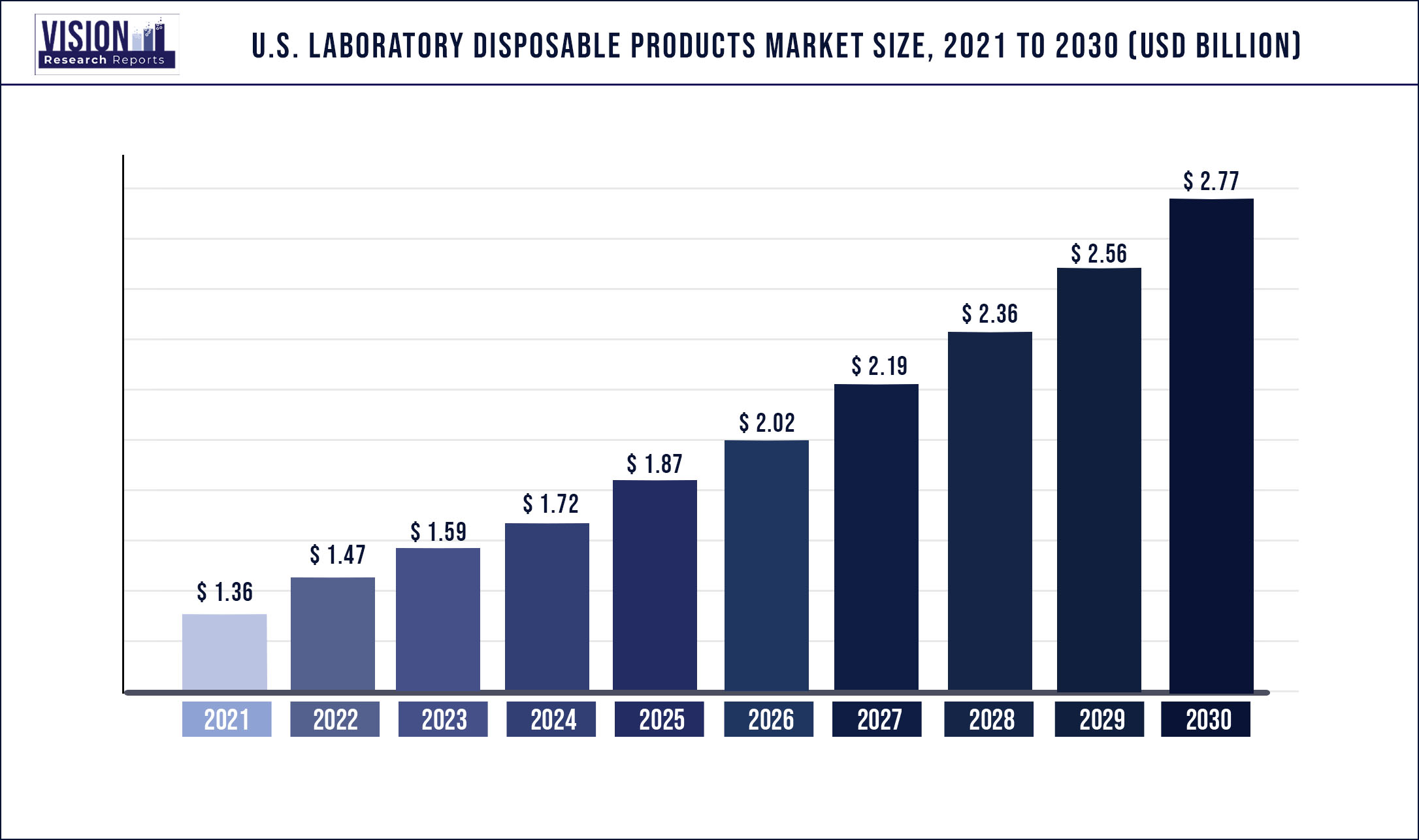

The U.S. laboratory disposable products market was valued at USD 1.36 billion in 2021 and it is predicted to surpass around USD 2.77 billion by 2030 with a CAGR of 8.22% from 2022 to 2030

Report Highlights

Increasing patient population in U.S. due to high prevalence of chronic disease is anticipated to drive the product demand.

In addition, increasing use of eco-friendly raw materials in laboratories is also expected to fuel the market. Environment-friendly raw materials are comparatively cheaper, easy to use and dispose, hygienic, and are easily available. Hence, laboratory professionals increasingly prefer eco-friendly raw materials, which in turn is expected to drive the U.S. laboratory disposable products market in near future.

Rising funding from private and public entities for research-based studies over the last few years has stimulated the development of more laboratories in educational institutions. This factor is expected to drive the growth of the market. Moreover, growing use of disposable products in healthcare industry is also anticipated to fuel the demand for laboratory disposable products in the forthcoming years.

Factors such as rise in number of laboratories in U.S., R&D activities in healthcare, and number of laboratory experiments are expected to create opportunities for the market players to expand their product portfolio.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.36 billion |

| Revenue Forecast by 2030 | USD 2.77 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.22% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, material, end-use, region |

| Companies Covered | Cardinal Health; Thomas Scientific; Medicus Health; Therapak; Dynarex Corporation; Thermo Fisher Scientific Inc.; McKesson Corporation; Medline Industries, Inc.; Becton Dickinson |

Product Insights

Specimen containers segment held the largest market share of 40.98% in 2021, due to an increase in a number of patients in the U.S. Rise in geriatric population in the U.S. is one of the major factors fuelling the product demand. Moreover, high prevalence of chronic disorders and rising geriatric population is also expected to drive the demand for laboratory disposable products. Growing incidence of various diseases demand pathological examination of urine, blood, stool, and sputum, which requires different disposables to confirm the diagnosis and to carry out a treatment plan.

Tissue collectors segment, on the other hand, is anticipated to register the highest CAGR of 10.2% over the forecast period. High prevalence of different types of cancer is anticipated to drive the segment growth. A high prevalence of cancer is expected to drive the product demand in the near future. Tissue examination is widely used for detecting different types of cancer. According to the National Cancer Institute, approximately 1,735,350 new patients were diagnosed with cancer in 2018, of which 609,640 cases resulted in death. Some common types of cancer reported in the country are lung and bronchus, prostate, breast, melanoma, bladder, colon, and rectal cancer.

Material Insights

The plastic segment is anticipated to continue holding the leading market share over the forecast period. The physical properties of plastic, easy availability, and increasing use of medical plastic disposables is projected to drive the growth of the segment. Glass segment is anticipated to expand at the fastest CAGR of over 9.4% over the forecast period. A large amount of medical plastic waste is generated in the U.S., which is leading to a shift in usage from plastic to glass laboratory disposable products. Rising preference for eco-friendly products is expected to bode well for the segment growth. For instance, in 2016, Greenhealth Exchange, an online marketplace, was launched by four major healthcare companies and two NGOs in the U.S. to promote green products, ranging from IV tubes to cafeteria food.

According to a research article published by the National Center for Biotechnology Information (NCBI) in 2015, 20 pounds of plastic waste is produced from a single hysterectomy procedure in U.S. According to the Center for Chronic Disease Prevention (CDC), six in every 10 adults in U.S. suffer from a chronic disease. Increasing prevalence of chronic diseases is projected to boost the demand for hospital treatments and procedures. High demand for laboratory disposables in healthcare centers for diagnosis and other medical purposes on a daily basis is expected to fuel the growth in the near future.

End-Use Insights

The CROs segment is expected to hold the largest market share owing to an increase in outsourcing by companies to save their time and to reduce investment. The hospital segment is expected to expand at a lucrative CAGR over the forecast period. The rapid growth can be attributed to increasing prevalence of cancer and chronic diseases in the U.S.

According to the Agency for Healthcare Cost and Utilization Project, in 2014, 10.1 million patients in hospital stay, underwent operating room procedures. As per the Leukemia and Lymphoma Society, in 2019, one person is diagnosed with blood cancer every 3 minutes in the U.S. Thus, there has been a rise in the number of hospitals stays and the prevalence of cancer and other chronic diseases in the country. Presence of a large patient pool is anticipated to increase the number of diagnostic tests performed, thereby driving the demand for laboratory disposables.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Laboratory Disposable Products Market

5.1. COVID-19 Landscape: U.S. Laboratory Disposable Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Laboratory Disposable Products Market, By Product

8.1. U.S. Laboratory Disposable Products Market, by Product, 2022-2030

8.1.1 Specimen Containers

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Transport Vials

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Collection and Transport Swabs

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Tissue Collectors

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Laboratory Disposable Products Market, By Material

9.1. U.S. Laboratory Disposable Products Market, by Material, 2022-2030

9.1.1. Glass

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Plastic

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Laboratory Disposable Products Market, By End-Use Type

10.1. U.S. Laboratory Disposable Products Market, by End-Use Type, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Ambulatory Surgical Centers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. CROs

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Laboratory Disposable Products Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Material (2017-2030)

11.1.3. Market Revenue and Forecast, by End-Use Type (2017-2030)

Chapter 12. Company Profiles

12.1. Cardinal Health

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thomas Scientific

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Medicus Health

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Therapak

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Dynarex Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thermo Fisher Scientific Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. McKesson Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medline Industries, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Becton Dickinson

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others