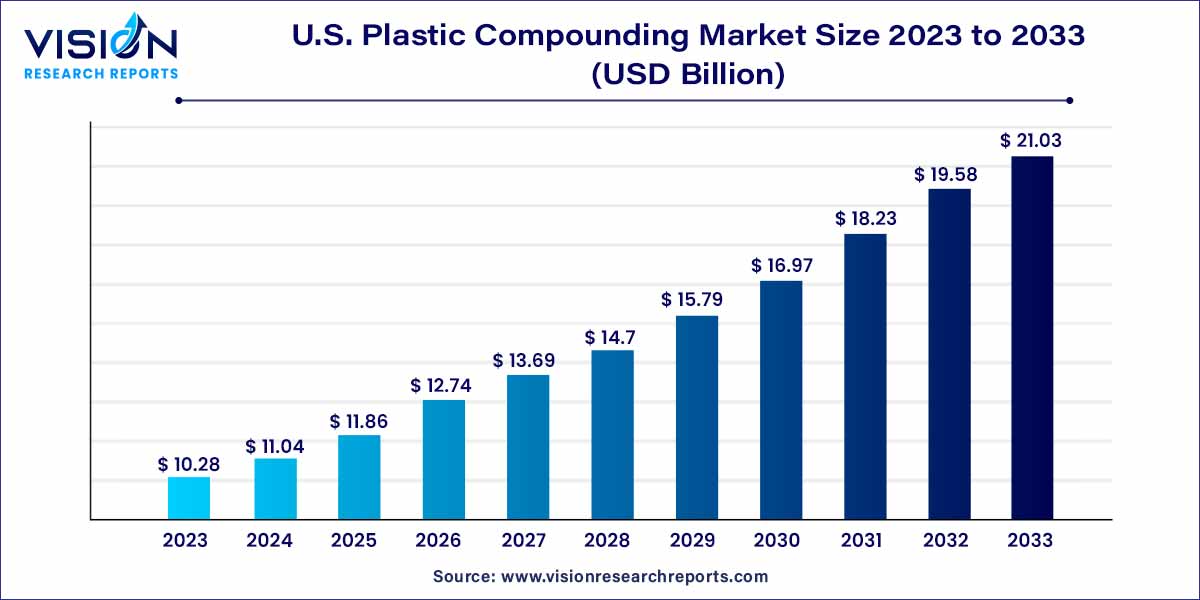

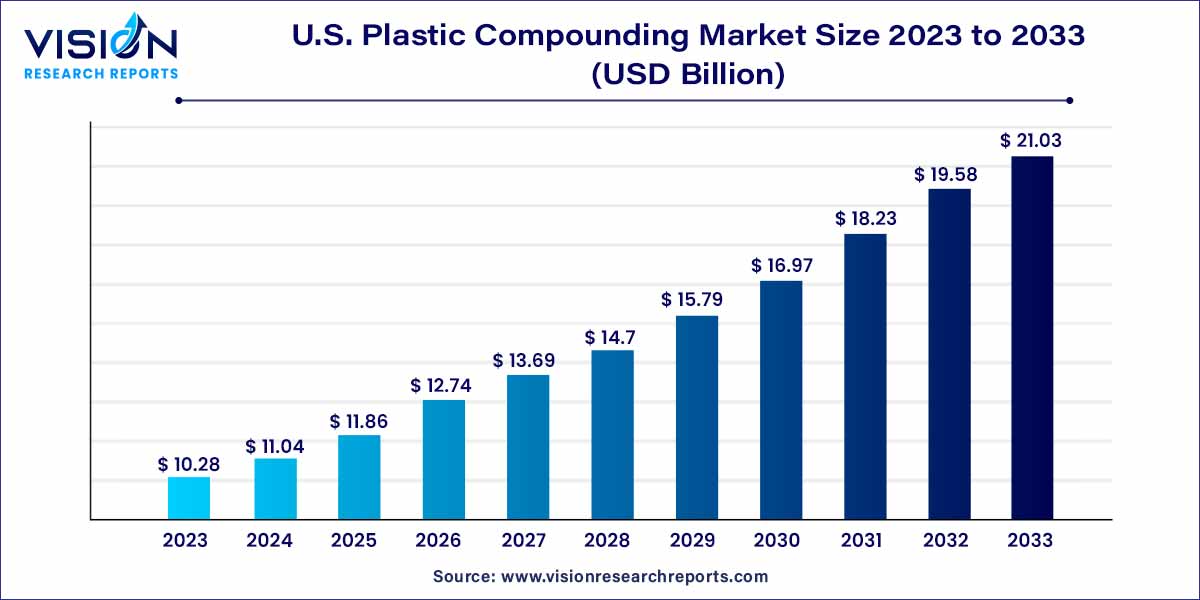

The U.S. plastic compounding market size was estimated at USD 10.28 billion in 2023 and it is expected to surpass around USD 21.03 billion by 2033, poised to grow at a CAGR of 7.42% from 2024 to 2033. The U.S. plastic compounding market is driven by growing demand for high-performance polymers, expanding automotive sector, rise in consumer packaging demands and focus on sustainable and bio-based materials.

Key Pointers

- By Product, the Polypropylene (PP) segment held the largest revenue share of 29% in 2023.

- By Product, the Polyethylene Terephthalate (PET) is expected to expand at the highest CAGR from 2024 to 2033.

- By Application, the automotive sector generated the maximum market share in 2023.

- By Application, the optical media segment is expected to grow at the fastest CAGR from 2024 to 2033.

U.S. Plastic Compounding Market Overview

The U.S. plastic compounding market stands at the forefront of innovation and growth, playing a pivotal role in the nation's dynamic manufacturing landscape. This overview delves into the key aspects that define the market, exploring its current state, notable trends, and future prospects.

U.S. Plastic Compounding Market Growth

The growth of the U.S. plastic compounding market can be attributed to several key factors. Firstly, the burgeoning demand for high-performance and specialty polymers across diverse industries, including automotive, packaging, construction, and electronics, has been a significant driver. The continuous evolution of material requirements in modern manufacturing further fuels the market's expansion. Additionally, the market benefits from the increasing emphasis on sustainability, with a rising demand for recycled and biodegradable materials. Technological advancements, particularly in the integration of smart technologies into plastic compounds, contribute to the market's dynamism. As the automotive sector expands and consumer packaging demands rise, the U.S. plastic compounding market is poised for sustained growth, with opportunities emerging from the exploration of alternative materials and innovative, environmentally friendly practices.

U.S. Plastic Compounding Market Trends:

- Rise in Recycled Materials Adoption: The U.S. plastic compounding market is witnessing a notable trend towards increased adoption of recycled materials. Companies are responding to environmental concerns by incorporating recycled plastics into their formulations, aligning with sustainability goals and meeting consumer demands for eco-friendly products.

- Growing Emphasis on Biodegradable Solutions: A discernible trend in the market involves a heightened focus on biodegradable materials. With increasing environmental consciousness, stakeholders in the plastic compounding sector are exploring and developing compounds that break down naturally, addressing concerns related to plastic waste and contributing to a more sustainable industry.

- Advancements in Lightweighting for Automotive Applications: The automotive sector plays a pivotal role in driving trends within the U.S. plastic compounding market. A prominent development is the emphasis on lightweighting, with manufacturers seeking innovative plastic compounds that contribute to overall vehicle weight reduction. This trend aligns with the automotive industry's pursuit of enhanced fuel efficiency and reduced carbon emissions.

- Integration of Smart Technologies: The market is experiencing a shift towards the integration of smart technologies into plastic compounds. This includes the incorporation of sensors and other intelligent features into plastic materials, opening avenues for applications in areas such as packaging and manufacturing, where real-time monitoring and data collection are becoming increasingly valuable.

- Customization and Tailored Solutions: Another noteworthy trend is the demand for customized plastic compounds. Industries are seeking tailored solutions that meet specific performance criteria, leading to a rise in research and development activities. This trend underscores the market's commitment to providing versatile and application-specific plastic compounding solutions.

- Focus on Sustainable Practices and Circular Economy: The U.S. plastic compounding market is embracing sustainable practices and circular economy principles. Companies are proactively engaging in initiatives to reduce environmental impact, improve recycling processes, and minimize waste. This trend reflects a broader industry commitment to balancing economic growth with environmental responsibility.

- Innovation in Material Properties: The market is characterized by a continuous pursuit of innovation in material properties. Stakeholders are investing in research and development to enhance the performance characteristics of plastic compounds, catering to evolving industry needs and staying ahead in a competitive landscape.

Product Insights

In 2023, Polypropylene (PP) dominated the market with the highest revenue share at 29%, primarily attributed to its extensive use in the manufacturing of automotive components. Renowned for providing dimensional fire resistance and a high heat distortion temperature, PP is favored in this industry. The market sees a growing significance in various PP combinations and its integration with other synthetic, natural fibers, and environmentally friendly polymers like thermoplastic starch (TPS) and polylactic acid (PLA), primarily due to their commendable mechanical and thermal properties.

Polyethylene Terephthalate (PET) is anticipated to exhibit the most rapid Compound Annual Growth Rate (CAGR) throughout the forecast period. This projection stems from the increasing demand for sustainable and recyclable plastics. PET holds a significant presence in the U.S. food packaging sector, thanks to its outstanding barrier properties.

Application Insights

In 2023, the automotive sector emerged as the market leader, propelled by supportive government regulations encouraging the production of lightweight vehicles and Electric Vehicles (EVs) to enhance fuel efficiency. Plastics, known for their lightweight nature and durability, are increasingly substituting traditional materials like metal, steel, and glass in automobiles. Regulatory frameworks such as those established by the U.S. Environmental Protection Agency (EPA), Corporate Average Fuel Economy (CAFE), and Beaches Environmental Assessment and Coastal Health (BEACH) are playing a pivotal role in stimulating market demand within the automotive segment by fostering a culture of fuel efficiency.

Looking ahead, the optical media segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) from 2024 to 2033. Optical media, including solid-state drives and compact discs, predominantly utilize polycarbonate compounds. Compared to conventional storage media, optical discs stand out for their remarkable durability and storage capacity. The integration of polycarbonate with other additives and polymers is a common practice to ensure the preservation and longevity of optical media.

U.S. Plastic Compounding Market Key Companies

- Adell Plastics Inc.

- Asahi Kasei Corporation

- Celanese Corporation

- DuPont de Nemours Inc.

- Solvay SA

- LyondellBasell Industries Holdings B.V.

- Dow Inc.

- RTP Company

- Avient Corporation

- Polyvisions Inc.

- ingfa Science & Technology Co. Ltd.

- Kraton Corporation

- Kuraray Co. Ltd.

- Polykemi AB

- Citadel Plastics

- DSM N.V.Arkema Group

- Sumitomo Bakelite Co. Ltd.

- Nova Polymers Inc.

- Europlas (PVCu) Ltd.

- US Plastics Recovery

- A. Schulman Inc.

- Teknor Apex Company

- Cabot Corporation

- Tosaf Group

- Mexichem Specialty Compounds Ltd.

- Ravago Manufacturing Americas

- Plastics Color Corporation

- AmeriLux International LLC

- Astra Polymers Compounding Co. Ltd.

U.S. Plastic Compounding Market Segmentations:

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

Frequently Asked Questions

The U.S. plastic compounding market size was reached at USD 10.28 billion in 2023 and it is projected to hit around USD 21.03 billion by 2033.

The U.S. plastic compounding market is growing at a compound annual growth rate (CAGR) of 7.42% from 2024 to 2033.

Key factors that are driving the U.S. plastic compounding market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others