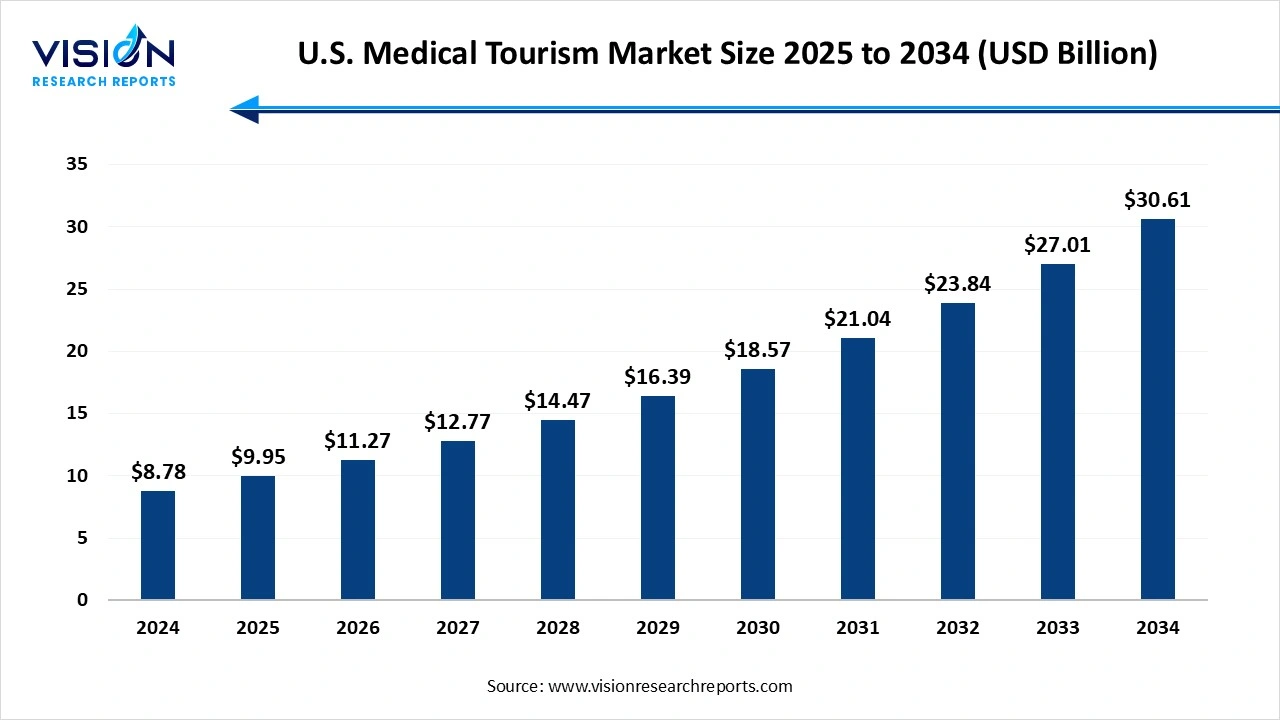

The U.S. medical tourism market size was valued at USD 8.78 billion in 2024 and is expected to grow from USD 9.95 billion in 2025 to around USD 30.61 billion by 2034, expanding at a CAGR of 13.3% during the forecast period. The rising prevalence of chronic diseases and trends towards cutting-edge medical treatment, healthcare facilities in the U.S., drive the market growth.

The U.S. medical tourism market comprises traveling outside the country of residence to receive medical care. The tourism to developed and undeveloped countries. In the U.S region, people travel from richer to less-developed countries to access health services. This shift is driven by the low-cost treatment in less developed nations. In the U.S, the high cost of healthcare treatment.

Some procedures in the U.S. have lengthy wait times, and certain medical procedures may not be fully covered by insurance plans in the U.S., prompting individuals to explore affordable options.

In the U.S region, the advanced medical technology, innovative therapies, and new medical research. The highly skilled specialists who are leaders in their respective fields, attracting patients seeking their expertise for complex, rare conditions. The U.S. provides patient concerns that offer comprehensive services, including language assistance, visa guidance, and travel planning, specifically catering to the needs of medical tourists.

The hospitals and facilitators offer packages covering treatment, accommodation, transportation, translation, and post-care, with some even including leisure activities. The advanced care areas such as cancer and critical care illnesses, organ transplantation, fertility treatments, and cosmetic procedures.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.78 billion |

| Revenue Forecast by 2034 | USD 30.61 billion |

| Growth rate from 2025 to 2034 | CAGR of 13.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered |

Cleveland Clinic, Mayo Clinic, The Johns Hopkins Hospital, Cedars-Sinai, Massachusetts General Hospital, UCSF Health, NewYork-Presbyterian Hospital, Ronald Reagan UCLA Medical Center, Northwestern Memorial Hospital, Stanford Health Care |

Medical Tourism Market in General for the U.S. Medical Tourism Market

The foaming alliance between US hospitals, international healthcare providers, and travel facilitators can streamline the process for medical tourists and expand the reach of US providers. The strategic partnerships and collaborations, integration in telehealth services, remote monitoring devices, and focus on wellness and cosmetic tourism drive the market growth. The high quality of healthcare services ns specialization of its domestic healthcare system, attracting international patients, and the expansion of the market growth.

High cost and post-treatment care, and follow-up challenges of the U.S. Medical Tourism Market

The medical treatment procedure cost is primarily restraining many international patients from seeking medical care. This disparity in costs, compared to other popular medical tourism can be significantly cheaper. Ensuring continuity of care after patient returns to their home countries is a significant challenge. A U.S. healthcare provider might be unfamiliar with the procedures performed abroad, potentially leading to a gap in follow-up care and complications that go unaddressed.

The inbound medical tourism U.S. medical tourism segment registered the maximum market share of 51% in 2024. The increase in high-quality healthcare systems, particularly their accredited hospitals and specialized centres, offers a strong reputation for quality, attracting patients seeking the best possible medical care. The technological advancement and specialized treatment, accreditation of hospitals, and trust are driving the market growth. The advancement in technology and specialized treatment, such as cutting-edge medical technology expertise in specialized areas, and specialized procedures for particular persons, like heart transplantation, oncology treatment, and other specialized services, are contributing to the market growth.

The outbound U.S. medical tourism segment is the fastest-growing in the market during the forecast period. In the costly healthcare treatment, the U.S., long wait times for certain elective surgeries, dental care, and specialty treatments are common. Medical tourism offers a solution, with international healthcare providers often providing more efficient access and significantly shorter wait times. The complex insurance structure and limited coverage, and access to specialized treatments and technologies. The rise of online medical tourism platforms and improved connectivity have made it easier for Americans to research, plan, and book medical procedures abroad.

By Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Medical Tourism Market

5.1. COVID-19 Landscape: U.S. Medical Tourism Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Medical Tourism Market, By Type

8.1.U.S. Medical Tourism Market, by Type Type

8.1.1. Inbound Medical Tourism

8.1.1.1. Market Revenue and Forecast

8.1.2. Outbound Medical Tourism

8.1.2.1. Market Revenue and Forecast

Chapter 9. U.S. Medical Tourism Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Type

Chapter 10. Company Profiles

10.1. Cleveland Clinic

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Mayo Clinic

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Cedars-Sinai

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Massachusetts General Hospital

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. UCSF Health

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. NewYork-Presbyterian Hospital

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Ronald Reagan UCLA Medical Center

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Northwestern Memorial Hospital

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Stanford Health Care

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others