The U.S. real estate software market size was estimated at around USD 2.47 billion in 2022 and it is projected to hit around USD 6.6 billion by 2032, growing at a CAGR of 10.33% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Real Estate Software Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.47 billion |

| Revenue Forecast by 2032 | USD 6.6 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered |

Altus Group Ltd.; Attom Data; Badger Maps; Black Knight Technologies, LLC; BoomTownROI; CoreLogic; Costar Realty Information Inc.; Commercial Real Estate Exchange, Inc. (Crexi.com); LionDesk LLC; Microsoft Corporation; MRI Software Inc.; Propertybase; RealPage, Inc.; Realvolve; Reonomy; SalesRabbit Inc.; SAP SE; Spotio; Wise Agent; Yardi Systems Inc. |

The continued integration of the latest technologies, such as big data analytics, Artificial Intelligence (AI), and Machine Learning (ML), into real estate solutions is expected to play a niche role in driving the growth of the market. Several real estate companies are integrating these technologies into their respective digital platforms to implement new business models and focus on a large customer base, supporting the proliferation of the market.

Significant population growth and rapid urbanization are encouraging the government to invest in the real estate sector, creating robust business opportunities for the U.S. real estate software market. A remarkable increase in residential and commercial real estate projects in the U.S. is expected to boost market growth during the forecast period. Furthermore, the U.S. government’s supportive initiatives for digitization are encouraging real estate companies to digitize their business operations. Real estate companies are adopting real estate software for digital marketing, generating potential leads, and gaining insights to make data-driven decisions, to achieve higher profitability from this potential market.

The increasing government initiatives toward the development of infrastructure have been significant in boosting the U.S. real estate software market growth. The U.S. Department of Transportation has been involved in Public-Private Partnerships (P3s), a contractual agreement between private entities and public agencies to enable better private participation in project delivery. The spending in the U.S. construction industry is likely to drive positive adoption of U.S. real estate software solutions over the forecast period. For instance, according to the U.S. Census Bureau, in February 2023, construction spending was USD 1,844.1 billion.

The integration of AI in real estate software has been on the rise among companies in the U.S. This can result in a major boost for the real estate software industry due to the various benefits of AI integration, such as automated valuation models, smart property analysis, mortgage calculation, property recommendation, CRM, management software solutions, automation of manual tasks, and aid in property development. These benefits have accelerated the adoption of AI-integrated real estate software solutions, resulting in more companies offering advanced products. For instance, in April 2023, Restb.ai (a Spanish computer vision company specializing in image recognition for the real estate industry) announced the launch of its AI-powered property description technology for the Canadian and U.S. real estate industries, enabling easy automation of creating property listing descriptions.

The high adoption of real estate software can be attributed to its ease of management, scalability and security, marketing and workflow automation, relationship retention, and generating potential leads. However, the high costs of real estate software are expected to restrict the U.S. real estate software industry growth during the forecast period. To overcome this issue, the companies operating in the market focus on understanding the exact client requirements and design the software accordingly to eliminate the additional costs which are incurred due to obsolete features.

Type Insights

The Customer Relationship Management (CRM) software segment accounted for the largest market share of 28% in 2022. The significant market share can be attributed to the presence of top companies offering different types of real estate software solutions, which can enable a wider reach and attract more customers. Some of the major companies offering different types of real estate software solutions include Altus Group; Rockport; and Matellio Inc., among others. The solutions these companies offer include property valuation software, which offers a myriad of functionalities, including commercial property valuations, cash flow forecasting, sensitivity analysis, and transaction analysis, creating a favorable environment for the U.S. real estate software industry.

The contract software segment is expected to register a CAGR of 11.42% through 2032. The growth of the segment can be attributed to the presence of top companies offering different types of contract software solutions, which can enable a wider reach and attract more customers. Further, the rising adoption of several digital technologies, such as AI-based contract software and e-signatures, is expected to create robust opportunities for segment growth in the forecast period.

Deployment Insights

The on-premise segment accounted for the largest market share of 47% in 2022. The growth of the segment can be attributed to several benefits, such as improved data security, and better control, among others, associated with the on-premise deployment of real estate software. The new, innovative real estate software solutions, which support on-premise deployment, are launched aggressively by top companies operating in the U.S. real estate software industry and are also contributing to the growth of the on-premise segment. For instance, SAP SE offers a solution named “SAP S/4HANA”, a software solution for contract, lease, and real estate management that supports on-premise deployment.

The cloud segment is anticipated to grow at a CAGR of 11.83% during the forecast period. The growth of the cloud segment can be attributed to benefits such as lower costs, flexibility, and scalability, associated with cloud-based deployment. The demand for cloud-deployable real estate software solutions has been gaining significant traction. For instance, in December 2022, Agilysys NV LLC, a hospitality software solution provider based in the U.S., announced an agreement with Marriott International, Inc., a hotel chain based in the U.S., to deploy Agilysys NV LLC's cloud-native property management system software across Marriott International, Inc.'s premium, luxury, and select service hotels in the U.S. and Canada in coming years.

End-Use Insights

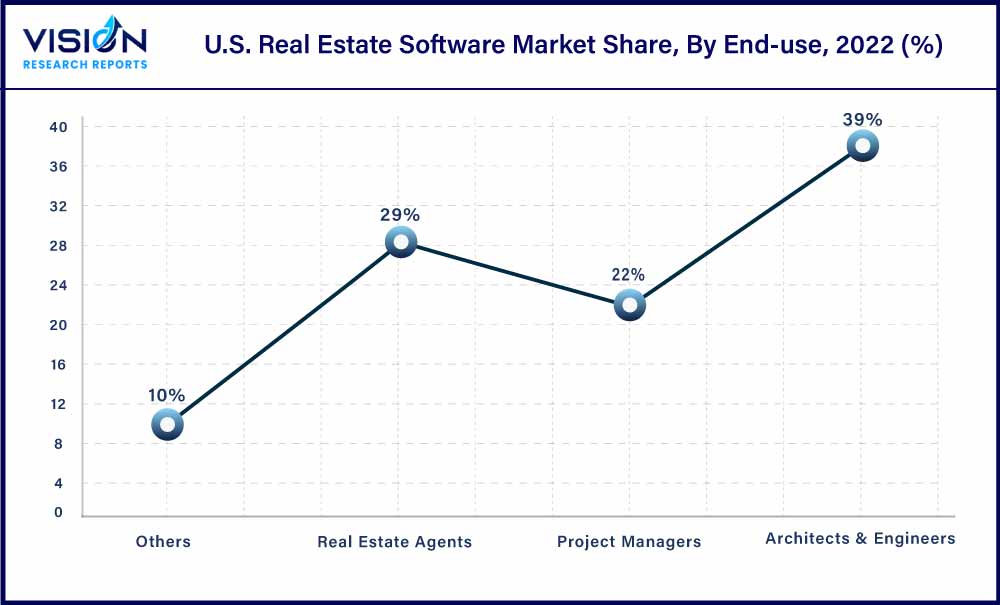

The architects & engineer segment accounted for the largest market share of 39% in 2022. Advances in Virtual Reality (VR) and Augmented Reality (AR) and their continued integration into real estate software, coupled with the significant growth in the number of construction projects being undertaken across the globe, are expected to open lucrative opportunities for architects and engineers, thereby driving the adoption of real estate software by architects and engineers over the forecast period. Several architects and engineers use real estate software to limit their reliance on paperwork and documentation while ensuring well-organized and automated worksites and lowering overall costs, supporting the growth of the U.S. real estate software industry.

The real estate agents segment is anticipated to grow at a CAGR of 10.94% during the forecast period. The growth of the segment can be attributed to the benefits such as additional help in managing relationships with brokers, sellers, agents, developers, and financial institutions, offered by real estate software. The presence of several incumbents in the market offering a complete package of software solutions for real estate agents is contributing to the growth of the segment. For instance, Propertybase, a real estate software provider based in the U.S., offers a solution named Propertybase GO, an ideal software package for real estate agents. The functionalities of the software include done-for-you lead generation, real estate CRM, and easy marketing automation.

Application Insights

The residential segment accounted for a market share of 61% in 2022. Business process outsourcing is used by various IT & telecommunications firms to develop and enhance their product & service offerings. In-house hiring is costly and requires lots of resources such as training, upkeep, office space, payroll, and IT infrastructure. BPO can provide better services with reduced costs to the clients through outsourcing as it saves expenses and resources in the setup process.

The commercial segment is expected to grow at the highest CAGR of 11.15% during the forecast period. The growth of the segment can be attributed to various strategic initiatives being pursued by the incumbents of the market to help customers in streamlining their business. For instance, in March 2023, STRATAFOLIO, INC, a software solution provider based in the U.S., became a member of Intuit QuickBooks Solution Provider Program. Using the Intuit QuickBooks platform, commercial real estate owners can handle their portfolios better from a single location and use critical data to streamline their business.

U.S. Real Estate Software Market Segmentations:

By Type

By Deployment

By End-Use

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Real Estate Software Market

5.1. COVID-19 Landscape: U.S. Real Estate Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Real Estate Software Market, By Type

8.1. U.S. Real Estate Software Market, by Type, 2023-2032

8.1.1. Customer Relationship Management Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Enterprise Resource Planning Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Property Management Software

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Contract Software

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others (Content Management Software, Investing/Financial Management Software, Skip Tracing Software, Property Valuation Software)

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Real Estate Software Market, By Deployment

9.1. U.S. Real Estate Software Market, by Deployment, 2023-2032

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Real Estate Software Market, By End-Use

10.1. U.S. Real Estate Software Market, by End-Use, 2023-2032

10.1.1. Architects & Engineers

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Project Managers

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Real Estate Agents

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others (Lenders, Financial Advisors, Property Owners, Sales Professionals)

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Real Estate Software Market, By Application

11.1. U.S. Real Estate Software Market, by Application, 2023-2032

11.1.1. Commercial

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Residential

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Real Estate Software Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by End-Use (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Altus Group Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Attom Data

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Badger Maps

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Black Knight Technologies, LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. BoomTownROI

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. CoreLogic

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Costar Realty Information Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Commercial Real Estate Exchange, Inc. (Crexi.com)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. LionDesk LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microsoft Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others