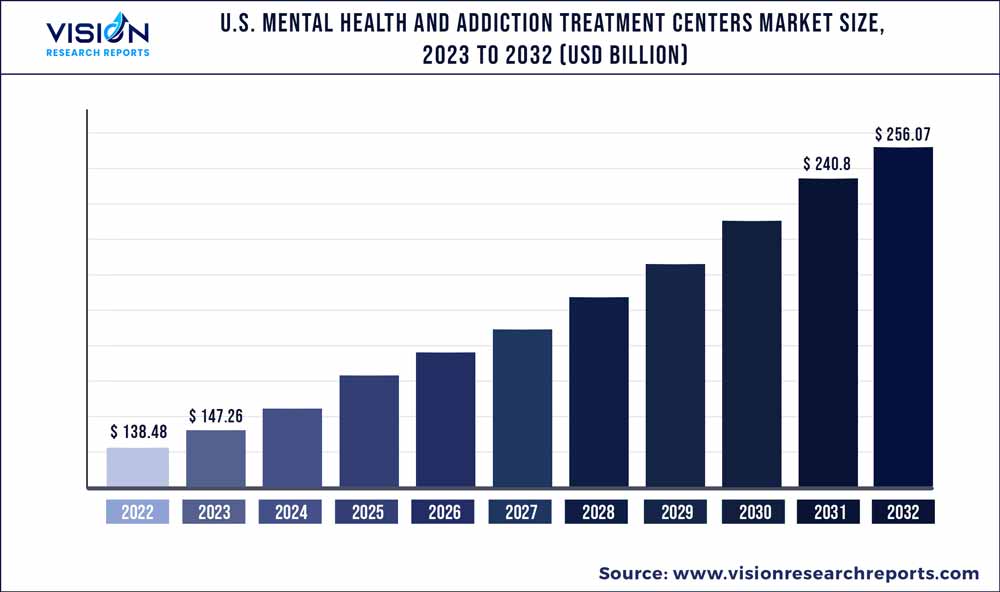

The U.S. mental health and addiction treatment centers market was estimated at USD 138.48 billion in 2022 and it is expected to surpass around USD 256.07 billion by 2032, poised to grow at a CAGR of 6.34% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Mental Health And Addiction Treatment Centers Market

| Report Coverage | Details |

| Market Size in 2022 | USD 138.48 billion |

| Revenue Forecast by 2032 | USD 256.07 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.34% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Acadia Healthcare; Behavioral Health Network, Inc. (BHN); Promises Behavioral Health; Pyramid Healthcare Inc; Haven Corporate; Universal Health Services, Inc. (UHS); Aware Recovery Care.; CareTech Holdings Plc; American Addiction Centers |

One of the primary driving factors for the growth of the U.S. mental health and addiction treatment centers market is the increasing prevalence of mental health and substance use disorders. As per the Substance Abuse and Mental Health Services Administration (SAMHSA), around 25% of Americans suffer from mental or substance use disorders and around 1 in 5 Americans experience mental illness, and 1 out of 12 Americans have a substance use disorder. Moreover, the rising prevalence of addiction and substance use disorders is also contributing to the growth of the market.

The rising prevalence of mental health disorders in the U.S. is a concerning trend that has been attributed to several factors including societal pressures, increasing rates of substance abuse, and the impact of technology and social media on mental health. These factors have contributed to an increase in anxiety, depression, and other mental disorders, leading to a significant rise in demand for mental health services.

The COVID-19 pandemic had a significant impact on mental health globally, leading to increased stress, anxiety, and depression due to lockdowns, economic instability, and overall well-being concerns. Disrupted daily routines, increased social isolation, and heightened financial and job-related stressors contributed to a rise in mental disorders. The WHO's World Mental Health Report revealed a 25% increase in depression and anxiety cases in the first year of the pandemic, bringing the total number of people with mental disorders close to 1 billion.

The pandemic has also highlighted the importance of behavioral health, leading to increased awareness and acceptance of behavioral health concerns. There has been a greater emphasis on providing behavioral health support and resources, such as teletherapy and online behavioral health services. According to a survey by the National Council for Behavioral Health, nearly 90% of mental health and addiction care providers in the U.S. reported using telehealth to deliver assistance during the pandemic.

Market players are investing in expanding their operations, developing new facilities, and enhancing their service offerings to meet the growing demand for mental and addiction treatment services. Acadia Healthcare, Universal Health Services, and Behavioral Health Group are major players that have announced plans to expand their operations and invest in new facilities in 2023. This investment is aimed at increasing access to mental and addiction care offerings and improving patient outcomes. In February 2023, Lehigh Valley Health Network (LVHN) and Universal Health Services (UHS) announced a joint venture to construct a new 144-bed behavioral health hospital in Hanover Township, Pennsylvania. The facility will be located across from the LVH-Muhlenberg campus and is intended to cater to the growing demand for high-quality behavioral healthcare offerings for seniors, adults, and adolescents.

Disorder Insights

By disorder, the mood disorder segment held the largest share of 24% in 2022.Mood disorders are a prevalent mental illness that impacts an individual's persistent emotional state and can be classified as affective disorders. According to the National Institute of Mental Health, it is estimated that 21.4% of U.S. adults experience a mood disorder at some point in their lives. Moreover, the segment growth is being driven by increasing awareness and diagnosis of mood disorders, advances in treatment methods such as cognitive-behavioral therapy and medication management, and greater insurance coverage for behavioral disorders treatment through the Affordable Care Act. These driving factors have led to a greater demand for specialized care centers for mood disorders during the forecast period.

Furthermore, the anxiety disorder segment is anticipated to grow at the fastest rate over the forecast period. Anxiety disorders are the most common mental illness in the U.S. According to data from the Anxiety and Depression Association of America, anxiety disorders impact 6.8 million adults and over 31.9% of adolescents aged between 13 and 18 years old in 2021. These statistics emphasize the significant impact of anxiety disorders on both age groups in the U.S. and highlight the need for effective treatment and support for affected individuals. Furthermore, the COVID-19 pandemic has heightened anxiety and stress levels, creating an uptick in demand for anxiety disorder treatment and support, thereby driving the segment's growth.

Treatment Centers Insights

By services, the outpatient treatment centers segment held the largest share of 43% in 2022. The segment is also expected to exhibit the highest CAGR during the forecast period. The demand for outpatient treatment centers has been on the rise in recent years due to the increasing prevalence of behavioral disorders and addiction issues in the U.S. According to the National Institute on Drug Misuse, there are over 14,500 drug abuse and addiction treatment facilities in the U.S., with outpatient treatment being a common option. Outpatient programs provide structured care to those struggling with addiction while enabling them to maintain social and professional responsibilities. Studies have shown that outpatient treatment can significantly increase the likelihood of long-term recovery for individuals with behavioral disorders.

The rising demand for outpatient mental health services has created an opportunity for providers, who are now expanding their services and introducing new and innovative approaches to treatment For instance, in April 2023 Hanley Center a behavioral health center launched a Mental Health Intensive Outpatient Program (IOP) to address the pressing need for outpatient services for people with mental disorders.

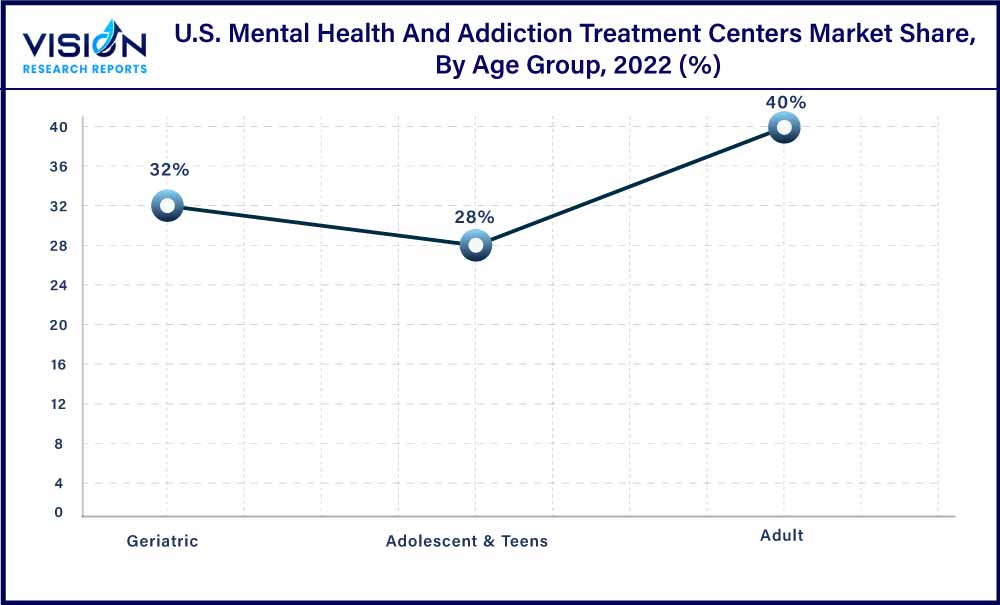

Age Group Insights

In 2022, the adult age group segment held the largest share of 40%. As per the National Institute on Drug Abuse, individuals above the age of 18 are more susceptible to mental and addiction disorders compared to younger age groups. This is mainly attributed to the various life stressors that come with aging, such as changes in relationships, financial strain, and physical well-being concerns. As a result, there is a growing need for accessible and effective behavioral and addiction treatment offerings that can address the unique needs of this demographic.

The adolescent & teens segment is anticipated to grow at the fastest rate over the forecast period. As per data from the National Institute of Mental Health (NIMH), around 20% of adolescents between the ages of 13 and 18 in the U.S. experience a severe mental disorder at some point during their lives. Governments are investing in mental and addiction treatment services to meet the growing demand for these services. In March 2023, the Health Resources and Services Administration (HRSA), under the U.S. Department of Health and Human Services (HHS), announced the availability of USD 25 million for the expansion of primary health care, including behavioral healthcare services, in schools. Currently, HRSA-funded health centers are operating over 3,400 school-based service sites across the U.S.

U.S. Mental Health And Addiction Treatment Centers Market Segmentations:

By Disorder Type

By Treatment Centers Type

By Age Group

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Disorder Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Mental Health And Addiction Treatment Centers Market

5.1. COVID-19 Landscape: U.S. Mental Health And Addiction Treatment Centers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Mental Health And Addiction Treatment Centers Market, By Disorder Type

8.1. U.S. Mental Health And Addiction Treatment Centers Market, by Disorder Type, 2023-2032

8.1.1 Mood Disorder

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Substance Abuse Disorders

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Anxiety Disorder

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Psychotic Disorders

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Eating Disorders

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Personality Disorders

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Mental Health And Addiction Treatment Centers Market, By Treatment Centers Type

9.1. U.S. Mental Health And Addiction Treatment Centers Market, by Treatment Centers Type, 2023-2032

9.1.1. Outpatient Treatment Centers

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Inpatient Treatment Centers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Residential Treatment Centers

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Other Treatment Options

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Mental Health And Addiction Treatment Centers Market, By Age Group

10.1. U.S. Mental Health And Addiction Treatment Centers Market, by Age Group, 2023-2032

10.1.1. Adult

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Geriatric

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Adolescent & Teens

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Mental Health And Addiction Treatment Centers Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Disorder Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Treatment Centers Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Age Group (2020-2032)

Chapter 12. Company Profiles

12.1. Acadia Healthcare

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Behavioral Health Network, Inc. (BHN).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Promises Behavioral Health.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Pyramid Healthcare Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Haven Corporate

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Universal Health Services, Inc. (UHS)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Aware Recovery Care.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CareTech Holdings Plc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. American Addiction Centers.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others