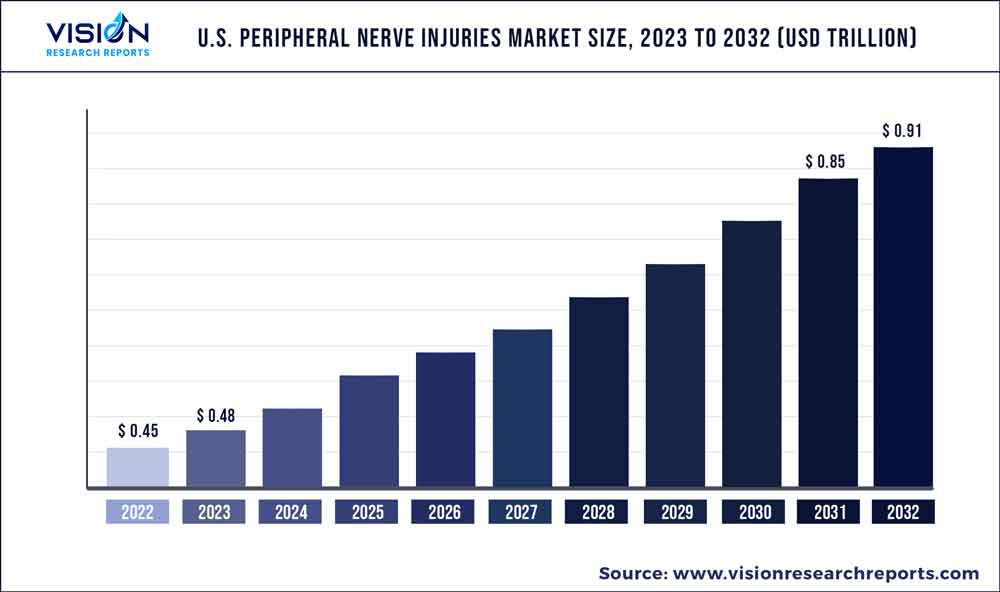

The U.S. peripheral nerve injuries market was valued at USD 0.45 trillion in 2022 and it is predicted to surpass around USD 0.91 trillion by 2032 with a CAGR of 7.35% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Peripheral Nerve Injuries Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.45 trillion |

| Revenue Forecast by 2032 | USD 0.91 trillion |

| Growth rate from 2023 to 2032 | CAGR of 7.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Axogen Corporation; Stryker/Collagen Matrix/Polyganics BV; Integra Lifesciences Corporation; Toyobo Co., Ltd.; Alafair Bioscience; Synovis Micro Companies Alliance, Inc. (Baxter International, Inc.) |

The growth of the market is attributed to factors such as a rising geriatric population coupled with increasing demand for minimally invasive procedures, technological advancements in surgical techniques and tools, and growing awareness among healthcare professionals and patients about peripheral nerve injuries.

Increasing funding by both private and public organizations is expected to play an important role in market growth. For instance, in September 2019, Renerva, LLC, a medical device company focused on innovating various techniques and technologies for Peripheral Nerve Injuries, received funding of USD 500,000 from the National Institute of Health (NIH), and the National Science Foundation (NSF). Similarly, in October 2022, NervGen Pharma Corp. was awarded up to USD 1.5 million in Department of Defense funding from MOMRP/JPC-5 to evaluate NervGen’s NVR-291-R for enhanced restoration and enable the accelerated function for peripheral nerve injuries.

Peripheral nerve damage is estimated to affect around 20 million people in the U.S., causing symptoms that may range from mild discomfort to severe disability. It may go undiagnosed or untreated. Moreover, current procedures can be associated with limitations that impact the quality of life. Thus, to address the issue, there have been some technological advancements in this market. For instance, Axogen is focused on the development and commercialization of technology for peripheral nerve repair & regeneration. Axogen’s platform for nerve repair & regeneration is built of complex portfolio of products such as biologically active, off-shelf processed human nerve allograft. This can serve as a bridge between severed peripheral nerves with up to 70 mm without any associated comorbidities.

Furthermore, COVID-19 has highlighted the importance of minimizing hospital stays and reducing the risk of complications associated with invasive procedures. This could result in an increasing emphasis on minimally invasive procedures for peripheral nerve injuries, such as endoscopic techniques, nerve decompression procedures, and ultrasound-guided interventions. These procedures may offer shorter recovery times, reduced hospital stays, and potentially lower costs, which could impact the market for traditional open surgical interventions.

Products/Therapies Insights

Based on products/therapies, nerve grafting captured the largest market share of 66% in 2022. Nerve grafting is required or performed when a patient experiences a complete loss of sensation or muscle function resulting in nerve injury. It is a surgical technique that involves the replacement or bridging of an injured nerve portion with another unrelated nerve. The segment is anticipated to grow as a result of numerous strategic activities, including product launches, partnerships, and collaborations. For instance, in May 2022, Axogen, Inc. released the findings of a clinical study comparing RECON from Axogen with conduits to Avance Nerve Graft. Phase 3 pivotal research met the target for the recovery of sensory function. In the second half of 2023, the corporation may use this information to submit a Biologics License Application (BLA).

The biomaterial segment is anticipated to grow at the fastest CAGR during the forecast period. Peripheral nerve injuries are a global challenge that results in long-term disability and reduced quality of life for patients. Such injuries are common and often require surgery due to the complexity & extent of the injury. Autografts are the current gold standard in clinical intervention, despite drawbacks such as donor site morbidity and lack of donor neural tissue. Therefore, the use of nerve conduits (NGCs) is an attractive alternative for the treatment of peripheral nerve damage. Biomaterials are designed to provide a protective layer over injured peripheral nerves and provide a semipermeable, resorbable sheath to facilitate nerve repair.

Surgery Insights

Based on surgery, direct nerve repair captured the largest market share of 43% in 2022. Direct nerve repair (also known as end-to-end neurorrhaphy) is considered the gold standard of surgical treatment for severe cases. These injuries lead to a loss of ability to communicate due to malfunction of motor & sensory nerves between the peripheral organs and the central nervous system (CNS), resulting in impairment. Direct nerve repair and autologous nerve grafts are still the gold-standard treatment options. Additionally, nerve conduits are very successful to provide an ideal peripheral support for neuronal recovery but are still insufficient. Moreover, an increasing number of traumatic accidents may lead to peripheral nerve injuries that may require surgical intervention, thereby impelling the segment growth.

However, the stem cell therapy segment is expected to expand at the fastest CAGR during the forecast period. Increase in government initiatives and approvals to conduct clinical trials is anticipated to fuel the market. There are approximately 2,754 (2021) in the U.S. that provide stem cell therapy, with the number likely to expand. A stem cell injection can cost around USD 8,000 to 30,000. Although many of these do not follow FDA regulations, they have been proven effective in the treatment of multiple conditions. The FDA has recommended these cells be controlled similar to drugs due to safety concerns raised by them. As a result, clinics may expect more stringent approval procedures in the future. These factors would further drive the segment growth.

Application Insights

Based on the application, the upper extremities segment captured the largest market share of 82% in 2022. Treatment of peripheral nerve injuries in the upper extremity involves nerve grafting, nerve transfer, or surgical repair. Increasing number of upper extremities is expected to impel the segment growth over the forecast period. Furthermore, the increasing incidence of accidental falls and medical conditions, such as Guillain-Barre syndrome, diabetes, and carpal tunnel syndrome, is expected to drive the segment. For instance, as per the CDC, every year, 3 million elderly people are treated in fall injury departments.

However, the lower extremities segment is expected to grow at the fastest CAGR during the forecast period. Increasing number of fractures and ligament injuries can lead to lower extremity injuries. Various nerve grafts, such as allografts & synthetic nerve grafts, can be used in the treatment of lower extremities. Several product launches and clinical trials, such as the Avance nerve graft by Axogen, Inc., are expected to boost the segment.

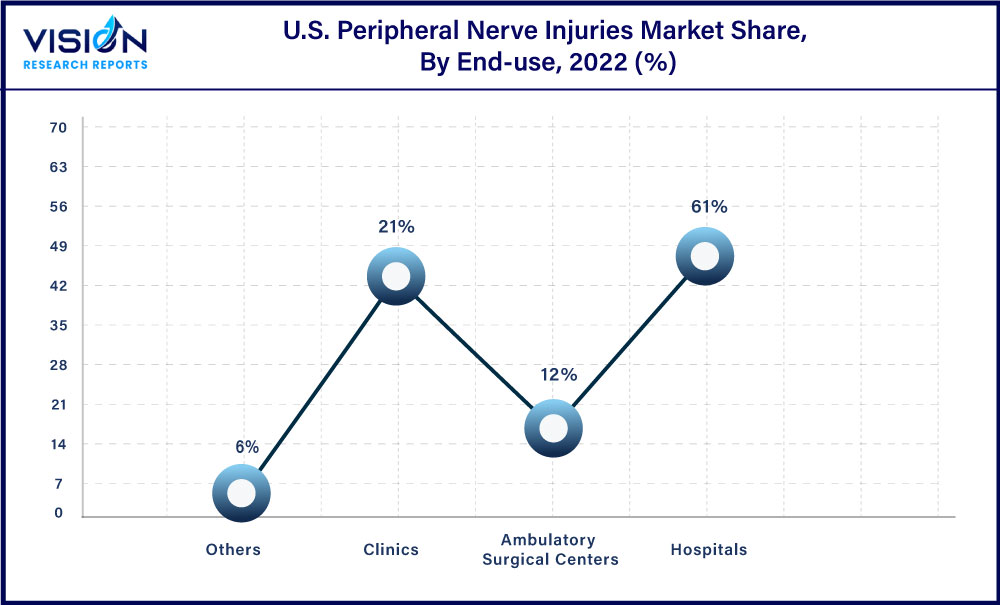

End-use Insights

Based on end use, the hospitals segment captured the largest market share of 61% in 2022. Hospitals have trained medical staff who can assess each patient. Increasing number of hospitals and surgical cases in hospitals are expected to boost the segment. In addition, hospitals may provide patients with education and advice on surgical care which may help promote healing. Thus, with the increasing number of hospitals, and hospitalization cases, the segment is expected to have significant growth over the forecast period.

However, the ambulatory surgical centers segment is expected to grow at the fastest rate during the forecast period. Ambulatory surgical centers have some advantages, such as shortened hospital stays. Moreover, various government initiatives are being undertaken to spread awareness about the benefits of surgical treatments in these centers, such as early mobilization of patients, low risk of hospital-acquired infections, and rapid recovery, thus, driving the segment growth.

U.S. Peripheral Nerve Injuries Market Segmentations:

By Products/Therapies

By Surgery

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Peripheral Nerve Injuries Market

5.1. COVID-19 Landscape: U.S. Peripheral Nerve Injuries Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Peripheral Nerve Injuries Market, By Products/Therapies

8.1. U.S. Peripheral Nerve Injuries Market, by Products/Therapies, 2023-2032

8.1.1. Nerve Grafting

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Biomaterial

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Peripheral Nerve Injuries Market, By Surgery

9.1. U.S. Peripheral Nerve Injuries Market, by Surgery, 2023-2032

9.1.1. Direct nerve repair

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Nerve Grafting

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Stem Cell Therapy

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Carpal Tunnel Release

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Internal Neurolysis

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Neurorrhaphy

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Peripheral Nerve Injuries Market, By Application

10.1. U.S. Peripheral Nerve Injuries Market, by Application, 2023-2032

10.1.1. Upper Extremities

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Lower Extremities

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Peripheral Nerve Injuries Market, By End-use

11.1. U.S. Peripheral Nerve Injuries Market, by End-use, 2023-2032

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Clinics

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Ambulatory Surgical Centers

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Peripheral Nerve Injuries Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Products/Therapies (2020-2032)

12.1.2. Market Revenue and Forecast, by Surgery (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Axogen Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Stryker/Collagen Matrix/Polyganics BV

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Integra Lifesciences Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Toyobo Co., Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Alafair Bioscience

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Synovis Micro Companies Alliance, Inc. (Baxter International, Inc.)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others