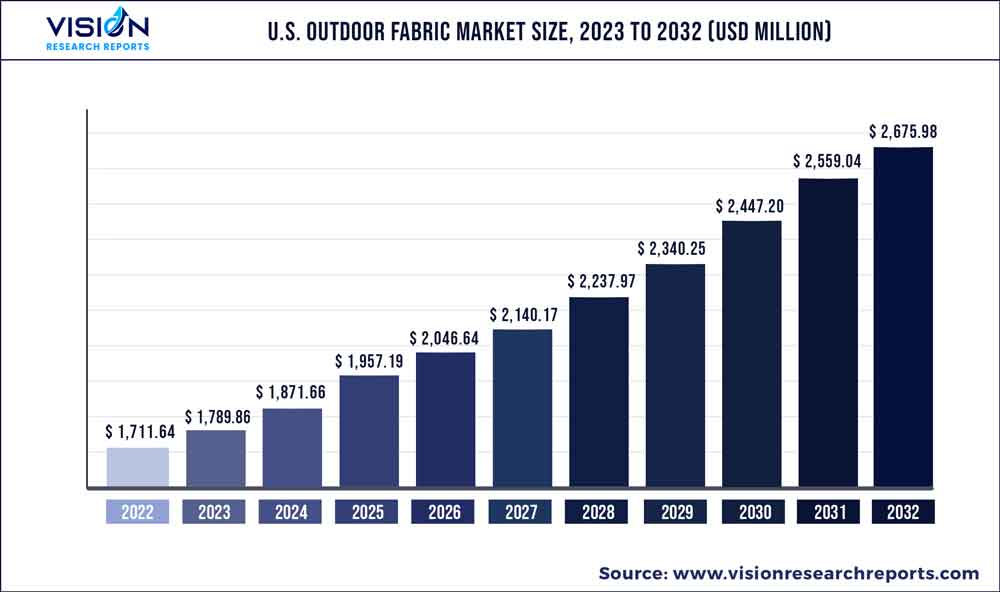

The U.S. outdoor fabric market size was estimated at around USD 1,711.64 million in 2022 and it is projected to hit around USD 2,675.98 million by 2032, growing at a CAGR of 4.57% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Outdoor Fabric Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1,711.64 million |

| Revenue Forecast by 2032 | USD 2,675.98 million |

| Growth rate from 2023 to 2032 | CAGR of 4.57% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BASF SE; W. L. Gore & Associates, Inc.; Freudenberg Performance Materials; Kolon Industries, Inc.; Glen Raven, Inc.; Milliken & Company; Eastex Products, Inc.; Maine-Lee Technology Group LLC. |

The key factors driving the growth include the increasing demand for outdoor fabrics in various end-use industries such as building and construction, healthcare, and protective clothing owing to their superior properties.

Outdoor fabric is a chemically treated fabric and is considered ideal for applications that require high resistance coupled with the quality of lasting for a longer period. The material is said to be chemical protectant, fade resistant, mold resistant, waterproof, stain resistant, and weather resistant. Additionally, the functional characteristics of the fabric such as colorfastness, cleanability, and UV resistance are further expected to drive the growth of the market.

This type of fabric is highly durable when compared to many indoor fabrics, which is expected to propel the demand for outdoor fabric in the U.S. market. Moreover, the market is further witnessing rising demand for the types of outdoor fabric including smart textiles, fire-resistant, and polymer-coated fabrics.

Smart textiles are poised to experience high growth over the forecast period, due to numerous potential medical, transportation, energy, security communication, and electronics applications. Fire-resistant textiles are majorly used in protective clothing for firefighters, bomb disposal crews, naval forces aboard ships and submarines, and nuclear, biological, and chemical operations along with several other defense and industrial applications.

The fabric is highly used in the automotive industry for manufacturing fabric convertible topping, upholstery, and carpeting. The growing automotive industry in the U.S. on account of technological advancement coupled with rising investment is further expected to drive the demand for outdoor fabrics in the country. The economy enjoys a superior production environment characterized by an open investment policy, a large consumer market, superior infrastructure, and the availability of a highly skilled workforce.

The outdoor fabrics are manufactured using a variety of materials such as polyester, olefin, acrylic, cotton, PTFE, PVC, and marine vinyl. Acrylic and olefin fabric is used in several sectors such as outdoor furniture including home furnishing and solar screen fabric. The demand for these two materials is expected to grow at a significant pace owing to properties such as mold, mildew, and water resistance. The olefin is expected to grow at a CAGR of 3.9% over the period. Moreover, acrylic outdoor fabric dominated the market in 2022 in terms of revenue and is anticipated to witness a CAGR of 4.2% over the forecasted period.

The U.S. outdoor fabric industry is anticipated to be hindered by fluctuating raw materials costs in the market. Several raw materials of outdoor fabrics such as polyester and acrylic are petroleum-based products that are primarily derived from crude oil. Thereby, the fluctuations in the prices of crude oil affect the outdoor fabric raw material costs. This in turn, further disrupts the supply chain of the market. Additionally, some harmful chemicals are also added to the fabrics, which also negatively affects the market growth.

Material Insights

The outdoor fabrics are manufactured using a variety of materials such as polyester, olefin, acrylic, cotton, PTFE, PVC, and marine vinyl. Acrylic and olefin fabric is used in the sector such as outdoor furniture including home furnishing and solar screen fabric. The demand for these two materials is expected to grow at a significant rate owing to properties such as mold, mildew, and water resistance. The olefin segment is expected to grow at a CAGR of 3.94% over the period. Moreover, the acrylic outdoor fabric dominated the outdoor fabric market in 2022 based on revenue and is anticipated to witness a CAGR of 4.26% over the forecasted period.

Polyester material dominated the U.S. outdoor fabric market in 2022 in terms of volume. The segment accounted for a volume of 14.84 kilotons in 2022 and is expected to grow due to the rising use of the material in the fire protection and defense industry. Polyester is manufactured in such a way that it delivers various superior properties such as reduction in heat transfer, glare, and harmful UV rays. The material is also fade and flame resistant, which makes it ideal for many products in the fire protection and defense industry. Furthermore, it finds application in manufacturing insulation panels, seats, defense equipment, firefighter clothing, and clothing for bomb disposal crews.

The PVC material segment was valued at a revenue of USD 68.46 million in 2022 and is anticipated to grow at a CAGR of 4.42% in terms of revenue over the forecast period. The PVC fabrics make the product waterproof and provide additional durability and strength. The growth of the segment can be attributed to several properties such as resistance to oil, mildew, UV rays, dirt, and chemicals. Furthermore, PVC fabric is highly preferred in outdoor products where long-term durability is required such as in the building & construction industry.

Marine vinyl accounted for the volume share of 25.93% in 2022 and is further expected to grow at a CAGR of 5.52% over the forecast period. The demand for marine vinyl is expected to grow in outdoor applications as it is majorly manufactured to withstand the harsh outdoor environment. Marine vinyl is considered to be waterproof, durable, and moisture resistance. The demand for marine vinyl is anticipated to propel especially in the marine application for manufacturing awnings and upholstery on boats on account of its ability to withstand water damage.

U.S. Outdoor Fabric Market Segmentations:

By Material

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Outdoor Fabric Market

5.1. COVID-19 Landscape: U.S. Outdoor Fabric Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. U.S. Outdoor Fabric Market, By Material

8.1.U.S. Outdoor Fabric Market, by Material Type, 2023-2032

8.1.1. Polyester

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Olefin

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Acrylic

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Cotton

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. PTFE

8.1.5.1.Market Revenue and Forecast (2020-2032)

8.1.6. PVC

8.1.6.1.Market Revenue and Forecast (2020-2032)

8.1.7. Marine Vinyl

8.1.7.1.Market Revenue and Forecast (2020-2032)

8.1.8. Others

8.1.8.1.Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Outdoor Fabric Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Material (2020-2032)

Chapter 10.Company Profiles

10.1. BASF SE

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. W. L. Gore & Associates, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Freudenberg Performance Materials

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Kolon Industries, Inc.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Glen Raven, Inc.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Milliken & Company

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Eastex Products, Inc.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Maine-Lee Technology Group LLC.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others