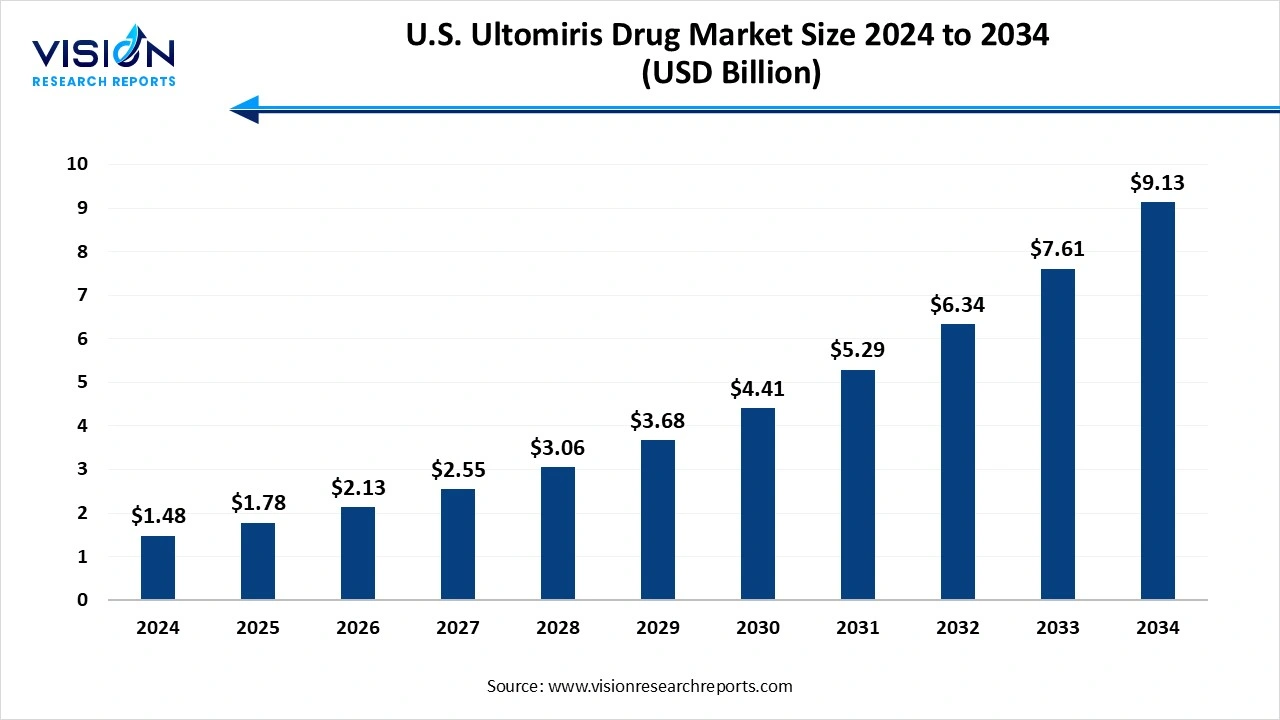

The U.S. ultomiris drug market size was exhibited at around USD 1.48 billion in 2024 and it is projected to hit around USD 9.13 billion by 2034, growing at a CAGR of 19.95% from 2025 to 2034.

The U.S. ultomiris drug market has gained significant traction in recent years, driven by growing demand for advanced treatments in rare and serious blood disorders. Ultomiris (ravulizumab-cwvz), developed by AstraZeneca's Alexion division, is a long-acting C5 complement inhibitor used primarily for treating paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). The drug’s extended dosing interval compared to its predecessor, Soliris, offers a major advantage in patient compliance and healthcare efficiency, positioning it as a preferred treatment option within its class.

The growth of the U.S. ultomiris drug market is primarily fueled by the increasing prevalence of rare and life-threatening blood disorders such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). These conditions often require lifelong treatment, creating sustained demand for effective and long-acting therapies like Ultomiris. Its ability to offer extended dosing intervals every eight weeks compared to biweekly infusions for alternatives like Soliris significantly enhances patient convenience and adherence, which is a key factor in its expanding market share.

In addition to clinical efficacy and patient-friendly dosing, market growth is being supported by continuous regulatory progress and label expansion. The U.S. Food and Drug Administration (FDA) has approved Ultomiris for additional indications, including generalized myasthenia gravis (gMG), with more in the pipeline such as neuromyelitis optica spectrum disorder (NMOSD). These developments open new revenue streams and broaden the drug’s applicability.

One of the key trends in the U.S. ultomiris drug market is the shift toward long-acting biologics that improve patient quality of life and reduce the burden on healthcare systems. Ultomiris has set a benchmark in this space by offering less frequent dosing compared to older therapies, reflecting a broader industry trend of prioritizing patient convenience. This approach not only boosts patient adherence but also reduces clinic visits and infusion-related costs, making the drug more attractive to both patients and providers.

Another significant trend is the diversification of ultomiris’s therapeutic reach through continuous clinical trials and FDA approvals for additional indications. The expansion beyond PNH and aHUS into conditions like generalized myasthenia gravis (gMG) and potentially neuromyelitis optica spectrum disorder (NMOSD) signals a strategic effort to tap into broader autoimmune and neurological segments. This trend aligns with the growing emphasis on personalized and targeted treatment in specialty pharmaceuticals.

One of the primary challenges facing the U.S. ultomiris drug market is its high treatment cost, which can limit accessibility for certain patient populations despite insurance coverage. Although Ultomiris offers improved dosing convenience and efficacy, its premium pricing poses significant reimbursement hurdles, especially in a healthcare environment increasingly focused on cost-effectiveness and value-based care. Payers may demand strong real-world evidence to justify its cost over older, less expensive alternatives, which could slow down adoption among providers who are sensitive to insurance constraints or budget limitations.

Another challenge is the intensifying competition within the complement inhibition therapy space. With the expiration of patents on predecessor drugs like Soliris and the rise of biosimilars and alternative therapies, Ultomiris faces the risk of losing market exclusivity and pricing power. Additionally, new entrants targeting the C5 pathway or exploring alternative mechanisms of action may erode its market share by offering lower costs or enhanced therapeutic profiles.

The paroxysmal nocturnal hemoglobinuria (PNH) held the largest market share of 49% in 2024. PNH is a rare, life-threatening blood disorder characterized by the destruction of red blood cells due to uncontrolled complement system activity. Ultomiris (ravulizumab-cwvz), developed as an advanced successor to Soliris, has quickly become a preferred treatment option for PNH due to its long-acting formulation, which allows for infusions every eight weeks compared to the biweekly dosing required with previous therapies. This extended dosing schedule greatly enhances patient quality of life and treatment adherence while maintaining robust efficacy in reducing hemolysis and the need for blood transfusions.

The generalized myasthenia gravis (gMG) is expected to emerge as the fastest-growing indication segment, with the highest projected CAGR between 2025 and 2034. In gMG, the immune system produces antibodies that disrupt communication between nerves and muscles, leading to muscle fatigue and functional impairment. Ultomiris was approved by the U.S. FDA for treating adults with anti-acetylcholine receptor (AChR) antibody-positive gMG, marking a significant advancement in the management of this debilitating condition.

The adult segment led the end-use category, capturing 61% of the total market share in 2024. Ultomiris has become widely adopted in adult populations due to its proven efficacy, long-acting dosing schedule, and established safety profile. The convenience of less frequent infusions is particularly beneficial for adults managing chronic conditions, allowing them to maintain a more consistent quality of life with fewer hospital or clinic visits.

The pediatric segment is anticipated to be the fastest-growing subsegment, with the highest projected CAGR between 2025 and 2034. The U.S. FDA has approved Ultomiris for pediatric patients with specific conditions such as PNH and atypical hemolytic uremic syndrome (aHUS), recognizing the need for safe and effective treatments in younger populations. Pediatric use requires careful dosing and monitoring, but the benefits of extended dosing intervals are equally impactful in reducing treatment burden for children and their caregivers.

The hospital pharmacies led the distribution channel, capturing 57% of the total revenue share in 2024. Ultomiris, being an intravenous biologic therapy used for rare and serious conditions like paroxysmal nocturnal hemoglobinuria (PNH) and generalized myasthenia gravis (gMG), requires precise dosing, trained healthcare professionals, and close patient monitoring all of which are best facilitated within hospital settings. Hospital pharmacies play a pivotal role in ensuring the proper handling, storage, and timely availability of the drug, especially in acute care scenarios.

The reliance on hospital pharmacies is also driven by the need to manage high-cost biologics within structured reimbursement systems and institutional formularies. These pharmacies help streamline procurement processes, manage insurance claims, and provide logistical support for maintaining inventory of temperature-sensitive drugs like Ultomiris. Additionally, hospitals often serve as referral centers for rare diseases, making them key access points for patients requiring advanced therapies.

By Indication

By End Use

By Distribution Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others