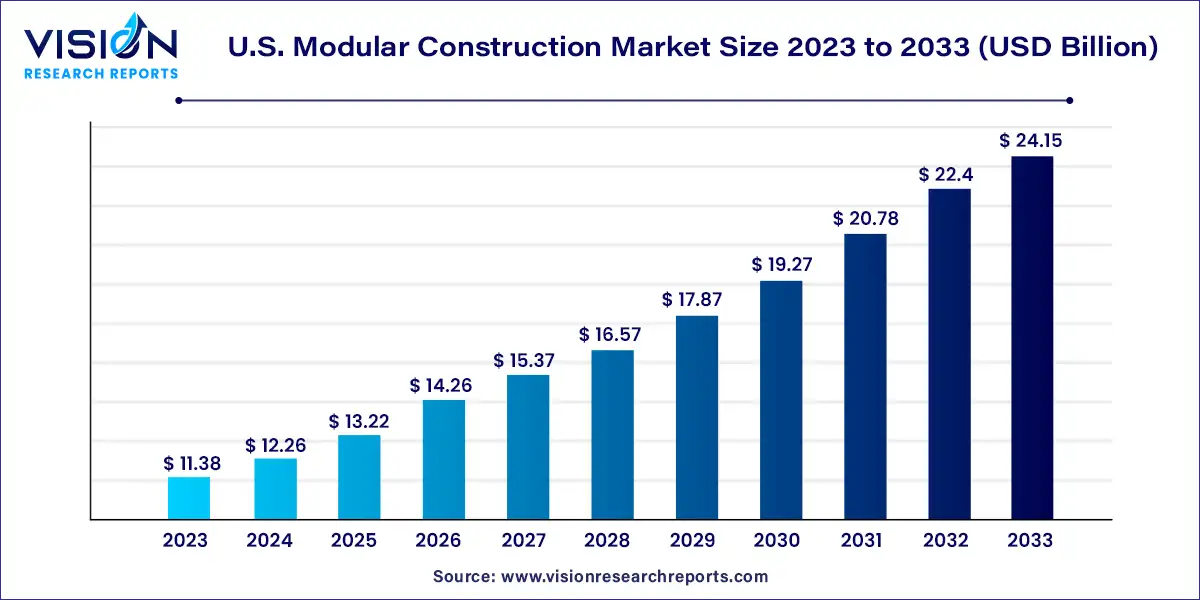

The U.S. modular construction market size was surpassed at USD 11.38 billion in 2023 and is expected to hit around USD 24.15 billion by 2033, growing at a CAGR of 7.82% from 2024 to 2033.

The growth of the U.S. modular construction market is driven by an increasing demand for affordable housing solutions, particularly in urban areas, has spurred the adoption of modular construction techniques due to their efficiency and cost-effectiveness. Secondly, advancements in technology, such as Building Information Modeling (BIM) and automation, have streamlined the modular construction process, making it more attractive to developers and contractors. Additionally, the COVID-19 pandemic has accelerated the adoption of modular construction methods, as they offer resilience to supply chain disruptions and enable faster project completion. Furthermore, growing awareness of the environmental benefits of modular construction, including reduced material waste and energy consumption, has contributed to its rising popularity.

| Report Coverage | Details |

| Market Size in 2023 | USD 11.38 billion |

| Revenue Forecast by 2033 | USD 24.15 billion |

| Growth rate from 2024 to 2033 | CAGR of 7.82% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on product, the modular construction industry in the U.S. was led by permanent construction with a revenue share of 72% in 2023. The segment is also forecasted to grow at the fastest CAGR over the coming years. Permanent modular construction (PMC) is an innovative and sustainable building method that facilitates off-site manufacturing of prefabricated modules that can be deployed in single or multi-story buildings. It offers higher quality control than on-site construction.

The permanent modular construction method has emerged as an alternative to traditional building methods in the U.S. over the past decade. An increase in per capita income among the middle-income group in the U.S. and the easy availability of finances are some factors responsible for the prevailing trend of owning a house in the country. This, in turn, is positively influencing the growth of the permanent segment of the prefabricated construction market in the U.S. The prefabricated modules can be integrated with existing structures or can be deployed independently. Permanent modular construction is carried out according to international and local building codes to ensure that required quality standards are met.

Relocatable or portable buildings are partially or completely constructed structures that are assembled in controlled manufacturing facilities using modular construction processes. Relocatable modular construction (RMC) activities in the U.S. are expected to increase in the coming years as temporary housing units for emergency and relief operations have gained popularity in the country over the past decade. Government initiatives and regulations related to sustainability and environmental protection in the U.S. are expected to fuel the growth of the relocatable segment of the modular construction market in the country over the forecast period.

Steel led the U.S. modular construction industry with the highest revenue share of 43% in 2023 and is expected to grow significantly over the coming years. In prefabricated building activities in the U.S., structural steel is used as a building material, which is available in different grades and can be welded into different shapes. It is used in the development of H-type beams, columns, angles, I-beams, and T-shaped structures. The material exhibits excellent mechanical and chemical properties such as high strength, durability, ductility, seismic resistance, and fast installation, along with offering ease of fabrication.

Steel is used in residential and non-residential building applications, including permanent and temporary modular buildings. It is affordable and readily available. The intrinsic properties of steel, including its strength, versatility, durability, and recyclability, result in the improved performance of the modular buildings constructed from it throughout their lifespan.

Timber has also emerged as a viable mass-scale alternative to traditional materials for use in modular construction activities in the U.S. over the past decade. This material is widely used in prefabricated building activities due to its high durability, lightweightness, and low toxicity. It is biodegradable and easy to reuse and recycle. Timber modular building uses traditional wood studs. In the past, most modular buildings made from wood were single-story structures; however, advancements in building technologies and engineering methods have made multi-story wood buildings a reality in the U.S.

Modular concrete structures comprise precast concrete beams, columns, foundations, and floor slabs, which are transported and assembled at the job sites with the help of professionals. The voids required for fitting door and window frames in these structures are precut and predesigned in factories. However, precast concrete building activities are comparatively more time-consuming than timber and steel construction activities.

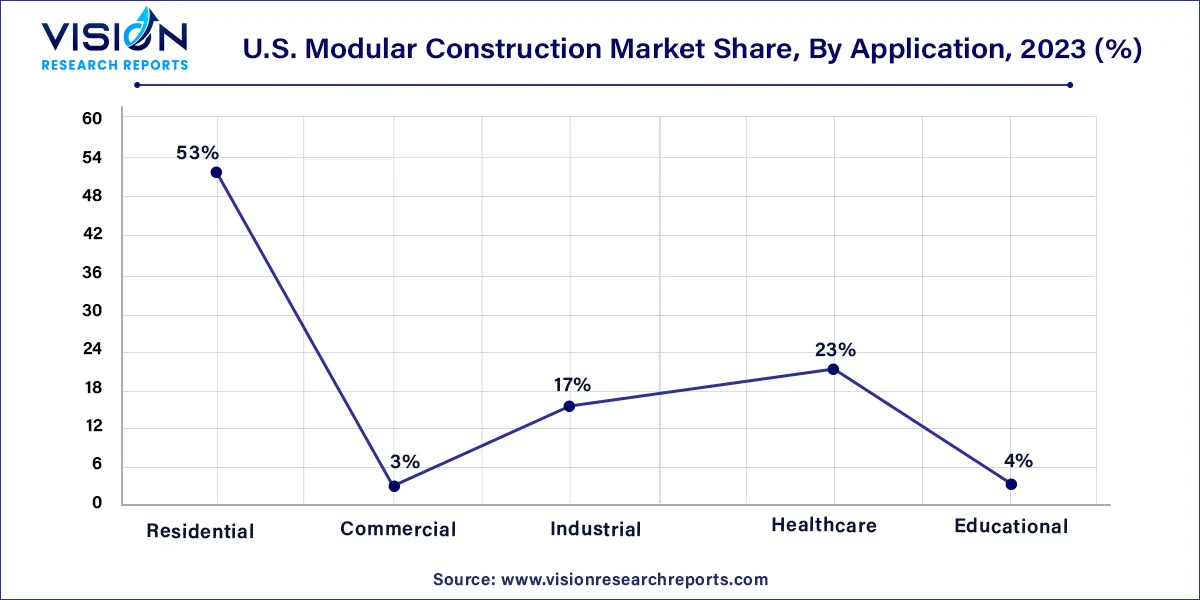

Based on application, the residential application dominated the market with the highest revenue share of 53% in 2023. Residential modular construction has become more appealing because of modern digital technologies, materials, and design capabilities, which have started to dispel the notion that modular buildings can be used to build low-quality modular homes. Modular construction can be used to construct attractive buildings that focus on sustainability and aesthetics. It allows rapid building, feasibility in terms of challenging designs, and building unique and customizable homes that fulfill the requirements of customers.

Industries may customize their designs and make use of the newest advancements in fashion and functionality thanks to modular construction. Before the development of modular construction, businesses had to invest numerous man-hours in planning and designing while waiting months or years for the real building to be finished. The planning and construction phases are greatly simplified by modular buildings, which also cuts the time it takes from conception to completion by several months or more. Moreover, industries are often located in remote locations, where there may be a shortage of skilled labor. By using industrial modular building methods, companies can spend less time and money recruiting labor in the area.

Modular building for hospitals and other healthcare applications is a design concept that has been discussed at great length but has yet to witness implementation at a large scale. For bathrooms, headwalls, and even entire hospitals, many healthcare organizations are switching to modular construction. Such a type of construction enables the development of quiet, safe, and hygienic medical, surgical, clinical, and dental facilities. Modular construction also helps in cost and time savings with the development of high-quality buildings.

By Product

By Material

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Modular Construction Market

5.1. COVID-19 Landscape: U.S. Modular Construction Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Modular Construction Market, By Product

8.1. U.S. Modular Construction Market, by Product, 2024-2033

8.1.1 Relocatable

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Permanent

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Modular Construction Market, By Material

9.1. U.S. Modular Construction Market, by Material, 2024-2033

9.1.1. Steel

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Wood

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Wood

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Modular Construction Market, By Application

10.1. U.S. Modular Construction Market, by Application, 2024-2033

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Educational

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Modular Construction Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Sekisui House Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. CIMC Modular Building Systems Holdings Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Lendlease Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Guerdon, LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Skanska.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. WillScot Mobile Mini Holdings Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ATCO Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Fluor Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. JL Construction.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Palomar Modular Buildings

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others