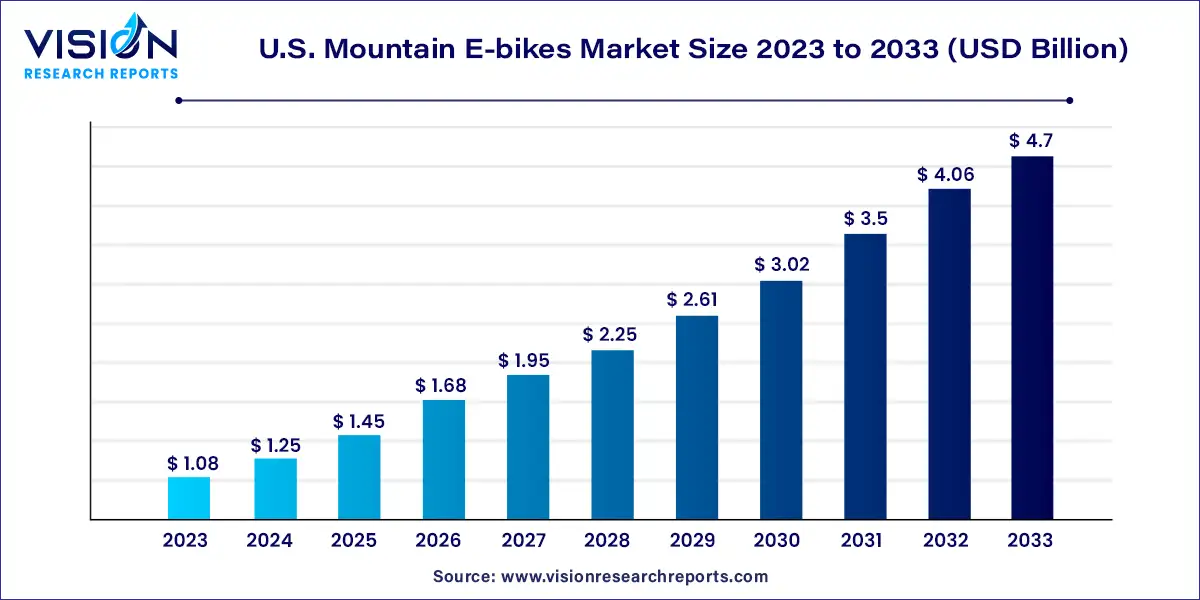

The U.S. mountain e-bikes market size was estimated at around USD 1.08 billion in 2023 and it is projected to hit around USD 4.7 billion by 2033, growing at a CAGR of 15.85% from 2024 to 2033.

The U.S. mountain e-bikes market has witnessed significant growth in recent years, driven by a combination of factors including increasing consumer interest in outdoor activities, advancements in e-bike technology, and a growing awareness of environmental sustainability.

The growth of the U.S. mountain e-bikes market is driven by an advancements in e-bike technology have led to the development of more powerful and efficient electric mountain bikes, enhancing their performance and appeal to consumers. Additionally, increasing awareness of environmental sustainability has spurred demand for eco-friendly transportation solutions, with mountain e-bikes being recognized as a greener alternative to traditional vehicles. Furthermore, the expansion of e-bike infrastructure, including dedicated trails and charging stations, has facilitated greater accessibility and convenience for riders, contributing to market growth. Moreover, changing consumer preferences towards active outdoor lifestyles and the desire for adventure-driven experiences have fueled the popularity of mountain e-biking, driving further market expansion.

The pedal-assisted segment dominated the market in 2023, holding a significant revenue share of 82%. Pedal-assisted e-mountain bikes are engineered to assist the rider's pedaling efforts, offering numerous benefits that drive demand within this segment. They provide an extra boost in speed and acceleration, facilitating easier navigation of hills, inclines, and rough terrains. This not only ensures a smoother ride but also reduces stress on the joints, enhancing overall comfort and enjoyment for riders. Furthermore, pedal-assist e-bikes are associated with reduced rider fatigue and extended range compared to throttle-assist bikes, amplifying their appeal.

Conversely, the throttle-assisted segment is anticipated to experience the fastest compound annual growth rate (CAGR) during the forecast period. Throttle-assisted e-MTBs are increasingly favored by mountain biking enthusiasts in the United States due to their user-friendly and intuitive control mechanisms. These bikes excel in various riding conditions, performing admirably on both hilly landscapes and flat terrain. Riders can effortlessly adjust the power output and speed to match the demands of the route, thanks to the absence of a requirement for pedaling. This feature makes throttle-assisted e-bikes particularly suitable for older individuals or those with medical conditions that may impede pedaling.

In terms of drive type, the chain drive segment held the largest revenue share in 2023. Chain drive e-MTBs remain popular due to their affordability. Chain drives have been a fundamental part of bicycle design for over a century, known for their durability and reliability. With regular maintenance, including proper lubrication, chain drives can endure for extended periods. The use of chains in e-MTBs offers a wide range of gearing options, making them suitable for diverse terrains and riders. Consequently, the demand for chain-driven e-mountain bikes is rising among outdoor enthusiasts. Additionally, the widespread availability of bikes using chain drives facilitates easy procurement of spares or replacements when needed, further boosting their demand.

On the other hand, the belt drive segment is projected to witness the highest growth rate through 2033. E-MTBs equipped with belt drives are favored by mountain bikers for their minimal maintenance and cleanliness requirements. Furthermore, belt drives operate silently, appealing to riders seeking a quieter experience or urban commuters. They are often lighter, appealing to bikers prioritizing ease and agility. Moreover, modern belt drives are crafted from advanced synthetic materials like nylon and carbon fiber, offering resistance to rust and corrosion. The absence of oil and grease for maintenance, coupled with their durable and noiseless operation, have contributed to the growing demand for this segment.

The lithium-ion battery segment dominated the revenue share in the U.S. mountain e-bikes market in 2023. Manufacturers of electric mountain bikes are increasingly turning to lithium-ion batteries due to their high energy density, lightweight construction, and long lifespan. These batteries can store a significant amount of energy, empowering riders to conquer steep inclines and challenging terrains. Manufacturers are continually innovating to develop more efficient and lighter batteries, aiming to enhance the range and performance of e-MTBs, thus fueling the expansion of this segment. For example, Pedego e-MTBs utilize top-quality lithium-ion cells from leading manufacturers such as LG, Panasonic, and Samsung Electronics, all meeting UL2580 standards.

Conversely, the lead acid battery segment is forecasted to experience moderate growth from 2024 to 2033. Lead-acid batteries are commonly employed in e-mountain bikes due to their cost-effectiveness compared to lithium-ion batteries. These batteries are readily available from local stores and various online retailers. Procuring sealed lead-acid batteries locally enables e-MTB manufacturers to avoid additional shipping costs, ultimately reducing the overall cost of e-MTBs. While lead-acid batteries offer high power output potential, their substantial weight and shorter lifespan may limit their demand, as buyers increasingly seek low-maintenance and portable solutions.

By Drive Type

By Propulsion Type

By Battery

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others