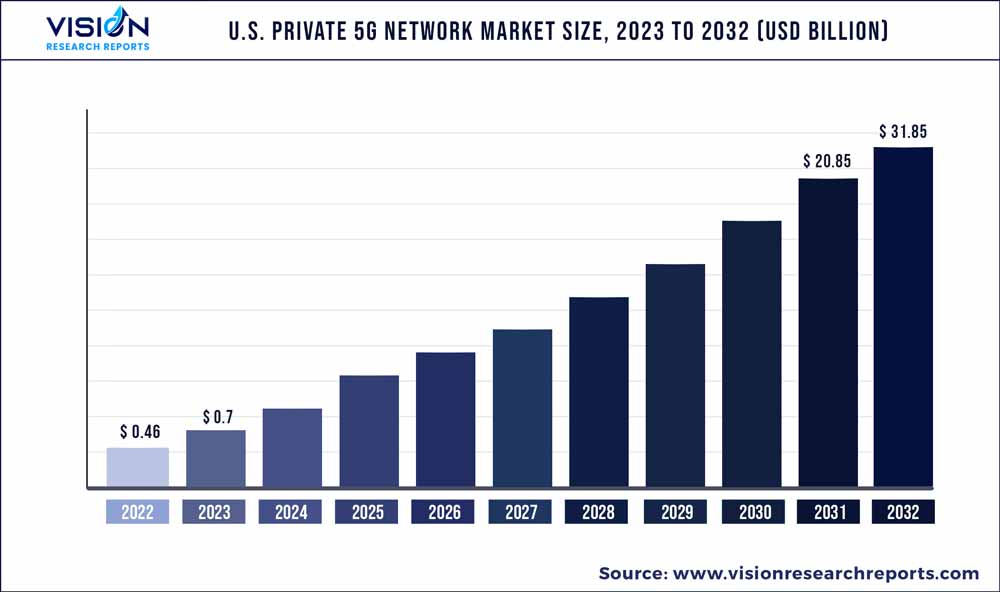

The U.S. private 5G network market was valued at USD 0.46 billion in 2022 and it is predicted to surpass around USD 31.85 billion by 2032 with a CAGR of 52.77% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Private 5G Network Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.46 billion |

| Revenue Forecast by 2032 | USD 31.85 billion |

| Growth rate from 2023 to 2032 | CAGR of 52.77% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AT&T Inc.; Cisco Systems, Inc.; Nokia Corporation; Samsung Electronics Co., Ltd.; Telefonaktiebolaget LM Ericsson; T-Systems International GmbH; Vodafone Group Plc; Verizon Communications Inc.; Mavenir; Broadcom, Inc.; Qualcomm Incorporated; Amazon Web Services, Inc.; Celona, Inc.; Altiostar |

The growth is fueled by the increasing demand for dedicated, non-public 5G networks that provide improved internet connectivity to enterprises, industries, and many other customers. These next-generation network services are evolving to meet the requirements of critical wireless communication in public safety, industrial operations, and mission-critical infrastructure connectivity. Additionally, the market growth is also driven by the rising need for low-latency, highly reliable connectivity to support industrial Internet of Things (IIoT) applications such as industrial cameras, industrial sensors, and collaborative robots.

Rising developments in private 5G network technology by several communication service providers are further fueling the growth of the U.S. private 5G network market. For instance, in November 2021, Verizon and Lockheed Martin collaborated on 5G.MIL technologies for providing reliable, ultra-secure connections for the U.S. Department of Defense (DoD) systems. As part of this collaboration, the companies are expected to develop a unified network that spans land, air, space, sea, and cyber domains. This is expected to be achieved through the integration of advanced platforms and technologies.

According to a report published by the GSM Association (GSMA), by 2025, approximately one-third of the global population will have access to 5G networks. The utilization of 5G networks is anticipated to be customized for specific applications, with performance precisely tailored to meet the specific requirements of end users. As 5G continues to be adopted worldwide, there is an expected rise in the utilization of private 5G networks across various industries. A private 5G network can transform industries owing to its various benefits, such as high speed, excellent connectivity, inclusion, and coverage, which bodes well for the market’s growth.

The deployment of IoT devices for various applications such as transportation, public safety and security, and energy management has contributed to a significant boost in developed countries such as the U.S., primarily driven by the rapid development of smart cities. To ensure secure and interconnected communication for these crucial applications, telecom providers are actively implementing 5G network infrastructure across industries, aiming to achieve advanced manufacturing capabilities in smart manufacturing environments.

Due to the advantages associated with private 5G networks, governments worldwide are promoting their adoption. However, deploying and implementing a private 5G network is a complex and costly process, which is expected to restrain the market’s growth. The deployment and maintenance of a private 5G network require significant investment in equipment and infrastructure. It also requires technical expertise, which ultimately increases the overall service cost of the private 5G network. Higher service costs and the complexity of network deployment are proving to be a hindrance to the market’s growth.

Component Insights

The hardware segment led the market and accounted for more than 53% of the revenue share in 2022. Increasing deployment of the core network, Radio Access Network (RAN), backhaul, and transport equipment for private 5G networks across various verticals, including enterprises, manufacturing, energy & utilities, smart cities, and others are driving the growth of the segment.

The increasing development of private 5G networks using RAN technology is expected to fuel the growth of the segment. For instance, in April 2023, Northeastern University's Institute for the Wireless Internet of Things (IoT) and its Open6G R&D Center introduced the operational private 5G network, which is fully automated using Artificial Intelligence (AI). This system is built using open-source components and is capable of delivering a programmable, fully virtualized, and O-RAN-compliant network within a campus setting.

The services segment is anticipated to grow at a significant CAGR during the forecast period. The segment is driven by the growing demand for support and specialized expertise in installing and managing private 5G networks. The companies provide an extensive range of services, including design, network planning, deployment, optimization, integration, and ongoing maintenance. They leverage their experience and extensive knowledge in telecommunications to deliver customized solutions tailored to the unique needs of their customers. Thus, the rising demand for dedicated services by customers to ensure high performance, seamless operation, and security is boosting the growth of the segment.

Frequency Insights

The Sub-6 GHz frequency segment dominated the market with a revenue share of more than 82% in 2022. The primary driving factor behind the segment’s growth is its capability to offer extensive coverage and superior penetration through various obstacles. Sub-6 GHz frequencies are particularly suitable for providing wide area coverage and catering to both outdoor and indoor environments. This frequency range facilitates efficient signal propagation, allowing signals to travel over long distances and penetrate physical barriers such as walls and buildings. The sub-6 GHz frequency range is highly advantageous for applications that require extensive coverage, including smart cities, industrial IoT, and large enterprise deployments, thus contributing to the overall segment’s growth.

The mmWave segment is anticipated to grow at a significant CAGR over the projection period. Growing adoption of mmWave private 5G network in various manufacturing industries owing to its benefits such as the ability to provide significantly higher data transfer rates and increased network capacity is boosting the segment’s growth. By deploying mmWave 5G private networks, factories can elevate their manufacturing capabilities, enabling workers to transition to higher-skilled roles. These networks facilitate the seamless connectivity of automated guided vehicles (AGVs) for the efficient movement of items across the factory floor. Additionally, they enable the integration of small cameras for equipment inspection, a task previously conducted by human operators. This advancement in connectivity allows manufacturing factories to improve productivity, enhance automation, and optimize operational efficiency.

Spectrum Insights

The unlicensed/shared segment dominated the U.S. private 5G network market and accounted for more than 73% of the revenue share in 2022. The segment growth is driven by the significant focus to release shared and unlicensed spectrums by the Federal Communications Commission (FCC) and MultiFire Alliance bodies for the private 5G network use cases. Moreover, with the open access benefits and affordable costs, the unlicensed/shared spectrum bandwidth is highly preferred and easily accessible during key use cases such as massive machine-type communications (mMTC).

The licensed segment is anticipated to grow at a significant CAGR over the projection period. Licensed spectrum, with its dedicated frequency bands, offers secure and interference-free communication, making it a preferred option for deploying private networks. As the demand for private 5G networks increases in various industries, access to licensed spectrum provides organizations with full control and exclusivity over their network resources. It allows them to tailor their network capacity, coverage, and performance to meet their specific needs, ensuring high-quality and reliable connectivity for critical applications. The licensed spectrum segment plays a vital role in enabling businesses to unlock the full potential of private 5G networks, unlocking new opportunities for digital transformation and innovation.

Vertical Insights

The manufacturing segment accounted for over 22% share of the market in 2022. The growth is driven by the increasing need for seamless connectivity in industrial environments, specifically to support the operation of advanced devices such as Ultra-HD cameras, extended reality headsets, and Automated Guided Vehicles (AGVs). Increasing demand for private 5G networks from industries such as electrical & electronics, heavy machinery, automotive, food & beverages, pharmaceuticals, and clothing & accessories, among others is further fueling the segment’s growth. Automotive manufacturers such as Ford, Toyota, General Motors (GM), and others are making significant investments to establish intelligent manufacturing bases. These investments are anticipated to propel the adoption of private 5G networks in the manufacturing sector, in the coming years.

The transportation & logistics segment is anticipated to grow at a significant CAGR over the projection period. The adoption of private 5G networks is anticipated to bring transformative changes to the transportation and logistics sectors, particularly through enhanced vehicle-to-vehicle and vehicle-to-infrastructure connectivity. Private 5G networks offer valuable opportunities for optimizing transportation functions such as precise fleet tracking and fleet management. Additionally, these networks can provide secure and uninterrupted connectivity between ports, ships, and vessels, fostering the growth of private 5G network adoption and driving market growth within the industry.

U.S. Private 5G Network Market Segmentations:

By Component

By Frequency

By Spectrum

By Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Private 5G Network Market

5.1. COVID-19 Landscape: U.S. Private 5G Network Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Private 5G Network Market, By Component

8.1. U.S. Private 5G Network Market, by Component, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Private 5G Network Market, By Frequency

9.1. U.S. Private 5G Network Market, by Frequency, 2023-2032

9.1.1. Sub-6 GHz

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. mmWave

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Private 5G Network Market, By Spectrum

10.1. U.S. Private 5G Network Market, by Spectrum, 2023-2032

10.1.1. Licensed

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Unlicensed/Shared

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Private 5G Network Market, By Vertical

11.1. U.S. Private 5G Network Market, by Vertical, 2023-2032

11.1.1. Manufacturing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Energy & Utilities

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Transportation & Logistics

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Defense

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Public Safety

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Enterprises & Campus

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Public Venues

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Mining

11.1.8.1. Market Revenue and Forecast (2020-2032)

11.1.9. Healthcare/Hospitals

11.1.9.1. Market Revenue and Forecast (2020-2032)

11.1.10. Oil & Gas

11.1.10.1. Market Revenue and Forecast (2020-2032)

11.1.11. Retail

11.1.11.1. Market Revenue and Forecast (2020-2032)

11.1.12. Agriculture

11.1.12.1. Market Revenue and Forecast (2020-2032)

11.1.13. Smart Cities

11.1.13.1. Market Revenue and Forecast (2020-2032)

11.1.14. Others (Construction Sites and Real Estate)

11.1.14.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Private 5G Network Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Frequency (2020-2032)

12.1.3. Market Revenue and Forecast, by Spectrum (2020-2032)

12.1.4. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. AT&T Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cisco Systems, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Nokia Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Samsung Electronics Co., Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Telefonaktiebolaget LM Ericsson

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. T-Systems International GmbH

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Vodafone Group Plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Verizon Communications Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Mavenir

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Broadcom, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others