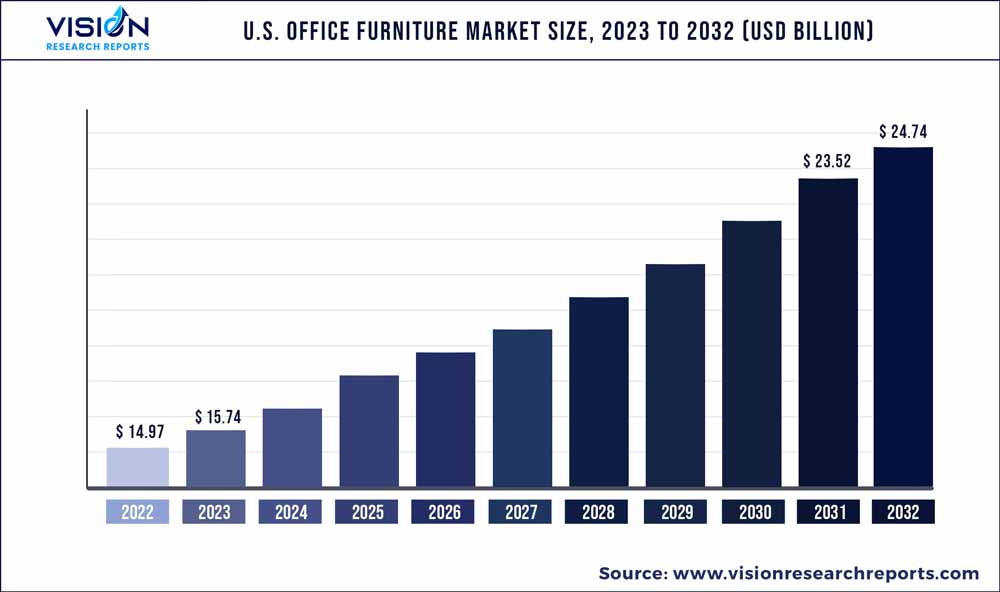

The U.S. office furniture market size was estimated at around USD 14.97 billion in 2022 and it is projected to hit around USD 24.74 billion by 2032, growing at a CAGR of 5.15% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Office Furniture Market

| Report Coverage | Details |

| Market Size in 2022 | USD 14.97 billion |

| Revenue Forecast by 2032 | USD 24.74 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Herman Miller; HNI Corp.; Steelcase; Haworth; Knoll; Ashley Furniture Industries Inc.; Global Furniture Group; Kimball International Inc.; Okamura Corp.; Interior Systems, Inc |

One of the major factors driving the market growth is the increasing building of households, offices, and commercial complexes. The growing number of people working from home or remote locations is increasing the demand for home office equipment among retailers and manufacturers. Customers are attracted to smart, comfy, and flexible furniture designs because of the easy and quick delivery alternatives. In addition, the rapid creation of IT parks and commercial zones has increased the number of corporate offices, resulting in a need for contemporary office furniture all over the world.

Organizations are also creating informal office areas to improve colleague communications, collaborative environments, and social connections. As a result of this trend, office furniture makers have begun to produce intelligently designed furniture. In addition, due to technological advancements and an increase in the number of cases of health issues caused by employees' sedentary lifestyles, there has been an increase in the demand for smart workplace furniture that provides internet connectivity while also promoting better posture and movement support. During the projection period, this factor is projected to have a substantial impact on the demand for office furniture. Moreover, the dynamic company landscape, the swift establishment of IT parks, the rise in startup ventures, corporate expansions, and growing commercial zones have fueled the demand for office spaces and employment opportunities.

The information technology industry remains a robust and expanding sector, with its significant influence on the U.S. economy and the job market. This scenario is expected to have a positive effect on the U.S. market. The tech industry experienced rapid expansion and substantial profitability during the pandemic as a result of increased online shopping, remote work, and virtual social interactions. However, the resurgence of commercial office real estate, driven by the tech industry's recovery, is evident in the suburban areas of Phoenix. According to a report by CBRE Group, Inc., the tech industry's leasing of office space in the U.S. increased by 27% in 2021 compared to 2020.

One of the primary factors propelling the market growth is the widespread adoption of the work-from-home (WFH) paradigm as a result of the coronavirus (Covid-19) pandemic. Because of the unexpected spread of the infection and the statewide lockdown, many people were working from home, which is boosting the demand for comfortable and sturdy office furniture for home offices. Furthermore, to strengthen their distribution network, many key players are forming agreements with e-commerce retail stores. The demand for office furniture grew in tandem with the exponential growth of commercial buildings and service sector jobs. Another factor projected to boost market growth is a rise in the number of start-ups and corporate expansions. The market growth is expected to be fueled by the increased demand for office space and employment.

COVID-19 has expedited a number of preexisting trends in the commercial property market surrounding health and well-being, activity-based working, flexibility, and the need for greater space use, in the American market, according to an ARUP report published in June 2020 titled Future of offices: in a post-pandemic world. The commercial offer is also being reshaped by sustainability, smart buildings, and the digital workplace. Taken together, these trends and changes will have a significant impact on the kind of workplaces that will be required in the aftermath of a pandemic. Consumers shifting from regional brands to international brands are influenced by the design and aesthetic appeal, along with the availability of a variety of colors and materials.

High durability, standard testing, certifications, such as the Business and Institutional Furniture Manufacturers Association (BIFMA) and Leadership in Energy and Environmental Design (LEED), and warranty play a role in consumers shifting toward international brands. Furthermore, the raw materials and fabric used in office furniture play a significant role in affecting consumers’ purchasing decisions. The use of anti-sweat and anti-microbial fabric for office seating to maintain hygiene and day-long comfort acts as an added benefit for customers with specific needs in mind.

Product Insights

The seating segment accounted for the largest share of over 28% in 2022. The segment is expected to register a CAGR of 5.33% from 2023 to 2032. Proper seating has become increasingly important as employees spend more than 8-10 hours every day at work. To minimize illness and fatigue, office chairs must be designed according to scientific principles as the optimal posture while working has a significant impact on health. In the U.S., there is a growing need for ergonomic seats, which aid in improving staff productivity, efficiency, and workplace aesthetics. Customers in the U.S. want to purchase high-quality furniture that not only looks good but is also composed of high-quality materials. When it came to selecting office furniture, in the U.S. in 2021, about a third of buyers prioritized desks and tables.

As a result of the COVID-19 outbreak, which resulted in widespread lockdowns and stay-at-home orders across the U.S., the demand for office furniture used in the home increased. Obesity is also a factor that is compelling manufacturers to change the design of office furniture, especially chairs and other seating products. Obesity affected about 40% of adults in the U.S. in 2021, up from 15% in 1990. As organizations attempt to accommodate greater body sizes in both dimension and weight, rising obesity cases have had an impact on furniture design, particularly for office chairs. The average office chair can support up to 300 pounds, whereas bariatric chairs may support up to 600 pounds. Taller chair backs and broader seats and bases are common features of bariatric chairs.

Distribution Channel Insights

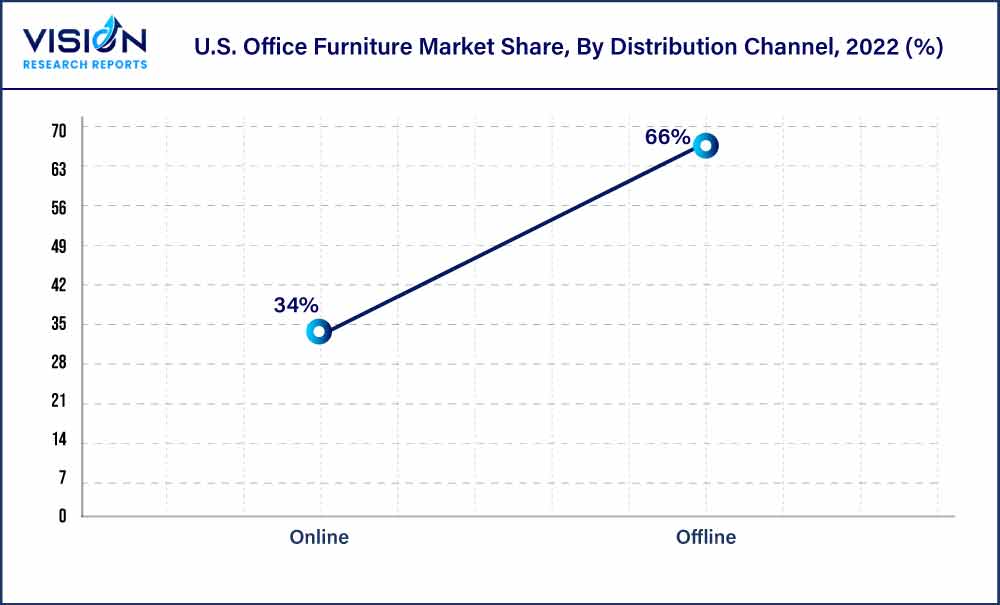

The online distribution channel segment accounted for a share of 34% in 2022. The segment is expected to register the fastest CAGR from 2023 to 2032. The segment is driven by the emergence of e-commerce retail channels and online furniture merchants. To extend their customer base, market participants are developing new digital platforms. For instance, Herman Miller launched a fully redesigned retail website in May 2021. In addition, the site features a fresh design and more storytelling content for goods, designers, and the brand. It also incorporates powerful AI-driven product recommendations as well as improved customer-centric website navigation that makes it easier to find exactly what a person is looking for.

Furniture e-retailers have noticed a significant increase in demand since e-commerce deliveries of non-essentials were authorized in the fourth phase of the lockdown, roughly two months after the lockdown began. This includes not only internet sellers but also rental companies. Offline furniture shopping addresses customer needs, such as personalized pre-sales information, installation support, and immediate delivery. The U.S. is developing in terms of technology infrastructure and internet adoption. Hence, a large portion of the population in the region is still shopping for furniture, including eco-friendly furniture, offline. U.S.-based Williams-Sonoma Inc. offers eco-friendly office furniture through online and offline modes.

U.S.-based Crate and Barrel is another eco-friendly furniture offering company that has stores and independent franchise stores in multiple continents and countries. In July 2021, Herman Miller announced the successful acquisition of Knoll, Inc., thereby establishing itself as the foremost authority in modern design. This merger brings together a total of 19 prominent brands, extending its reach to over 100 countries across the globe. With a vast network of dealers and showrooms, including 64 showrooms worldwide and over 50 physical retail outlets, the combined company boasts extensive global multi-channel and e-commerce capabilities.

U.S. Office Furniture Market Segmentations:

By Product

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Office Furniture Market

5.1. COVID-19 Landscape: U.S. Office Furniture Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Office Furniture Market, By Product

8.1. U.S. Office Furniture Market, by Product, 2023-2032

8.1.1. Seating

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Modular Systems

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Desks & Tables

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Office Furniture Market, By Distribution Channel

9.1. U.S. Office Furniture Market, by Distribution Channel, 2023-2032

9.1.1. Online

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Offline

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Office Furniture Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Herman Miller

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. HNI Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Steelcase

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Haworth

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Knoll

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ashley Furniture Industries Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Furniture Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kimball International Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Okamura Corp.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Interior Systems, Inc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others