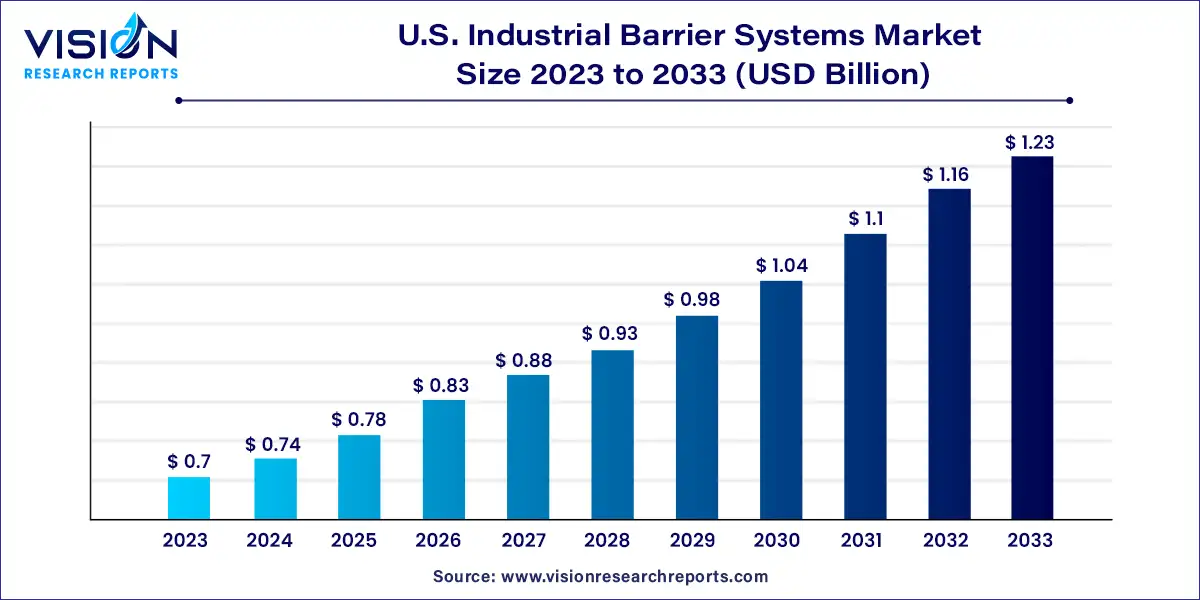

The U.S. industrial barrier systems market size was surpassed at USD 0.7 billion in 2023 and is expected to hit around USD 1.23 billion by 2033, growing at a CAGR of 5.84% from 2024 to 2033.

The industrial barrier systems market in the United States is experiencing significant growth driven by various factors such as increasing safety regulations, rising awareness about workplace safety, and the need for efficient traffic management in industrial facilities.

The growth of the U.S. industrial barrier systems market is propelled by the stringent safety regulations imposed by government bodies drive the demand for advanced barrier solutions to ensure workplace safety and mitigate potential hazards. Additionally, increasing awareness among industries about the importance of safeguarding assets and infrastructure further fuels market growth. Moreover, the rising need for efficient traffic management within industrial facilities, coupled with the expansion of industrial sectors, stimulates the demand for barrier systems. Furthermore, advancements in barrier technology, including the development of innovative materials and automated systems, play a crucial role in driving market growth by offering enhanced safety features and improved efficiency. Overall, these growth factors collectively contribute to the expansion of the U.S. industrial barrier systems market, presenting lucrative opportunities for market players.

| Report Coverage | Details |

| Market Size in 2023 | USD 0.7 billion |

| Revenue Forecast by 2033 | USD 1.23 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.84% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The safety fences segment dominated the market with the largest revenue share of 25% in 2023. The growth of the safety fences segment can be attributed to the increasing number of companies offering innovative safety fences designed for multiple purposes. For instance, in March 2023, Mezzanine Safety-Gates, Inc., a U.S.-based protection equipment provider, announced a new design of the Roly safety gate, which protects both people and products. The roly confinement design incorporates a high strength, high visibility netting system on the safety gate to prevent employees from reaching into the loading zone with their hands. Such initiatives for product launches are expected to drive the growth of the safety fences segment.

The guardrails segment is anticipated to grow at a CAGR of 7.76% during the forecast period. The growth can be attributed to the rising number of companies offering guardrails with enhanced capabilities. For instance, in March 2023, Diamon-Fusion International, Inc., a U.S.-based restoration and protection products provider, announced a partnership with Q-railing, a German railing system provider, to provide Diamon-Fusion Protective coating on Q-railing glass guardrail systems. These systems are designed for light commercial, commercial, and residential applications and offer benefits such as the prevention of staining, repelling of water, and low-cost maintenance. Such initiatives for product launches are expected to drive the growth of the guardrails segment.

By Type

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Industrial Barrier Systems Market

5.1. COVID-19 Landscape: U.S. Industrial Barrier Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. U.S. Industrial Barrier Systems Market, By Type

8.1.U.S. Industrial Barrier Systems Market, by Type Type, 2024-2033

8.1.1. Bollards

8.1.1.1.Market Revenue and Forecast (2021-2033)

8.1.2. Safety Fences

8.1.2.1.Market Revenue and Forecast (2021-2033)

8.1.3. Safety Gates

8.1.3.1.Market Revenue and Forecast (2021-2033)

8.1.4. Guardrails

8.1.4.1.Market Revenue and Forecast (2021-2033)

8.1.5. Barriers For Machinery

8.1.5.1.Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1.Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Industrial Barrier Systems Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Type (2021-2033)

Chapter 10.Company Profiles

10.1. A-Safe

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. BOPLAN

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Ritehite

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Fabenco by Tractel

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Wildeck

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. McCue

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Barrier1

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Betafence

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Mezzanine Safety-Gates, Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Saferack

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others