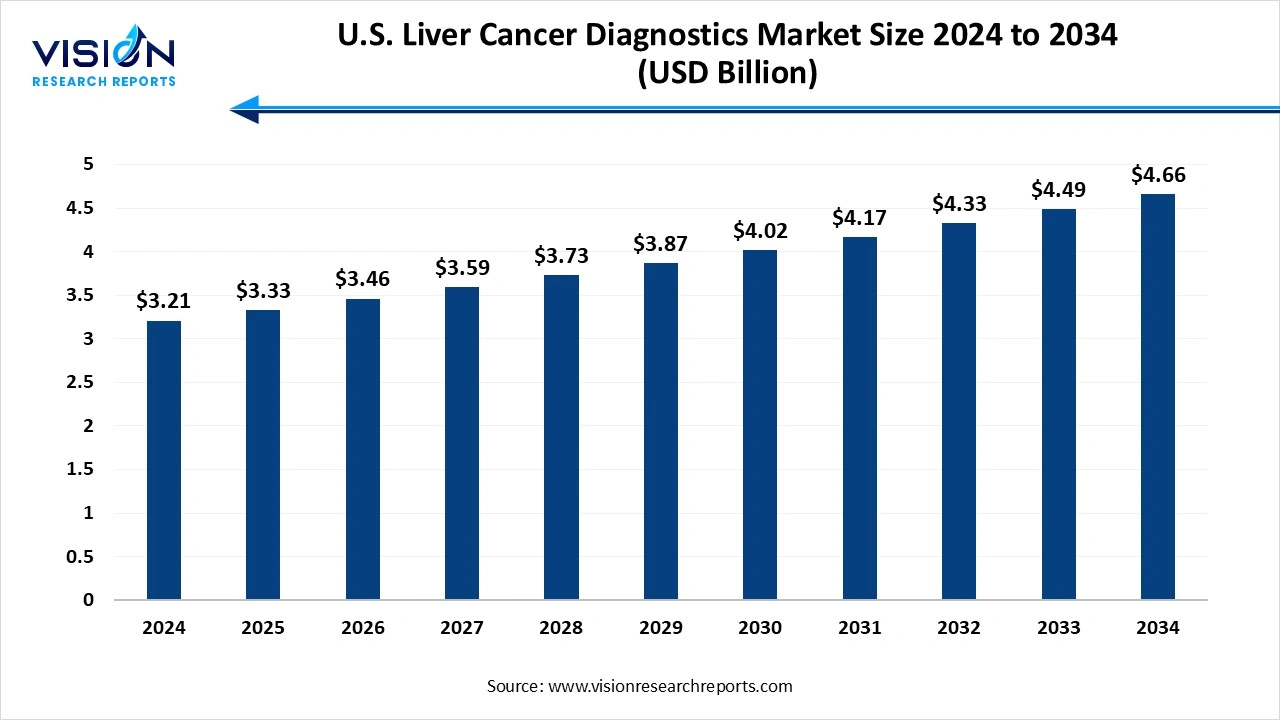

The U.S. liver cancer diagnostics market size was evaluated at USD 3.21 billion in 2024 and is expected to grow from USD 3.33 billion in 2025 to reach around USD 4.66 billion by 2034, growing at a CAGR of 3.8% from 2025 to 2034. The growth of the U.S. liver cancer diagnostics market is driven by the rising incidence of liver cancer due to chronic hepatitis infections, alcohol-related liver disease, and increasing cases of NAFLD and NASH. Advancements in imaging technologies like CT, MRI, and contrast-enhanced ultrasound are improving early detection accuracy.

Liver cancer remains a significant healthcare challenge in the United States, necessitating a robust diagnostic infrastructure to enable timely detection and intervention. The U.S. liver cancer diagnostics market encompasses a range of modalities and technologies aimed at accurate disease identification, staging, and monitoring.

The growth of the U.S. liver cancer diagnostics market is propelled by an escalating incidence of liver cancer, driven by factors such as chronic hepatitis C infection and non-alcoholic fatty liver disease, underscores the critical need for advanced diagnostic solutions. Secondly, advancements in imaging technologies, including computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound, have significantly enhanced the accuracy and efficiency of liver cancer detection, contributing to market expansion. Additionally, the integration of biomarkers and liquid biopsy techniques into diagnostic workflows offers non-invasive means of early detection and monitoring, further driving market growth. Furthermore, the growing emphasis on early detection and personalized medicine, coupled with investments in healthcare infrastructure development, fosters a conducive environment for market expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.21 Billion |

| Revenue Forecast by 2034 | USD 4.66 Billion |

| Growth rate from 2025 to 2034 | CAGR of 3.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | Abbott Laboratories, Guardant Health, Thermo Fisher Scientific Inc., Illumina Inc., F. Hoffmann-La Roche Ltd., Qiagen N.V., Siemens Healthineers, Becton, Dickinson & Company, Epigenomics AG, Koninklijke Philips N.V., and FUJIFILM Healthcare Americas Corporation. |

In 2024, the laboratory tests category emerged as the frontrunner, capturing the largest revenue share at approximately 40%. Within laboratory testing, biomarker assessments and blood tests are key components. These tests are pivotal in the detection and monitoring of liver cancer, analyzing specific molecules in the blood to signal the presence of the disease or offer insights into its progression. Commonly utilized biomarkers for liver cancer include alpha-fetoprotein (AFP), des-gamma-carboxy prothrombin (DCP), and glypican-3.

Various imaging modalities and blood tests are accessible for liver cancer screening, encompassing ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and serum alpha-fetoprotein (AFP) assessments. Early detection of hepatocellular carcinoma (HCC) is paramount for initiating potentially curative interventions during the disease's initial stages. Promisingly, imaging ligands targeting glypican-3 receptor expression, such as peptides, antibodies, and aptamers, demonstrate potential for precise diagnosis, staging, and prognosis of HCC.

Hospitals and diagnostic laboratories claimed dominance in the market, seizing a revenue share of about 49.32% in 2024. Hospitals serve as primary diagnostic hubs, extending care, managing diseases, and administering treatment for various conditions like Hepatocellular Carcinoma (HCC) and cholangiocarcinoma. They offer resources for long-term disease management and treatment, proving indispensable for patients necessitating continuous medical attention. Moreover, hospitals and diagnostic laboratories provide economically viable screening options, enabling timely detection and intervention. Their equipped facilities, proficient healthcare personnel, advanced diagnostic capabilities, specimen collection proficiency, and robust data sensitivity contribute to expedited turnaround times for diagnosis and treatment.

The pharmaceutical and Contract Research Organization (CRO) laboratories segment anticipates notable growth over the forecast period, marked by a significant Compound Annual Growth Rate (CAGR). This growth stems from their pivotal role in advancing cancer research, facilitating drug development, and contributing to the approval process for new oncology treatments.

By Test Type

By End-use

U.S. Liver Cancer Diagnostics Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Liver Cancer Diagnostics Market

5.1. COVID-19 Landscape: U.S. Liver Cancer Diagnostics r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Liver Cancer Diagnostics Market, By Test Type

8.1. U.S. Liver Cancer Diagnostics Market, by Test Type, 2025-2034

8.1.1. Laboratory Tests

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Imaging

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Endoscopy

8.1.3.1. Market Revenue and Forecast (2025-2034)

8.1.4. Biopsy

8.1.4.1. Market Revenue and Forecast (2025-2034)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 9. U.S. Liver Cancer Diagnostics Market, By End-use

9.1. U.S. Liver Cancer Diagnostics Market, by End-use, 2025-2034

9.1.1. Hospitals & Diagnostic Laboratories

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. cademic & Research Institutes

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Pharmaceutical & CRO Laboratories

9.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Test Type (2025-2034)

10.1.2. Market Revenue and Forecast, by End-use (2025-2034)

Chapter 11. Company Profiles

11.1. Abbott Laboratories

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Guardant Health

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Thermo Fisher Scientific, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Illumina, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. F. Hoffmann-La Roche Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Qiagen N.V.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Siemens Healthineers

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Becton, Dickinson & Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Epigenomics AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Koninklijke Philips N.V.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others