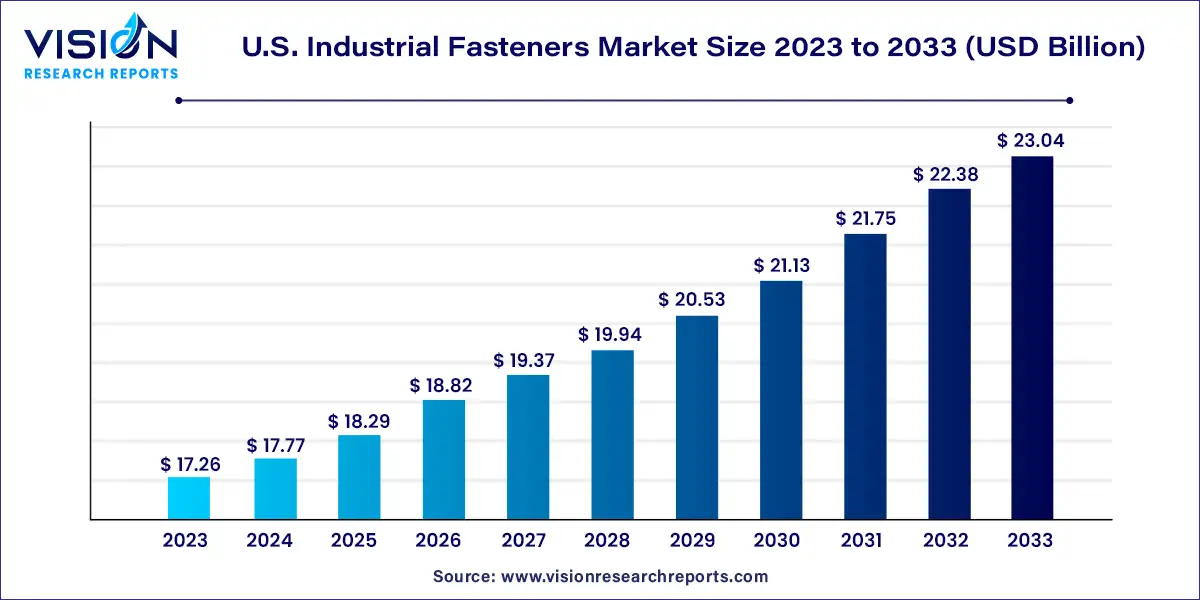

The U.S. industrial fasteners market was valued at USD 17.26 billion in 2023 and it is predicted to surpass around USD 23.04 billion by 2033 with a CAGR of 2.93% from 2024 to 2033.

The industrial fasteners market in the United States is a vital component of the manufacturing sector, encompassing a wide range of products essential for various industries such as automotive, aerospace, construction, and electronics. Fasteners play a crucial role in securely joining components and structures, ensuring structural integrity, safety, and reliability in diverse applications.

The growth of the U.S. industrial fasteners market is propelled by several key factors. Firstly, the continuous expansion of industrial production across various sectors, including automotive, aerospace, construction, and electronics, drives the demand for fastening solutions. Additionally, infrastructure development projects, such as roadways, bridges, and commercial buildings, contribute to market growth by necessitating a significant volume of fasteners. Furthermore, the automotive manufacturing sector, a major consumer of industrial fasteners, exhibits sustained growth, fueled by consumer demand and technological advancements. Moreover, the increasing adoption of advanced fastening technologies, including automated assembly systems and Industry 4.0 integration, enhances efficiency and productivity in manufacturing processes, further boosting market expansion. Lastly, stringent safety and quality standards mandate the use of high-performance fasteners in critical applications, ensuring reliability and durability, thereby stimulating market demand.

| Report Coverage | Details |

| Market Size in 2023 | USD 17.26 billion |

| Revenue Forecast by 2033 | USD 23.04 billion |

| Growth rate from 2024 to 2033 | CAGR of 2.96% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of raw material, metal and plastic industrial fasteners are among the most prominent types. The metal industrial fasteners segment dominated the industry in 2023 with a revenue share of 90%. However, due to its high corrosion resistance and lightweight features, the product is anticipated to expand at a slower rate than its counterpart, owing to the rising penetration of plastic in applications such as aerospace and automotive.

The metal fasteners industry is dominated by small and medium-scale fastener manufacturing companies spread across the U.S. as the metal fasteners offer high mechanical strength and impact resistance and are less susceptible to harsh conditions such as high temperature and pressure. A key concern for metal fastener manufacturers is that the metal often tends to corrode when exposed to water, which impairs its performance and durability in end-use applications.

The plastic industrial fasteners segment is anticipated to register the fastest-growing CAGR of 3.94% over the forecast period. As of 2022, plastic raw material account for a very small share of the overall market. However, the product is expected to gain increasing importance, especially from the automotive, electronics, and aerospace industries owing to its lightweight, improved mechanical properties, and low cost as compared to metal fasteners.

In terms of product, the industrial grade fasteners have been broadly classified based on their design into four major segments, namely externally threaded, internally threaded, non-threaded, and aerospace grade fasteners. In 2022, the externally threaded segment held the largest market share of 52% owing to their wide application in the automotive, building & construction, railway, marine, and shipbuilding industries.

Over the projected period, the non-threaded segment is anticipated to register the fastest CAGR of 3.66% over the forecast period. Pins, washers, rivets, hooks, grommets, O-rings, clamps, cable ties, and nails are examples of non-threaded fasteners. These devices are used to fasten pipe fittings in the automotive and construction industries, as well as for cable management and wire harnesses. Due to its low cost and low weight, plastic non-threaded fasteners are anticipated to fuel high demand in various application areas.

Over the projection period, the aerospace grade segment is anticipated to grow at a CAGR of 3.29%. The aircraft industry employs a wide range of fasteners, including pins, rivets, bolts, screws, and collars. Aerospace grades are distinguished from other industrial fasteners by their excellent quality. Aerospace grades must be exceptionally durable to sustain extremely high pressures and temperatures. Furthermore, the weight of aerospace-grade fasteners is a major consideration for their selection, as lightweight fasteners with great endurance are sought for aircraft applications.

In terms of application, the automotive segment is one of the key applications of the market. The segment held a major market share of over 29% in 2023. High production volumes of vehicles in the U.S. have been a key factor driving the growth of the automotive industry in the country over the past few years. According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 10.1 million automobiles were produced in the U.S. in 2022, witnessing an increase of 9.7% compared to that in 2021.

In the automotive industry, fasteners are used for two basic functions, namely, bonding, and for preventing noise, vibration, and harshness (NVH). The parts of passenger cars and light commercial vehicles are manufactured separately and then assembled to develop a unit. This process requires various bonding components such as adhesives, tapes, sealants, and fasteners.

Aerospace has been a major application segment of the market as it consumes high volumes of prime-grade fasteners. The products used in aerospace applications are primarily divided into four categories, namely, screws and bolts; nuts; expansion fasteners, including bolts, rivets, pins, nails, hooks, and rings. These fasteners are either used in permanent or temporary aerospace applications.

The increasing popularity of gardening in the U.S. is expected to propel the demand for various lawn and garden products, including cultivators, mini tractors, and irrigation sprinklers. Fasteners form essential components of these machines as they hold their different equipment parts together. The mechanization of gardening, which enables the use of electric equipment instead of handheld products, is anticipated to have a positive impact on the growth of the lawns and gardens segment of the market from 2024 to 2033.

By Raw Material

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others