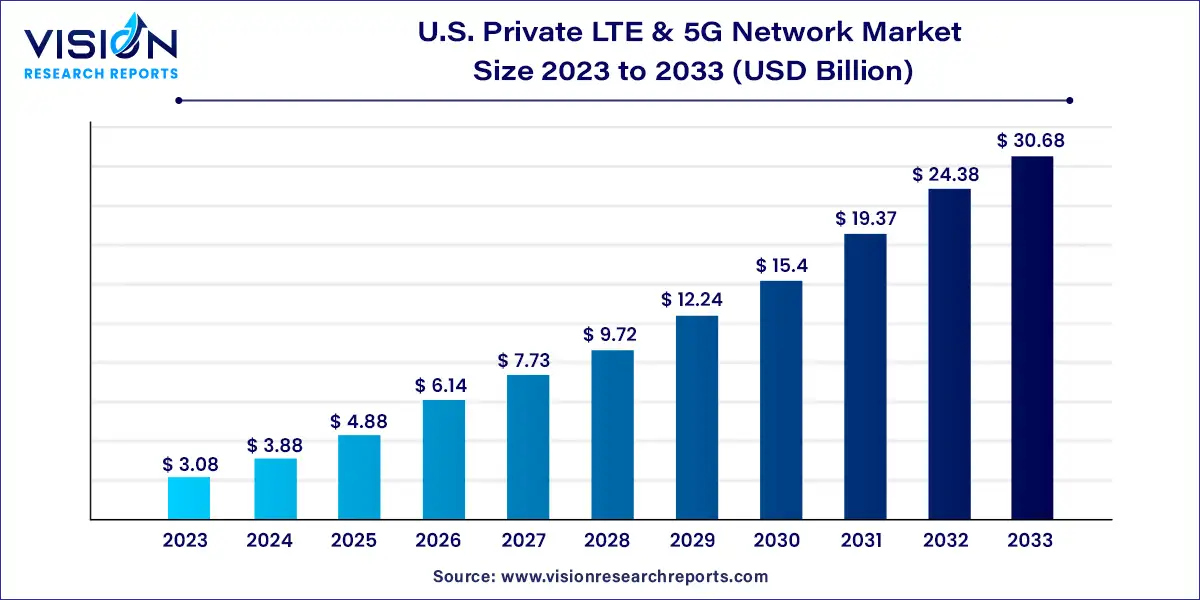

The U.S. private LTE & 5G network market size was estimated at around USD 3.08 billion in 2023 and it is projected to hit around USD 30.68 billion by 2033, growing at a CAGR of 25.83% from 2024 to 2033.

The U.S. private LTE & 5G network market is experiencing robust growth driven by the increasing demand for high-speed, reliable, and secure wireless communication solutions across various industries. As organizations seek to leverage advanced connectivity for mission-critical applications, private LTE and 5G networks are emerging as preferred alternatives to traditional wireless networks. This overview provides insights into the dynamics shaping the U.S. Private LTE & 5G Network market, including key trends, market drivers, challenges, and opportunities.

The growth of the U.S. private LTE & 5G network market is propelled by several key factors. Firstly, the increasing demand for dedicated, high-performance wireless communication solutions across industries drives the adoption of private LTE and 5G networks tailored to specific requirements. These networks offer enhanced coverage, capacity, and reliability, supporting mission-critical applications such as IoT, automation, and real-time analytics. Secondly, regulatory initiatives to allocate spectrum for private networks, such as the CBRS band, facilitate cost-effective deployment and interference-free operations. Additionally, the integration of edge computing capabilities enables low-latency processing and real-time data analytics, driving demand for converged solutions.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.08 billion |

| Revenue Forecast by 2033 | USD 30.68 billion |

| Growth rate from 2024 to 2032 | CAGR of 25.83% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hardware segment led the market and accounted for more than 53% of the revenue share in 2023. This high share is attributable to the growing deployment of the Radio Access Network (RAN), backhaul, and transport equipment, and the core network for private LTE and 5G networks. The need for improved connectivity to connect a large chain of sensors at industrial premises is anticipated to boost RAN equipment adoption and installation. Furthermore, the increasing development of private 5G networks using RAN technology is expected to fuel the segment's growth. For instance, in April 2023, the Institute for the Wireless Internet of Things (WIoT) at Northeastern University, along with its Open6G R&D Center, unveiled an operational private 5G network. This advanced network is entirely automated using Artificial Intelligence (AI). It has been constructed using open-source components, offering a programmable, fully virtualized, and open-RAN-compliant system designed to serve within a campus environment.

The services segment is expected to expand at a high CAGR from 2024 to 2033 on account of the emerging need for 5G deployment and integration. This segment is categorized based on installation and integration, support, and maintenance, and data services. The installation and integration segment held the largest market share in 2022 on account of the high demand for infrastructure integration, consulting, and application integration services. The market is anticipated to flourish owing to the partnerships between cloud service providers, system integrators, equipment vendors, and application/software developers to integrate and deploy core network infrastructure and complete private virtualized RAN (vRAN/C-RAN) at the customer premises.

The sub-6 GHz segment led the market in 2023 with a revenue share of more than 98%. The sub-6 GHz frequency encompasses a low band and a mid-band of spectrum ranges, mainly 6 GHz and below. The increasing development of sub-6 GHz frequency-based 5G modules by several market players across the globe is attributed to the segment’s growth. In September 2022, at MWC Las Vegas, Fibocom, an IoT wireless solutions and modules provider, introduced the FX170(W) series, its latest offering in the 5G Sub-6GHz and mmWave module category. These modules are powered by Snapdragon's X65 5G Modem-RF System and are designed to provide users with a seamless and high-speed wireless connectivity experience.

The mmWave frequency segment is expected to register a high CAGR over the forecast period. mmWave frequencies are high band frequencies that provide significantly high connectivity with very low latency. These frequency bands are highly beneficial for public safety and industrial infrastructure connectivity applications that require highly reliable networks. Additionally, the FCC has released several mmWave frequencies, including 38.6 to 40.0 GHz, 24.75 to 25.25 GHz, 24.25 to 24.45 GHz, and 47.20 to 48.20 GHz, among others, for 5G use cases. Thus, the high focus on releasing mmWave frequencies for mission-critical applications is expected to boost the growth of the mmWave segment over the forecast period.

The unlicensed/ shared spectrum segment dominated the market with a revenue share of more than 89% in 2023 and is expected to continue leading over the forecast period. The high revenue share is attributed to the substantial focus on releasing shared and unlicensed spectrums by FCC and MultiFire Alliance bodies for the private LTE and 5G use cases. Additionally, with the affordable costs and open access benefits, the unlicensed spectrum bandwidth is highly preferred and easily accessible during massive machine-type communications (mMTC).

The licensed spectrum for private LTE and 5G network services involves higher costs than the unlicensed/ shared spectrum. Customers need to purchase and procure a license for a particular spectrum bandwidth to deliver enhanced and secured wireless connectivity for its private use cases. Also, access to a licensed spectrum can be achieved from Communication Service Providers (CSP) and direct bidding through the federal government auctions. The demand for licensed spectrums is expected to significantly grow in industrial, government, and defense sectors that require highly secured connectivity.

The manufacturing segment held the largest market share of around 22% in 2023 and is expected to continue leading over the forecast period. The high revenue share is attributable to the growing demand for private network infrastructure across various factories/manufacturing facilities in the U.S. to improve their overall productivity and operational efficiency. The deployment of private LTE and 5G networks primarily caters to the need for high-speed bandwidth for critical use cases, including AGV, UHD wireless cameras, machine-to-machine communications, collaborative/cloud robots, predictive maintenance, and process monitoring, among others. Furthermore, the AGV applications in the industries are expected to portray a remarkable demand for private LTE and 5G networks. The segment is further bifurcated into automotive, electrical, and electronics, food and beverages, pharmaceuticals, heavy machinery, and clothing and accessories.

The transportation and logistics segment is expected to experience substantial growth throughout the forecast period. This segment is further bifurcated into warehouses, vehicle-to-everything (V2X) connectivity, ports, airports, and rail. The segment’s growth can be attributed to the increasing need for enhanced and secure network connectivity to support various applications, such as autonomous forklifts, warehouse robots, and private connectivity solutions at railway stations and airports. These advancements in connectivity solutions are driving the growth of the market.

By Component

By Frequency

By Spectrum

By Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Private LTE & 5G Network Market

5.1. COVID-19 Landscape: U.S. Private LTE & 5G Network Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Private LTE & 5G Network Market, By Component

8.1. U.S. Private LTE & 5G Network Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Private LTE & 5G Network Market, By Frequency

9.1. U.S. Private LTE & 5G Network Market, by Frequency, 2024-2033

9.1.1. Sub-6 GHz

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. mmWave

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Private LTE & 5G Network Market, By Spectrum

10.1. U.S. Private LTE & 5G Network Market, by Spectrum, 2024-2033

10.1.1. Licensed

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Unlicensed/Shared

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Private LTE & 5G Network Market, By Vertical

11.1. U.S. Private LTE & 5G Network Market, by Vertical, 2024-2033

11.1.1. Transportation & Logistics

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Energy & Utilities

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Defense

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Public Safety

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Enterprises & Campus

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Public Venues

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Mining

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Healthcare/Hospitals

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Oil & Gas

11.1.9.1. Market Revenue and Forecast (2021-2033)

11.1.10. Retail

11.1.10.1. Market Revenue and Forecast (2021-2033)

11.1.11. Agriculture

11.1.11.1. Market Revenue and Forecast (2021-2033)

11.1.12. Smart Cities

11.1.12.1. Market Revenue and Forecast (2021-2033)

11.1.13. Others (Construction Sites and Real Estate)

11.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Private LTE & 5G Network Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Frequency (2021-2033)

12.1.3. Market Revenue and Forecast, by Spectrum (2021-2033)

12.1.4. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 13. Company Profiles

13.1. AT&T Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Broadcom Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cisco Systems, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Nokia Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Qualcomm Technologies, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Samsung Electronics Co., Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Telefonaktiebolaget LM Ericsson

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. T-Systems International GmbH

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Verizon Communications Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Vodafone Group Plc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others