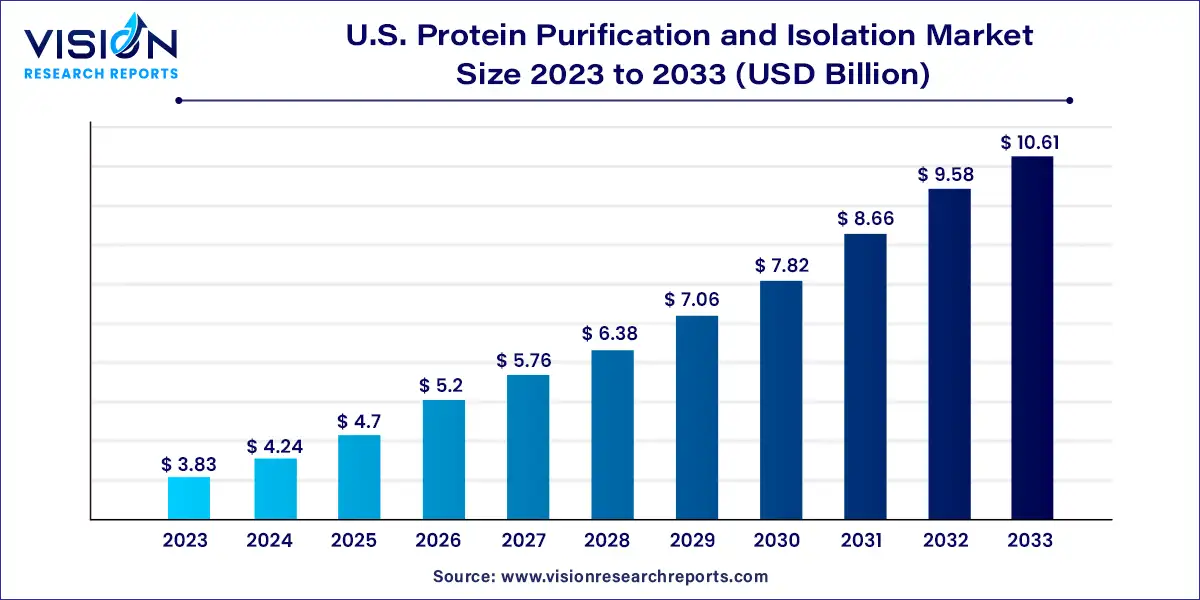

The U.S. protein purification and isolation market size was valued at around USD 3.83 billion in 2023 and it is projected to hit around USD 10.61 billion by 2033, growing at a CAGR of 10.73% from 2024 to 2033.

The U.S. protein purification and isolation market have experienced significant growth, driven by the rising demand for high-quality proteins across various industries such as pharmaceuticals, biotechnology, and research. This market encompasses a wide range of techniques and products aimed at separating and purifying proteins from complex biological samples.

The growth of the U.S. protein purification and isolation market is propelled by an advancements in protein purification technologies, including novel chromatography techniques and automation solutions, have enhanced the efficiency and throughput of protein isolation processes. Secondly, the increasing research activities in proteomics and drug discovery, driven by the demand for targeted therapies, have spurred the adoption of protein purification products. Additionally, the growing prevalence of chronic diseases necessitating protein-based therapeutics has further boosted market growth. Furthermore, the pharmaceutical and biotechnology industries, major end-users of protein purification products, continue to invest in research and development, driving innovation and market expansion.

Chromatography dominated the market and held the largest revenue share of 30% in 2023 and is expected to grow at the fastest CAGR during the forecast period. This technique is highly accurate and sensitive for protein isolation and purification. As a result, many companies focus on launching new products based on this technology to broaden their product range. For instance, Bio-Rad introduced ChromLab Software in 2018, a unique software for protein purification using NGC chromatography systems. The availability of various chromatography techniques suitable for a wide range of applications further propels the segment’s growth.

Electrophoresis held the second-largest revenue market share in 2023 due to its effectiveness in separating proteins based on various properties like size, charge, and shape, allowing for precise purification. This technique is crucial for protein characterization, ensuring sample purity, and enabling detailed analysis of proteins. Electrophoresis, particularly gel electrophoresis, is widely used in laboratories for its ability to separate proteins efficiently, making it a fundamental step in proteomics analysis. The high resolution and accuracy of electrophoresis, especially in techniques like SDS-PAGE and 2D electrophoresis, contribute to its popularity and essential role in protein purification workflows.

Consumables dominated the market and held the largest share of 62% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2033. The broad consumables category includes various commonly used items such as columns, reagents, kits, resins, and magnetic beads. In 2023, the kits segment emerged as the dominant player within the consumable product category. The popularity of kits can be attributed to their convenience and the numerous advantages. One such advantage is their effective use in isolating GST-tagged proteins from either crude or cleared lysate.

Instruments are expected to show lucrative growth during the forecast period due to the advancement of precise, sensitive, and portable instruments. This growth is further fueled by the increased utilization and commercialization of cutting-edge equipment for protein analysis, ensuring accurate outcomes. The emphasis on technological innovation and the demand for more efficient purification methods are driving the expansion of this segment. As a result, the instruments sector is expected to experience lucrative growth during the forecast period, catering to the evolving needs of the protein purification and isolation industry.

Protein-protein interaction studies dominated the market and held the largest revenue share of 33% in 2023 due to their crucial role in understanding biological processes and developing targeted therapies. Researchers can uncover disease mechanisms, identify drug targets, and design more effective treatments by investigating how proteins interact. This focus on protein interactions has driven demand for purification and isolation products, especially in academic institutes and research organizations, leading to significant market growth. The emphasis on studying protein-protein interactions reflects a strategic approach to advancing biomedical research and drug development.

Drug screening is estimated to grow at the highest CAGR of 11.43% during the forecast period. This process plays a crucial role in discovering new drugs with diverse applications. It involves the creation of drugs that are more effective and have fewer side effects than traditional ones. Furthermore, the rise in R&D investments by manufacturers for the screening of new drugs, particularly through structure-based studies and protein-protein interactions, is expected to fuel the growth of this segment.

Academic and research institutes dominated the market and held the largest revenue share of 41% in 2023. This can be attributed to the increasing number of research initiatives these institutes undertake. These initiatives primarily focus on structural and functional proteomics, comprehensive kinetic analysis, and the study of protein-protein interactions. The growing interest and investment in these research areas have increased the demand for protein purification and isolation solutions. These solutions are critical for successfully executing these research initiatives, thereby driving their adoption in academic and research institutes. This trend is expected to continue, further solidifying the position of these institutes in the market.

Hospitals are estimated to witness the highest growth of CAGR of 11.63% over the forecast period due to their significant role in various medical applications. These products are essential for studying protein structure, function, and interactions and are vital for diagnostics, therapeutics, and research. They are used in drug development, studying protein interactions, and researching protein-based therapeutics, all crucial for medical advancements. The demand for high-quality proteins in pharmaceuticals and biotechnology, often used in hospitals, further drives the need for these products. Thus, the high demand for these products in hospitals stems from proteins' critical role in various medical applications.

By Product

By Technology

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others