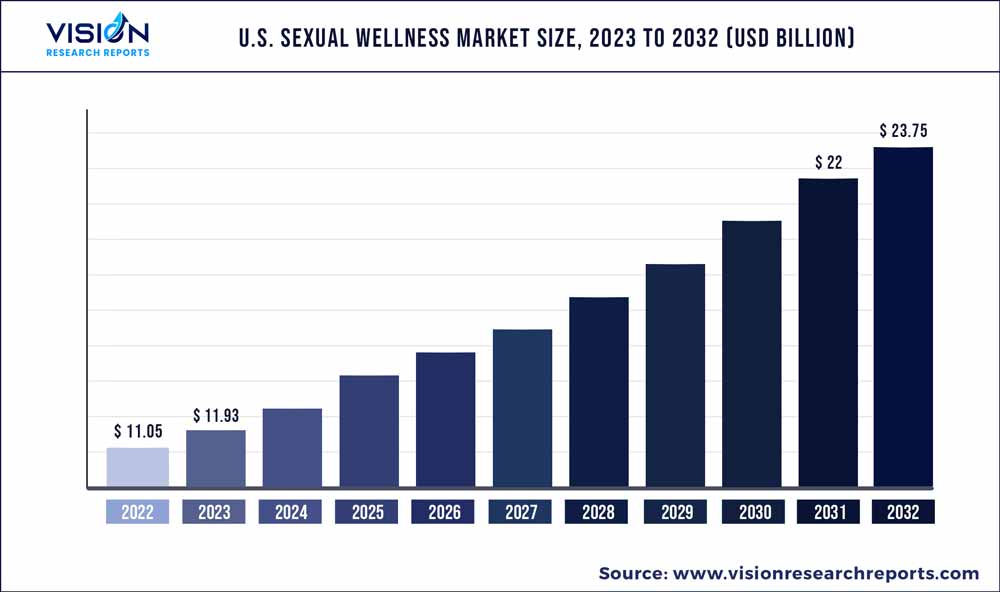

The U.S. sexual wellness market was surpassed at USD 11.05 billion in 2022 and is expected to hit around USD 23.75 billion by 2032, growing at a CAGR of 7.95% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Sexual Wellness Market

| Report Coverage | Details |

| Market Size in 2022 | USD 11.05 billion |

| Revenue Forecast by 2032 | USD 23.75 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.95% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; Veru Inc.; Doc Johnson Enterprises; Mayer Laboratories, Inc.; LifeStyles Healthcare Pte Ltd; BioFilm, Inc.; LELO; Trigg Laboratories Inc.; Unbound; CC Wellness |

The market is anticipated to exhibit lucrative growth in the coming years due to the rising prevalence of Sexually Transmitted Diseases (STDs) and HIV infection. Increasing government initiatives and NGOs participating in promoting the use of contraceptives is expected to boost market growth. The increasing childbearing population of women in the U.S. and the ease of online shopping and e-commerce are expected to further facilitate the sales of sexual wellness products. The NYC Health Department recommended masturbation as the safest form of sexual activity to minimize contact with others and reduce the spread of COVID-19. Since the pandemic has reduced the stigma around masturbation, an increasing number of customers in the country are opting for various sex toys to improve their sexual experience.

The stigma attached to sexual activities & experimenting is reducing due to liberalization and growing acceptance of homosexuality. Sex-positive movements have helped clear the stereotypes related to gender, age, and social construct of people. The banks and investors who were reluctant to fund ventures in sexual wellness products are now investing in this space. In recent times, the stereotypical perception has witnessed some change, and angel investors are also increasingly investing with manufacturers. For Instance, in March 2021, PLBY Group, Inc spent USD 25 million, to buy a TLA acquisition firm selling sex toys through a subsidiary. Major brands in the U.S. market for sexual wellness are expected to witness lucrative demand due to the growing use of sex toys among both men and women.

The U.S. government is also taking initiatives toward sexual wellness by promoting safe sex, propelling the growth of the market. For instance, In June 2020, the New York health department started a home delivery service called “Door 2 Door” to promote the practice of safe sex. The service provides delivery of condoms, lubricants, and HIV tests via an online platform. Before the onset of the COVID-19 pandemic, the people in New York had access to complimentary condoms and lubricants from over 3,500 non-profit organizations that were authorized by the health department to dispense these products throughout New York City.

Product Insights

The U.S. sexual wellness market has been segmented into sex toys, condoms, and personal lubricants. Sex toys held the largest share of 84% of the product segment. Liberalization and an increasing number of individuals embracing their sexuality have led both young women and men to experiment and explore. Adult vibrators are now a part of mainstream personal care products to promote healthy sexual lives. Increased spending capacities and improved standards of living in developing economies are expected to drive market growth during the forecast period.

The condom market in the U.S. is positively impacted by changing lifestyles and the increasing trend of having multiple sex partners. Thus, there has been an increase in condom use for pregnancy and STI/HIV prevention. Sex education, ethnicity, and sexual orientation are some of the key factors, which impact the usage of condoms in the U.S. among people aged between 15 and 44. The condom segment is further divided into male and female condoms.

The personal lubricants segment is expected to witness the highest CAGR during the forecast period. The use of lubricants can alleviate the problem and is preferred by the older cohort. Water-based lubricant is the most used lubricant by consumers worldwide. These lubricants are affordable and compatible with condoms and other sexual wellness products such as vibrators. They provide the feel of natural vaginal lubricants and are easy to wash off, which makes them popular among consumers for masturbation and penetrative sex.

Distribution Channel Insights

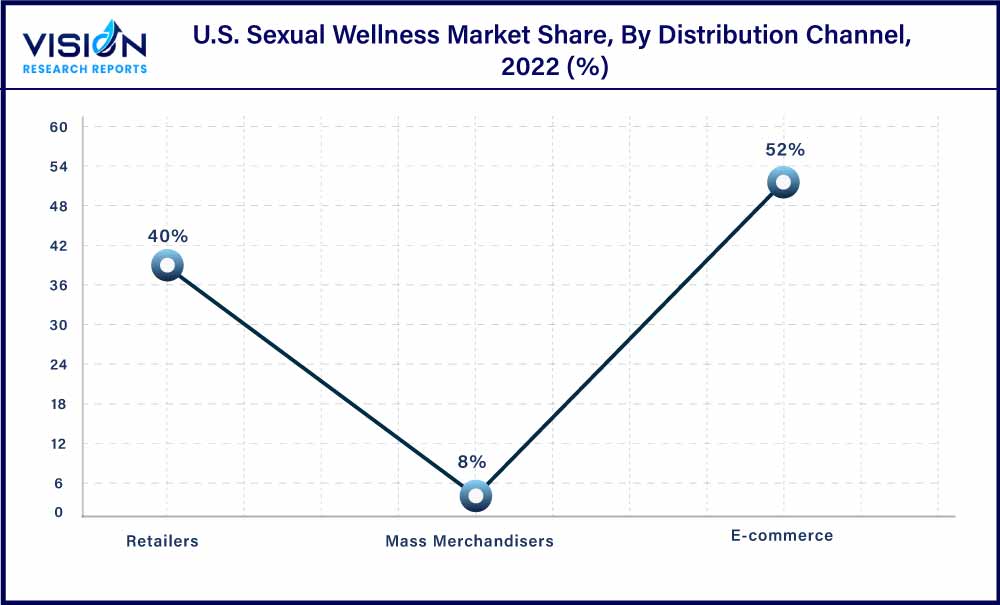

Based on distribution channels, the U.S. sexual wellness market is further divided into mass merchandisers, retail pharmacies, and e-commerce. The e-commerce segment held the largest revenue share of 55% and it is expected to witness the fastest growth owing to the increasing penetration of the Internet and the availability of a wide product portfolio on e-commerce platforms. The anonymity maintained in product delivery is an added advantage for customers opting for online purchases over brick-and-mortar stores, especially in the case of sex toys.

The convenience of viewing, selecting, and ordering through online shopping websites, without revealing one’s identity, removes the barrier of judgment in most cases and thus boosts the use of sexual wellness products. The most frequently ordered products include vibrators, rubber penis, and lubricants. Freedom to select any lubricant from the variety of products available under different brands has enabled e-commerce platforms to gain popularity among customers. Moreover, the assurance of delivering the packages discreetly via e-commerce platforms has increased purchases among women of all age groups.

Retail grocery stores, hypermarkets, and supermarkets are categorized as mass merchandisers for the distribution of sexual wellness products. In the U.S., mass merchandisers are witnessing increased sales of sexual wellness products. The availability of sex toys, sexual enhancement products, condoms, lubricants, sex games, apparel, and lingerie has increased, as supermarkets are allocating more shelf space for these products. Retailers, such as Walmart, 7-Eleven, and Costco Wholesale Corporation, have started the trend of displaying sexual wellness products in the wellness aisle along with other products such as pregnancy tests, sanitary napkins, and other female & male care products.

U.S. Sexual Wellness Market Segmentations:

By Product

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Sexual Wellness Market

5.1. COVID-19 Landscape: U.S. Sexual Wellness Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Sexual Wellness Market, By Product

8.1. U.S. Sexual Wellness Market, by Product, 2023-2032

8.1.1. Sex Toys

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Condoms

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Personal Lubricants

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Sexual Wellness Market, By Distribution Channel

9.1. U.S. Sexual Wellness Market, by Distribution Channel, 2023-2032

9.1.1. E-commerce

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Retailers

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Mass Merchandisers

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Sexual Wellness Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Church & Dwight Co., Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Reckitt Benckiser Group plc

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Veru Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Doc Johnson Enterprises

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mayer Laboratories, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. LifeStyles Healthcare Pte Ltd

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. BioFilm, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. LELO

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Trigg Laboratories Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Unbound

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others