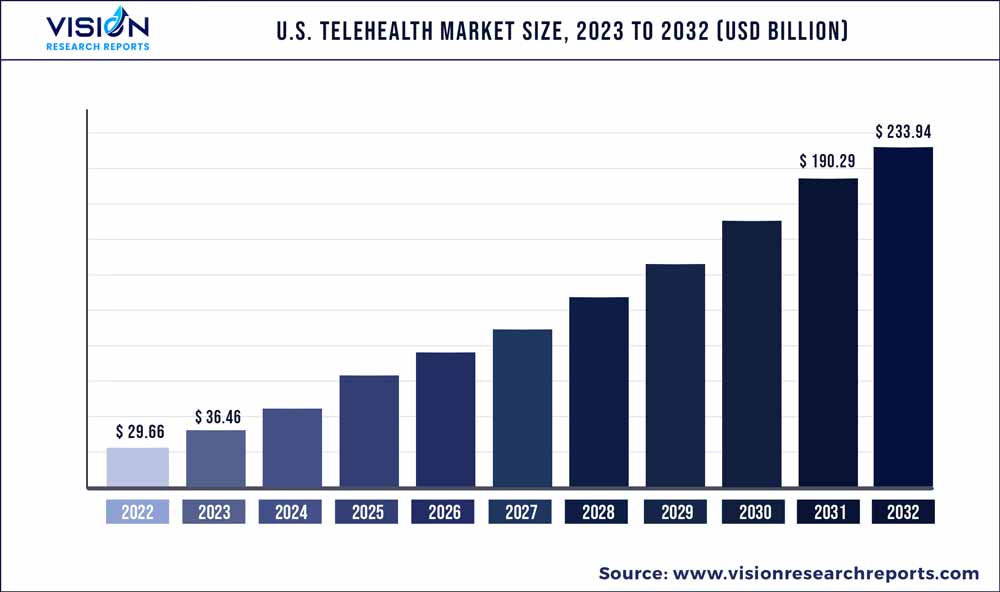

The U.S. telehealth market size was estimated at around USD 29.66 billion in 2022 and it is projected to hit around USD 233.94 billion by 2032, growing at a CAGR of 22.94% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Telehealth Market

| Report Coverage | Details |

| Market Size in 2022 | USD 29.66 billion |

| Revenue Forecast by 2032 | USD 233.94 billion |

| Growth rate from 2023 to 2032 | CAGR of 22.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Koninklijke Philips N. V.; Siemens Healthineers; Cerner Corp.; GE Healthcare; Medtronic PLC; Teladoc Health Inc.; American Well; Doctor on Demand; U.S.Med; MDLive |

The scarcity of healthcare specialists and primary care physicians in the U.S. is one of the major factors expected to accelerate the market growth in the U.S. For instance, according to the Association of American Medical Colleges (AAMC) estimation, there can be an estimated shortage of between 37,800 and 124,000 physicians by 2034, including a shortage of both specialty and primary care physicians. The market is expected to witness a significant boost from substantial investments made by the government in digital health and virtual care. In addition, the establishment of remote healthcare services has been prevalent in the U.S. for a considerable period.

Notably, the National Aeronautics and Space Association (NASA) played a vital role in pioneering telemedicine development, with studies indicating that NASA introduced telemedicine in the United States as early as 1960. Presently, approximately 76% of hospitals in the U.S. utilize some form of telemedicine to connect with patients. Furthermore, the market in the country is driven by advanced healthcare management practices, the development of innovative software solutions, and the presence of numerous market players operating across various segments, including mobile and network operations.

Reports indicate that approximately 82% of individuals aged 18 to 49 years in the U.S. use smartphones, providing them with access to various digital health technologies. Moreover, around 15% of the population owns a smart wearable device connected to a mobile phone.In recent years, the utilization of virtual healthcare has become crucial in enhancing health equity by delivering prompt treatment and clinical evaluations, particularly to the most marginalized communities. To bolster telehealth services and address the healthcare needs of rural areas in the United States, the Biden-Harris Administration made a significant investment of more than 19 million USD in August 2021.

This investment was directed through the Health Resources and Services Administration (HRSA) at the U.S. Department of Health and Human Services (HHS).Market participants are actively involved in the development of cutting-edge healthcare products, including secure data storage platforms, telecare platforms, and the establishment of robust network infrastructure. They are also promoting the adoption of remote health and telemedicine services. Industry reports indicate that over 30% of healthcare providers utilize patient monitoring and virtual care services to enhance patient care and engagement.

Moreover, according to HIMSS Analytics, 34% of healthcare organizations provide remote patient monitoring, and 31% utilize video-based services. These trends are anticipated to drive market growth during the forecast period.In addition, the COVID-19 pandemic has shown the importance of virtual healthcare services. Before the pandemic, the utilization of such services in the U.S. was relatively low. However, in response to the physician shortage during the COVID-19 crisis, the telehealth market in the U.S. experienced an exponential surge. Telehealth emerged as an essential tool to address the urgent healthcare needs arising from the pandemic.

Factors, such as the high rate of COVID-19 infections, challenges in accessing traditional medical care, and the national emergency, prompted increased investments by government organizations in the U.S. For instance, in February 2021, the United States Department of Agriculture (USDA) allocated USD 42 million for the development of telemedicine infrastructure and distance learning programs aimed at improving health outcomes and education. The USDA funded 86 projects in rural communities through the Distance Learning and Telemedicine (DLT) program, enabling the provision of rural healthcare education and grants for the purchase of telemedicine equipment for interactive telecommunications and distance learning.

Product Type Insights

The services segment dominated the overall industry in 2022 and accounted for the largest share of 48% of the overall revenue. The increasing need for remote healthcare services, along with the rapid progress in digital healthcare infrastructure, is a primary driver for the segment's growth. In addition, the market is supported by the presence of a large number of service providers. Moreover, the current trend of outsourcing these services is fueling the growth of the services segment. Healthcare facilities often lack the necessary resources and expertise to implement digital health solutions, leading to the outsourcing of these services.

Furthermore, the growing demand for telehealth applications in chronic disease management, real-time monitoring, and the continuous advancements in digital infrastructure, internet accessibility, smartphone usage, and hardware and software components are all contributing to the growth of this segment. The software segment is expected to witness the fastest growth rate over the forecast period. Telehealth services rely on software as a fundamental component. Various software platforms exist for telehealth services, enabling the storage, analysis, and sharing of healthcare information. With the help of telehealth software, patients can conveniently access affordable healthcare services in a shorter timeframe.

The growing demand to address the rising medical costs, the increasing need for accurate and timely information retrieval, and the rising expenses of patient care are key factors driving the growth of this segment. In addition, a rise in demand for efficient management of organizational workflows in healthcare institutions and the implementation of healthcare IT infrastructure by both private and public entities contribute to the expansion of the software market in healthcare systems. Furthermore, numerous software developers are dedicated to continuously enhancing their products by incorporating advanced features to maintain a strong market presence. For example, in May 2021, MediTelecare introduced MediTely, a state-of-the-art mobile telehealth application designed specifically for older adults residing outside of long-term care facilities.

Delivery Mode Insights

The web-based delivery segment accounted for the largest revenue share of 47% in 2022. The increasing utilization of web-based delivery methods in mobile health communication and remote patient monitoring, aimed at enhancing the quality of healthcare in rural areas, is driving the growth of this segment. Furthermore, the widespread adoption of web-based platforms by healthcare providers and patients is contributing to the revenue generated by this segment. The expanding telehealth industry and the cost-effectiveness of virtual care are also expected to provide support for the growth of web-based delivery in the foreseeable future.

In addition, numerous prominent international organizations are leveraging web-based information and communication technologies (ICTs) platforms to address healthcare challenges in both developed and developing countries. For instance, the World Health Organization (WHO) has established the Observatory for eHealth (GOe) to assess the status of eHealth solutions, including telemedicine, at the national, regional, and international levels in the United States. The cloud-based delivery model is anticipated to be the fastest segment over the forecast period. The segment is expected to experience significant growth in the coming years due to the increasing adoption of cloud storage platforms by both patients and clinicians.

This growth can be attributed to several factors, including the cost-effectiveness, speed, and virtual data storage capabilities offered by cloud storage solutions. The prevalence of security breaches in web-based and on-premises deployments has also contributed to the rising utilization of cloud-based technology. Furthermore, the advantages associated with cloud technology, such as the utilization of external web servers, remote access & authorization, seamless information sharing across different stages of the value chain, and the ability to promptly detect security threats & vulnerabilities, have further facilitated its adoption. These benefits are driving the growth of the segment as more organizations recognize the value of cloud storage solutions.

End-use Insights

The providers segment held the largest revenue share of 54% in 2022 owing to multiple factors, including the increasing number of telehealth service providers in the U.S. and the growing awareness among individuals about the benefits of telehealth. There is a rising demand for reducing hospital admissions and improving hospital workflow, which is driving the adoption of telehealth technologies among healthcare providers. In addition, the increasing shortage of physicians and high burnout rates in the healthcare industry are driving the adoption of telehealth services. Furthermore, the rise in partnerships and collaborations among public and private healthcare organizations to promote the adoption and accessibility of telehealth services is fueling the growth of this segment.

The patients segment is expected to register the fastest growth rate during the forecast period. The growth of the segment can be attributed to several key factors. Firstly, there is an increasing awareness among the patient population about the benefits and convenience of telehealth services. Moreover, the high level of internet penetration in the U.S. enables widespread access to telehealth platforms. The affordability and potential for improved clinical outcomes associated with telehealth services are also driving the growth of this segment. Moreover, the rising number of smartphone users, the presence of technology-friendly users, and the continuous expansion of internet connectivity across the country are expected to further support the growth of the patients segment.

U.S. Telehealth Market Segmentations:

By Product Type

By Delivery Mode

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Telehealth Market

5.1. COVID-19 Landscape: U.S. Telehealth Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Telehealth Market, By Product Type

8.1. U.S. Telehealth Market, by Product Type, 2023-2032

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Telehealth Market, By Delivery Mode

9.1. U.S. Telehealth Market, by Delivery Mode, 2023-2032

9.1.1. Web-based

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cloud-based

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. On-premises

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Telehealth Market, By End-use

10.1. U.S. Telehealth Market, by End-use, 2023-2032

10.1.1. Providers

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Payers

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Patients

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Telehealth Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Delivery Mode (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Koninklijke Philips N. V.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Siemens Healthineers.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cerner Corp.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GE Healthcare

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Medtronic PLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Teladoc Health Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. American Well

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Doctor on Demand

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. U.S.Med

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. MDLive

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others