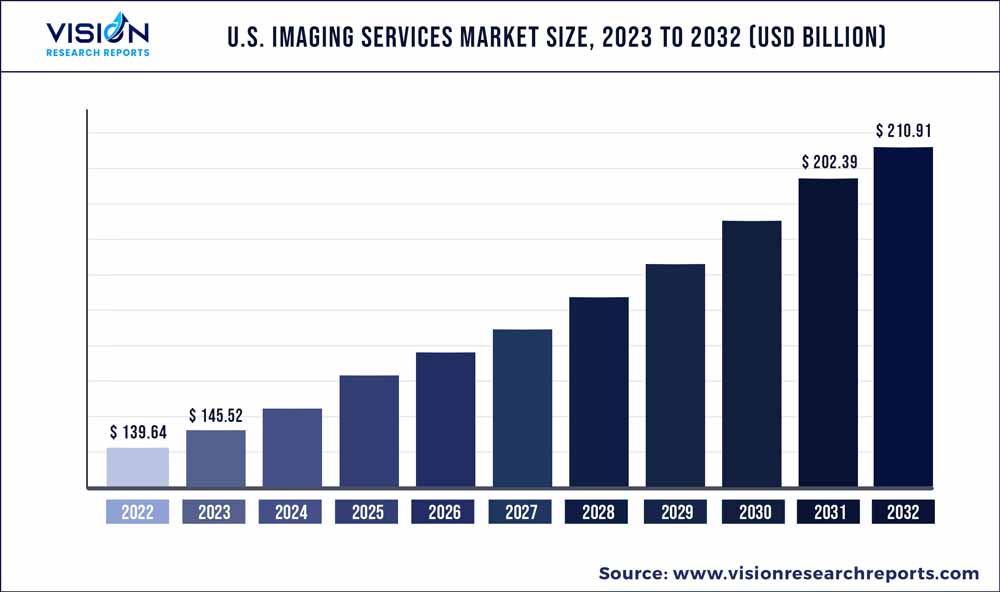

The U.S. imaging services market was surpassed at USD 139.64 billion in 2022 and is expected to hit around USD 210.91 billion by 2032, growing at a CAGR of 4.21% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Imaging Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 139.64 billion |

| Revenue Forecast by 2032 | USD 210.91 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.21% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Radnet, Inc.; Alliance Medical; Inhealth Group; Sonic Healthcare; Dignity Health; Medica Group; Global Diagnostics; Novant Health; Concord Medical Services Holdings Limited; Center for Diagnostic Imaging, Inc.; Unilabs; Healius Limited; Simonmed Imaging |

The major factors attributed to the growth include the increasing prevalence of cancer and cardiac disorders coupled with growing awareness about medical imaging technology. For instance, according to National Center for Health Statistics, in 2023, almost 1,958,310 new cancer cases and 609,820 cancer deaths are estimated to occur in the United States. In addition, the development of various technologies for enhancing medical imaging services is anticipated to boost market growth in the coming years.

Medical imaging is the preferred diagnostic technique as it provides vital information with speed, safety, and accuracy. Imaging services involve different imaging modalities such as X-ray, ultrasound, nuclear medicines scans, MRI, and CT scans which are non-invasive techniques used for diagnosing various diseases easily. Additionally, these imaging services help in early diagnosis of the disease, which helps in positive treatment outcomes.

The development of various technologies for enhancing medical imaging services is anticipated to boost the market growth in the coming years. Furthermore, the rapidly increasing aging population and high incidence of cancer are factors expected to drive market growth. Growing funding to support ongoing research activities and rising private-public initiatives related to medical imaging are factors likely to propel the overall market growth.

Contrast-enhanced ultrasound and lung CT scans have been extensively used in assessing COVID-19 patients during the first and second waves of the ongoing pandemic. These modalities were also used along with magnetic resonance imaging during clinical trials of COVID-19 vaccines. However, the overall procedural volume declined due to cancellation and delaying of planned hospital visits.

The unavailability of skilled radiologists for non-COVID operations was one of the major factors causing the sudden market decline. Restrictions to visit hospitals and imaging centers drastically reduced regular imaging procedures including scheduled mammography screenings. The market is expected to witness growth in 2021 with the adoption of ambulatory imaging centers and teleradiology services.

The growing prevalence of cancer and cardiovascular diseases is expected to drive the need for medical imaging services. According to WHO, Cardiovascular diseases (CVDs) are the major cause of death globally, taking approximately 17.9 million lives each year. Additionally, as per the Centers for Disease Control & Prevention, in the United States, every year about 805,000 people have a heart attack and about 1 in 20 adults age 20 and older have coronary artery disease (about 5%).

Medical imaging helps in the early and accurate diagnosis of diseases, which helps in providing effective disease treatment. Therefore, to control the growing disease burden, a large number of medical professionals are using medical imaging devices in imaging services before performing surgeries. Medical professionals rely on preoperative MRI and CT scans in imaging services to visualize and determine the margins of tumors during surgeries.

In interventional radiology, healthcare professionals use medical imaging systems to guide minimally invasive surgical procedures that treat, diagnose, and cure several conditions. Imaging modalities include CT, fluoroscopy, ultrasound, and MRI. Minimally invasive surgeries offer numerous benefits such as faster recovery time, smaller incisions, reduced scarring and pain, increased accuracy & shorter hospital stays compared to open surgery techniques, which is expected to fuel the imaging services market.

Modality Insights

Based on modality, the market is segmented into X-rays, CT scans, nuclear medicine scans, MRI scans, ultrasound, and mammography. Nuclear medicine scans held the largest share of 25% in 2022. Rising awareness levels among physicians and clinical researchers regarding the benefits of nuclear imaging scans coupled with increasing application areas such as cases in oncology, and neurological diseases are the factors driving the market.

Moreover, the magnetic resonance imaging segment is expected to grow at the highest CAGR of 4.55% over the forecast period, owing to the factors such as the increasing geriatric population, technological advancements such as introduction of the hybrid MRI equipment, high-field MRI, superconducting (SC) magnets, and installation of software, availability of universal health coverage, and growing burden on chronic diseases are fueling the market’s growth.

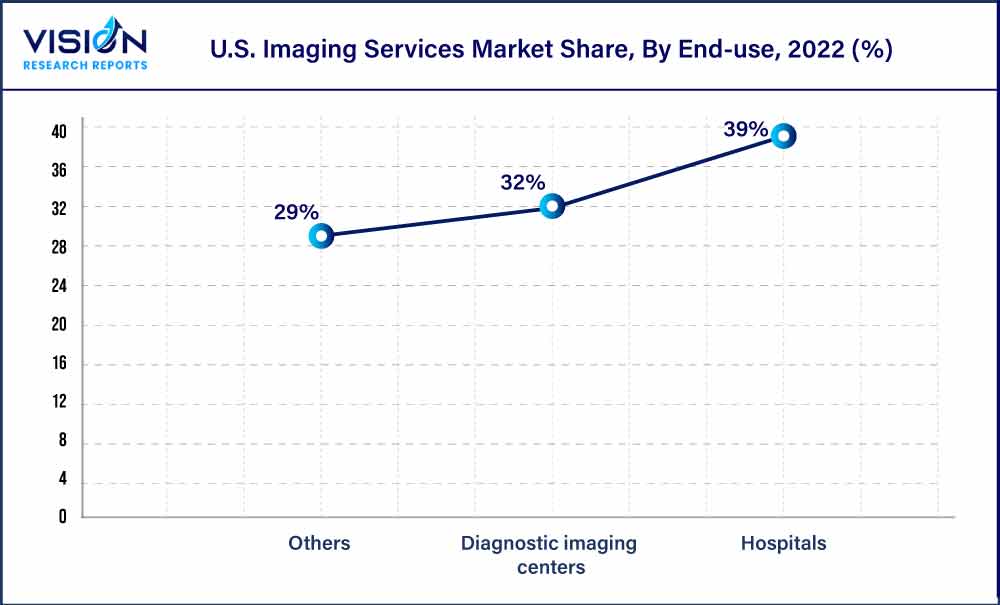

End-use Insights

Based on end-use, the market is segmented into diagnostic imaging centers, hospitals, and others. Others include imaging centers for specific modalities such as MRI, CT scan, and other outpatient settings. Hospitals held the largest share of 39% in 2022, owing to the increasing prevalence of various conditions such as cancer and cardiac disorders. According to the International Agency for Research on Cancer, in 2020, around 2,281,658 new cancer cases were diagnosed in the U.S. Similarly, as per the Centers for Disease Control and Prevention (CDC), in 2020, about 382,820 million adults in the U.S. were died due to heart disease.

Furthermore, the availability of multiple imaging modalities in single facility and reimbursement policies for the imaging procedures are also expected to impact the overall market growth. Congress and the Centers for Medicare & Medicaid Services (CMS) have come up with policies affecting advanced diagnostic imaging services such as CT, MRI, PET/CT, and nuclear procedures. Medicare covers imaging services through different payment systems such as Hospital Outpatient Prospective Payment System (HOPPS), Physician Fee Schedule (PFS), and Inpatient Prospective Payment System.

Others segment is also expected to grow at a significant CAGR during the forecast period. The need for medical imaging services is increasing, hence, hospitals are opening healthcare centers in outpatient settings to meet this growing demand at low-cost. Hospitals have provided MRI services in an outpatient setting such as in strip malls and shopping centers. This is aimed to ease access to imaging services for patients. Additionally, the service cost in such outpatient settings is low, thus, expected to drive its growth during the forecast period.

U.S. Imaging Services Market Segmentations:

By Modality

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Imaging Services Market

5.1. COVID-19 Landscape: U.S. Imaging Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Imaging Services Market, By Modality

8.1. U.S. Imaging Services Market, by Modality, 2023-2032

8.1.1. X-rays

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. CT scans

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Nuclear medicine scans

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. MRI scans

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Ultrasound

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Mammography

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Imaging Services Market, By End-use

9.1. U.S. Imaging Services Market, by End-use, 2023-2032

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Diagnostic imaging centers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Imaging Services Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Modality (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Radnet, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Alliance Medical

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Inhealth Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sonic Healthcare

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dignity Health

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Medica Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Diagnostics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Novant Health

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Concord Medical Services Holdings Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Center for Diagnostic Imaging, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others