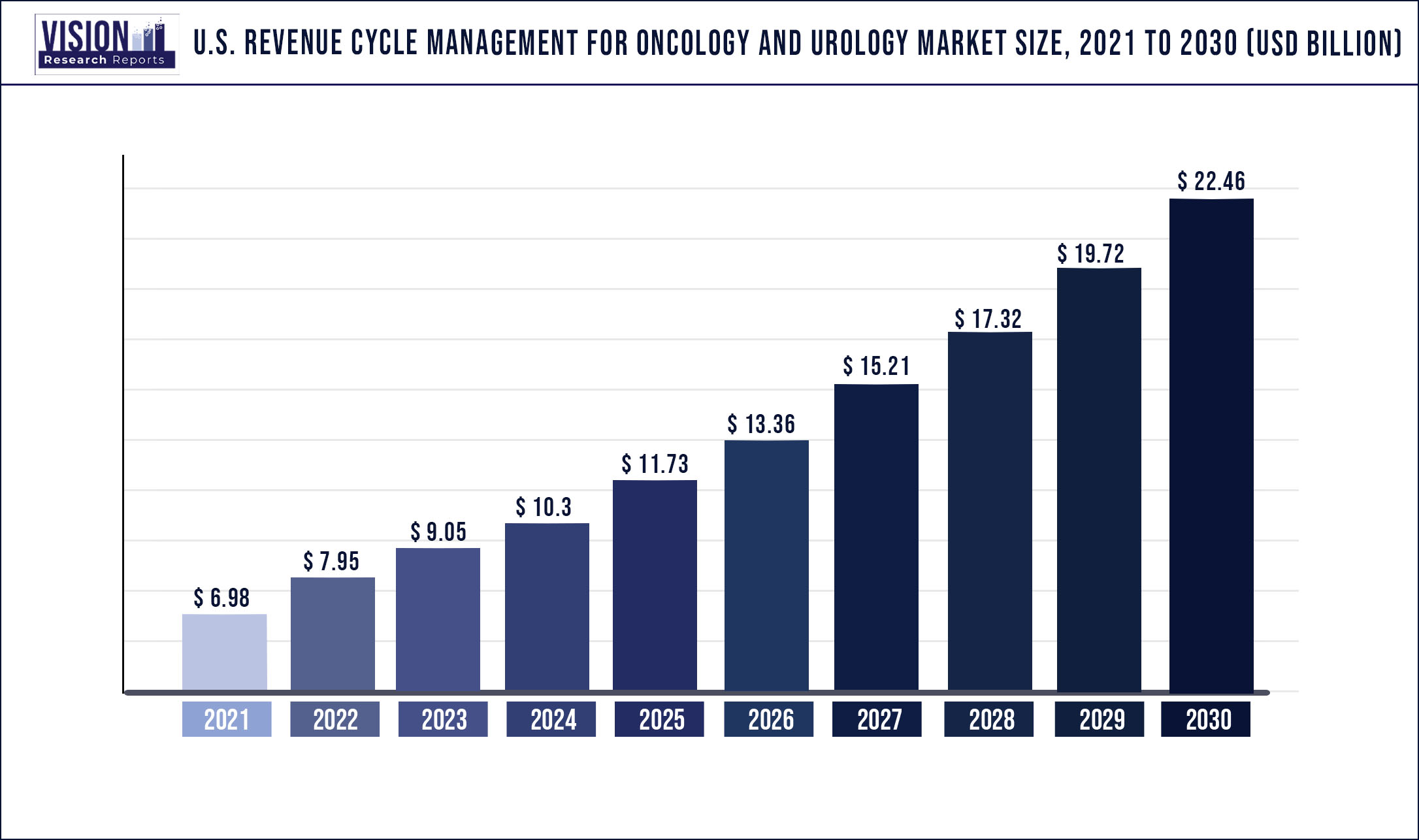

The U.S. revenue cycle management for oncology and urology market was estimated at USD 6.98 billion in 2021 and it is expected to surpass around USD 22.46 billion by 2030, poised to grow at a CAGR of 13.87% from 2022 to 2030.

Report Highlights

The market growth can be attributed to the rising adoption of applications that would help in streamlining revenue cycles for various healthcare institutions and technological advancements undertaken by the key players in the market.

Developers and vendors of RCM platforms & solutions are supporting healthcare facilities in accommodating and getting themselves accustomed to the transitions associated with ICD-10. RCM providers are focusing on increasing staff resources & providing adequate training sources and improving customer engagement. For instance, in January 2020, OnQ launched Robotic Process Automation (RPA). The company’s accessible RPA solutions considerably helped in enhancing service quality, improving efficiencies, and shortening medical billing procedures.

According to The State of RPA in the Revenue Cycle survey conducted in 2021, 51% of the healthcare systems in the U.S. are widely adopting Robotic Process Automation (RPA) in improving their RCM platforms. RPA and automation allow to streamline and simplify various aspects of the RCM solution that is repetitive, manual, or rule-based. The survey further states that midsized and large-sized hospitals are using automation across all functions of their RCM platform. The top five RCM processes wherein automation is widely being used are Eligibility (59%), Authorization (57%), Claims/Follow-up (43%), Charge Capture (39%), and Payments/Collections (39%).

Increasing adoption of RCM outsourcing in the U.S. is expected to positively impact the growth of the market during the forecast period. The changing aspects of RCM outsourcing are mainly due to the availability of finances, value addition, and business prospects. Moreover, due to awareness regarding cost savings with respect to the adoption of RCM solutions, efficient and cost-effective services are some of the major advantages of RCM outsourcing. Despite this, the shortage of skilled professionals required for managing the revenue cycle management software is expected to restrain the growth of the market over the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 6.98 billion |

| Revenue Forecast by 2030 | USD 22.46 billion |

| Growth rate from 2022 to 2030 | CAGR of 13.87% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Sourcing, end-use |

| Companies Covered |

United Urology Group; Cardinal Health; Flatiron; Oncospark.com; Fedora Solutions; BillingParadise; Gentem; Integra Connect LLC; R1 RCM Inc. |

Sourcing Insights

The in-house segment held the largest share of 71.6% in 2021. The increasing use of in-house RCM solutions to manage the financials of healthcare facilities contributed to market growth. The in-house solutions offer advantages such as flexibility over functioning, direct control of the platform, and high return on investments which increased the adoption of the in-house RCM solutions. Furthermore, the availability of players providing the solutions such as Flatiron, Connect LLC; Gentem Health, Inc., and BillingParadise has increased the demand for the solutions.

The outsourced RCM services segment is anticipated to witness lucrative growth during the forecast period due to the increased number of healthcare facilities outsourcing RCM services to the market players due to the reduced costs and higher efficiency. Moreover, the incorporation of the ICD-10 coding structure, the shortage of healthcare staff, and the growing expansion of outpatient services boosted the demand for outsourced RCM services. Furthermore, outsourcing RCM lowers staff responsibility and improves collection level & pace by decreasing denials, thereby aiding the segment growth.

End-Use Insights

The hospitals segment accounted for the largest share of 57.63% in 2021. The RCM solutions help healthcare facilities to manage clinical and administrative functions associated with payment, claims processing, and revenue generation which is expected to contribute to the growth of the segment. Moreover, increasing collaborations of the hospitals with RCM providers in order to implement innovative solutions for effective management of reimbursements and related claims is expected to boost the adoption of RCM solutions in the facilities.

The physicians and clinical services segment is anticipated to witness the fastest growth during the forecast period owing to the increasing adoption of RCM solutions by private physicians in order to manage the medical and financial results. Moreover, the incorporation of RCM helps to reduce operational costs, manage reimbursements and boost patient and provider revenue which is expected to drive the adoption by physicians.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Revenue Cycle Management for Oncology And Urology Market

5.1. COVID-19 Landscape: U.S. Revenue Cycle Management for Oncology And Urology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Revenue Cycle Management for Oncology And Urology Market, By Sourcing

8.1. U.S. Revenue Cycle Management for Oncology And Urology Market, by Sourcing, 2022-2030

8.1.1. In-house

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. External RCM Apps/ Software

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Outsourced RCM Services

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. U.S. Revenue Cycle Management for Oncology And Urology Market, By End-use

9.1. U.S. Revenue Cycle Management for Oncology And Urology Market, by End-use, 2022-2030

9.1.1. Physicians & Clinical Services

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. U.S. Revenue Cycle Management for Oncology And Urology Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Sourcing (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. United Urology Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cardinal Health

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Flatiron

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Oncospark.com

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Fedora Solutions

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BillingParadise

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Gentem

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Integra Connect, LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. R1 RCM Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others