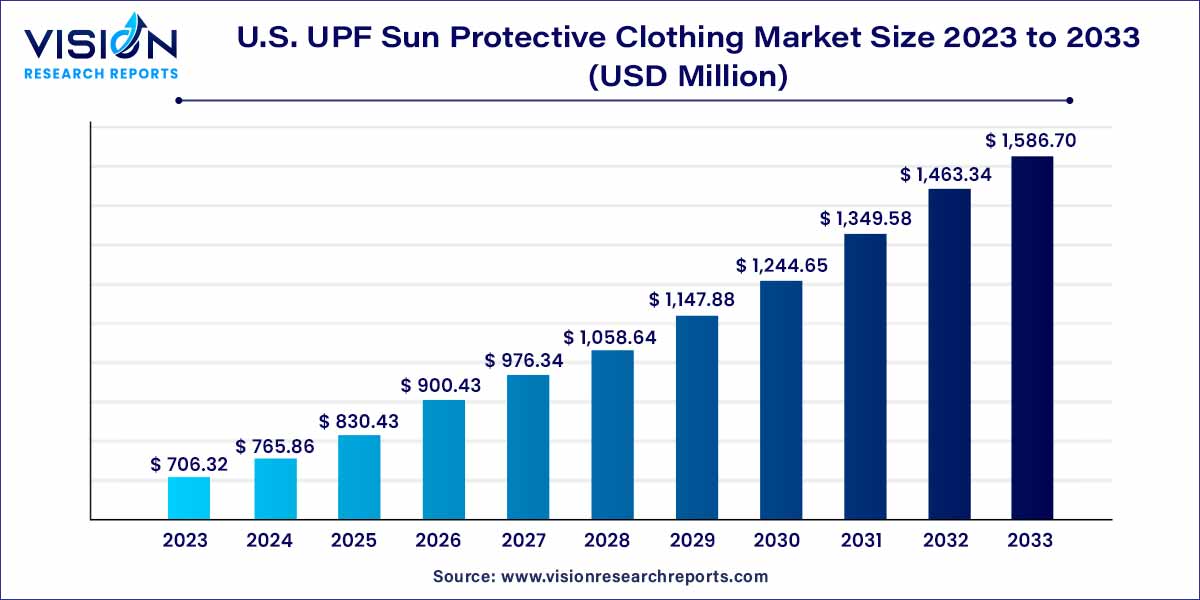

The U.S. UPF sun protective clothing market size was surpassed at USD 706.32 million in 2023 and is expected to hit around USD 1,586.7 million by 2033, growing at a CAGR of 8.43% from 2024 to 2033.

In recent years, the awareness of the harmful effects of ultraviolet (UV) rays on human skin has led to a significant rise in the demand for UPF (Ultraviolet Protection Factor) sun protective clothing. The United States, with its diverse climate and outdoor lifestyle, has witnessed a substantial surge in the market for UPF sun protective clothing. This specialized apparel not only shields individuals from the sun's harmful rays but also caters to the growing fashion-conscious consumers who seek both style and sun protection.

The U.S. UPF sun protective clothing market is experiencing robust growth due to several key factors. Increasing awareness about the harmful effects of UV radiation on the skin has driven a surge in demand for UPF sun protective clothing among health-conscious consumers. Additionally, the fusion of fashion and functionality in these garments has expanded the market beyond traditional users, appealing to style-conscious individuals as well. Stringent regulations promoting sun protection, coupled with technological advancements in fabric materials, have further propelled market growth. Ongoing research and development efforts have led to the creation of innovative UPF fabrics that provide superior UV protection while ensuring comfort, driving consumer confidence. These factors, combined with the market's ability to cater to diverse consumer preferences and age groups, are fueling the continued expansion of the U.S. UPF sun protective clothing market.

| Report Coverage | Details |

| Market Size in 2023 | USD 706.32 million |

| Revenue Forecast by 2033 | USD 1,586.7 million |

| Growth rate from 2024 to 2033 | CAGR of 8.43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The shirts, t-shirts, jackets, and hoodies segment held the highest market share of 47% in 2023. Shirts, t-shirts, jackets, and hoodies offer high coverage and protection for the torso from harmful sun rays. Moreover, sun protection products, such as sunscreen, which are usually greasy, lead to discomfort for end-users. Furthermore, mineral-based chemical-free sunscreen products with better efficiency that offer protection against prolonged exposure to harmful sun rays are expensive.

The pants & shorts segment is expected to grow at the fastest CAGR of 8.46% over the forecast period. Pants and shorts, often overlooked in sun protection discussions, have not been left behind in the UPF revolution. These bottom-wear options are thoughtfully designed with UPF fabrics that shield the wearer's skin from harmful UV rays, making them indispensable for sun-exposed activities. UPF pants and shorts provide a comfortable fit while ensuring effective sun protection, making them popular choices for outdoor enthusiasts, travelers, and individuals engaged in a range of outdoor pursuits.

The women's segment dominated the market with the largest market share of 47% in 2023 in the U.S. The UPF sun protective clothing market for women encompasses a wide array of choices, reflecting the multifaceted lives women lead. Stylish UPF dresses, blouses, and skirts are designed with specialized fabrics that offer reliable sun protection without compromising on style. These garments, often featuring trendy patterns and elegant designs, cater to women who seek both fashion and functionality in their wardrobes. UPF swimsuits and cover-ups are also prominent offerings, ensuring that women can enjoy beach outings and pool activities while safeguarding their skin from harmful UV rays. Additionally, women's UPF accessories like hats, scarves, and gloves complement their outfits, providing comprehensive sun protection for outdoor adventures.

The men's segment is anticipated to grow at the noteworthy CAGR of 8.48% from 2024 to 2033. The men’s UPF sun protective clothing, there is a focus on combining practicality with style. UPF shirts, ranging from casual button-ups to performance-oriented sports shirts, are engineered to provide excellent sun protection without compromising on comfort. Men's UPF t-shirts, often featuring sporty designs, cater to those seeking a blend of style and functionality for their outdoor activities. UPF jackets, hoodies, and trousers designed for men offer versatility, making them suitable for various weather conditions. Men's UPF accessories such as wide-brimmed hats and sunglasses complete the ensemble, ensuring comprehensive protection against UV radiation.

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. UPF Sun Protective Clothing Market

5.1. COVID-19 Landscape: U.S. UPF Sun Protective Clothing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. UPF Sun Protective Clothing Market, By Product

8.1. U.S. UPF Sun Protective Clothing Market, by Product, 2024-2033

8.1.1. Hats & Caps

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Shirts, T-shirts, Jackets, & Hoodies

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pants & Shorts

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Swimwear

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. UPF Sun Protective Clothing Market, By End-use

9.1. U.S. UPF Sun Protective Clothing Market, by End-use, 2024-2033

9.1.1. Men

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Women

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Kids

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. UPF Sun Protective Clothing Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Coolibar Sun Protective Clothing

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Summerskin

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Solumbra

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. UV Skinz, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Solbari Sun Protection

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Cabana Life

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Columbia Sportswear Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Little Leaves Clothing Company

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. IBKUL

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Nozone Clothing US

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others