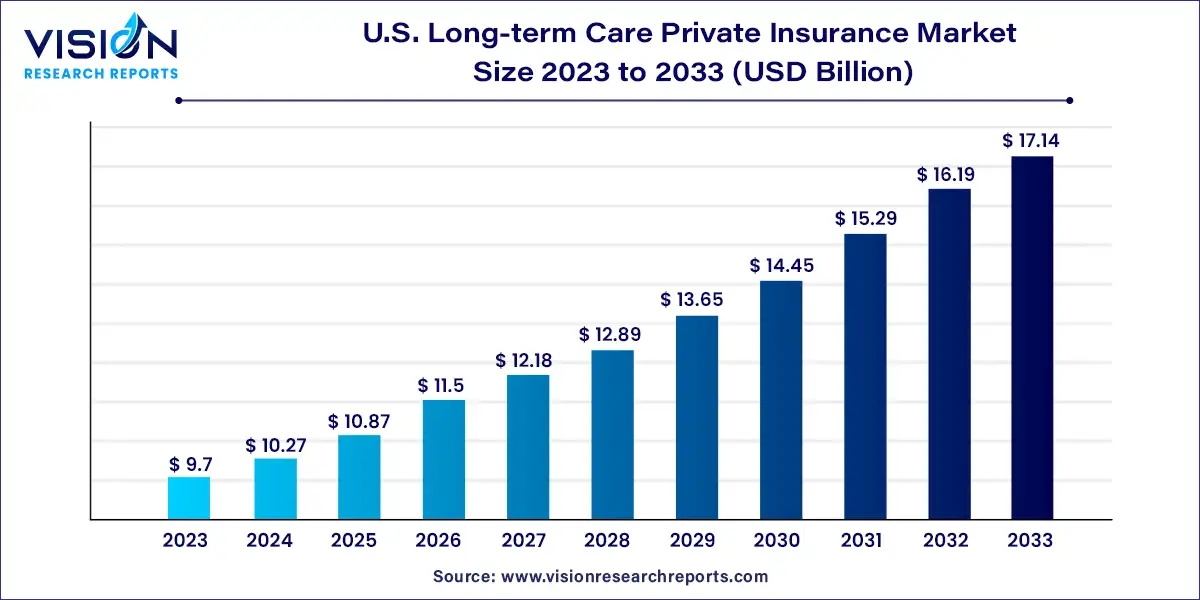

The U.S. long-term care private insurance market was estimated at USD 9.7 billion in 2023 and it is expected to surpass around USD 17.14 billion by 2033, poised to grow at a CAGR of 5.86% from 2024 to 2033.

In the landscape of healthcare financing, long-term care (LTC) insurance has emerged as a vital component, particularly in the United States. As the population ages and the need for extended care services increases, understanding the dynamics of the U.S. long-term care private insurance market becomes paramount. This comprehensive overview aims to delve into the intricacies of this market segment, exploring its growth drivers, challenges, key players, and future prospects.

The growth of the U.S. long-term care private insurance market is propelled by several key factors. Firstly, the aging population, particularly the baby boomer generation, drives increased demand for long-term care services. With longer life expectancies, there is a heightened need for financial protection against the high costs associated with extended care. Secondly, rising healthcare expenses, especially for long-term care services, underscore the importance of insurance products that offer financial security. Thirdly, evolving consumer preferences towards comprehensive coverage and flexible benefits tailored to individual needs contribute to market expansion. These growth factors collectively shape the landscape of the U.S. long-term care private insurance market, highlighting the imperative for insurers to innovate and adapt to meet the evolving needs of consumers.

| Report Coverage | Details |

| Market Size in 2023 | USD 9.7 billion |

| Revenue Forecast by 2033 | USD 17.14 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.86% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

An increasing aging population, the cost of long-term care, and increased consumer awareness are some of the factors driving the growth of the market. Moreover, changing demographics & family dynamics are some other major factors expected to contribute to the market growth during the forecast period.

The outbreak of COVID-19 significantly impacted the long-term care private insurance market. The COVID-19 pandemic has increased awareness of the risks and challenges related to long-term care, especially in institutional settings such as nursing homes and assisted living facilities.

This heightened awareness of the risks associated with institutional care has increased the demand for long-term care insurance as individuals seek coverage for home-based care options and alternative care settings. Moreover, companies have adjusted and reviewed the terms and conditions of their long-term care insurance policies in response to the COVID-19 pandemic. This includes extending coverage for home-based care, clarifying coverage for infectious diseases, and providing telehealth options.

Increased consumer awareness regarding long-term care is a major contributing factor to the market growth. In 2021, the number of new consumers for individual long-term care approximately tripled. The increase was likely a one-time blip brought on by the introduction of a public option in the state of Washington, which led many citizens to seek private insurance instead of enrolling in the government-mandated program. In 2021, the Transamerica affiliates of Aegon NV issued novel individual long-term care policies covering 60,664 lives, or roughly 55,000 more consumers than in 2020.

Furthermore, the aging population in the U.S. is rising rapidly, mainly due to the baby boomer generation reaching retirement age. According to a report from the Administration on Aging, around 17% of individuals living in the U.S., or over 1 in 6, were 65 or above in 2020. By 2040, the number of people 65 and over is predicted to rise to almost 80.8 million. By 2040, it also forecasts a double increase in even older residents, with the number of those 85 and older predicted to rise from 6.7 million in 2020 to 14.4 million. Long-term care services become more necessary as people age, increasing the demand for LTC insurance coverage.

Based on buyer age, the age 55 to 65 segment accounted for the largest market share of 57% in 2023. Buying long-term care insurance in the age group of 55 to 65 provides a longer planning horizon. People have more time to assess their requirements, research insurance choices, and make informed decisions about the coverage that best suits their needs. Moreover, many people in this age group are in the early stage of retirement planning. As retirement nears, individuals become more aware of the potential need for long-term care in the future.

Before age 55 is also expected to show a significant market share in the forecast period due to the increasing awareness about long-term care insurance. Individuals are being educated earlier on regarding the costs and risks of long-term care, which is given more importance. Financial planning initiatives, Awareness campaigns, and changing societal attitudes have contributed to increased awareness of the need for early planning and LTCI coverage.

By Buyer Age

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others