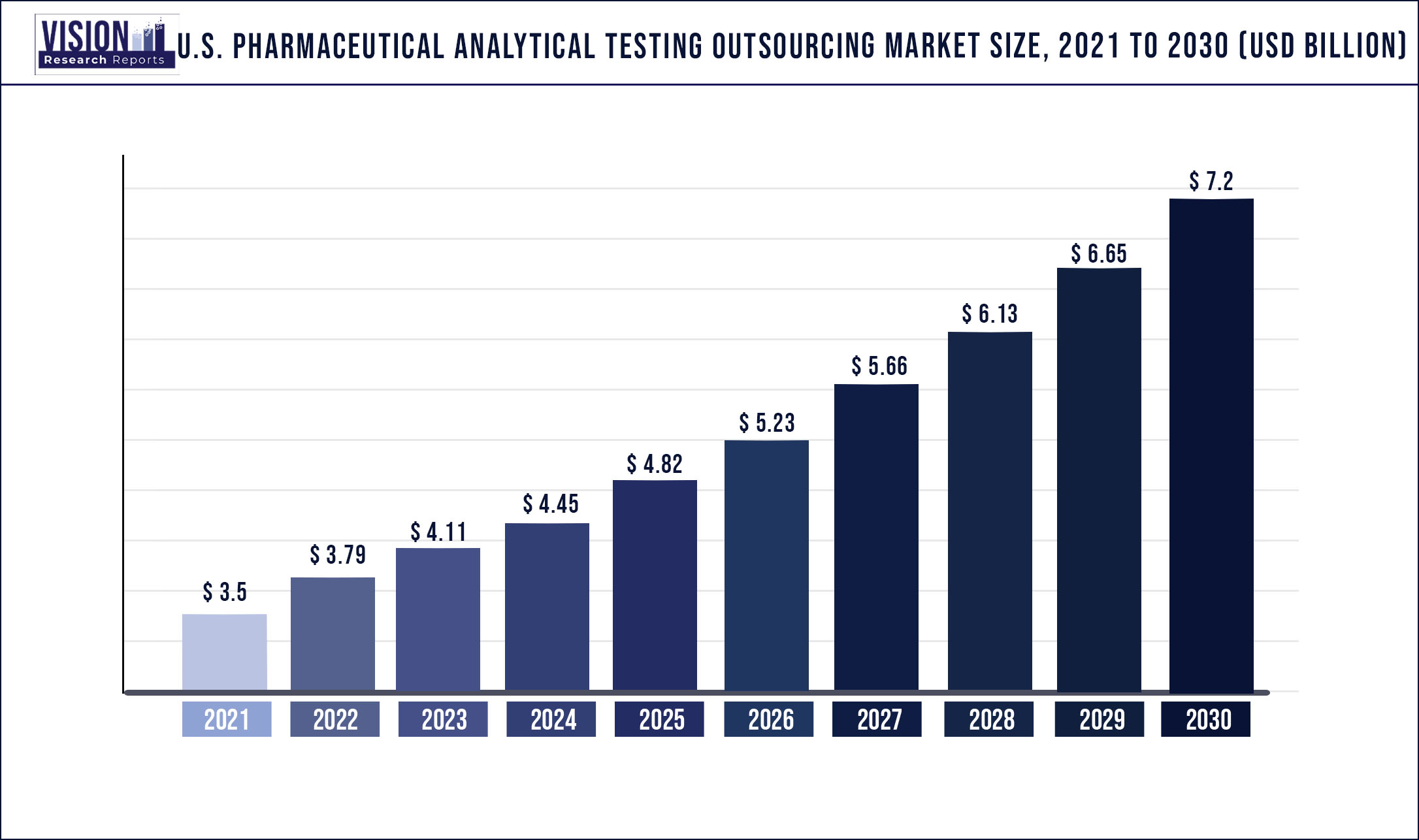

The U.S. pharmaceutical analytical testing outsourcing market was surpassed at USD 3.5 billion in 2021 and is expected to hit around USD 7.2 billion by 2030, growing at a CAGR of 8.34% from 2022 to 2030

Report Highlights

Technological advancements in the healthcare industry and an increase in end-users are the key factors driving the growth of the U.S. market.

Analytical testing services outsourcing allows companies to handle more complex or repetitive tasks while also assisting companies in concentrating on their core competencies. Enabling medical organizations to avoid developing specialized facilities and hiring staff, results in cost savings. The identification and measurement of ingredients in drugs or therapeutic solutions are included in pharmaceutical analytical testing. The market is anticipated to expand during the assessment period as a result of rising R&D investments and rising drug demand.

The outsourcing of pharmaceutical analytical testing has been significantly impacted by the COVID-19 pandemic. Due to various pharmaceutical companies' internal lab testing capacities being reduced or shut down, the pharmaceutical analytical services-an important component of the healthcare infrastructure-were initially disrupted. The workers initially faced several difficulties, including reduced lab capacity because of concerns about spreading the virus, IT issues, and difficulties sending samples for testing. However, various strategies, including rotating shifts, reducing manpower, and working from home, have been adopted by companies to mitigate or prevent these difficulties.

Various companies supported the government's efforts to stop the COVID-19 pandemic by producing various cutting-edge tests and solutions. These businesses were able to reduce the effects of COVID-19 on their operations. For example, 40 million COVID-19 tests were successfully manufactured by Eurofins laboratories. Additionally, new test kits are being created for various variants. When WHO classified it as a variant of concern, they released an omicron test kit the same day.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.5 billion |

| Revenue Forecast by 2030 | USD 7.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.34% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Services, end-use |

| Companies Covered | West Pharmaceutical Services, Inc.; SGS SA; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; Pharmaceutical Product Development, LLC.; Wuxi AppTec, Inc.; Boston Analytical; Charles River Laboratories |

Services Insights

The market is divided into bioanalytical testing, method development and validation, stability testing, and other testing services based on the type of service provided. The bioanalytical testing outsourcing services segment is further classified into clinical and non-clinical sub-group, while the method development and validation services were narrowed down to extractable and leachable, impurity method, technical consulting, and other method validation services.

The stability testing services segment has been bifurcated into drug substance, stability indicating method validation, accelerated stability testing, photostability testing, and other stability testing methods. The other testing services segment accounted for the maximum revenue share of the U.S. pharmaceutical analytical testing outsourcing market of 39.93% in 2021. The segment is likely to remain dominant even during the forecast years.

The bioanalytical testing segment is expected to rise with the fastest CAGR of 8.8% over the forecast period due to rising R&D spending by players in the biopharmaceutical industry and a preference for outsourcing analytical testing. The segment for bioanalytical testing has expanded as a result of the rising number of clinical trial registrations and the entry of new players into the market over the past decades.

In bioanalytical testing, drugs, formulations, or active ingredients are analyzed inside of biological systems like blood, urine, serum, and tissue. The sector can be broadly divided into clinical and non-clinical bioanalytical testing and is anticipated to experience profitable growth during the forecast period. Due to strict regulatory frameworks surrounding the process of drug discovery and development and the rising number of clinical trials, clinical bioanalytical testing is anticipated to grow at the fastest rate of any segment.

End-use Insights

The pharmaceutical companies segment accounted for a revenue share of 47.4% in 2021. This growth is anticipated to be fueled by several factors, including an increase in product development activities, rising corporate R&D spending, and the need to create novel therapies. For instance, Pace Analytical Services acquired Drug Delivery Experts, LLC in July 2021. DDE, a CDMO as well, focuses on the development of combined drug-device products and complicated injectable drug formulations.

Due to the acquisition, the company would be able to help an increasing number of clients who need assistance during the drug development process and contribute expertise in extended-release injectable technologies and drug-device combo products. Such U.S. developments would increase the demand in the market.

The biopharmaceutical companies segment is expected to register the fastest CAGR of 8.74% over the forecast period. The International Council for Harmonization (ICH) Q3D elemental impurities guideline and ICH M7 guideline implementation is among the new regulatory requirements. This regulatory guideline's main goal is to offer a useful framework for categorization, qualification, and identification. Pharma companies would be able to enhance the drug development process to these changes in regulatory requirements.

The primary factors most likely to drive the growth of the segment for biopharmaceutical companies over the forecast period include an increase in clinical trial registrations and new entrants into the market over the past ten years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Pharmaceutical Analytical Testing Outsourcing Market

5.1. COVID-19 Landscape: U.S. Pharmaceutical Analytical Testing Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Pharmaceutical Analytical Testing Outsourcing Market, By Services

8.1. U.S. Pharmaceutical Analytical Testing Outsourcing Market, by Services, 2022-2030

8.1.1. Bioanalytical Testing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Method Development and Validation

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Stability Testing

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Other Testing Services

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Pharmaceutical Analytical Testing Outsourcing Market, By End-use

9.1. U.S. Pharmaceutical Analytical Testing Outsourcing Market, by End-use, 2022-2030

9.1.1. Pharmaceutical Companies

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Biopharmaceutical Companies

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Contract Research Organizations

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Pharmaceutical Analytical Testing Outsourcing Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Services (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. West Pharmaceutical Services, Inc.

11.1.1. Company Overview

11.1.2. Services Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SGS SA

11.2.1. Company Overview

11.2.2. Services Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eurofins Scientific

11.3.1. Company Overview

11.3.2. Services Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Pace Analytical Services Llc

11.4.1. Company Overview

11.4.2. Services Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Intertek Group Plc

11.5.1. Company Overview

11.5.2. Services Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Pharmaceutical Product Development, LLC.

11.6.1. Company Overview

11.6.2. Services Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Wuxi AppTec, Inc.

11.7.1. Company Overview

11.7.2. Services Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Boston Analytical

11.8.1. Company Overview

11.8.2. Services Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Charles River Laboratories

11.9.1. Company Overview

11.9.2. Services Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others