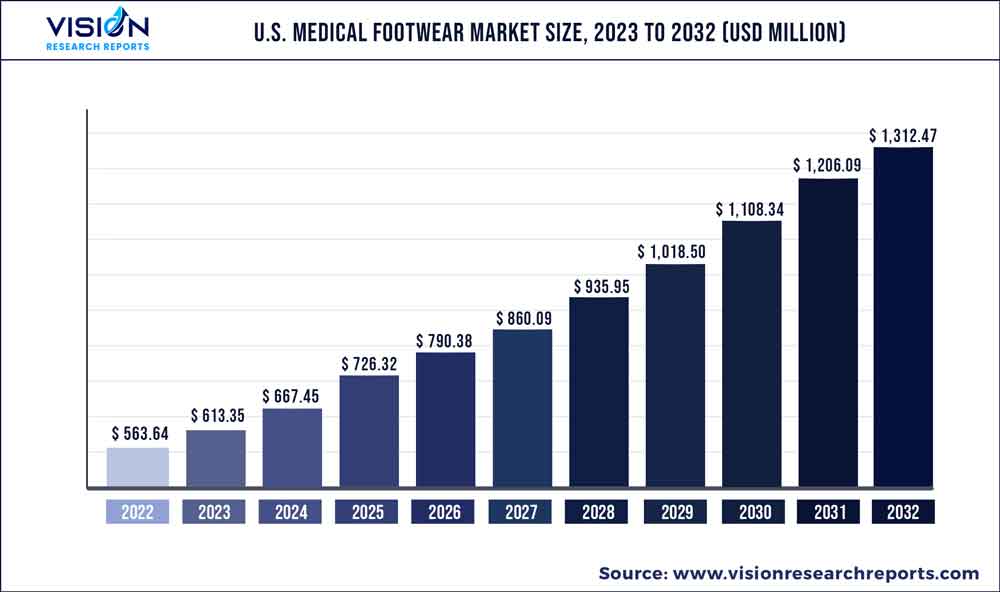

The U.S. medical footwear market was valued at USD 563.64 million in 2022 and it is predicted to surpass around USD 1,312.47 million by 2032 with a CAGR of 8.82% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Medical Footwear Market

| Report Coverage | Details |

| Market Size in 2022 | USD 563.64 million |

| Revenue Forecast by 2032 | USD 1,312.47 million |

| Growth rate from 2023 to 2032 | CAGR of 8.82% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | DJO, LLC; New Balance; Orthofeet.com; Aetrex Worldwide, Inc.; Drewshoe, Incorporated; DARCO International, Inc.; Anodyne, LLC; and Apexfoot.com |

With increasing incidences of foot-related accidents and chronic conditions, there has been growing awareness among the general population of the country regarding the usage of medical footwear. The middle-aged and geriatric population groups, which are more prone to diabetes, arthritis, and heel spurs have been at the forefront of adopting medical footwear as a viable mode of treatment and therapy. The increasing geriatric population has been a key driving factor for the medical footwear market in the U.S.

Aging causes numerous orthopedic conditions, such as late-onset rheumatoid arthritis, osteoporosis, and osteoarthritis. With low population growth, the population in the country has been aging and as a result, the geriatric population in the U.S. has been growing at a higher rate than the age groups of 0 to 18 years and 18 to 64 years. As the geriatric population base continues to grow, the prevalence of age-related orthopedic conditions is slated to rise. This will spur the demand for medical footwear among this demographic group over the forecast period. The men segment dominated the market and held the major revenue share in 2022. Medical footwear is designed to provide maximum comfort and support, which is especially important for people who spend long hours standing or walking.

Many men who work in healthcare or other professions that require standing or walking for extended periods find that medical footwear helps reduce fatigue and prevent foot pain. Moreover, it can help prevent and alleviate a variety of foot problems, such as plantar fasciitis, bunions, and heel spurs. It can also help improve posture and reduce back pain. All these factors contribute to the segment growth. Proper fit is crucial for medical footwear to provide the necessary support and comfort. Many people prefer to try on shoes in person to ensure a good fit, rather than relying on online size charts and descriptions. Medical footwear can be complex and may require the expertise of a specialist to find the right shoe for a specific foot condition or work environment.

Offline retailers can provide guidance and advice based on their experience and knowledge of the products they carry. In addition, medical footwear may require customization, such as orthotic inserts or modifications for specific foot conditions. These customizations are often best done in-person, with the help of a specialist. Such factors are propelling the product sales through offline distribution channels. Various steps are being undertaken by these companies including partnerships, mergers & acquisitions, global expansion, and others to gain a higher share of the industry.

End-use Insights

The women’s category segment is anticipated to grow at the fastest CAGR of 9.65% over the forecast period. Adherence to wearing medical shoes can be hampered by the appearance and appeal of footwear designs, particularly among females, according to a 2019 study by Jarl G and colleagues. The study also discovered that women have worse diabetes health than men, despite women’s increasing requirement to stick to the use of an off-loading device. Female diabetic patients had a negative attitude regarding the appearance and price of medical footwear. According to the study, women don’t like shoes, claiming that the therapeutic footwear's huge size and unfeminine appearance had a negative effect on their self-esteem. Many brands are launching medical shoes just for women and in better designs.

In 2021, the brand Easy Spirit teamed up with Martha Stewart to launch a collection of comfortable and stylish footwear for women. The footwear in this line is lightweight, orthotic-friendly, and offers plenty of arch support. The men’s segment dominated the industry with a higher share of over 55% in 2022. The high use of medical footwear among men is contributing to the higher share of the segment. According to the study conducted by Jarl G and colleagues, men favored conventional shoes over therapeutic shoes when it came to the appearance and weight of the shoe. they feel that the therapeutic shoes are more comfortable in practical use. The study also suggests that men have a better attitude regarding the appearance and price of medical footwear than women.

Distribution Channel Insights

The offline segment led the market with the highest share of over 80.04% in 2022. Various medical footwear manufacturing companies sell their products at diverse offline distribution channels including supermarkets/hypermarkets, specialty stores, convenience stores, medical/healthcare, centers, and mono-brand stores. Most consumers prefer offline distribution channels when purchasing medical footwear due to the exclusive offerings by product specialists and good after-sales service. In the U.S., there are numerous specialist medical footwear retail businesses. Customers can choose from a variety of options at experience retailers. To attract customers, many brands have established experience stores in the U.S. Incorrect fitting of footwear causes foot problems.

The online distribution segment is anticipated to grow at a CAGR of 9.63% over the forecast period. The rapid expansion of e-commerce, along with growing digitalization, is driving the online sales of medical footwear in the U.S. In addition, easy payment transactions and busy lifestyles of consumers make online shopping an easier option. This, in turn, is expected to increase the revenue generation from the online distribution channel over the forecast period. All major players in the market offer their products online, either through their own websites or other online retail stores. Major players in the e-commerce sector include Amazon.com and eBay, Inc. The prices of medical footwear sold on these websites vary depending on the brands and the ongoing discounts and offers.

U.S. Medical Footwear Market Segmentations:

By End-use

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Medical Footwear Market

5.1. COVID-19 Landscape: U.S. Medical Footwear Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Medical Footwear Market, By End-use

8.1. U.S. Medical Footwear Market, by End-use, 2023-2032

8.1.1. Men

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Women

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Medical Footwear Market, By Distribution Channel

9.1. U.S. Medical Footwear Market, by Distribution Channel, 2023-2032

9.1.1. Offline

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Online

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Medical Footwear Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by End-use (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. DJO, LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. New Balance

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Orthofeet.com

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Aetrex Worldwide, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Drewshoe, Incorporated

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. DARCO International, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Anodyne, LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Apexfoot.com

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others