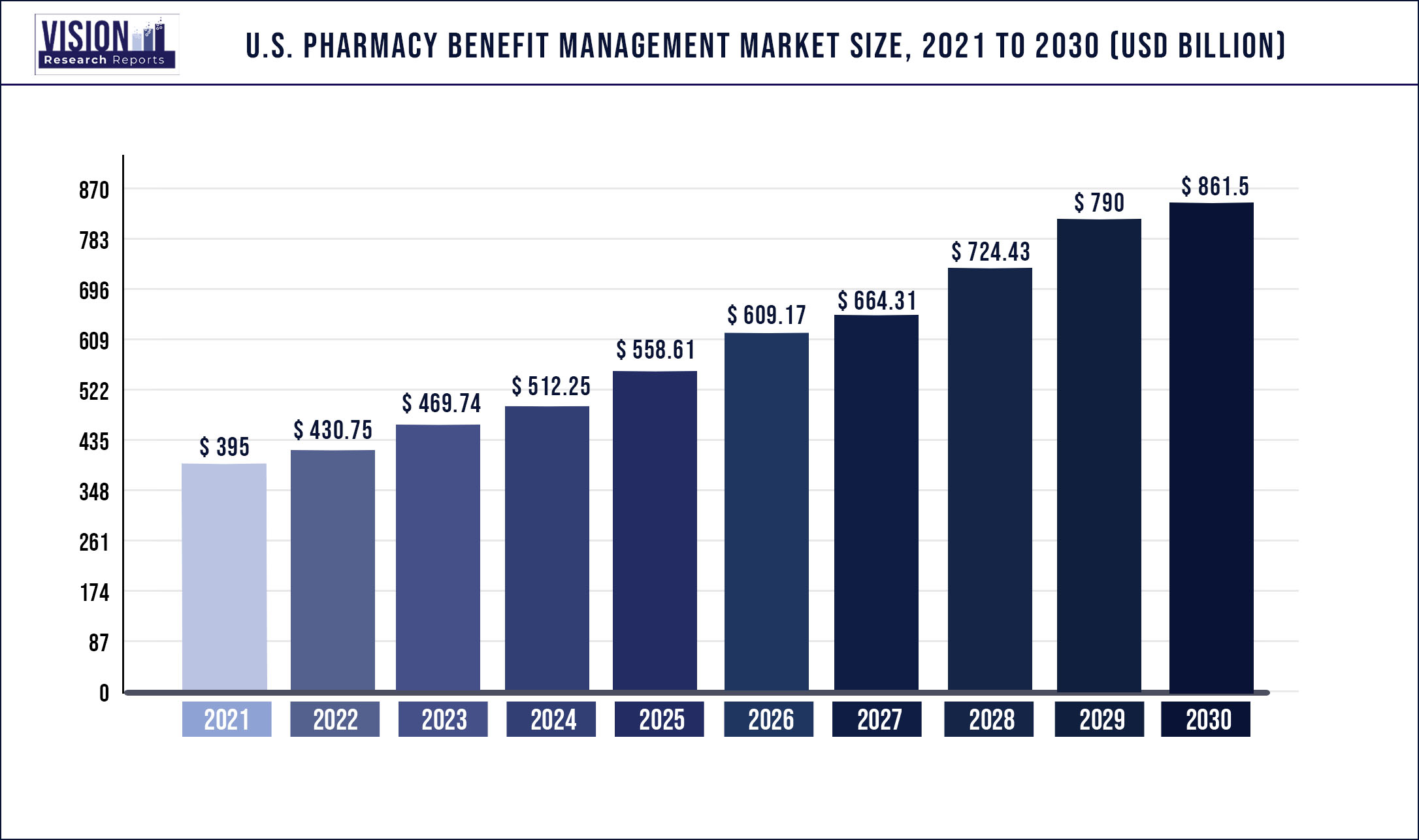

The U.S. pharmacy benefit management market size was estimated at USD 395 billion in 2021 and it is expected to surpass around USD 861.5 billion by 2030, poised to grow at a CAGR of 9.05% over the forecast period 2022 to 2030.

Increasing vertical integration of key market players, rising prevalence of chronic disease, and shrinking FDA generic-approval backlog are some of the primary growth stimulants for the market.

Vertical integration of pharmacy benefits management (PBM) organizations with health insurance companies are poised to result in increased control of PBMs over distribution systems. This will lead to rise in rebates, ultimately increasing the cost of drug list prices. Moreover, it will result in a monopoly of certain market player, concentrating sales and revenue generation.

The business of insuring and administering employee benefit programs in the country, especially, health care programs, is heavily regulated by federal and state laws and administrative agencies, such as the Department of Health and Human Services (HHS), State Departments of Insurance, Centers for Medicare & Medicaid Services (CMS), Internal Revenue Services, and Departments of Labor.

All PBM businesses in the U.S. must include home delivery and specialty pharmacies licensed as pharmacies in the states of establishment. Several states in the country regulate the scope of prescription (Rx) drug coverage and delivery channels to receive drugs for managed care organizations (MCOs), insurers, and Medicaid care plans. Certain home delivery and specialty pharmacies must be registered with the U.S. Drug Enforcement Administration (DEA) and individual state controlled substance authorities.

Scope of the Report

| Report Coverage | Details |

| Market Size in 2021 | USD 395 Billion |

| Revenue Forecast By 2030 | USD 861.5 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 9.05% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Business Model Insights

Standalone pharmacy benefits management held the leading revenue share in the market in 2021. It included major players such as CVS Health and Express Scripts who underwent major mergers by the end of 2021. The merger trend was introduced recently in this market as the Federal Trade Commission (FTC) refused many applications for mergers in the past, mainly between pharmaceutical players and PBMs.

The mergers were anticipated to allow drug manufacturers to manage pricing policies and to understand pricing information of competitors. However, the market experienced consolidations between PBMs and health insurers leading to the strengthening of key players in the market. Key mergers will be effective from 2020 along with other agreements and alliances that will change market dynamics over the forecast period.

End-Use Insights

Based on end-use, the U.S. PBM market has been bifurcated into commercial and federal. The commercial segment is anticipated to dominate the market throughout the forecast horizon. The majority of the U.S. employees are enrolled under commercial private insurance plans to benefit from the copay system for high-cost drugs.

Federal support is significant for government employees wherein premiums vary for different health plans and are paid in part by employers and employees. Employers usually pay up to 72.0% of the total amount in an average plan for self-only or family coverage while employees pay the rest.

Key Players

Market Segmentation

By Business Model

By End User

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Pharmacy Benefit Management Market

5.1. COVID-19 Landscape: U.S. Pharmacy Benefit Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Pharmacy Benefit Management Market, By Business Model

8.1. U.S. Pharmacy Benefit Management Market, by Business Model, 2022-2030

8.1.1. Standalone PBM

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Health Insurance Providers

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Retail Pharmacy

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Pharmacy Benefit Management Market, By End User

9.1. U.S. Pharmacy Benefit Management Market, by End User, 2022-2030

9.1.1. Commercial

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Federal

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Pharmacy Benefit Management Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.1.2. Market Revenue and Forecast, by End User (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End User (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.2.2. Market Revenue and Forecast, by End User (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End User (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End User (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End User (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End User (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End User (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End User (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.4.2. Market Revenue and Forecast, by End User (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End User (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End User (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End User (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.5.2. Market Revenue and Forecast, by End User (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End User (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Business Model (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End User (2017-2030)

Chapter 11. Company Profiles

11.1. CVS Health

11.1.1. Company Overview

11.1.2. Business Model Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Aetna

11.2.1. Company Overview

11.2.2. Business Model Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Express Scripts

11.3.1. Company Overview

11.3.2. Business Model Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cigna

11.4.1. Company Overview

11.4.2. Business Model Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. OptumRx, Inc.

11.5.1. Company Overview

11.5.2. Business Model Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Walgreens Booth Alliance

11.6.1. Company Overview

11.6.2. Business Model Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MedImpact Healthcare Systems, Inc.

11.7.1. Company Overview

11.7.2. Business Model Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Anthem

11.8.1. Company Overview

11.8.2. Business Model Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rite Aid

11.9.1. Company Overview

11.9.2. Business Model Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others