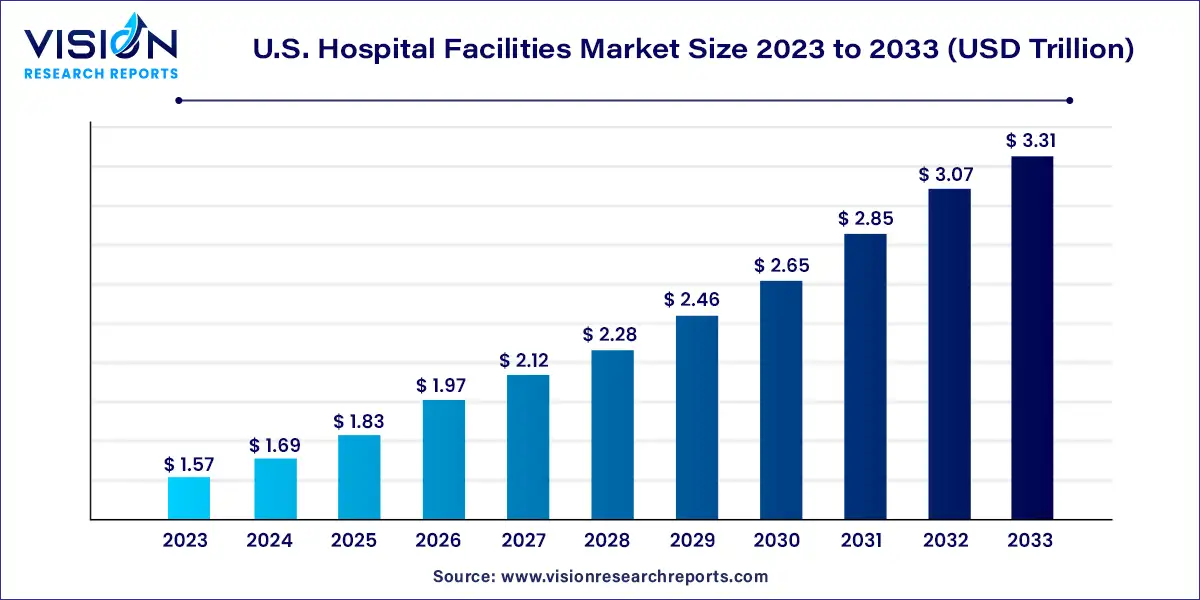

The U.S. hospital facilities market was estimated at USD 1.57 trillion in 2023 and it is expected to surpass around USD 3.31 trillion by 2033, poised to grow at a CAGR of 7.73% from 2023 to 2032.

The U.S. hospital facilities market encompasses a diverse array of healthcare institutions, ranging from small community hospitals to large academic medical centers. As the cornerstone of the nation's healthcare infrastructure, these facilities play a vital role in providing comprehensive medical services to patients across the country.

The U.S. hospital facilities market is experiencing notable growth, driven by several key factors. Firstly, the increasing demand for healthcare services due to population growth, aging demographics, and the prevalence of chronic diseases is fueling the expansion of hospital facilities across the country. Additionally, advancements in medical technology and treatment modalities are necessitating infrastructure upgrades and the construction of specialized facilities to meet evolving patient needs. Moreover, government initiatives aimed at improving access to healthcare, such as the Affordable Care Act, have stimulated investment in hospital infrastructure development. Furthermore, the growing emphasis on patient-centered care and quality outcomes is driving hospitals to invest in state-of-the-art facilities equipped with advanced amenities and technology. Lastly, strategic partnerships and mergers within the healthcare industry are fostering consolidation and driving investment in modernizing existing hospital facilities to enhance operational efficiency and patient satisfaction. Collectively, these growth factors are shaping the landscape of the U.S. hospital facilities market, positioning it for continued expansion and innovation in the years ahead.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.57 trillion |

| Revenue Forecast by 2033 | USD 3.31 trillion |

| Growth rate from 2024 to 2033 | CAGR of 7.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of patient services, the market is segmented into outpatient services and inpatient services. The outpatient services segment dominated the market in 2023 with a revenue share of 53%. The development of new technologies such as telemedicine, telemonitoring, and diagnostic techniques has led to shorter patient stays as physicians can provide treatment remotely, which in turn reduces overhead costs and patient fees. Furthermore, there is a gradual shift to outpatient or daycare surgeries among patients. Minimally invasive surgeries have made it possible for daycare surgeries to flourish. This is expected to boost the outpatient service segment growth.

The inpatient services segment is expected to grow owing to the rising number of hospitalizations and the high cost of care for inpatients. The growing population, rise in life expectancy to more than 75 years, and increasing prevalence of lifestyle illnesses in the U.S. have increased the need for continuous & coordinated care for patients recuperating from an acute accident or sickness. As a result of these factors, the inpatient services segment is likely to grow in the market over the forecast period. However, the segment growth is projected to be moderate during the forecast period. Inpatient services are the primary source of revenue for hospitals. However, due to the introduction of novel techniques such as better diagnostics and interventional surgeries, the recovery time for patients is being reduced. Thus, the average time for an inpatient is reduced, which in turn is expected to decrease the share of the inpatient services segment in the near future.

Based on service type, the market is segmented into acute care, cardiovascular, cancer care, neurorehabilitation & psychiatry services, pathology lab, diagnostic, and imaging, obstetrics & gynecology, and others. The cardiovascular segment dominated the market in 2023 with a market share of 22%. The segment is expected to dominate the market throughout the forecast period. Growing adoption of a sedentary lifestyle has led to a rise in the incidences of obesity in the U.S., thereby, increasing the risk of heart disease. Thus, the increasing number of patients suffering from CVDs is expected to propel segment growth.

The cancer care segment is anticipated to register a significant CAGR over the forecast period. Cancer is the second leading cause of death in the U.S. after CVD. The relapsing nature of the disease and frequent chemotherapy sessions are contributing to an increase in the number of hospitalizations due to cancer. According to the American Cancer Society, around 1.9 billion new cancer cases are expected to be diagnosed in the U.S. in 2022. The increasing cost of cancer treatment, the rising number of specialized oncology departments & oncologists, and a supportive reimbursement framework are among the factors expected to propel segment growth.

The acute care segment is anticipated to register the fastest CAGR of 8.84% over the forecast period owing to the increasing demand for primary care services and rising prevalence of acute infections. For instance, according to the CDC, a total of 523,000 emergency visits for infectious and parasitic diseases resulted in admissions in 2018.

Based on bed size, the market is segmented into 0-99, 100-199, 200-299, and 300-more. The 0-99 segment dominated the market in 2023 with a revenue share of 55%. This segment comprises small hospitals that primarily serve rural or remote areas with low population density. These hospitals play an important role in providing access to basic healthcare services to communities although some hospitals in this segment fulfill specialized needs of the services based on the local population. Their primary focus is on delivering essential medical care.

The 100-199 segment is anticipated to register the fastest CAGR of 8.20% over the forecast period. These hospitals are better equipped to offer a wider range of services and specialties compared to the smaller facilities. With a higher bed capacity, they can accommodate more patients and address a broader spectrum of medical needs.

The 399 and more segment is anticipated to witness a lucrative CAGR over the forecast period. They are equipped with modern technology, specialized medical staff, and research capabilities, driving advancements in medical science. These are the factors attributed to the growth of this segment.

In terms of facility type, the market is segmented into public/community hospitals, state owned & federal hospitals, and private hospitals. The public/community hospitals segment dominated the market in 2023 with a share of 54%. For instance, community hospitals had a total of 789,354 beds. Community hospitals hold the highest number of patient beds and tend to a wide variety of care areas/medical issues through their different services. They are non-profit organizations meant for public services and are supported by various philanthropic groups, businesses, and crowd-funded societies. The rise in inpatient admissions and the financial support from business groups is expected to drive the segment growth.

The state-owned and federal hospitals segment held the second prominent position in the market. The state-owned hospitals primarily aim to target patients who require acute care, including infection control and accident/trauma cases. Federal hospitals play an essential role in providing healthcare services to patients who have limited access to quality care. According to AHA, in 2022, there were 207 federal hospitals in the U.S. Increasing access to public healthcare is expected to drive the segment growth.

On the other hand, the private hospitals segment is anticipated to witness lucrative growth over the forecast period. Private hospitals have gradually advanced their technology to better serve patients in need of critical care, such as cancer patients. The growing number of private hospitals and consolidation of healthcare facilities are expected to bolster the growth of the segment.

By Patient Service

By Facility Type

By Service Type

By Bed Size

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Hospital Facilities Market

5.1. COVID-19 Landscape: U.S. Hospital Facilities Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Hospital Facilities Market, By Patient Service

8.1. U.S. Hospital Facilities Market, by Patient Service, 2024-2033

8.1.1. Inpatient

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Outpatient

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Hospital Facilities Market, By Facility Type

9.1. U.S. Hospital Facilities Market, by Facility Type, 2024-2033

9.1.1. Private Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. State Owned & Federal Hospitals

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Public/Community Hospitals

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Hospital Facilities Market, By Service Type

10.1. U.S. Hospital Facilities Market, by Service Type, 2024-2033

10.1.1. Acute Care

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cardiovascular

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cancer Care

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Neurorehabilitation & Psychiatry Services

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Pathology Lab, Diagnostics, and Imaging

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Obstetrics & Gynecology

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Hospital Facilities Market, By Bed Size

11.1. U.S. Hospital Facilities Market, by Bed Size, 2024-2033

11.1.1. 0-99

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. 100-199

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. 200-299

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. 300-more

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Hospital Facilities Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Patient Service (2021-2033)

12.1.2. Market Revenue and Forecast, by Facility Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Service Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Bed Size (2021-2033)

Chapter 13. Company Profiles

13.1. The Johns Hopkins Hospital

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Mayo Clinic Health System (Mayo Clinic)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cleveland Clinic

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cedars Sinai

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. The General Hospital Corporation (Massachusetts General Hospital)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. The Regents of The University of California (UCSF Health)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. NewYork-Presbyterian Hospital

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Brigham And Women's Hospital

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. UCLA Health

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Northwestern Memorial Hospital

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others