS, it is estimated that around 61.5 million Americans are enrolled in Medicare in 2021. Out of these, 3.8 million were new enrollees. These total beneficiaries include 49% of people between the ages 65 and 74, followed by 26% between 84, 14% under age 65, and 11% are 85 or older.

Based on the condition, the market is segmented into traumatic, infectious, gastrointestinal, psychiatric, cardiac, neurologic, and others. The infectious conditions segment dominated the market with the largest revenue share of 39% in 2023. This can be attributed to increasing ER visits during flu season. According to the CDC National Hospital Ambulatory Medical Care Survey, in 2018, fever and cough accounted for 5,837,000 and 4,955,000 emergency visits in the U.S. The segment is projected to witness the highest CAGR of 6.23% during the forecast period owing to the high transmissibility of infectious diseases.

Significant increases in the number of motor vehicle accidents and increasing incidence of spinal cord injury, TBI, unintentional falls, and concussion are expected to drive the growth of the traumatic conditions segment. Traumatic Brain Injury (TBI) is a major cause of disability and death in the U.S. As per the National Hospital Ambulatory Medical Care Survey, there were 0.3 million ED visits due to accidents and 35 million ED visits due to injury in the U.S. This is likely to favor segment growth.

On the other hand, gastrointestinal and cardiac conditions segments are expected to grow at a moderate rate in the market for U.S. hospital emergency departments during the forecast period. According to the Nationwide Emergency Department Sample, in 2018, a total of 7.07 million and 3.6 million ED visits took place due to diseases of the digestive and circulatory systems, respectively. The U.S.'s rising burden of digestive and cardiac diseases will likely favor both segments' growth.

By Insurance Type

By Condition

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Hospital Emergency Department Market

5.1. COVID-19 Landscape: U.S. Hospital Emergency Department Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Hospital Emergency Department Market, By Insurance Type

8.1. U.S. Hospital Emergency Department Market, by Insurance Type, 2024-2033

8.1.1. Medicare & Medicaid

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Private & Others

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Hospital Emergency Department Market, By Condition

9.1. U.S. Hospital Emergency Department Market, by Condition, 2024-2033

9.1.1. Traumatic

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Infectious

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Gastrointestinal

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Psychiatric

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cardiac

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Neurologic

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Hospital Emergency Department Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Insurance Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Condition (2021-2033)

Chapter 11. Company Profiles

11.1. Parkland Health

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Lakeland Regional Health

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. St. Joseph’s Health

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Natchitoches Regional Medical Center

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Schoolcraft Memorial Hospital

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Clarion Hospital

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. USA Health

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Baptist Health South Florida

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Montefiore Medical Center

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. LAC+USC Medical Center

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others