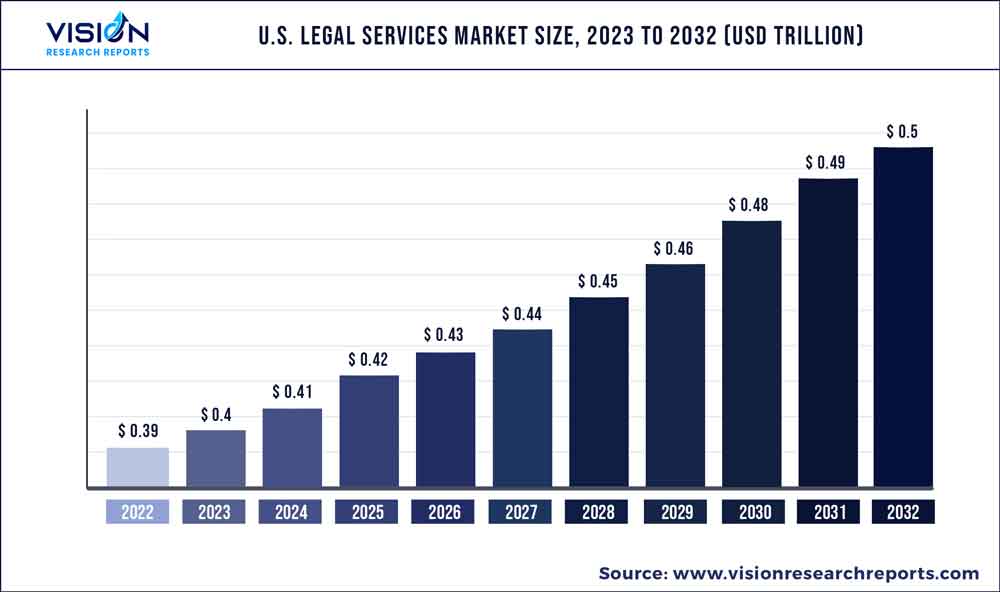

The U.S. legal services market was surpassed at USD 0.39 trillion in 2022 and is expected to hit around USD 0.5 trillion by 2032, growing at a CAGR of 2.52% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Legal Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.39 trillion |

| Revenue Forecast by 2032 | USD 0.5 trillion |

| Growth rate from 2023 to 2032 | CAGR of 2.52% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Baker & McKenzie; Clifford Chance; Deloitte; DLA Piper; Ernst & Young (E&Y); Jones Day; Kirkland & Ellis LLP; Latham & Watkins LLP; Morgan, Lewis & Bockius LLP; Norton Rose Fulbright; PwC; SIDLEY AUSTIN LLP; Skadden, Arps, Slate, Meagher & Flom LLP; White & Case LLP |

The growth can be credited to the increasing need for legal services across small to large-scale enterprises. They provide a wide range of services, including protection of business owners’ personal assets, protection of the enterprise against discrimination, dealing with employee contracts, wrongful termination, copyright claims, incorporation, etc. The rising need among businesses to comply with regulations and remain competitive is positively influencing the U.S. legal services industry.

The legal industry in the U.S. is witnessing a significant transformation in terms of practice model and technological adoption. Legal service firms are inclined to improve their processes through Artificial Intelligence (AI), Big Data analytics, automation tools, team collaboration platforms, cloud computing, etc., to gain a competitive edge in the market. In March 2023, Casetext, a legal AI company, launched CoCounsel, its AI legal assistant powered by GPT-4, the advanced large language model from OpenAI. The company confirmed that GPT-4 passed the Uniform Bar Exam’s multiple-choice as well as written portions, providing a professional-grade AI for law.

Big Data analytics is also expected to offer lucrative opportunities for the U.S. legal services industry. This, in turn, has facilitated the growth of startups such as Ravel Law, FiscalNote, and InvestCEE Tanacsado Kft., which provide quality and technologically advanced analytical insights to their clients. Besides, the increasing adoption of legal library applications such as iLegal, NotaryCam, and LawSauce Legislation to provide lawyers and people access to legal services is also favoring the market growth.

Another crucial factor expediting the growth of the market or legal services in the U.S. is the increased adoption of in-house digital strategies that help enhance and transform the activities and processes of businesses. Moreover, there has been stable growth in the implementation of cloud technology by legal departments and law firms.

Services Insights

The corporate segment is estimated to witness a CAGR of over 3.05% from 2023 to 2032. This can be credited to the increasing demand for these services driven by the emergence of new types of financial transactions on corporate fronts. The rising demand for services associated with intellectual property in the corporate sector is projected to impel segmental growth. Moreover, increasing cases of arguments over harassment of employees, organizational discrimination audits, and copyright violation & patent infringement are instigating the demand for corporate services to a great extent.

The litigation segment held a considerable revenue share of the market of over 29.04% in 2022. The law firms involved in third-party legal financing and litigation funding are expanding their geographical presence and diversifying their jurisdiction range. This has created ample opportunities for litigation service providers. Moreover, the enforcement of stringent regulations in labor relations and Intellectual Property (IP) protection has also instigated the demand for litigation services in the U.S.

Firm Size Insights

Large firms segment accounted for a revenue share of over 31.06% in 2022, owing to a diversified range of services. These firms provide most judicial work, such as significant business transactions, large-scale litigations, criminal defense matters for businesses across various industries, etc. The increased demand from large organizations for corporate and judicial services is driving the growth of the large firms segment.

Small firms segment is estimated to record a notable CAGR from 2023 to 2032. These law firms provide personalized services and a one-on-one working relationship as they handle a limited number of cases. Moreover, they are more affordable as they charge less due to their lesser cost of operations as compared to large firms. These legal service firms are growing geographically while expanding their global customer base by providing high-end specialized services that involve complex transactions, which is expected to drive segmental growth over the coming years.

Application Insights

Legal business firms sector accounted for a significant market share of nearly 63% in 2022. These firms are formed by a few lawyers to involve in the law practice and they are primarily involved in advising clients about their legal responsibilities & rights and represent the clients in criminal or civil cases, business transactions, and other matters requiring legal advice. The increasing investments by these firms in client education, pipeline management, local community activities, and public relations is expected to drive segmental growth over the forecast period.

Private practice attorneys segment is estimated to record a substantial CAGR of nearly 4.0% from 2023 to 2032. This can be credited to increasing preference for private attorneys as they give undivided attention to a particular client’s case. Moreover, they have access to the resources such as mental health assessments, DNA and other testing, expert witnesses, forensics specialists, private investigators, etc., required to mount a viable defense.

U.S. Legal Services Market Segmentations:

By Services

By Firm Size

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Services Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Legal Services Market

5.1. COVID-19 Landscape: U.S. Legal Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Legal Services Market, By Services

8.1. U.S. Legal Services Market, by Services, 2023-2032

8.1.1 Taxation

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Real Estate

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Litigation

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Bankruptcy

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Labor/Employment

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Corporate

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Legal Services Market, By Firm Size

9.1. U.S. Legal Services Market, by Firm Size, 2023-2032

9.1.1. Large Firms

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Medium Firms

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Small Firms

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Legal Services Market, By Application

10.1. U.S. Legal Services Market, by Application, 2023-2032

10.1.1. Private Practicing Attorneys

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Legal Business Firms

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Government Departments

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Legal Services Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Services (2020-2032)

11.1.2. Market Revenue and Forecast, by Firm Size (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Baker & McKenzie

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Clifford Chance

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Deloitte

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DLA Piper

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Ernst & Young (E&Y)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Jones Day

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Kirkland & Ellis LLP

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Latham & Watkins LLP

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Morgan, Lewis & Bockius LLP

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Norton Rose Fulbright

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others