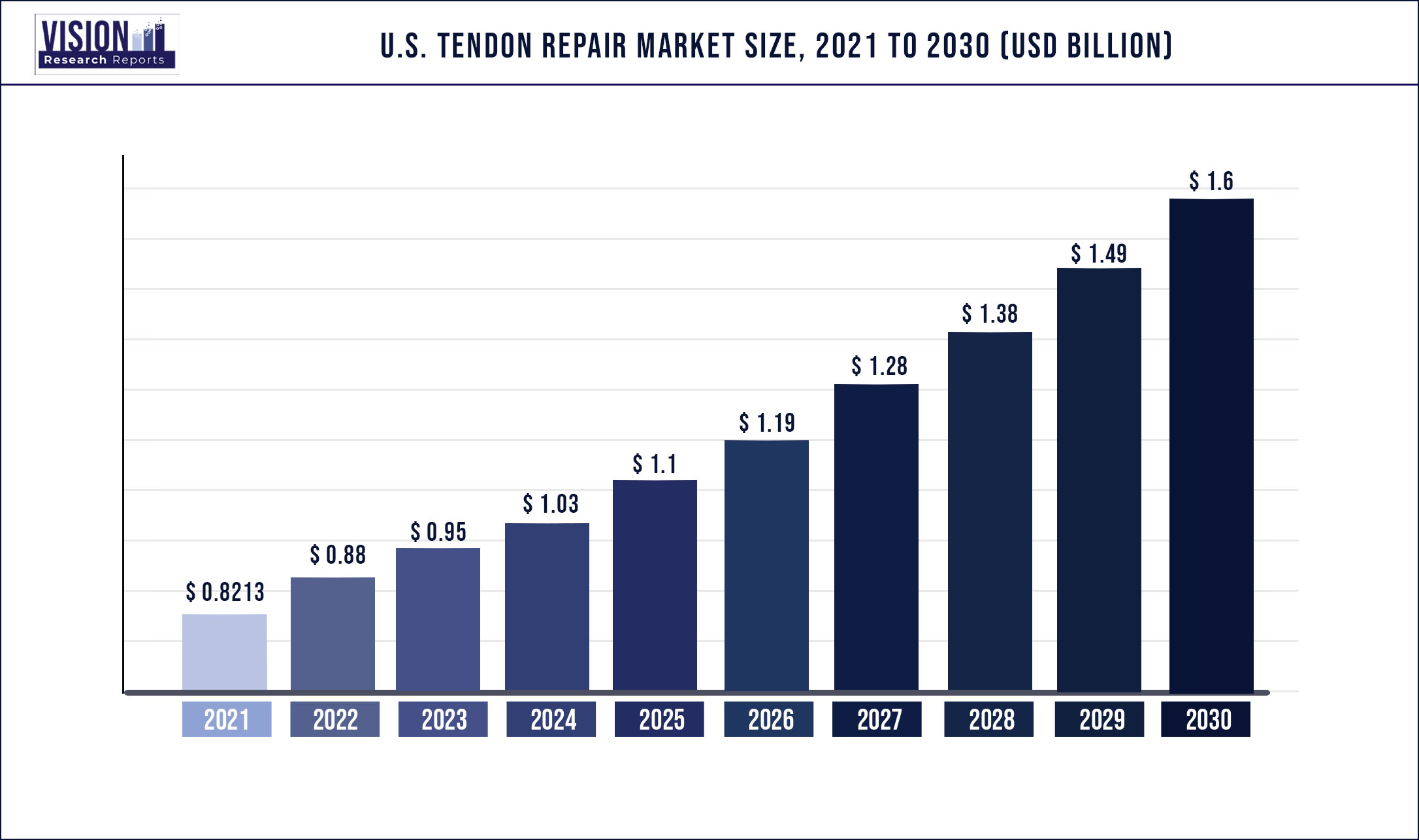

The U.S. tendon repair market was valued at USD 821.3 million in 2021 and it is predicted to surpass around USD 1.6 billion by 2030 with a CAGR of 7.69% from 2022 to 2030

Report Highlights

The rapid rate at which the geriatric population across the country is rising for the past few years has been a major contributor to the market, in terms of patient numbers.

Furthermore, the yearly rise in sports-related injuries across all age groups also contributes to the growing target population for the tendon repair market in the U.S. The geriatric population in the US has crossed 50 million, and the number is set to increase in the coming years. Age-related degeneration of soft tissue makes them more susceptible to injuries and tears of soft tissue.

Sports-related injuries are rapidly increasing as more and more people actively engage in some form of physical activity. Professional athletes and specifically older athletes are more prone to tears and sprains in tendons and other soft tissue due to the nature of the sport they engage in.

For instance, the number of people suffering some form of injury from football and soccer is significantly greater than in other sporting activities. High contact and impact are both responsible factors for tendon injuries and tears, which often require surgical intervention or rehabilitation, or both. This is expected to bode well for the growth of the market.

The prevalence of musculoskeletal diseases in the U.S. is a big contributor to the patient pool. According to the United States Bone & Joint Initiative, 12% to 14% of the population in the U.S. is bound to visit a physician for back pain. These factors are the key drivers for the growth of the tendon repair market in the U.S.

The application segment was dominated by the rotator cuff repair category with a revenue share of 38.7% as of 2021. The major contributors are the rapidly aging population and sports-related injuries. A research article published in JSES Reviews, Reports and Techniques, stated that the number of rotator cuff repairs in the U.S. increased by 1.2% on annual basis between 2007-2016.

The bicep tenodesis application segment is expected to register the fastest growth over the forecast period. The injuries are more commonly associated with sports like baseball and tennis, among others. Age-related degeneration of soft tissue along with the above-stated factors is expected to propel the growth of the tendon repair market across the U.S.

Based on product type, the suture anchor devices segment was the largest category with the highest revenue share of 40.4% in 2021. These are commonly used in tendon repair surgeries for fixing bone to the tendon, in case of severe damage. These provide strength and stability to the repaired area; the types of sutures and anchors have been different as per advancing technologies.

The fastest growth was registered by the matrix and scaffolds type of products. The product category has been the rage, off-late due to the multifarious benefits over traditional repair methods. Mechanical fixation comes with its own set of complications, matrices and scaffolds are circumventing those and are resulting in better repair results and ease in second surgeries, if at all required and these factors are key drivers for the growth of the U.S. market.

The marked reduction in social interactions during the pandemic resulted in a severe fall in the number of patient visits for sports-related injuries, also there was a decrease in the number of elective procedures for the elderly, due to the overburdened state of the healthcare system. The market for U.S. tendon repair is expected to grow manifold, once social interaction resumes to its full capacity.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 821.3 million |

| Revenue Forecast by 2030 | USD 1.6 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.69% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, product |

| Companies Covered | Stryker Corporation; Arthrex, Inc.; CONMED Corporation; Integra LifeSciences; Smith+Nephew; TendoMend; Alafair Biosciences; MIMEDX |

Application Insights

The rotator cuff repair held the largest share of 38.9% in 2021. Rotator cuff injuries are the most commonly occurring shoulder injuries in older people, occurring at a rate of 30% in people aged 60 and above, and increasing drastically up to 62% for people aged 80 and above, as per an article published in Arthroscopy, Sports Medicine and Rehabilitation. The 7-year study revealed that arthroscopic procedures for repair increased by 15% and open surgeries decreased by the same percentage.

The fastest growth was observed in biceps tenodesis for the forecast period. This type of injury is both sports-related, due to the overuse of a particular muscle, like repetitive arm movements in baseball, tennis, swimming, etc., and degeneration due to advancing age is another reason for injury to this soft tissue group. The increasing geriatric population, as well as the number of sports injuries, are driving the growth of the market.

Product Insights

The largest product category as of 2021 was suture anchor devices, with a revenue share of 40.5%. These are increasingly preferred due to their strength of fixation as well as rigidity and support they provide to the injury site. The newer types of biodegradable, bio-stable, and bio-composite suture anchors are being sold in the market whose properties vary as per the needs of the injury type, and innovations in the type of suture anchor are one of the major factors signifying the growth of the segment.

The matrix and scaffolds segment is expected to register the fastest CAGR of 11.7% during the forecast period. The growth can be attributed to the increasing interest in alternative treatment types for tears of soft tissue. Matrices and scaffolds eliminate the need to use technologies with high limitations. These are often made from the patient’s own cells or can also be acellular, they release active substances at the injury site and promote the formation of healthy tissue, this has been driving the growth in this product type and the overall industry.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Tendon Repair Market

5.1. COVID-19 Landscape: U.S. Tendon Repair Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Tendon Repair Market, By Application

8.1. U.S. Tendon Repair Market, by Application, 2022-2030

8.1.1. Rotator Cuff Repair

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Achilles Tendinosis Repair

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Cruciate Ligament Repair

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Bicep Tenodesis

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Tendon Repair Market, By Product

9.1. U.S. Tendon Repair Market, by Product, 2022-2030

9.1.1. Implants

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Suture Anchor Devices

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Grafts

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Matrix/Scaffolds

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Screws

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Tendon Repair Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Application (2017-2030)

10.1.2. Market Revenue and Forecast, by Product (2017-2030)

Chapter 11. Company Profiles

11.1. Stryker Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Arthrex, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. CONMED Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Integra LifeSciences

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Smith+Nephew

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. TendoMend

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Alafair Biosciences

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. MIMEDX

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others