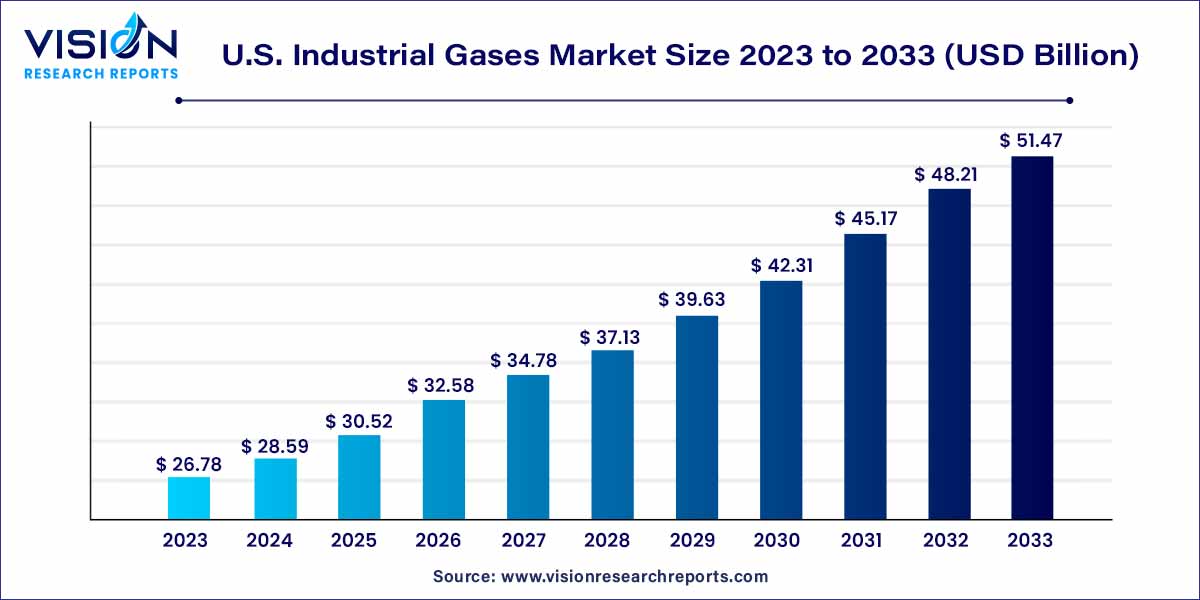

The U.S. industrial gases market size was estimated at around USD 26.78 billion in 2023 and it is projected to hit around USD 51.47 billion by 2033, growing at a CAGR of 6.75% from 2024 to 2033. The U.S. industrial gases market represents a vital and dynamic sector that plays a pivotal role in supporting various industries' operational processes. Industrial gases are essential for a wide array of applications, ranging from manufacturing and healthcare to energy and electronics. As a key enabler of diverse industrial processes, the market has experienced notable growth and evolution in recent years.

The growth of the U.S. industrial gases market is propelled by the ongoing trend of industrialization in the United States has significantly increased the demand for industrial gases across diverse sectors. As manufacturing processes evolve and expand, gases like oxygen, nitrogen, and hydrogen play crucial roles in various applications. Additionally, technological advancements contribute to the market's growth, as innovative applications emerge, spanning from cutting-edge medical treatments to precise manufacturing techniques. Furthermore, the dynamics within the energy sector, where industrial gases are integral to processes such as refining and natural gas production, significantly drive market expansion. The healthcare industry also contributes to the surge in demand, relying on medical gases for therapeutic and diagnostic purposes. Overall, the confluence of industrialization, technological progress, and diverse industry dependencies positions the U.S. industrial gases market for sustained and robust growth.

| Report Coverage | Details |

| Market Size in 2023 | USD 26.78 billion |

| Revenue Forecast by 2033 | USD 51.47 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.75% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Oxygen dominated the market with a revenue share of 38% in 2023, owing to its wide range of applications, due to its life-sustaining and oxidizing properties. It plays a critical role in several health applications and medical procedures. Oxygen is used in respiratory treatment and during surgeries. The versatility and essentiality of oxygen make it a vital component in chemical and healthcare industries.

Oxygen is the second-largest constituent of the Earth’s atmosphere, accounting for a share of 20.8% in terms of volume. Although oxygen is used in gaseous form in most applications, it is generally liquefied so that it can be effectively and efficiently transported and stored in large volumes.

Oxygen is used in certain medical devices and apparatuses such as oxygen concentrators and ventilators, which are used for patients with severe respiratory ailments. In addition, it is utilized in certain diagnostic procedures, such as oximetry, to measure the amount of oxygen in the blood of the patients.

Moreover, increasing usage of CO2 in the beverage and medical industries is further anticipated to be a key factor driving the product market. In the food & beverage industry, CO2 is widely used for freezing vegetables, fruits, and meat & poultry products.

The use of CO2 in medical applications is increasingly gaining significance. It is used to minimize invasive surgeries. The surge in research & development investments for the launch of advanced technologies related to enhanced oil recovery (EOR) and carbon capture and storage (CCS) has led to the rising demand for CO2. This, in turn, is anticipated to fuel the growth of the carbon dioxide segment in Las Vegas industrial gases market in the coming years.

Healthcare applications led the market with a revenue share of 27% in 2023. Industrial gases are a vital part of the healthcare sector owing to their role in different applications. In medical applications, oxygen is used in respiratory therapy, anesthesia, and life support systems. This is further driving the industrial gas market in the U.S.

Las Vegas has a few of the major hospitals in the U.S., including the Sunrise Hospital and Medical Center, the University Medical Center, and the Valley Hospital Medical Center, which provides different medical services such as specialized treatments, surgeries, and emergency care. Besides this, there are around 70 other hospitals and medical clinics serving the residents and tourists in the city. Industrial gases are a vital part of the healthcare sector owing to their role in different applications. This is further driving the industrial gases market in Las Vegas.

In medical and pharmaceutical industries, nitrogen is used in numerous applications. Cryopreservation utilizes nitrogen at a large scale to preserve blood, blood components, cells, body fluids, and tissue samples for an extended duration. Moreover, nitrogen is useful for surgical procedures carried out by power gas-operated medical devices. In these devices, nitrogen acts as a coolant for carbon dioxide surgical lasers to reduce the damage to adjacent tissues. Nitrogen is utilized in medical imaging applications as well.

Industrial gases such as carbon dioxide and nitrogen are used in a wide range of applications in the food & beverages industry. They are employed for chilling & freezing and modified atmospheric packaging (MAP) applications, as well as for controlling the temperature of food products during their transportation and storage. These gases are mainly used to maintain the quality of food products and increase their shelf life. In addition, industrial gases are used as indicators to ensure that the required quality of food products is maintained during their processing and storage.

Nitrogen is used at a large scale in the electronics industry, the growth of this industry in the U.S. is expected to drive the demand for nitrogen. Moreover, the rising adoption of advanced technologies in different industries in the region has fueled the demand for semiconductors. This, in turn, surges the consumption of nitrogen used for developing semiconductors in the U.S.

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Industrial Gases Market

5.1. COVID-19 Landscape: U.S. Industrial Gases Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Industrial Gases Market, By Product

8.1. U.S. Industrial Gases Market, by Product, 2024-2033

8.1.1. Nitrogen

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hydrogen

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Carbon Dioxide

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Oxygen

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Argon

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Acetylene

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Industrial Gases Market, By Application

9.1. U.S. Industrial Gases Market, by Application, 2024-2033

9.1.1. Healthcare

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Manufacturing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Metallurgy & Glass

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Food & Beverages

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Retail

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Chemicals & Energy

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others Applications

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Industrial Gases Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Messer North America, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Products and Chemicals, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Linde plc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Air Liquide

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Matheson Tri-Gas, Inc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BASF SE

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MESA Specialty Gases & Equipment

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Universal Industrial Gases, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others