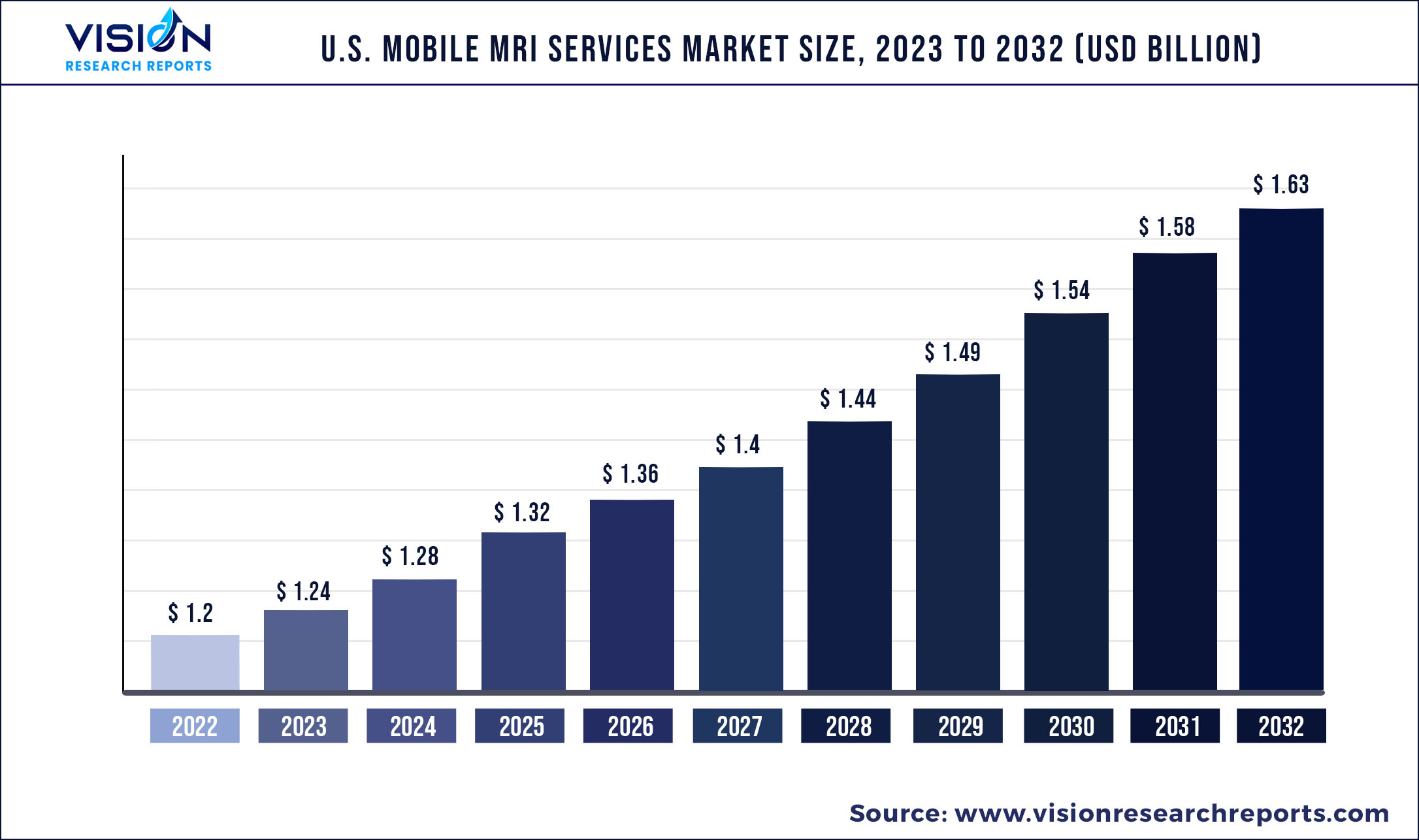

The U.S. mobile MRI services market was surpassed at USD 1.2 billion in 2022 and is expected to hit around USD 1.63 billion by 2032, growing at a CAGR of 3.13% from 2023 to 2032.

Key Pointers

The major factors attributed to the growth include the convenience and cost-effectiveness of mobile MRI service compared to traditional imaging equipment. The market is further driven by the increasing prevalence of chronic disorders such as cancer, cardiovascular, and neurological conditions. For instance, according to the International agency for cancer research, in 2020 there were about 2,281,658 new cancer cases in the U.S., which is expected to increase to 8,432,938 by 2025.

Furthermore, the benefits provided by mobile MRI facilities have been a major factor in driving their adoption by patients and healthcare professionals; the patients can remain in the care of the renowned facility and in the comfort of their familiar surroundings while being examined quickly and effectively by mobile imaging staff. Mobile MRI is an efficient modality that many end users are adopting owing to its numerous advantages, thus boosting the market growth. A facility may require a mobile unit for a number of reasons, such as its flexibility to relocate to any location the facility needs to provide MRI tests at various hospitals or imaging centers in a network, or the ability to offer patients a lower travel distance within a large institution.

Some facilities find it more convenient to provide MRI services next to parking lots so that patients never have to enter the facility. In addition, mobile MRI can potentially be helpful as a temporary MRI alternative for a hospital. This includes when a building is being constructed when a fixed unit is being repaired or maintained, or when determining whether a fixed unit will be useful in the future. Before incurring the costs involved in buying a new unit, a hospital or medical practice can use mobile MRIs to see how much demand they would have if they provided the on-site services of a fixed MRI machine.

The need for mobile MRI services is anticipated to increase owing to the rising incidence of cardiovascular and cancer disorders. Medical imaging assists in the early and precise diagnosis of disorders, which then help in the successful management of diseases. Therefore, many end users are adopting mobile MRI. Additionally, this end-user organizes medical camps in the vicinity of hospitals and imaging centers to reach out to the community and undertake screenings in an effort to control the rising illness burden. Patients don't need to travel to hospitals or specialized imaging centers because they can view their results remotely, however, they need to visit the hospital to get a treatment plan from a physician.

U.S. Mobile MRI Services Market Segmentations and Key Players:

| By Application | By End-use | Key Players |

|

Neurological Cardiovascular Vascular Others |

Hospitals Imaging Centers Others |

Shared Medical Services DMS Health KMG Front Range Mobile Imaging, Inc. Meridian Group International INTERIM DIAGNOSTIC IMAGING, LLC |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Mobile MRI Services Market

5.1. COVID-19 Landscape: U.S. Mobile MRI Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Mobile MRI Services Market, By Application

8.1. U.S. Mobile MRI Services Market, by Application, 2023-2032

8.1.1. Neurological

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cardiovascular

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Vascular

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Mobile MRI Services Market, By End-use

9.1. U.S. Mobile MRI Services Market, by End-use, 2023-2032

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Imaging Centers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Mobile MRI Services Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Shared Medical Services

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DMS Health

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. KMG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Front Range Mobile Imaging, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Meridian Group International

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. INTERIM DIAGNOSTIC IMAGING, LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others