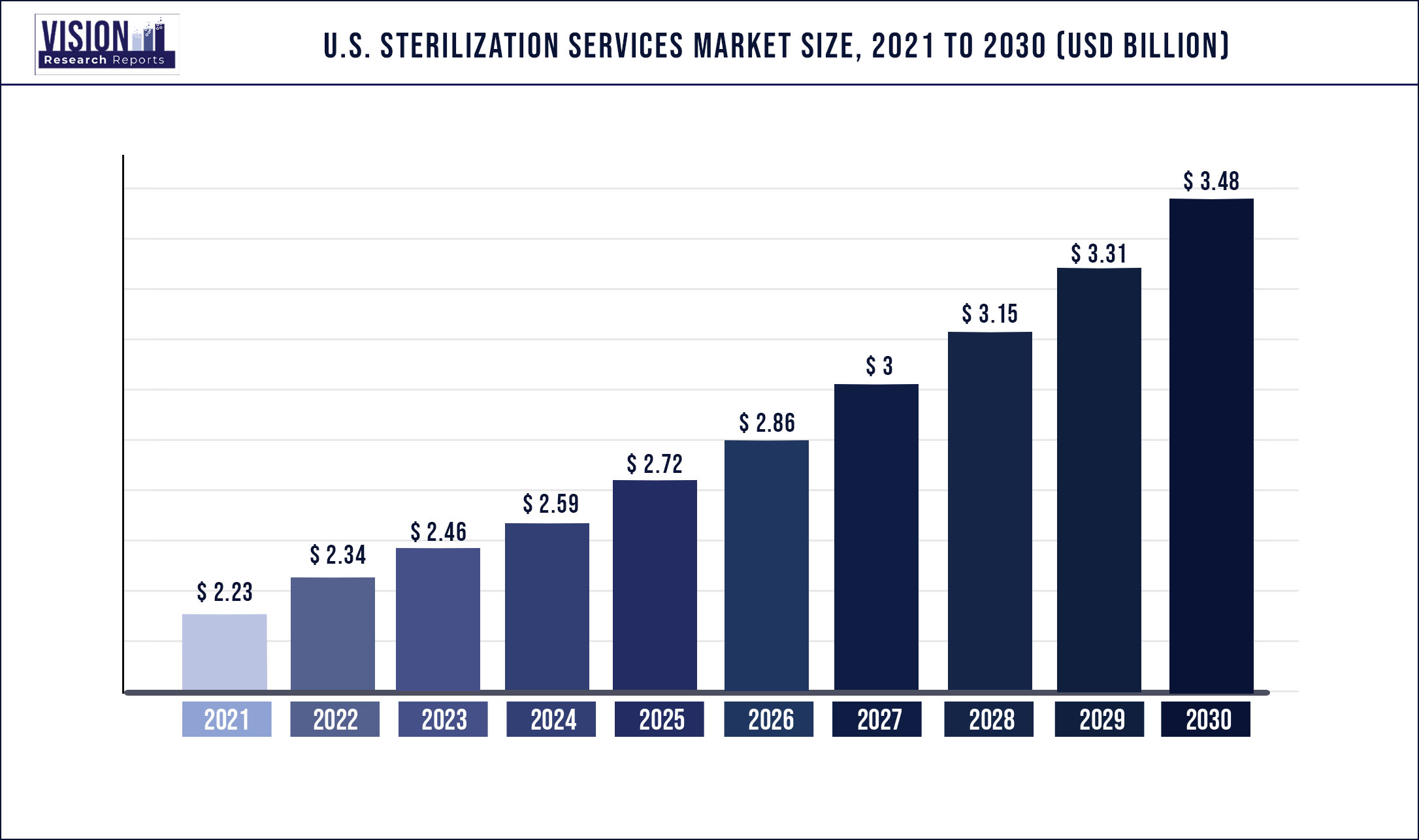

The U.S. sterilization services market size was estimated at around USD 2.23 billion in 2021 and it is projected to hit around USD 3.48 billion by 2030, growing at a CAGR of 5.07% from 2022 to 2030

Report Highlights

Supportive government investments in the healthcare industry, increasing R&D activities, and rising volume of drug launches are key factors impacting market growth.

The U.S. government has been keen on curbing healthcare costs and this is anticipated to encourage the FDA to speed up approval procedures for generic pharmaceuticals. Faster approvals drive the need for newer sterility testing methods, compelling innovative market participants to spend more on such solutions, thereby propelling the market. With increasing demand for drugs, companies are launching newer drugs with different routes of administration, dosage, or for a new indication. These launches require thorough sterility testing and this is anticipated to drive market growth.

By end use, the market is divided into hospitals, pharmaceuticals, medical device companies, clinical laboratories/research centers, and others, which includes food and beverage companies. Hospitals dominated the overall sterilization services market in 2016 and the segment is expected to retain its top position throughout the forecast period. Increasing incidence of hospital-acquired infections, growing number of surgical procedures, and constantly rising patient pool are prime factors driving this segment.

Currently, the U.S. sterilization services industry is consolidated in nature with only a few top companies capturing the major share. Some of the leading players are STERIS Corporation; Getinge Group; and Advanced Sterilization Products Services, Inc. Other prominent companies include 3M, Belimed, Cantel Medical, MATACHANA GROUP, and Sterigenics International LLC. In September 2016, Cantel announced the acquisition of Vantage Endoscopy’s endoscopy assets. This expansion of direct sales and acquisition of assets of its Canadian distributor is expected to strengthen the company’s position in the infection prevention market.

Type Insights

Based on type, the market is segmented into contract and validation services. The contract segment captured the largest market share in 2021 and is expected to continue its dominance through the forecast period. Contract services include in-house and off-site sterilization of medical devices, pharmaceuticals, and packaged units. Most of the in-house sterilization in hospitals is executed in the sterile processing department. Contract services are preferred by hospitals and manufacturers as they significantly reduce cost and resource burden and allow them to focus on their core activities.

Validation services require significant investments in terms of consumables. The presence of a large number of market players is expected to hurt the prices of these services as it reduces profit margins. However, validation of sterilization is a mandatory step in every healthcare center, which is expected to offset the adverse impact of the restraint.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.23 billion |

| Revenue Forecast by 2030 | USD 3.48 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.07% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, technique, delivery mode, end-use |

| Companies Covered | Steris PLC; 3M; Advanced Sterilization Products Services; Cantel; J&J; Stryker; E-beam; Cretex; Sotera Health |

Technique Insights

An increasing number of surgical procedures and rising geriatric population have driven the adoption of a variety of sterilization services. Market players have been making significant investments in research and development of novel techniques. Heat sterilization is the most widely used and reliable method of sterilization. It works best when used in a hydrated form rather than a dry state. Low-temperature sterilization technique is compatible with most delicate medical equipment and is extremely easy to control and monitor.

Delivery Mode Insights

Based on delivery mode, the market is segmented into off-site and on-site. The off-site segment is expected to witness the fastest growth rate during the forecast period. An increasing number of service providers and the rising trend of outsourcing sterilization services are factors anticipated to fuel segment growth.

On-site sterilization services require significant space, equipment, and manpower and so these departments are best for manufacturers with high output. Currently, heat and EtO are widely-used techniques in on-site settings. However, most novel materials used in medical devices are prone to deterioration by heat, limiting the use of such techniques in these settings.

End-use Insights

By end-use, the market is segmented into hospitals, pharmaceuticals, medical device companies, clinical laboratories/research centers, and others, which includes food and beverage companies. The hospital segment dominated the U.S. sterilization services market in 2021 and is expected to retain its position throughout the forecast period.

Increasing prevalence of hospital-acquired infections, the surge in the number of surgical procedures performed, and constantly expanding patient pool are prime factors driving this segment.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Sterilization Services Market

5.1. COVID-19 Landscape: U.S. Sterilization Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Sterilization Services Market, By Technique

8.1. U.S. Sterilization Services Market, by Technique, 2022-2030

8.1.1. Steam

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. EtO

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. E-beam radiation

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Gamma radiation

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Sterilization Services Market, By Type

9.1. U.S. Sterilization Services Market, by Type e, 2022-2030

9.1.1. Contract services

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Validation services

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Sterilization Services Market, By Delivery Mode

10.1. U.S. Sterilization Services Market, by Delivery Mode, 2022-2030

10.1.1. Onsite

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Offsite

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Sterilization Services Market, By End-use

11.1. U.S. Sterilization Services Market, by End-use, 2022-2030

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Pharmaceutical companies

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Medical device companies

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Clinical laboratories

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global U.S. Sterilization Services Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Technique (2017-2030)

12.1.2. Market Revenue and Forecast, by Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Delivery Mode (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Steris PLC

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. 3M

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Advanced Sterilization Products Services

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cantel

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. J&J

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Stryker

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. E-beam

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Cretex

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Sotera Health

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others