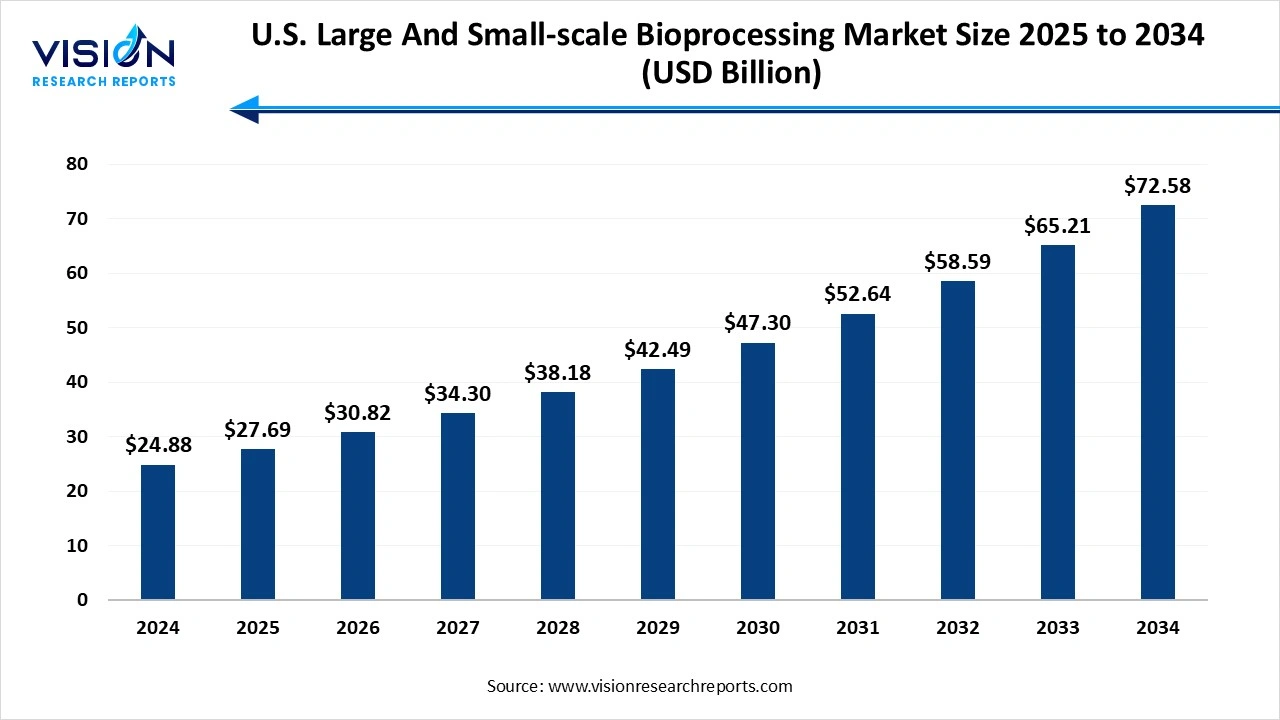

The U.S. large and small-scale bioprocessing market size accounted for USD 24.88 billion in 2024 and it is projected to hit around USD 72.58 billion by 2034, growing at a CAGR of 11.3% from 2025 to 2034. The rising demand for biopharmaceuticals, growing chronic diseases, personalized medicine, technological advancements, and continuous bioprocessing, a growing focus on eco-friendly bioprocessing and manufacturing organizations, drive the market growth.

The U.S. large and small-scale bioprocessing market contains the use of living cells or their component, such as enzymes or microorganisms, to carry out laboratory or pilot plant-scale operations, where processes are conducted on a few liters. The large-scale bioprocesses are performed on a much larger scale, typically ranging from hundreds of liters to thousands of liters, and are designed to produce large quantities of the final product. The large-scale bioprocessing used in pharmaceutical production, such as monoclonal antibodies, vaccines, and insulin, as well as biofuel production and the food and beverage industry. The market growth is driven by the increasing prevalence of chronic diseases and the development of targeted therapies, increasing need for personalized medicine more investment in biotechnology research expands the potential for new bioprocessing applications, expansion of the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.88 billion |

| Revenue Forecast by 2034 | USD 72.58 billion |

| Growth rate from 2025 to 2034 | CAGR of 11.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | Merck KGaA, Thermo Fisher Scientific, Inc., Danaher (Cytiva), Corning Inc., Sartorius AG, Lonza, Eppendorf AG, Getinge AB, PBS Biotech, Inc., Meissner Filtration Products, Inc., Entegris, Saint-Gobain, Repligen Corporation, Avantor, Inc., Distek, Inc., F. Hoffmann-La Roche Ltd, Bio-Synthesis, Inc. |

The key U.S. events for networking, exploring new technologies, and attending sessions on single-use systems and other innovations, they offer the best ecosystem for growing and supporting biotech companies, such as pharmaceutical and gene therapy, drug development in the bioprocessing industry, feature presentations and new product launches, and drive the market growth. (Source: Informaconnect)

The move toward tailoring treatments based on an individual's genetic profile is creating demand for flexible, small-scale bioprocessing equipment. This provides an important occasion for vendors who can produce innovative, modular platforms for small-batch and patient-specific treatments.

The facilities required for establishing or expanding bioprocessing are a massive upfront investment in advanced equipment, cleanrooms, and automated systems. Beyond initial setup, bioprocessing involves substantial recurring expenses. These include the cost of raw materials, energy, quality control, maintenance, and, especially for large-scale operations, the regular replacement of disposable components hinders the market growth.

How did the Industrial Scale Segment Dominate the U.S. Large and Small-scale Bioprocessing Market in 2024?

The industrial scale segment held the largest share of the market in 2024. The high demand for established biologics, the consistent and high-volume demand for commercial biologics, such as monoclonal antibodies and vaccines. The high-volume production of blockbuster drugs allows for significant economies of scale, which lowers the cost, high-output manufacturing. The increasing number of expiring patents for biologics has fueled the demand for cost-effective biosimilars. The strategic investment in large facilities and proven multi-use technology, and the rise of hybrid bioprocessing models, which combine the cost benefits of multi-use systems with the flexibility of single-use technologies, drive the market growth.

The small-scale segment is expected to grow at a notable rate during the predicted timeframe, owing to the rising focus of personalized medicine and advanced therapies, such as cell and gene require flexible, customized small-scale bioprocessing solutions. The increase in biotech startups and academic research drives demand for small-scale systems for early drug development and testing. Significant public and private investment supports biotechnology R&D, particularly for smaller, cost-effective systems. The technological advancement, including single-use and modular systems, improves efficiency and reduces contamination risk in small-scale operations.

Why does the Downstream Processing Segment Dominate the U.S. Large and Small-scale Bioprocessing Market by Platform?

The downstream processing segment held the largest share of the market in 2024, due to technological advancements and innovations in chromatography resins, and automated chromatography improved separation efficiency and capacity. The adoption of single-use components in downstream workflows increased flexibility, reduced contamination risk. The increasing pipeline of new biologics, biosimilars, and cell and gene therapies is driving demand for scalable and high-therapeutic downstream technologies. The strict regulatory requirements and focus on efficiency and intellectual property are expansion of the market growth.

The fermentation segment is expected to grow at a notable rate, as the fermentation process, which involves using microorganisms to produce valuable products, is widely used in various industries, including biopharmaceuticals and the production of specialty industrial chemicals. The rising demand for biosimilar and complex biopharmaceuticals relies deeply on fermentation technology to produce therapeutic proteins, monoclonal antibodies, and vaccines. The adoption of the continuous fermentation process allows for more efficient, sustainable, and cost-effective production compared to the traditional method. The increasing demand for flexible and scalable solutions and growth in single-use bioreactors boost the market growth.

How did the bioreactors/fermenters Segment Dominate the U.S. Large and Small-scale Bioprocessing Market in 2024?

The bioreactors/fermenters segment held the largest share of the market in 2024. The significant increase in the development and production of therapeutic proteins, monoclonal antibodies, and vaccines directly increased the need for bioreactors to cultivate the cells and microorganisms that produce these products. The rising demand for bioprocessing equipment, including bioreactors, and increasing emphasis on precision medicine, which involves tailoring treatments to individual patients, have spurred the need for advanced biomanufacturing processes that rely heavily on bioreactor technology.

The cell culture products segment is expected to grow at a notable rate during the predicted timeframe, owing to the increasing demand for cell and gene therapies rising demand for biologics, drugs, vaccines, and novel cell and gene therapies requires advanced cell culture. The rising need for precision and control, and increasing R&D in cell-based research. The media formulation offers improved consistency, reduced variability, and better regulatory compliance, particularly important for cell and gene therapy applications.

How did the Biopharmaceuticals Segment Dominate the U.S. Large and Small-scale Bioprocessing Market in 2024?

The biopharmaceuticals segment held the largest share of the market in 2024. The expanding number of approvals and use of biologic drugs for chronic diseases drives the bioprocessing sector essential for their production. The expansion of treatment options, including vaccines and cell gene therapies increasingly crucial for treating chronic disease. The shift toward personalized medicine, especially in treating cancer and rare genetic disorders, drove demand for small-scale bioprocessing. The substantial investment in R&D is expanding the pipeline of complex biologic therapies, and integration in automation, real-time analysis, and artificial intelligence has improved the efficiency, precision, and scalability of bioprocessing.

The specialty industrial chemicals segment is expected to grow at a notable rate during the predicted timeframe, owing to the environmental concerns and sustainability goals intensifying. U.S. industries are turning toward bioprocessing as an eco-friendly alternative to conventional chemical manufacturing. The advancement of new drugs and therapies requires novel chemical inputs and process adjustments, and the expansion of bioprocessing drives the market growth. The bioprocess requires highly pure and precisely formulated chemicals for tasks, such as cell culture, fermentation, and downstream processing, especially indispensable chemicals.

How did the Multi-Use Segment Dominate the U.S. Large and Small-scale Bioprocessing Market in 2024?

The multi-use segment holds a dominant share of the market in 2024. The multiuse system is are preferred choice for large-scale production due to its durability, cost efficiency over long production cycles, and ability to handle complex biologics. It offers precise control, enables rigorous cleaning, and facilitates repeatable processes, essential for high biological production. They support complex workflows and allow for customization, scalability, and control over every stage of the bioprocess. This system is preferred for large-scale commercial production, the expansion of market growth.

The single-use segment is expected to grow at a notable rate during the predicted timeframe, due to single-use offers unparalleled flexibility, enabling biopharmaceutical companies to quickly adapt production processes to accommodate various product types and fluctuating batch sizes, from small-scale clinical trials to large-scale commercial manufacturing. The single-use technologies required a lower initial investment, reduced cleaning, sterilization, and validation needs translates to significant operational cost savings over the long term. The single-use minimizes contamination risk, and the growing demand for biologics and personalized medicine drives the market growth.

How did the In-House Segment Dominate the U.S. Large and Small-scale Bioprocessing Market in 2024?

The in-house segment held the largest share of the market in 2024. The in-house segment maintains control and quality, and in-house production allows companies to protect their intellectual property and proprietary manufacturing processes, particularly relevant for advanced therapies with high value. The companies with existing infrastructure are investing in advanced bioprocessing technologies to scale operations effectively and manage costs over the long term. The rising demand for biologics and the need for end-to-end manufacturing integration further reinforce the preference for in-house production.

The outsourced segment is expected to grow at a notable rate during the predicted timeframe, owing to the companies' cloud outsourced manufacturing and focusing their resources on research, development, and innovation. The increasing growth in specialized biomanufacturing and a focus on accelerating time to market and regulatory compliance. The need for rapid development timelines and navigation of complex regulatory pathways encourages outsourcing. Many small and mid-sized firms chose to outsource their bioprocessing needs to contract development and manufacturing organizations and contract research organizations.

1. R&D

The U.S. large and small-scale bioprocessing market is expansion of commercial biologics, economies of scale, a hybrid system, and advanced downstream processing.

2. Patient Support and Services.

The U.S. large and small-scale bioprocessing market offers access and reimbursement support, adherence and education, side effect management, logistical coordination, and concierge services.

3. Clinical Trials and Regulatory Approvals.

Clinical trials are a crucial step in bioprocessing that evaluate a drug's safety and efficacy in humans. In the U.S., a company must file an Investigational New Drug (IND) application with the FDA before starting human trials.

By Scale

By Workflow

By Product

By Application

By Use-Type

By Mode

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Mode Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Large and Small-scale Bioprocessing Market

5.1. COVID-19 Landscape: U.S. Large and Small-scale Bioprocessing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Large and Small-scale Bioprocessing Market, By Scale

8.1. U.S. Large and Small-scale Bioprocessing Market, by Scale

8.1.1. Industrial Scale (Over 50,000 Liter)

8.1.1.1. Market Revenue and Forecast

8.1.2. Small Scale (Less Than 50,000 Liter)

8.1.2.1. Market Revenue and Forecast

Chapter 9. U.S. Large and Small-scale Bioprocessing Market, By Workflow

9.1. U.S. Large and Small-scale Bioprocessing Market, by Workflow

9.1.1. Downstream Processing

9.1.1.1. Market Revenue and Forecast

9.1.2. Fermentation

9.1.2.1. Market Revenue and Forecast

9.1.3. Upstream Processing

9.1.3.1. Market Revenue and Forecast

Chapter 10. U.S. Large and Small-scale Bioprocessing Market, By Product

10.1. U.S. Large and Small-scale Bioprocessing Market, by Product

10.1.1. Bioreactors/Fermenters

10.1.1.1. Market Revenue and Forecast

10.1.2. Cell Culture Products

10.1.2.1. Market Revenue and Forecast

10.1.3. Filtration Assemblies

10.1.3.1. Market Revenue and Forecast

10.1.4. Bioreactors Accessories

10.1.4.1. Market Revenue and Forecast

10.1.5. Bags & Containers

10.1.5.1. Market Revenue and Forecast

10.1.6. Others

10.1.6.1. Market Revenue and Forecast

Chapter 11. U.S. Large and Small-scale Bioprocessing Market, By Application

11.1. U.S. Large and Small-scale Bioprocessing Market, by Application

11.1.1. Biopharmaceuticals

11.1.1.1. Market Revenue and Forecast

11.1.2. Speciality Industrial Chemicals

11.1.2.1. Market Revenue and Forecast

11.1.3. Environmental Aids

11.1.3.1. Market Revenue and Forecast

Chapter 12. U.S. Large and Small-scale Bioprocessing Market, By Use-Type

12.1. U.S. Large and Small-scale Bioprocessing Market, by May

12.1.1. Multi-Use

12.1.1.1. Market Revenue and Forecast

12.1.2. Single-Use

12.1.2.1. Market Revenue and Forecast

Chapter 13. U.S. Large and Small-scale Bioprocessing Market, By Mode

13.1. U.S. Large and Small-scale Bioprocessing Market, by Mode

13.1.1. In-House

13.1.1.1. Market Revenue and Forecast

13.1.2. Outsourced

13.1.2.1. Market Revenue and Forecast

Chapter 14. U.S. Large and Small-scale Bioprocessing Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Forecast, by Scale

14.1.2. Market Revenue and Forecast, by Workflow

14.1.3. Market Revenue and Forecast, by Product

14.1.4. Market Revenue and Forecast, by Application

14.1.5. Market Revenue and Forecast, by May

14.1.6. Market Revenue and Forecast, by Mode

Chapter 15. Company Profiles

15.1. Merck KGaA

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Thermo Fisher Scientific, Inc.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Danaher (Cytiva)

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Corning Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Sartorius AG

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Lonza

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Eppendorf AG

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Getinge AB

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. PBS Biotech, Inc.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Meissner Filtration Products, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others