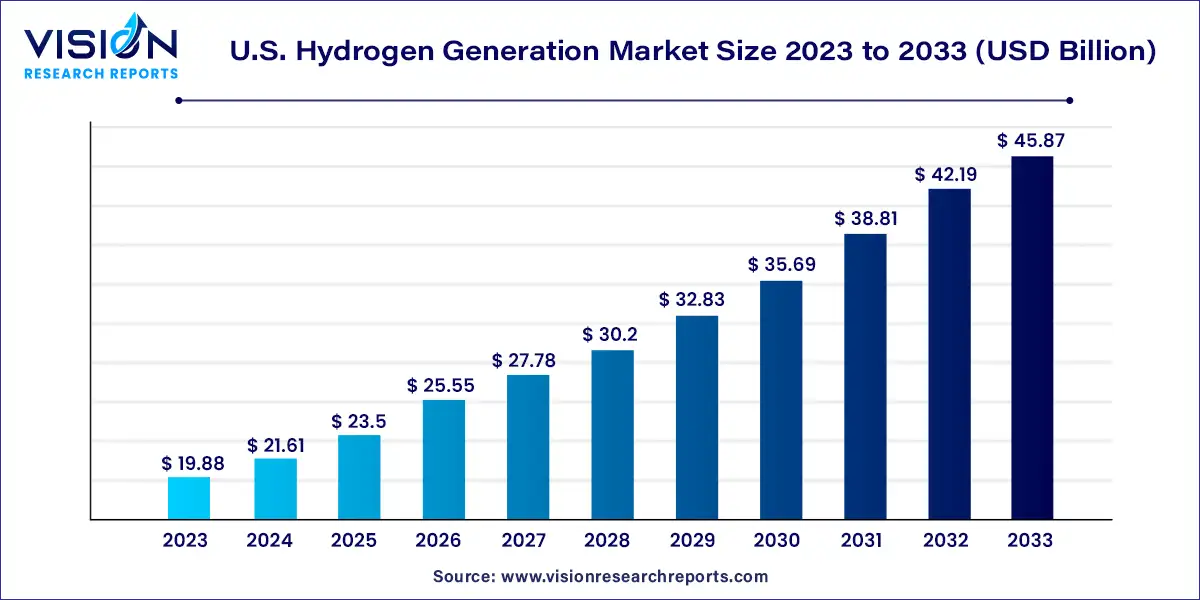

The U.S. hydrogen generation market was estimated at USD 19.88 billion in 2023 and it is expected to surpass around USD 45.87 billion by 2033, poised to grow at a CAGR of 8.72% from 2024 to 2033.

The U.S. hydrogen generation market stands at the forefront of the global energy transition, poised to redefine the landscape of sustainable energy solutions. As the world intensifies its efforts to combat climate change and reduce carbon emissions, hydrogen emerges as a pivotal player in the quest for clean energy alternatives.

The growth of the U.S. hydrogen generation market is propelled by an increasing environmental consciousness and stringent regulations aimed at curbing carbon emissions drive the demand for clean energy alternatives, positioning hydrogen as a key solution. Moreover, advancements in renewable energy integration, particularly in electrolysis-based hydrogen production, bolster the market's sustainability credentials and attractiveness. Additionally, collaborative efforts between government bodies, industry stakeholders, and research institutions foster innovation and accelerate the deployment of hydrogen technologies, amplifying market growth. Furthermore, supportive policies, incentives, and funding initiatives at multiple levels incentivize investments in hydrogen infrastructure, paving the way for market expansion.

In 2023, the merchant segment emerged as the dominant force in the market, commanding a revenue share exceeding 55%. Projections indicate its continued ascendancy, with an anticipated fastest growth rate, boasting a CAGR of 9.22% throughout the forecast period. Originating in the UK and taking root in the U.S. in 1998, merchant power generation has flourished. These plants, characterized by their independence from traditional utilities, are strategically designed for competitive wholesale markets. Unlike conventional independent power plants, merchant power facilities are purpose-built for sales in competitive spot markets, facilitated by short-term agreements.

The operational framework of merchant power generation facilitates direct sales from producers to retailers, who subsequently distribute electricity to consumers. Nonetheless, the transmission and distribution infrastructures remain under the purview of government agencies.

In 2023, steam methane reforming emerged as the predominant technology segment, capturing the largest revenue share. Renowned for its cost-effectiveness, efficiency, and widespread utilization, this process stands as a cornerstone in hydrogen generation, offering both near- and mid-term advantages in energy security and environmental stewardship. Notably, steam reforming boasts the highest efficiency among existing commercial hydrogen production methods, rendering it the favored choice among alternatives.

Coal gasification technology is poised for rapid growth within this segment throughout the forecast period. Leveraging coal as its primary feedstock, coal gasification facilitates the production of syngas—a blend predominantly composed of hydrogen, carbon monoxide, methane, carbon dioxide, oxygen, and water vapor. The hydrogen derived from this process finds application across various sectors, including ammonia production, fossil fuel upgrading, and the burgeoning hydrogen economy. Given the current technological advancements and the abundance of coal reserves across the nation, coal gasification presents a viable and economically feasible option for large-scale hydrogen production. As of December 2021, the United States held approximately 22% of the world's total coal reserves, further underscoring its potential as a key player in coal-based hydrogen generation

In 2023, ammonia production emerged as the dominant application segment, commanding a revenue share exceeding 21%. A significant portion of the hydrogen produced finds its utilization in ammonia plants. The potential of ammonia as a carbon-free fuel, hydrogen carrier, and energy storage medium presents an opportunity for the widespread deployment of renewable hydrogen technologies. The rise of green ammonia, characterized by its absence of carbon emissions, has witnessed a surge in adoption in recent years. Numerous companies are establishing green ammonia production facilities to meet the escalating demand.

The transportation segment is forecasted to experience the fastest compound annual growth rate (CAGR) during the projection period. The increasing demand for hydrogen as a vehicle fuel is expected to drive market expansion in the years ahead. Many automotive manufacturers are investing in the development of hydrogen-powered vehicles. For instance, in September 2021, Hyundai announced its intentions to offer hydrogen fuel cell-powered vehicles for its entire commercial vehicle lineup by 2028. Other companies, including Toyota Motors, BMW AG, and the Volkswagen Group, are also planning to introduce new hydrogen-powered vehicles in the near future, further stimulating demand during the forecast period.

In 2023, natural gas emerged as the dominant source segment, commanding a substantial revenue share of 77%. The power industry has notably shifted its focus towards large-scale power plants exceeding 200 megawatts (MW), with an increasing incorporation of natural gas as a primary feedstock for hydrogen generation. Given the projected surge in electricity demand, estimated to rise by nearly two-thirds of the current demand throughout the forecast period, the utilization of natural gas in steam methane reforming processes has gained prominence. This method, prevalent among various hydrogen production processes in the U.S., utilizes methane-rich raw materials like natural gas. The process involves heating the gas to temperatures ranging between 700°C–1,000°C and subjecting it to high pressure, resulting in the breakdown of methane into hydrogen, with carbon dioxide and carbon monoxide produced as by-products.

On the other hand, water as a source for hydrogen generation is anticipated to experience the fastest compound annual growth rate (CAGR) of 18.85% during the forecast period. Electrolysis stands out as a promising method for producing hydrogen from renewable resources. This process involves the splitting of water molecules into hydrogen and oxygen within an electrolyzer. Through this approach, hydrogen can be generated with minimal local air pollutants and greenhouse gas emissions. The efficiency of conversion to hydrogen in electrolysis technology ranges from 80% to 90%, highlighting its potential as an environmentally friendly alternative for hydrogen production.

By System

By Technology

By Application

By Source

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others