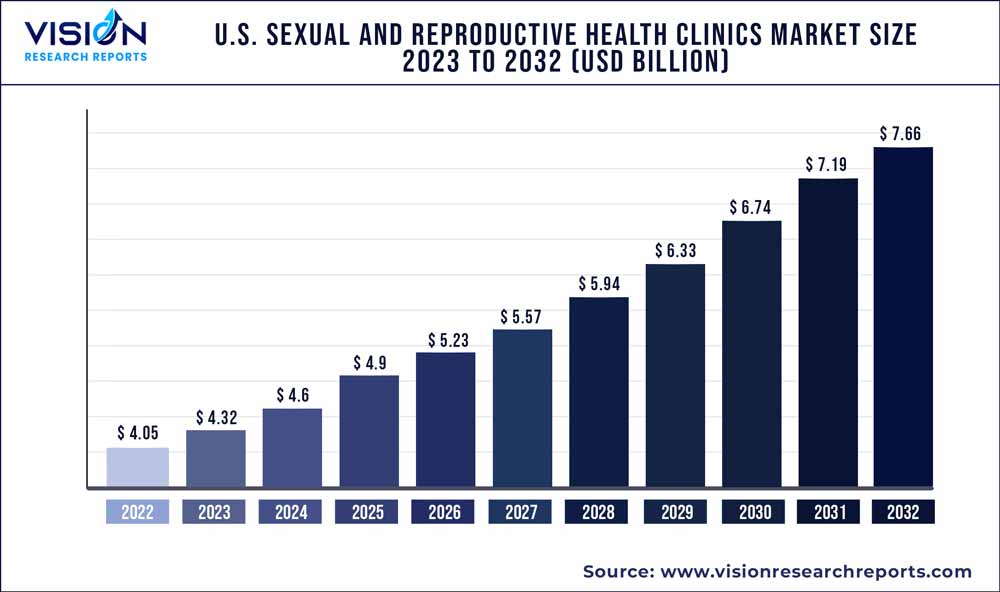

The U.S. sexual and reproductive health clinics market size was estimated at around USD 4.05 billion in 2022 and it is projected to hit around USD 7.66 billion by 2032, growing at a CAGR of 6.58% from 2023 to 2032.

The U.S. sexual and reproductive health clinics market stands as a vital component of the nation's healthcare infrastructure, addressing the unique and multifaceted needs of individuals in matters related to reproductive health. This comprehensive overview aims to provide a holistic understanding of the market, encompassing its scope, key players, regulatory landscape, and the factors influencing its growth.

The growth of the U.S. sexual and reproductive health clinics market is propelled by a confluence of factors that collectively contribute to its expanding significance. Firstly, increasing awareness and education surrounding reproductive health issues foster a proactive approach among individuals, driving higher demand for the services offered by these clinics. Moreover, advancements in medical technology, particularly in diagnostic and telehealth services, enhance the accessibility and efficiency of reproductive healthcare. Legislative efforts and advocacy initiatives further contribute to market growth by ensuring favorable regulatory environments and sustained funding. The evolving societal landscape, marked by changing demographics and attitudes towards sexual and reproductive health, underscores the need for flexible and inclusive service delivery models. As the market adapts to these dynamic factors, it positions itself not only as a healthcare provider but also as a crucial contributor to public health education and preventive care, ensuring a positive trajectory for future growth.

| Report Coverage | Details |

| Market Size in 2022 | USD 4.05 billion |

| Revenue Forecast by 2032 | USD 7.66 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.58% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The market is categorized based on ownership into private providers, publicly supported clinics, hospital-affiliated, and other providers. The publicly supported clinic segment claimed the largest market share, primarily due to the prevalence of government-operated clinics in 2022. The Affordable Care Act (ACA) and Medicaid expansion have notably broadened access to sexual and reproductive health services, prompting an increased utilization of publicly supported clinics. These clinics are pivotal in advancing community health initiatives, particularly for underserved populations.

Publicly supported clinics extend a diverse array of sexual and reproductive health services, coupled with educational resources, catering to individuals who may face challenges in accessing such facilities. Consequently, these clinics play a vital role in delivering essential sexual and reproductive health care, especially for women in lower income brackets, foreign-born women, those covered by Medicaid, and the uninsured. Notably, two-thirds of women seeking care at clinics for their sexual and reproductive health needs identify these clinics as their primary source of medical care. Looking ahead, the private provider segment is anticipated to experience the fastest CAGR from 2023 to 2032.

The preference for private providers is driven by various factors, including the desire for personalized care, discretion, and convenience. Moreover, private clinics often specialize in fertility services, offering comprehensive assessments, consultations, and treatments for individuals or couples encountering challenges with conception. These services encompass diagnostic tests, fertility medications, intrauterine insemination (IUI), in vitro fertilization (IVF), and other assisted reproductive technologies, contributing significantly to the anticipated growth of this market segment.

The market is categorized by age group into three segments: 15 to 25 years, 26 to 35 years, and 36 to 44 years. The 15 to 25-years age group held the largest revenue share of 41% in 2022, and it is anticipated to exhibit the highest growth rate from 2023 to 2032. This surge is linked to increased sexual activity and heightened awareness of the importance of Sexually Transmitted Infection (STI) testing. The prevalence of STIs is notably higher among individuals aged 15 to 25, owing to factors such as elevated levels of sexual activity, multiple partners, and inconsistent use of protection. For instance, the Centers for Disease Control and Prevention (CDC) reports that around 46% of new STIs occur in individuals aged 15 to 24.

Additionally, the 26 to 35 years age group is projected to experience significant growth during the forecast period. Women in this age range are in their reproductive years, and health issues related to fertility, such as hormonal infertility, endometriosis, and Polycystic Ovary Syndrome (PCOS), become more pertinent. Moreover, this age bracket contributes substantially to market expansion due to the demand for educational programs, contraceptive counseling, and testing and treatment for STIs/STDs.

The market is segmented based on services into birth control, pregnancy-related procedures, sexually transmitted diseases (STDs), and others. The birth control segment secured the largest market share and is projected to demonstrate the fastest CAGR from 2023 to 2032. This growth can be attributed to several factors, including an escalating demand for diverse birth control methods and advancements in contraceptive technology. Notably, the recent emphasis on abortion bans in several U.S. states has correspondingly increased the demand for various contraceptive methods. Furthermore, the introduction of new, more effective, and long-acting reversible contraceptive methods is anticipated to propel industry growth.

For instance, Agile Therapeutics, a pharmaceutical company, launched Twirla, a hormonal patch, in the U.S. in the fourth quarter of 2020. The increased availability of generic and cost-effective drugs and devices has driven a surge in demand for contraceptives among teenagers. On the other hand, the pregnancy-related services segment is poised for significant growth during the forecast period, driven by the rising demand for infertility treatments and services. Pregnancy-related care is becoming increasingly prevalent in the market, with approximately 10% of women in the U.S. aged 15-44 years facing difficulties in getting pregnant or staying pregnant, according to the Centers for Disease Control and Prevention (CDC). This trend is expected to fuel the demand for infertility treatment services in clinics.

By Ownership

By Age Group

By Service

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Ownership Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Sexual And Reproductive Health Clinics Market

5.1. COVID-19 Landscape: U.S. Sexual And Reproductive Health Clinics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Sexual And Reproductive Health Clinics Market, By Ownership

8.1. U.S. Sexual And Reproductive Health Clinics Market, by Ownership, 2023-2032

8.1.1 Private Provider

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Publicly Supported Clinic

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hospital Affiliated and Other Providers

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Sexual And Reproductive Health Clinics Market, By Age Group

9.1. U.S. Sexual And Reproductive Health Clinics Market, by Age Group, 2023-2032

9.1.1. 15 to 25 Years

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 26 to 35 Years

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. 36 to 44 Years

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Sexual And Reproductive Health Clinics Market, By Service

10.1. U.S. Sexual And Reproductive Health Clinics Market, by Service, 2023-2032

10.1.1. Birth control

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Pregnancy Related Services

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Sexually Transmitted Diseases (STDs)

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Sexual And Reproductive Health Clinics Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Ownership (2020-2032)

11.1.2. Market Revenue and Forecast, by Age Group (2020-2032)

11.1.3. Market Revenue and Forecast, by Service (2020-2032)

Chapter 12. Company Profiles

12.1. Public Health Solutions

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Teton County, WY

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ramsey County.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Bloom Women’s Health.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Planned Parenthood Federation of America Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Pacific Reproductive Center

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Male Sexual & Reproductive Health Center.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. University of Rochester Medical Center Rochester

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. NY (Golisano Children's Hospital)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others