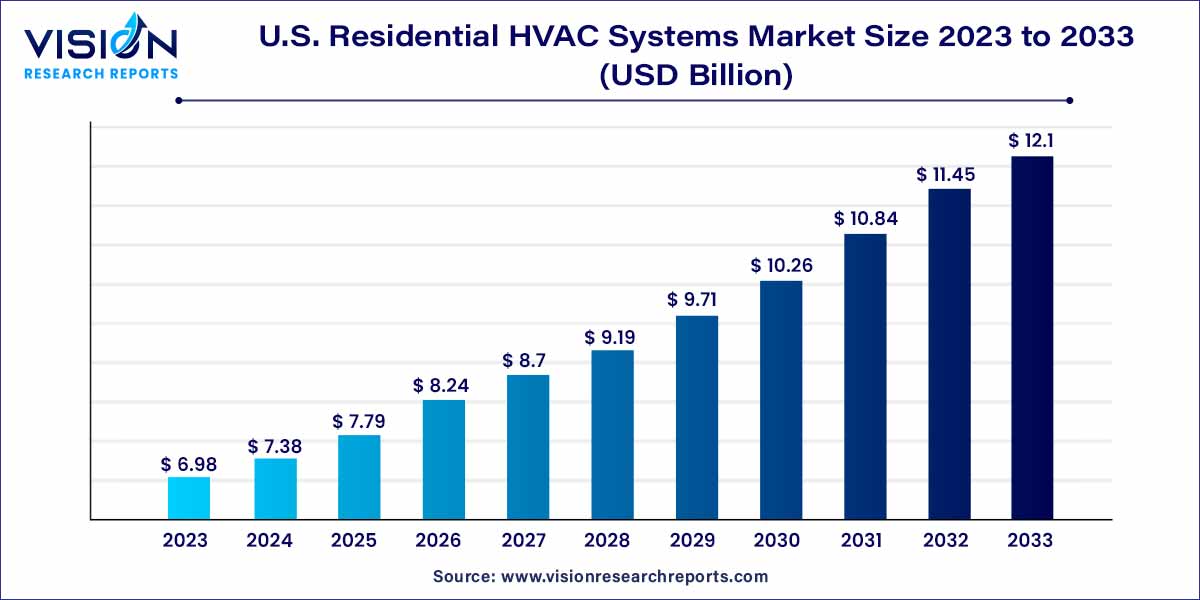

The U.S. residential HVAC systems market was valued at USD 6.98 billion in 2023 and it is predicted to surpass around USD 12.1 billion by 2033 with a CAGR of 5.65% from 2024 to 2033. The U.S. residential HVAC systems market stands at the intersection of technological innovation, environmental consciousness, and consumer demand for comfort and efficiency. HVAC, which encompasses Heating, Ventilation, and Air Conditioning systems, has become an integral part of American households, ensuring optimal climate control and indoor air quality.

The growth of the U.S. Residential HVAC Systems Market can be attributed to several key factors. Firstly, increasing awareness among consumers about energy efficiency and environmental concerns has led to a rising demand for HVAC systems that are both technologically advanced and eco-friendly. Secondly, advancements in smart home technologies, including IoT integration and connected HVAC systems, have enhanced user experience and convenience, further boosting market growth. Additionally, government initiatives and incentives promoting energy-efficient appliances have encouraged homeowners to invest in high-efficiency HVAC systems. Moreover, the need for superior indoor air quality and comfortable living spaces has driven the market, with consumers seeking innovative HVAC solutions. Lastly, ongoing research and development in the HVAC sector have resulted in the introduction of cutting-edge technologies, ensuring sustained market growth while meeting the evolving demands of consumers.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.98 billion |

| Revenue Forecast by 2033 | USD 12.1 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The cooling segment led the market with the largest revenue share of 58% in 2023. The cooling segment includes a diverse range of products designed to maintain a comfortable temperature inside homes, particularly during hot weather. Air conditioners, central air conditioning systems, and ductless mini-split systems are prominent examples, each offering specific advantages catering to various household needs. These cooling solutions have evolved significantly, incorporating advanced technologies such as inverter compressors and smart controls, enhancing both efficiency and user experience.

The heating segment is expected to grow at the CAGR of 5.47% over the forecast period. The heating segment comprises products aimed at providing warmth during colder months. Furnaces, heat pumps, and radiant heating systems are integral components of the residential heating category. Furnaces, traditionally powered by gas or electricity, distribute heated air through ducts, ensuring consistent warmth throughout homes. Heat pumps, known for their energy efficiency, offer both heating and cooling functionalities, making them versatile solutions. Radiant heating systems, placed under floors or within walls, provide a comfortable heating experience by radiating heat upwards. These heating products have witnessed innovations, embracing eco-friendly practices and energy-saving features, aligning with the industry's sustainable objectives.

By Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Residential HVAC Systems Market

5.1. COVID-19 Landscape: U.S. Residential HVAC Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Residential HVAC Systems Market, By Product

8.1.U.S. Residential HVAC Systems Market, by Product Type, 2024-2033

8.1.1. Heating

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ventilation

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Cooling

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Residential HVAC Systems Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Carrier

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Daikin Industries Ltd.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Emerson Electric Co.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Haier Group

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Johnson Controls

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. LG Electronics

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Lennox International

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Mitsubishi Electric Corporation

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Rheem Manufacturing Company

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Trane Technologies plc

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others