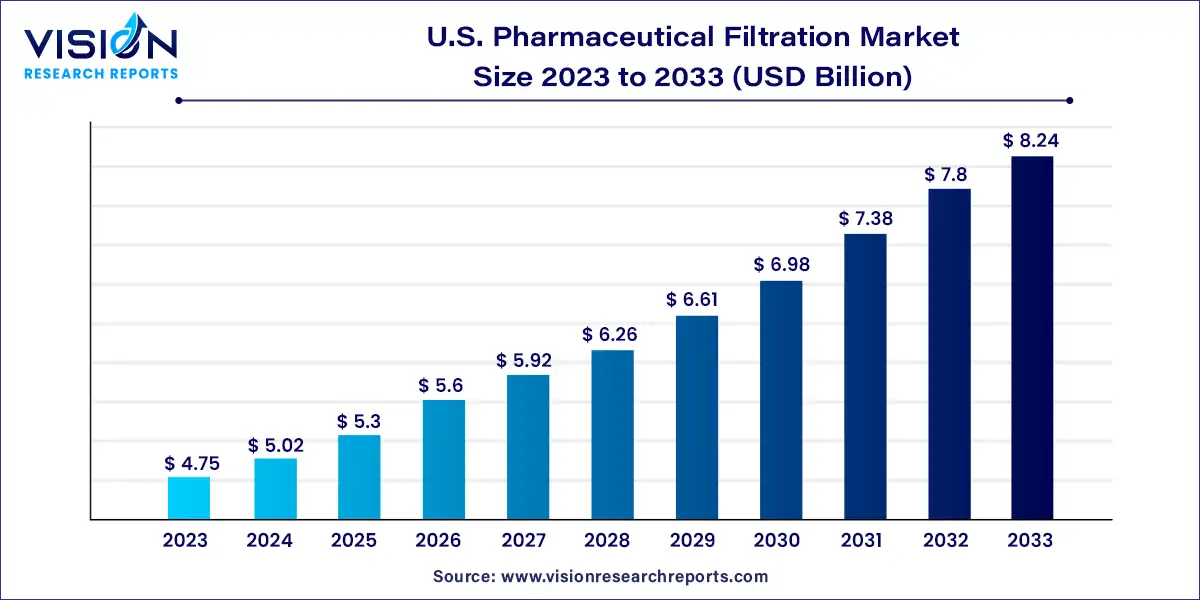

The U.S. pharmaceutical filtration market size was estimated at USD 4.75 billion in 2023 and it is expected to surpass around USD 8.24 billion by 2033, poised to grow at a CAGR of 5.66% from 2024 to 2033.

The pharmaceutical filtration market in the United States is witnessing significant growth driven by various factors such as increasing pharmaceutical manufacturing activities, stringent regulatory requirements, and rising demand for biopharmaceutical products. Filtration plays a critical role in ensuring the safety, purity, and efficacy of pharmaceutical products, making it an indispensable component of the manufacturing process.

The growth of the U.S. pharmaceutical filtration market is propelled by an escalating demand for pharmaceutical products, both domestically and internationally, is driving increased manufacturing activities. This surge necessitates efficient filtration systems to uphold product quality and meet stringent regulatory standards. Secondly, regulatory bodies such as the FDA impose rigorous guidelines to ensure the safety and efficacy of pharmaceuticals, mandating the use of advanced filtration technologies to eliminate impurities and contaminants. Thirdly, the rising popularity of biopharmaceuticals, including monoclonal antibodies and vaccines, presents a significant growth opportunity. These complex biologics require specialized filtration solutions for purification and sterile filtration, contributing to market expansion.

The membrane filters segment held a dominant share of 26% in the year 2023 and is expected to grow at the fastest CAGR during the forecast period. The membrane filter has capacity for precise and uniform pore size distribution that ensures consistent filtration quality. Owing to the factor of meeting dedicated standards and specifications, the segment witnesses a large market share. Moreover, these filters are the byproducts of several different forms of raw materials such as nylon, PTFE, and PVDF that allow versatility in applications.

There are four forms of membrane filtration- reverse osmosis, nanofiltration, ultrafiltration, and microfiltration, which are categorized according to the size of the particles that are to be separated from the feed liquid. Only a few carefully chosen components from the feed stream can pass through the membrane separating them because of its highly specialized properties. Hence, it is widely in demand. Furthermore, several R&D activities, product launches, and expansion by market players are propelling the segment growth in the market.

The microfiltration segment held a dominant share of 34% in the year 2023 owing to factors such as versatility and ability to eliminate a range of impurities from biopharmaceutical products. In addition, this technique does not impact the biological activity or stability of the medium filtered, while removing particles and impurities. Strategic initiatives are being adopted by the manufacturers which is expected to aid the segment growth.

The nanofiltration segment is estimated to register fastest CAGR during the forecast period owing to the advantage of removing particles very selectively and based on their size and charge. This leads to wide usage in molecular separation and removing endotoxins and pyrogens. Furthermore, increasing risk of water pollution by pharmaceutical companies, several commercial spaces have adopted nanofiltration, intending to remove elements such as caffeine, paracetamol, and naproxen from wastewater.

The sterile segment held a dominant share of 58% in the year 2023. Sterile filtration is a pivotal stage in the production of several pharmaceutical items such as injectable medications and vaccines. This guarantees the elimination of possible impurities that can impact the product’s safety and effectiveness. Moreover, strategic collaborations with prominent pharmaceutical manufacturers smoothen automated sterile filtration implementation processes in pharmaceutical applications.

The non-sterile segment is estimated to register a considerable CAGR during the forecast period as it helps in removing particulates of solutions. It also helps in pre-filtration level for subsequent sterile filtration, thus, increasing the life of sterile filters. These factors are expected to boost the market growth in the upcoming years.

The final product processing segment held a dominant share of 41% in the year 2023 and is estimated to register the fastest CAGR during the forecast period as well. This is attributed to it being an integral part of pharmaceutical filtration that ensures safety efficacy and quality of the product, further meeting regulatory standards and patient expectations.

The cell separation segment is also expected to register a considerable CAGR during the forecast period. Cell separation or isolation techniques are widely used to develop and manufacture biologics, such as monoclonal antibodies and recombinant proteins. These products have been gaining traction over the past few decades. The mounting demand for biologics is anticipated to create a high demand for separation solutions during manufacturing process, thus, supporting the growth of the market for cell separation.

The manufacturing scale of operations held a dominant share of 64% in the year 2023.In operations, the filtration processes in manufacturing ensure safety, purity, and efficacy of the drug. In addition, final product quality is related directly to the filtration processes of drug manufacturing. Several regulatory norms drive the manufacturers to adhere to filtration practices. For instance, the U.S. FDA demands strict adherence to the Current Good Manufacturing Practice (CGMP) practices that involve appropriate filtration techniques.

The research and development scale segment are estimated to register fastest CAGR during the forecast period. The organizations practicing R&D play a vital role in drug innovation along with advancing pharmaceutical practices intended to improve patient care. Additionally, ongoing research activities in academic institutions further promote pharmaceutical filtration product usage. For instance, in May 2023, Harvard Medical School conducted a trial intending to formulate a biologic treatment for rheumatoid arthritis. This is expected to boost the usage of single-use filtration products.

By Product

By Technique

By Type

By Application

By Scale of Operation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Pharmaceutical Filtration Market

5.1. COVID-19 Landscape: U.S. Pharmaceutical Filtration Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Pharmaceutical Filtration Market, By Product

8.1. U.S. Pharmaceutical Filtration Market, by Product, 2024-2033

8.1.1. Membrane filters

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Prefilters & depth media

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Single-use systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Cartridges & capsules

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Filter holders

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Filtration accessories

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global U.S. Pharmaceutical Filtration Market, By Technique

9.1. U.S. Pharmaceutical Filtration Market, by Technique, 2024-2033

9.1.1. Microfiltration

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Ultrafiltration

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cross flow filtration

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Nanofiltration

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global U.S. Pharmaceutical Filtration Market, By Type

10.1. U.S. Pharmaceutical Filtration Market, by Type, 2024-2033

10.1.1. Sterile

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Non-Sterile

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global U.S. Pharmaceutical Filtration Market, By Application

11.1. U.S. Pharmaceutical Filtration Market, by Application, 2024-2033

11.1.1. Final product processing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Raw material filtration

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Cell separation

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Water purification

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Air purification

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Pharmaceutical Filtration Market, By Scale of Operation

12.1. U.S. Pharmaceutical Filtration Market, by Scale of Operation, 2024-2033

12.1.1. Manufacturing scale

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Pilot scale

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Research & development scale

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Pharmaceutical Filtration Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.2. Market Revenue and Forecast, by Technique (2021-2033)

13.1.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by Scale of Operation (2021-2033)

Chapter 14. Company Profiles

14.1. Eaton.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Merck KGaA

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Amazon Filters Ltd.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Thermo Fisher Scientific Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Parker Hannifin Corp.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. 3M

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Sartorius AG.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Graver Technologies

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Danaher.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Meissner Filtration Products, Inc

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others