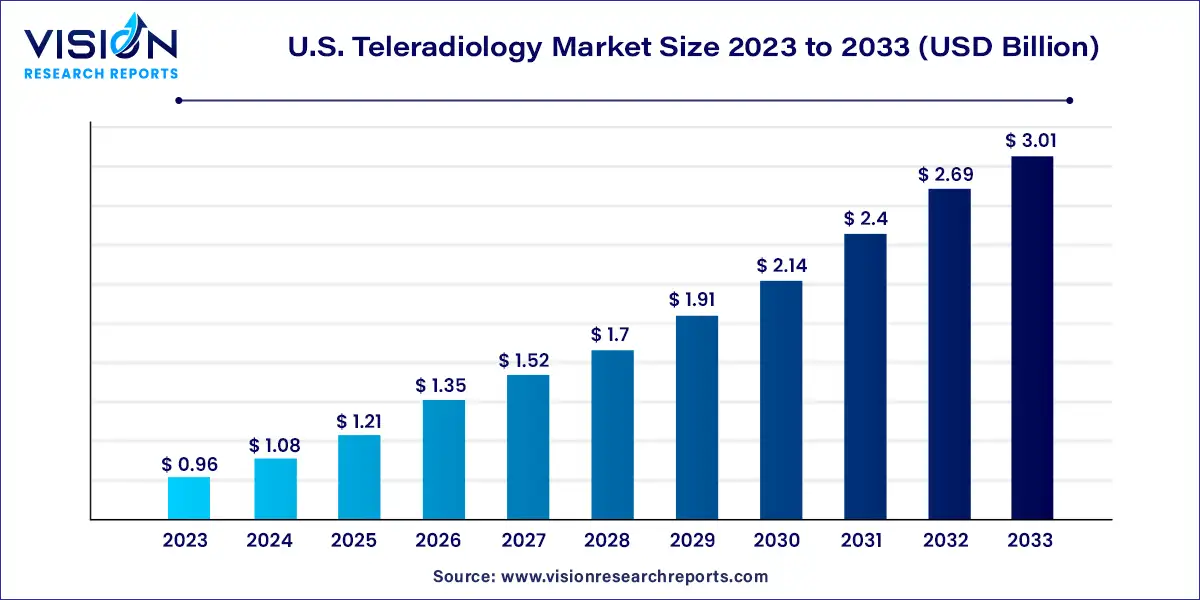

The U.S. teleradiology market was surpassed at USD 0.96 billion in 2023 and is expected to hit around USD 3.01 billion by 2033, growing at a CAGR of 12.12% from 2024 to 2033.

Teleradiology, a branch of telemedicine, has emerged as a critical component of modern healthcare delivery, particularly in the United States. This innovative practice involves the remote interpretation and transmission of medical images, such as X-rays, MRIs, and CT scans, by radiologists located off-site.

The growth of the U.S. teleradiology market is propelled by several key factors. Technological advancements in digital imaging technology and internet connectivity have significantly enhanced the efficiency and reliability of teleradiology services. Additionally, the demand for timely diagnostics has driven healthcare providers to adopt teleradiology to overcome geographical barriers and access specialized expertise on-demand. The shortage of radiologists in certain regions of the U.S. has also contributed to the adoption of teleradiology services, addressing staffing challenges and ensuring timely interpretation of medical images. Moreover, the cost-effectiveness of teleradiology solutions, which eliminate the need for maintaining in-house radiology departments, further fuels market growth. These factors collectively underscore the importance of teleradiology in modern healthcare delivery, driving its continued expansion in the U.S. market.

| Report Coverage | Details |

| Market Size in 2023 | USD 0.96 billion |

| Revenue Forecast by 2033 | USD 3.01 billion |

| Growth rate from 2024 to 2033 | CAGR of 12.12% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on product, the market is segmented into X-rays, CT scans, MRI scans, ultrasound, and nuclear imaging. The X-rays segment held the largest revenue share of 30% in 2023. The segment's dominance is due to its lower cost, high utilization in primary diagnosis, and the advent of cutting-edge equipment such as filmless x-ray scanners. In addition, this method has a wide range of applications in the fields of chest imaging, orthopedics, heart diagnostics, cancer diagnosis, and dentistry imaging.

The advancements in the X-ray system and the cost-effective availability of the devices boost the industry growth. For instance, in July 2022, at the European Congress of Radiology held in Vienna, Siemens Healthineers introduced Mobilett Impact, its most recent mobile X-ray equipment. All the advantages of a transportable X-ray system for scanning at the patient's bedside were combined with complete digital functionality, an affordable price, and the following features: With Mobilett Impact, the whole imaging workflow-not just the imaging itself-can be completed at the patient's bedside.

The market for CT scans is expected to expand at the highest CAGR of 12.84% during the forecast period. This imaging technique's key advantage is that it makes it possible to image soft tissues, blood vessels, and bones in great detail. Additionally, this service is inexpensive, takes less time, and is more available than other modalities. With a greater focus being placed on cancer prevention and early diagnosis, several population-level screening programs are being created, and CT is predominantly employed as part of the lung health check program. The expansion of CT is facilitated by the delivery of quicker and sharper images of intricate body parts like the brain, heart cavities, and lungs. The increase in the demand for CT scans in the country is anticipated to create lucrative market growth opportunities.

Based on type, the market is segmented into preliminary tests and final tests. The preliminary tests segment held the largest revenue share above 65% in 2023. It involves the electronic transfer of the diagnostic images from the medical center to a remote radiologist who can immediately examine the photos and offer preliminary findings. In situations where time is critical, such as trauma cases or urgent procedures, this might be extremely important. As preliminary tests may be produced more quickly and cheaply than final reports, they are frequently used in emergency treatment. In hospitals and imaging facilities after-hours, providers receive better insurance reimbursement. Consequently, a quicker pace of growth is projected.

The final tests segment is anticipated to exhibit the fastest CAGR of 13.25% from 2024 to 2033. Final reads are increasingly preferred by providers since they produce thorough, reliable results with fewer errors. More final reads and preliminary reads with in-depth radiologists' reports are now being reimbursed by Medicare than typical preliminary reads. Growing competition among teleradiology service providers has resulted in innovations in technology that make it easier for outside radiologists to connect with the sites they scan for, driving teleradiology business entities to produce more final reads. This helps explain the final report segment's significant CAGR over the forecast period. Its lower market size can be attributed to the fact that these studies take more time and hence have higher costs involved.

Based on end-use, the market is segmented into hospitals, radiology clinics, and ambulatory imaging centers. The hospitals segment held the largest market share of approximately 54% in 2023. In situations of emergency, teleradiology treatments are usually suggested. For instance, teleradiology may assist in a more rapid diagnosis and immediate start of medical care if a patient arrives at a hospital suffering severe head injuries when a neuroradiologist is yet to arrive. Therefore, it is anticipated that the market expansion over the forecast period will be driven by a rise in urgent visits to healthcare facilities. By utilizing teleradiology products and services, hospitals can also reduce the expense of employing radiologists.

The radiology clinics segment is anticipated to exhibit a CAGR of 12.55% from 2024 to 2033. Radiology clinics are hospitals that specialize in providing diagnostic imaging services. By offering several imaging modalities like X-rays, ultrasounds, CT scans, MRIs, and more, they play a significant part in the healthcare system. To evaluate the images and offer precise diagnoses, radiology clinics work with radiologists. These clinics frequently have cutting-edge imaging technology and are manned by certified radiologic technologists. The knowledge of subspecialized radiologists, who might not be accessible locally, can be helpful to patients.

By Product

By Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Teleradiology Market

5.1. COVID-19 Landscape: U.S. Teleradiology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Teleradiology Market, By Product

8.1. U.S. Teleradiology Market, by Product, 2024-2033

8.1.1 X-rays

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. CT Scans

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. MRI Scans

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Ultrasound

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Nuclear Imaging

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Teleradiology Market, By Type

9.1. U.S. Teleradiology Market, by Type, 2024-2033

9.1.1. Preliminary Tests

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Final Tests

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Teleradiology Market, By End-use

10.1. U.S. Teleradiology Market, by End-use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Radiology Clinic

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Ambulatory Imaging Centers

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Teleradiology Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Virtual Radiologic (vRad).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agfa-Gevaert Group.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ONRAD, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Everlight Radiology.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. 4ways Healthcare Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. RamSoft, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. USARAD Holdings, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Koninklijke Philips N.V.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Matrix (Teleradiology Division of Radiology Partners).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Medica Group PLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others