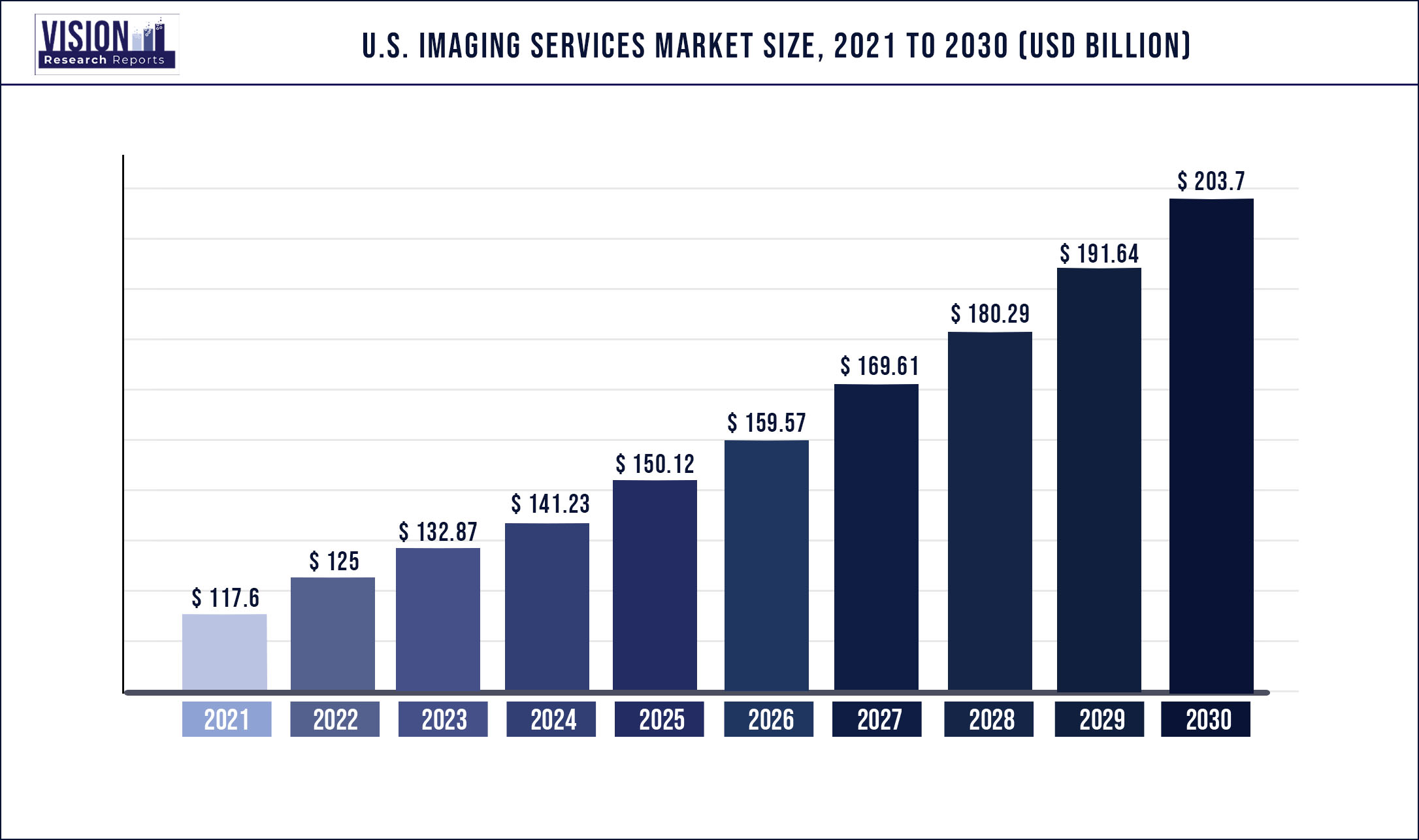

The U.S. imaging services market size was estimated at around USD 117.6 billion in 2021 and it is projected to hit around USD 203.7 billion by 2030, growing at a CAGR of 6.29% from 2022 to 2030.

The growing prevalence of cancer and cardiac disorders among other conditions is expected to drive the growth. Imaging services involve different imaging modalities, such as X-rays, mammography, CT scans, nuclear medicine scans, MRI scans, and ultrasound. Each modality includes its associated advantages of diagnosing a wide range of healthcare conditions accurately.

Adoption of imaging services in the U.S. is increasing gradually to enhance early diagnosis of the disease, which, in turn, improves its treatment options. Moreover, the growing adoption of non-invasive and cost-efficient procedures is expected to contribute to market growth. Medical imaging services consume less time in comparison to other invasive procedures and thus helps in reducing hospital stay and cost associated with it. Various technologies are being developed to enhance medical imaging devices by improving the image quality captured by them. These fine and sharp images help in diagnosing the disease at an early stage, thereby improving its treatment outcomes.

The number of outpatient settings in the U.S. is increasing rapidly and the installation of advanced imaging devices in these settings is on the rise. As per the Organization for Economic Co-operation and Development (OECD), in 2021, 17.9 per 1,000,000 inhabitants MRI units were installed in hospitals. Moreover, the growing number of CT scans in the U.S. is expected to propel the overall market growth. As per Statista, in 2019, 279 per 1,000 inhabitants CT scans were performed in U.S. Additionally, the low cost of CT scans in comparison to MRI is expected to drive its adoption.

Major challenges in this market include the high cost of certain modalities, such as MRI, and side effects associated with each imaging modality. MRI scans are mainly preferred in diagnosing various conditions as they help in proper tissue differentiation. However, the average cost of the procedure in the U.S. is USD 1,430, which is high in comparison to other imaging modalities, thus hindering the overall market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 117.6 billion |

| Revenue Forecast by 2030 | USD 203.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.29% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Modality, end-use |

| Companies Covered | Radnet, Inc.; Alliance Medical; Inhealth Group; Sonic Healthcare; Dignity Health; Medica Group; Global Diagnostics; Novant Health; Concord Medical Services Holdings Limited; Center for Diagnostic Imaging, Inc.; Unilabs; Healius Limited; Simonmed Imaging |

Modality Insights

Based on modality, the market is segmented into X-rays, CT scans, nuclear medicine scans, MRI scans, ultrasound, and mammography. X-ray held the largest share of 19.5% in 2021. X-ray is one of the most preferred primary medical imaging modalities for various examinations and procedures.

This service non-invasively diagnoses and monitors the disease and helps in effective surgical treatment planning. However, the adoption of this service may experience a decline during the forecast period due to the availability of other effective modalities with fewer associated side effects. The ionizing radiation used during X-ray imaging is harmful and can cause damage to the DNA, which can cause cancer and similar conditions.

Moreover, the contrast agents used for X-ray imaging may also lead to some reactions in the body. On the other hand, CT scan is expected to grow at the fastest growth rate during the forecast period. The major advantage associated with this imaging modality is that it helps in detailed imaging of bone, blood vessels, and soft tissues at the same time. Additionally, this service is available at affordable costs and consumes less time in comparison to other modalities.

End-use Insights

Based on end-use, the market is segmented into diagnostic imaging centers, hospitals, and others. Others include imaging centers for specific modalities such as MRI, CT scan, and other outpatient settings. Hospitals held the largest share of 39.6% in 2021, owing to the increasing prevalence of various conditions such as cancer and cardiac disorders. According to the international agency for cancer research, in 2020, around 2,281,658 new cancer cases were diagnosed in the U.S. Similarly, as per the Centers for Disease Control and Prevention (CDC), in 2020, about 382,820 million adults in the U.S. died due to heart disease.

Furthermore, the availability of multiple imaging modalities in single facility and reimbursement policies for the imaging procedures are also expected to impact the overall market growth. Congress and the Centers for Medicare & Medicaid Services (CMS) have come up with policies affecting advanced diagnostic imaging services such as CT, MRI, PET/CT, and nuclear procedures. Medicare covers imaging services through different payment systems such as Hospital Outpatient Prospective Payment System (HOPPS), Physician Fee Schedule (PFS), and Inpatient Prospective Payment System.

The others segment is also expected to grow at a significant rate during the forecast period. The need for medical imaging services is increasing, hence, hospitals are opening healthcare centers in outpatient settings to meet this growing demand at a low cost. Hospitals have provided MRI services in outpatient setting such as in strip malls and shopping centers. This is aimed to ease the access to imaging services for the patients. Additionally, the service cost in such outpatient settings is low, thus, expected to drive its growth during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Imaging Services Market

5.1. COVID-19 Landscape: U.S. Imaging Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Imaging Services Market, By Modality

8.1. U.S. Imaging Services Market, by Modality, 2022-2030

8.1.1. X-rays

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. CT scans

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Nuclear medicine scans

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. MRI scans

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Ultrasound

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Mammography

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. U.S. Imaging Services Market, By End-use

9.1. U.S. Imaging Services Market, by End-use, 2022-2030

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Diagnostic imaging centers

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. U.S. Imaging Services Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Modality (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Radnet, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Alliance Medical

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Inhealth Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sonic Healthcare

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dignity Health

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Medica Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Global Diagnostics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Novant Health

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Concord Medical Services Holdings Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Center for Diagnostic Imaging, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others