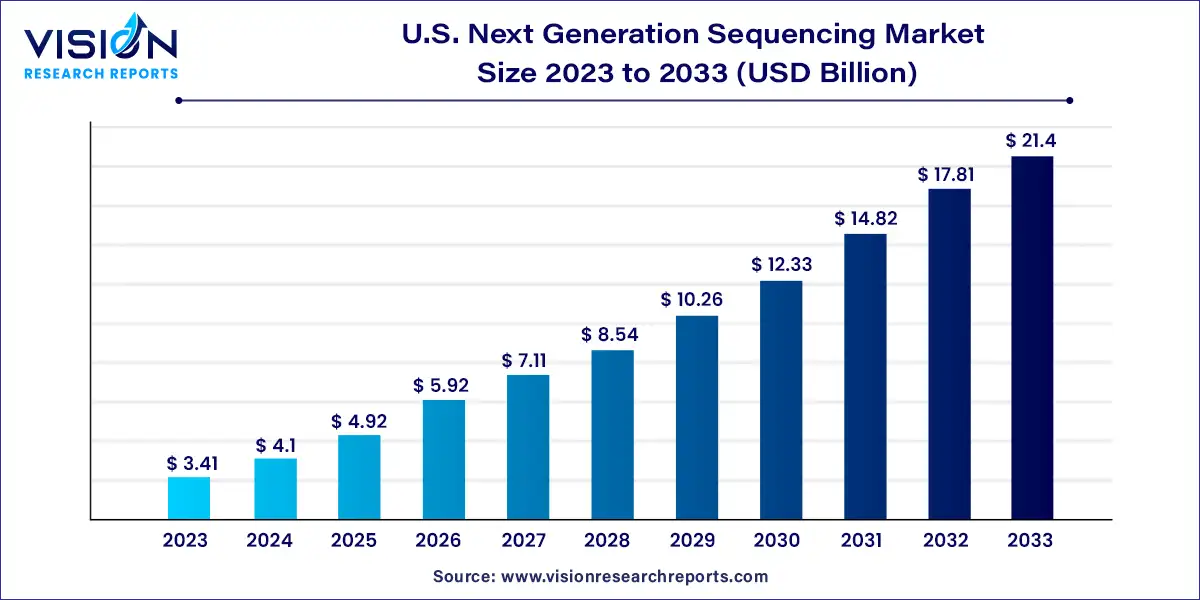

The U.S. next generation sequencing market size was estimated at USD 3.41 billion in 2023 and it is expected to surpass around USD 21.4 billion by 2033, poised to grow at a CAGR of 20.16% from 2024 to 2033.

The landscape of healthcare is continually evolving, with advancements in technology playing a pivotal role in shaping the future of medical diagnostics and treatments. Next Generation Sequencing (NGS) has emerged as a transformative tool in the field of genomics, revolutionizing our understanding of genetic diseases, personalized medicine, and precision healthcare.

The growth of the U.S. next generation sequencing (NGS) market is propelled the technological advancements play a pivotal role, with ongoing innovations enhancing the accuracy, throughput, and cost-effectiveness of sequencing processes. This has widened the scope of NGS applications across various sectors, including clinical diagnostics, oncology research, and agricultural genomics. Furthermore, the increasing demand for precision medicine has spurred the adoption of NGS in clinical settings, driving market expansion. Moreover, robust research and development initiatives, coupled with investments from government bodies, academic institutions, and pharmaceutical companies, contribute to the market's growth trajectory. Additionally, the declining cost of sequencing has democratized access to NGS technologies, fostering widespread adoption and market penetration.

The segment focusing on targeted sequencing and resequencing dominated the revenue share in 2023, accounting for 72%, and is poised to experience the highest CAGR throughout the forecast period. These technologies are predominantly utilized in clinical applications such as cancer diagnostics, prenatal testing, and genetic disease screening. Their ability to precisely analyze specific genomic areas renders them highly suitable for clinical use, thus fueling their widespread adoption within the healthcare sector. Furthermore, ongoing advancements in targeted sequencing and resequencing technologies have bolstered sequencing throughput, enabling researchers to analyze larger sample numbers concurrently. This enhanced throughput facilitates more efficient study designs and expedites research progress.

On the other hand, the whole genome sequencing (WGS) segment is projected to undergo significant expansion by 2033, driven by the escalating adoption of precision medicine and personalized healthcare. Recent progress in WGS technology has enabled the comprehensive sequencing of an individual's entire genome, offering valuable insights into genetic variations and potential disease susceptibilities. Consequently, targeted therapies and personalized treatment strategies have emerged, promising improved patient outcomes and reduced healthcare expenditures. Moreover, the declining costs of WGS and the growing accessibility of sequencing services have democratized its usage among researchers and clinicians, further propelling the growth of this segment.

The consumables segment accounted for the larger revenue share in 2023 and it is anticipated to grow at the fastest CAGR of 21.08% over the forecast period. The dominance can be attributed to the high demand for sequencing reagents, kits, and other consumables required for NGS procedures. As NGS technologies are more widely adopted in research and clinical settings, the demand for consumables is expected to continue to increase. In addition, advancements in sequencing technologies are resulting in new applications and workflows, which is further driving the demand for new and innovative consumables.

The platforms segment is expected to witness significant growth from 2024 to 2033, due to the increasing demand for better and more advanced sequencing platforms. Several companies are investing heavily in the development of new and innovative platforms that can provide faster and more accurate sequencing results. For instance, in April 2022, Thermo Fisher Scientific introduced the Ion Torrent Genexus Dx Integrated Sequencer. It is a CE-IVD marked and automated NGS platform designed to provide results within a single day. These trends are expected to continue in the coming years, driving further growth in the platform product segment.

In 2023, the sequencing segment commanded the largest market share at 58%. The sequencing workflow encompasses a comprehensive process essential for obtaining precise and dependable results. It involves multiple stages, including sample preparation, sequencing, and data analysis. As the demand for NGS-based research and clinical applications continues to surge, the market for sequencing workflow is anticipated to witness further growth in the forthcoming years.

Meanwhile, the NGS data analysis segment is poised to exhibit the highest CAGR over the forecast period, driven by the escalating need for efficient and accurate analysis of genomic data. With NGS technology gaining traction across diverse applications such as drug discovery, clinical diagnostics, and personalized medicine, the demand for NGS data analysis is expected to soar. Furthermore, the availability of advanced software and tools tailored for NGS data analysis is also bolstering the expansion of this segment.

In 2023, the oncology segment claimed the largest market share of 27%, propelled by the escalating prevalence of cancer nationwide. NGS technology has heralded a paradigm shift in cancer diagnosis and treatment by enabling more precise and thorough genomic analysis of tumors, paving the way for personalized and targeted therapeutic interventions. Furthermore, ongoing research and development endeavors in the oncology sphere are fostering increased demand for NGS applications within this domain.

Concurrently, the consumer genomics segment is poised to witness the highest CAGR of 22.78% during the forecast period. There is a burgeoning interest among consumers in uncovering insights about their genetic composition, ancestry, and susceptibility to specific health conditions. Direct-to-consumer (DTC) genetic testing companies are offering affordable and user-friendly NGS-based DNA testing kits, empowering consumers with valuable information about their genetic traits, ancestral origins, and potential health vulnerabilities. This surge in consumer curiosity is anticipated to drive the demand for consumer genomics applications.

In 2023, academic research held the largest market share of 51%. Academic institutions are at the forefront of genomic research and innovation. Researchers in academia are driven by interest and the purpose of knowledge, leading them to explore diverse areas of genomics using NGS technology. Their pioneering work drives the development of new sequencing methodologies, data analysis techniques, and applications, shaping the direction of the entire field. Government funding agencies, private foundations, and research grants often support academic research. These funding sources provide financial support for purchasing NGS equipment, reagents, and computational resources necessary for conducting genomic studies. The availability of funding enables academic researchers to invest in NGS technology and infrastructure, contributing to the growth of the market.

The clinical research segment is expected to grow at the highest CAGR of 22.88% from 2024 to 2033. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have approved several NGS-based tests and assays for clinical use, particularly in oncology and infectious diseases. The establishment of regulatory frameworks and guidelines for NGS-based diagnostics has increased confidence in the reliability and accuracy of genomic testing, facilitating the adoption of NGS technology in clinical research. As regulatory approvals for NGS-based tests continue to expand across different therapeutic areas, the demand for NGS in clinical research is expected to grow.

By Technology

By Product

By Application

By Workflow

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Next Generation Sequencing Market

5.1. COVID-19 Landscape: U.S. Next Generation Sequencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Next Generation Sequencing Market, By Technology

8.1. U.S. Next Generation Sequencing Market, by Technology, 2024-2033

8.1.1. Whole Genome Sequencing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Whole Exome Sequencing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Targeted Sequencing & Resequencing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Next Generation Sequencing Market, By Product

9.1. U.S. Next Generation Sequencing Market, by Product, 2024-2033

9.1.1. Platforms

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Consumables

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Next Generation Sequencing Market, By Application

10.1. U.S. Next Generation Sequencing Market, by Application, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinical Investigation

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Reproductive Health

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. HLA Typing/Immune System Monitoring

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Metagenomics, Epidemiology & Drug Development

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Agrigenomics & Forensics

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Consumer Genomics

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Next Generation Sequencing Market, By Workflow

11.1. U.S. Next Generation Sequencing Market, by Workflow, 2024-2033

11.1.1. Pre-sequencing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Sequencing

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. NGS Data Analysis

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Next Generation Sequencing Market, By End-use

12.1. U.S. Next Generation Sequencing Market, by End-use, 2024-2033

12.1.1. Academic Research

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Clinical Research

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Hospitals & Clinics

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Pharma & Biotech Entities

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Other Users

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Next Generation Sequencing Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Technology (2021-2033)

13.1.2. Market Revenue and Forecast, by Product (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Illumina, Inc

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. QIAGEN

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Thermo Fisher Scientific, Inc

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. BGI

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Pacific Biosciences

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Bio Rad Laboratories

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Oxford Nanopore Technologies, Inc

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. F. Hoffmann-La Roche AG

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Agilent Technologies, Inc

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Eurofins Scientific

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others