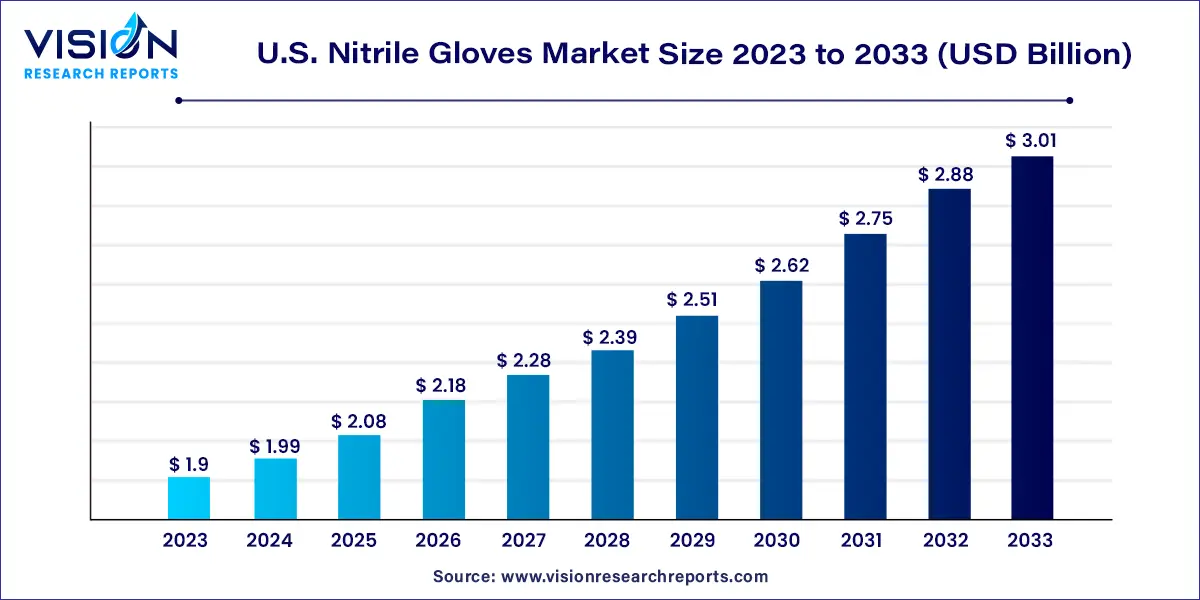

The U.S. nitrile gloves market was surpassed at USD 1.9 billion in 2023 and is expected to hit around USD 3.01 billion by 2033, growing at a CAGR of 4.72% from 2024 to 2033.

The U.S. nitrile gloves market stands at the intersection of burgeoning demand and innovative technology. Nitrile gloves, crafted from a synthetic rubber compound, have become indispensable across various sectors due to their exceptional attributes. These gloves are latex-free, ensuring safety for those with latex allergies, and are renowned for their durability, chemical resistance, and superior puncture protection.

The growth of the U.S. nitrile gloves market is underpinned by several key factors. Firstly, the heightened emphasis on healthcare and hygiene standards, particularly in the wake of global health concerns, has propelled the demand for nitrile gloves in medical facilities, driving substantial market growth. Secondly, the expanding industrial sector, including automotive, manufacturing, and food processing industries, relies on nitrile gloves to ensure the safety of their workforce, boosting market demand significantly. Additionally, continuous advancements in manufacturing technologies have led to the production of gloves with enhanced durability, comfort, and chemical resistance, augmenting their application across diverse sectors. Moreover, the latex-free nature of nitrile gloves makes them accessible to individuals with latex allergies, broadening their consumer base. Lastly, the market’s responsiveness to evolving environmental concerns and the development of sustainable practices have further bolstered its growth trajectory. These factors combined create a robust market environment, fostering the steady expansion of the U.S. nitrile gloves market.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.9 billion |

| Revenue Forecast by 2033 | USD 3.01 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The powdered type segment held the largest revenue share of 23% in 2023. Powdered nitrile gloves, historically prevalent, were introduced to facilitate easy wearing and removal, reducing friction and making them more comfortable for users. The powder, usually cornstarch, acts as a lubricant, allowing wearers to slide the gloves on and off with ease. However, concerns arose regarding powder contamination, particularly in sensitive environments like healthcare and food handling, where even trace amounts of powder could pose risks. These concerns led to a paradigm shift towards powder-free nitrile gloves.

The powder-free type segment is anticipated to expand at a CAGR of 5.36% over the forecast period. Powder-free nitrile gloves, free from cornstarch or any other powder-based lubricants, have gained immense popularity in recent years, especially in sectors where hygiene and precision are paramount. The absence of powder eliminates the risk of allergic reactions, making them a preferred choice for individuals with sensitive skin or latex allergies. Moreover, powder-free gloves find extensive use in industries demanding stringent contamination control, such as pharmaceuticals and cleanroom environments. Their seamless fit and tactile sensitivity make them ideal for tasks requiring precision and dexterity.

The disposable product segment accounted for the largest revenue share of 82% in 2023. Disposable nitrile gloves, perhaps the more widely recognized category, are designed for single-use applications. Their primary purpose is to provide a reliable barrier against contaminants and pathogens, making them indispensable in sectors such as healthcare, food handling, and laboratory settings. Their convenience lies in their easy disposal after use, ensuring hygiene and preventing the spread of infections. This category's popularity is attributed to its versatility, finding applications not only in medical environments but also in industries requiring short-term hand protection, such as catering and janitorial services.

The durable product segment is expected to grow at the fastest CAGR of 7.76% during the forecast period. The durable nitrile gloves category represents a sturdier, long-lasting solution. Unlike their disposable counterparts, durable nitrile gloves are engineered for extended use and repeated wear. Their robust nature makes them ideal for tasks demanding higher levels of protection, durability, and resistance to wear and tear. Industries like automotive, manufacturing, and construction, where workers are exposed to harsh chemicals, sharp objects, or abrasive materials, benefit significantly from the reliability and longevity offered by durable nitrile gloves. Additionally, these gloves often feature enhanced grip and dexterity, enabling users to handle intricate tasks with precision while ensuring comprehensive hand protection.

The medical & healthcare end-use segment accounted for the biggest revenue share of 83% in 2023. Within the medical and healthcare sector, nitrile gloves have become indispensable. Hospitals, clinics, and diagnostic centers rely on these gloves to maintain rigorous standards of hygiene and protect both healthcare professionals and patients from infections. The latex-free nature of nitrile gloves ensures that individuals with latex allergies can receive necessary medical care without concerns. Moreover, especially in times of pandemics, the demand for nitrile gloves surges, emphasizing their critical role in preventing the spread of diseases. Their puncture resistance and durability make them ideal for a wide array of medical procedures, from surgeries to simple examinations, highlighting their versatility and reliability in healthcare settings.

In the automotive industry, nitrile gloves serve as a vital safety gear, safeguarding workers from various hazards present in the manufacturing and maintenance processes. Automotive technicians routinely handle chemicals, oils, and greases, making hand protection essential. Nitrile gloves, with their resistance to chemicals and punctures, provide an effective barrier, ensuring the safety of workers. Additionally, these gloves offer excellent grip, allowing technicians to handle tools and components with precision. This grip is crucial in tasks requiring dexterity, such as assembling intricate car parts. Nitrile gloves in the automotive sector enhance workplace safety and contribute significantly to the efficiency of operations by reducing the risk of accidents and injuries.

By Type

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Nitrile Gloves Market

5.1. COVID-19 Landscape: U.S. Nitrile Gloves Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Nitrile Gloves Market, By Type

8.1. U.S. Nitrile Gloves Market, by Type, 2024-2033

8.1.1 Powdered

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Powder-free

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Nitrile Gloves Market, By Product

9.1. U.S. Nitrile Gloves Market, by Product, 2024-2033

9.1.1. Disposable

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Durable Head Protection

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Nitrile Gloves Market, By End-use

10.1. U.S. Nitrile Gloves Market, by End-use, 2024-2033

10.1.1. Medical & Healthcare

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oil & Gas

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Food & Beverage

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Metal & Machinery

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Chemical & Petrochemical

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Pharmaceutical

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Cleanroom

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Others

10.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Nitrile Gloves Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Ansell Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Top Glove Corporation Bhd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hartalega Holdings Berhad.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Superior Gloves.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kimberly-Clark Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. The Glove Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. US Glove Supply.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Supermax Corporation Berhad (Supermax Healthcare Inc.)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SHOWA GROUP.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. SafeSource Direct

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others