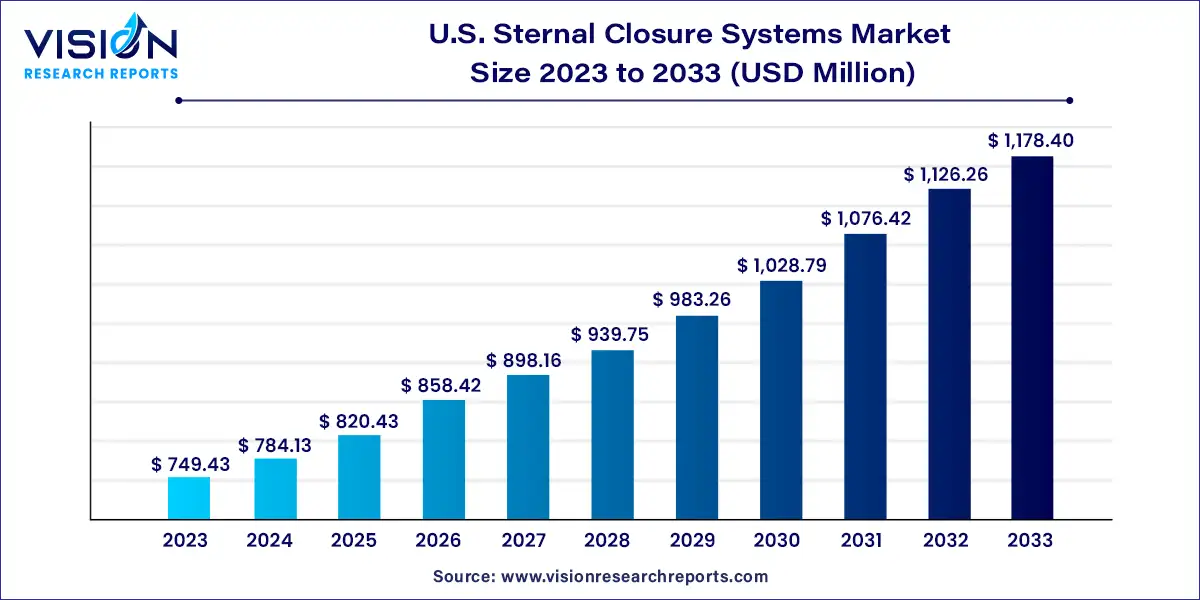

The U.S. sternal closure systems market was estimated at USD 749.43 million in 2023 and it is expected to surpass around USD 1,178.4 million by 2033, poised to grow at a CAGR of 4.63% from 2024 to 2033.

The U.S. sternal closure systems market is a vital component of the healthcare sector, playing a crucial role in post-operative care and patient recovery. Sternal closure systems are utilized in various surgical procedures, particularly cardiac surgeries, to ensure proper wound closure and stability of the sternum. This overview provides insights into the dynamics, trends, and key factors shaping the landscape of the U.S. Sternal Closure Systems market.

The growth of the U.S. sternal closure systems market is propelled by several key factors. Firstly, the escalating incidence of cardiovascular diseases drives the demand for cardiac surgeries, consequently increasing the adoption of sternal closure systems. Secondly, continuous technological advancements in surgical techniques and closure device designs enhance the safety, efficacy, and usability of these systems, fostering market expansion. Additionally, the preference for minimally invasive procedures is on the rise, leading to a greater demand for sternal closure systems that facilitate less invasive sternotomy approaches, resulting in quicker recovery periods and improved patient outcomes. These factors collectively contribute to the growth trajectory of the U.S. Sternal Closure Systems market, positioning it as a pivotal segment within the healthcare industry.

In 2023, medial sternotomy dominated the market share at 52%. This procedure facilitates access to the heart, lungs, and adjacent structures, making it a preferred choice for heart valve replacement and coronary artery bypass surgeries. Notably, medial sternotomy is recognized for its ability to minimize postoperative infections and complications, which has contributed to its increasing demand in the global sternal closure systems market. The surge in the elderly population, prone to chronic cardiovascular ailments, is expected to further propel the need for medial sternotomy procedures.

Meanwhile, the bilateral thoracosternotomy segment is poised for rapid expansion, projected to achieve the highest compound annual growth rate (CAGR) from 2024 to 2033. Also known as the clamshell incision, bilateral thoracosternotomy presents a viable option for lung transplantation, particularly in cases of end-stage pulmonary disorders like Chronic Obstructive Pulmonary Disease (COPD), cystic fibrosis, and emphysema. With a rising prevalence of these conditions, the demand for lung transplantation procedures is anticipated to drive market growth significantly.

In 2023, stainless steel commanded the largest market share, accounting for approximately 28%. This dominance can be attributed to the ample availability of raw material suppliers and the economic feasibility and affordability associated with stainless steel. Renowned for its cost-effectiveness, durability, and ease of manufacturing, stainless steel remains a preferred material type in the sternal closure systems market. Furthermore, the market is witnessing a surge in new product launches by various companies, further propelling the growth of stainless steel in this sector.

Meanwhile, the titanium segment is poised to experience the fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth trajectory is fueled by several factors, including titanium's corrosion resistance, its ability to effectively fuse with human bones, biocompatibility, and non-ferromagnetic properties. Notably, the non-ferromagnetic nature of titanium implants enables patients to safely undergo magnetic resonance imaging (MRI) scans. Additionally, the high efficacy, non-toxicity, and stability of titanium products contribute to their increasing popularity within the sternal closure systems market.

In 2023, closure devices emerged as the dominant type, capturing the highest market share of 73%. This segment is poised to maintain its lead and experience the fastest compound annual growth rate (CAGR) throughout the forecast period. The growth of closure devices is attributed to their ability to minimize post-surgical complications and facilitate quicker recovery outcomes. Additionally, advancements in technology, extensive mergers and acquisitions, and the introduction of innovative products are driving market expansion. For instance, in November 2023, Orthofix Medical Inc. launched WaveForm L, a lateral lumbar interbody system tailored for lateral lumbar interbody fusion (LLIF) procedures, offering enhanced strength and stability.

Conversely, the bone cement segment is anticipated to witness significant growth at a noteworthy CAGR from 2024 to 2033. This growth trajectory is propelled by the increasing number of median sternotomy procedures and the rising prevalence of cardiovascular disorders in the U.S. Combining bone cement with wires has emerged as an alternative to traditional sternal closure methods. Market players are prioritizing strategic partnerships and funding initiatives to bolster their research and development capabilities, thereby expanding their product portfolios.

By Product

By Procedure

By Material

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Sternal Closure Systems Market

5.1. COVID-19 Landscape: U.S. Sternal Closure Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Sternal Closure Systems Market, By Product

8.1. U.S. Sternal Closure Systems Market, by Product, 2024-2033

8.1.1 Closure Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Sternal Closure Wires

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sternal Closure Plates and Screws

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Sternal Closure Clips

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Sternal Closure Cables

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Bone Cement

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Sternal Closure Systems Market, By Procedure

9.1. U.S. Sternal Closure Systems Market, by Procedure, 2024-2033

9.1.1. Median Sternotomy

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hemisternotomy

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Bilateral Thoracosternotomy

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Sternal Closure Systems Market, By Material

10.1. U.S. Sternal Closure Systems Market, by Material, 2024-2033

10.1.1. Titanium

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Polyether Ether Ketone (PEEK)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Stainless Steel

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Sternal Closure Systems Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Procedure (2021-2033)

11.1.3. Market Revenue and Forecast, by Material (2021-2033)

Chapter 12. Company Profiles

12.1. DePuy Synthes.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Zimmer Biomet Holdings, LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. KLS Martin Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Stryker.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Orthofix Holdings Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GE Healthcare.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. A&E Medical Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Acute Innovations.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Abyrx, Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others