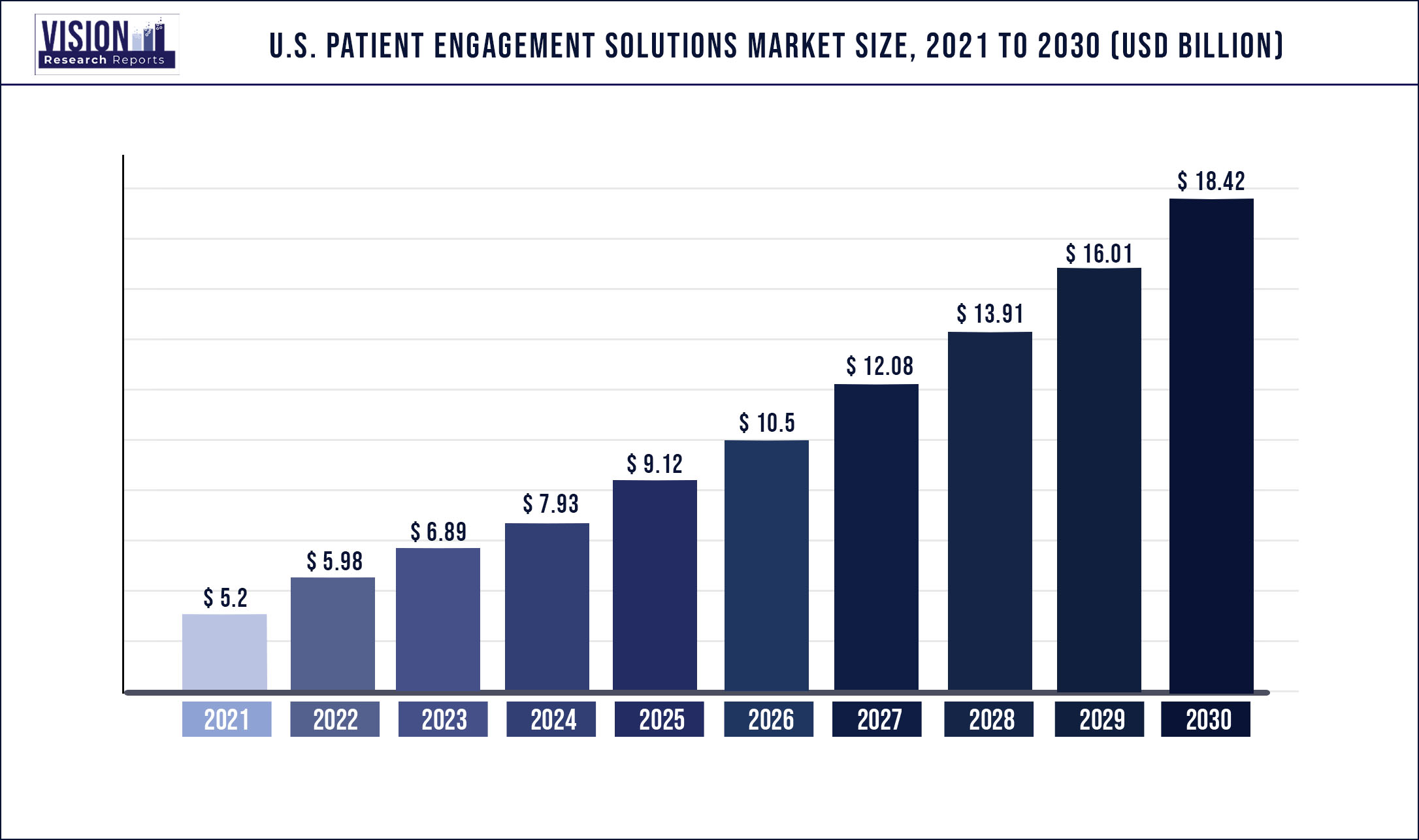

The U.S. patient engagement solutions market was valued at USD 5.2 billion in 2021 and it is predicted to surpass around USD 18.42 billion by 2030 with a CAGR of 15.09% from 2022 to 2030.

Report Highlights

The key factors driving the market growth include rising digitalization in healthcare, the prevalence of chronic conditions, adoption by patients, and the COVID-19 pandemic.

The COVID-19 pandemic acted as a catalyst for rapid business and economic changes. Certain trends, which grew steadily in the past decades, including digital healthcare solutions, unexpectedly became omnipresent as lockdowns directed remote operations and large-scale reliance on technology. In addition, the COVID-19 pandemic has shown the importance for clinicians to have rapid and full access to a patient's history to make the best-informed decision about their care. This propelled the growth of the market.

For instance, in February 2020, Solutionreach, Inc. launched SR Health, an AI-based patient engagement platform for hospitals, health systems, and enterprise healthcare organizations. This was followed by the addition of vaccine distribution messaging as part of its SR Health COVID-19 Communications solution, in January 2021. A large population over the age of 60 is a key driver for the U.S. patient engagement solutions market. This is owing to lower immunity levels in the geriatric population and higher vulnerability to chronic conditions such as obesity, cardiac problems, and cancer.

In fact, as per the U.S. Census Bureau, the median age of the country’s population is estimated to reach age 43 by 2060 with just two-and-a-half working-age adults for every retirement-age individual. This indicates an aging U.S. population that is more likely to avail the best possible treatments to increase life span. The incidence of chronic illnesses in the U.S. is also on the rise despite the availability of several effective therapies. The incidence of chronic illnesses in the U.S. is also on the rise despite the availability of several effective therapies.

Chronic ailments are the leading cause of disability & death and are the leading drivers of the country’s USD 3.8 trillion 12-monthly healthcare costs, according to the CDC. The COVID-19 outbreak has expedited the necessity for digital solutions, highlighting the need for remote care, which is not only preferred but also essential. Increasing adoption of mobile platforms coupled with the dissemination of uninterrupted 3G, 4G networks, and emerging 5G technology, are rapidly boosting the use of mobile health.

Furthermore, there has been an incredible upsurge in the use of mobile phones and the internet by physicians in the U.S. leading to the progress of mobile health solutions. The usage of mobile applications has proven to be very effective in spreading awareness about chronic diseases, managing personal health, communicating with healthcare providers, and maintaining health records. This is expected to fuel the market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 5.2 billion |

| Revenue Forecast by 2030 | USD 18.42 billion |

| Growth rate from 2022 to 2030 | CAGR of 15.09% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Delivery type, component, functionality, therapeutic area, application, end-user |

| Companies Covered | Cerner Corporation (Oracle); NextGen Healthcare, Inc.; Epic Systems Corporation; Allscripts Healthcare, LLC; McKesson Corporation; ResMed; Koninklijke Philips N.V.; Klara Technologies, Inc.; CPSI; Experian Information Solutions, Inc.; athenahealth, Inc. |

Delivery Type Insights

The web & cloud-based solutions segment dominated the U.S. patient engagement solutions market by delivery type in 2021 and is also anticipated to expand at the fastest CAGR of over 15.33%. Government initiatives such as the Electronic Health Record Incentive Program, which aims at increasing U.S. patient engagement with the help of patient portals, are anticipated to propel the growth during the forecast period.

In May 2019, Icon plc released a web-based clinical trial platform, to deliver patients with study-related data and connectivity with the nearest investigative location. Elsevier, on the other hand, launched PatientPass, a cloud-based patient education platform in the U.S. in September 2020. In October 2020, Cerner extended its partnership with Amazon Web Services (AWS) by allowing users of the Halo fitness tracker to share data directly with their providers. The collaboration with Amazon also includes the migration of many of Cerner’s solutions to the public cloud.

Component Insights

The software & hardware segment contributed to the largest share of the market by component, as patient engagement solutions are primarily software-centric. Patient engagement solutions help doctors educate the patients and engage them in order to enhance treatment efficiency. It helps in recording patient information and helping the doctors in setting patient appointments, diet, and medication records. The patient-doctor sessions can be recorded and stored on patient portals for further analysis and interpretations. This facilitates patient participation and reduces the readmission rate.

The growing use of mhealth Apps and remote monitoring devices is also expected to contribute to segment growth. In addition, the services segment is also estimated to grow notably during the forecast period. As more and more healthcare organizations, clinics, and hospitals adopt digital health solutions, it is expected to increase demand for training, consulting, implementation, and support & maintenance services, thus driving the segment growth.

Functionality Insights

The communication segment held over 35.5% of the market in 2021, while the health tracking & insights segment is anticipated to progress at the fastest rate of over 16.77% in the coming years. In August 2020, Loudoun Medical Group in the U.S. utilized IBM’s Phytel to automate outreach to its diabetic patient population. This resulted in USD 192,000 in revenue and helped the Loudoun Medical Group to enhance the quality of care provided to its patients. Communication technologies form the core of patient engagement solutions.

The COVID-19 pandemic further propelled the development, integration, and adoption of communication solutions such as telehealth, remote data exchange, remote monitoring, and online payments. The application of AI, analytics, and machine learning in patient engagement is expected to enhance tracking and reporting capabilities. This, in turn, is anticipated to increase patient compliance in tracking their health journey and improve patient outcomes in the long term.

Application Insights

Outpatient health management held over 39.1% of the market in terms of application. The others segment, comprising patient engagement for clinical studies and preventive care, is projected to expand at the fastest rate of more than 15% during the forecast period. This is due to market players developing newer products to help simplify the management of health at individual and large population levels.

dbMotion, for example, is an interoperable platform for population health management, offered by Allscripts Healthcare. Amadeus by Orion health is another population health management solution that serves as a foundation platform for the company’s care management and patient engagement applications. Aerial platform by Medecision is a scalable, SaaS solution used by home health and community-based organizations among others, to provide personalized member and patient engagement.

Therapeutic Area Insights

Chronic disease management represented the largest share of over 44.22% of the U.S. patient engagement solutions industry in 2021. According to the National Center for Chronic Disease Prevention and Health Promotion estimates, 4 in 10 Americans suffer from 2 or more chronic diseases. Rising tobacco use, poor nutrition, lack of physical activity, and alcoholism were identified as the key contributors to the rising incidence of chronic diseases in the U.S.

Health & wellness segment, on the other hand, is expected to register exponential growth of more than 15.2% during the forecast period. This is owing to the increasing adoption of patient engagement solutions in preventive care and general health management, such as weight management and mental health. Concerns and awareness regarding mental health, for instance, are driving patients and providers to adopt novel ways to track treatment.

Patient engagement solutions allow providers and patients to stay connected during the patient's care journey and ensure optimum delivery of care. As per the National Institute of Mental Health, 51.5 million American adults lived with a mental illness in 2019. The growing number of patients seeking treatment for mental health disorders ranging from depression to panic disorders is expected to propel the market growth.

End User Insights

Providers contributed over 46.4% of the market share by end-user in 2021. The payers segment, on the other hand, is expected to register the highest growth of over 15% in the coming years. This is owing to the rising need to deliver care and patient education in an engaging way for chronic disease management. Medhost’s YourCare Everywhere is a health and wellness consumer engagement solution designed to enable two-way communication between patients and providers.

Force Therapeutics Platform, on the other hand, provides video-based education, messaging, digitized workflows, data & analytics, and other features to achieve better patient outcomes. The increasing use of mobile health and advancements in cloud technology is expected to boost the adoption of patient engagement solutions in the near future. Payers are adopting risk-sharing strategies with providers, with an intention to manage consumer care and engage patients at every stage to manage chronic health conditions.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End User Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Patient Engagement Solutions Market

5.1. COVID-19 Landscape: U.S. Patient Engagement Solutions Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Patient Engagement Solutions Market, By Delivery Type

8.1. U.S. Patient Engagement Solutions Market, by Delivery Type, 2022-2030

8.1.1. Web & Cloud-based

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Patient Engagement Solutions Market, By Component

9.1. U.S. Patient Engagement Solutions Market, by Component, 2022-2030

9.1.1. Software & Hardware

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Patient Engagement Solutions Market, By Functionality

10.1. U.S. Patient Engagement Solutions Market, by Functionality, 2022-2030

10.1.1. Communication

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Health Tracking & Insights

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Billing & Payments

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Administrative

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Patient Education

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Patient Engagement Solutions Market, By Therapeutic Area

11.1. U.S. Patient Engagement Solutions Market, by Therapeutic Area, 2022-2030

11.1.1. Health & Wellness

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Chronic Disease Management

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global U.S. Patient Engagement Solutions Market, By Application

12.1. U.S. Patient Engagement Solutions Market, by Application, 2022-2030

12.1.1. Population Health Management

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Outpatient Health Management

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. In-Patient Health Management

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global U.S. Patient Engagement Solutions Market, By End User

13.1. U.S. Patient Engagement Solutions Market, by End User, 2022-2030

13.1.1. Payers

13.1.1.1. Market Revenue and Forecast (2017-2030)

13.1.2. Providers

13.1.2.1. Market Revenue and Forecast (2017-2030)

13.1.3. Others

13.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 14. Global U.S. Patient Engagement Solutions Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Forecast, by Delivery Type (2017-2030)

14.1.2. Market Revenue and Forecast, by Component (2017-2030)

14.1.3. Market Revenue and Forecast, by Functionality (2017-2030)

14.1.4. Market Revenue and Forecast, by Therapeutic Area (2017-2030)

14.1.5. Market Revenue and Forecast, by Application (2017-2030)

14.1.6. Market Revenue and Forecast, by End User (2017-2030)

Chapter 15. Company Profiles

15.1. Cerner Corporation (Oracle)

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. NextGen Healthcare, Inc.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Epic Systems Corporation

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Allscripts Healthcare, LLC

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. McKesson Corporation

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. ResMed

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Koninklijke Philips N.V.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Klara Technologies, Inc.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. CPSI

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Experian Information Solutions, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others